Deferred Tax In Balance Sheet

Deferred Tax In Balance Sheet - Web a deferred income tax is a liability recorded on a balance sheet resulting from a difference in income recognition between tax laws and the company’s accounting methods. It is the opposite of a deferred tax liability, which represents. Deferred tax assets and liabilities, along. Tax basis may differ from the. Web common types of deferred taxes fixed assets. In many cases, tax basis may be less than the respective book carrying value, given accelerated cost. The liability is deferred due to a. Web a deferred tax liability is a listing on a company's balance sheet that records taxes that are owed but are not due to be paid until a future date. Web key takeaways a deferred tax asset is an item on the balance sheet that results from an overpayment or advance payment of taxes.

Web a deferred tax liability is a listing on a company's balance sheet that records taxes that are owed but are not due to be paid until a future date. Tax basis may differ from the. Web a deferred income tax is a liability recorded on a balance sheet resulting from a difference in income recognition between tax laws and the company’s accounting methods. Web key takeaways a deferred tax asset is an item on the balance sheet that results from an overpayment or advance payment of taxes. Web common types of deferred taxes fixed assets. Deferred tax assets and liabilities, along. The liability is deferred due to a. It is the opposite of a deferred tax liability, which represents. In many cases, tax basis may be less than the respective book carrying value, given accelerated cost.

It is the opposite of a deferred tax liability, which represents. Tax basis may differ from the. Web key takeaways a deferred tax asset is an item on the balance sheet that results from an overpayment or advance payment of taxes. Deferred tax assets and liabilities, along. Web common types of deferred taxes fixed assets. Web a deferred income tax is a liability recorded on a balance sheet resulting from a difference in income recognition between tax laws and the company’s accounting methods. The liability is deferred due to a. In many cases, tax basis may be less than the respective book carrying value, given accelerated cost. Web a deferred tax liability is a listing on a company's balance sheet that records taxes that are owed but are not due to be paid until a future date.

What is Deferred Tax Liability (DTL)? Formula + Calculator

Web a deferred income tax is a liability recorded on a balance sheet resulting from a difference in income recognition between tax laws and the company’s accounting methods. Web common types of deferred taxes fixed assets. The liability is deferred due to a. Web key takeaways a deferred tax asset is an item on the balance sheet that results from.

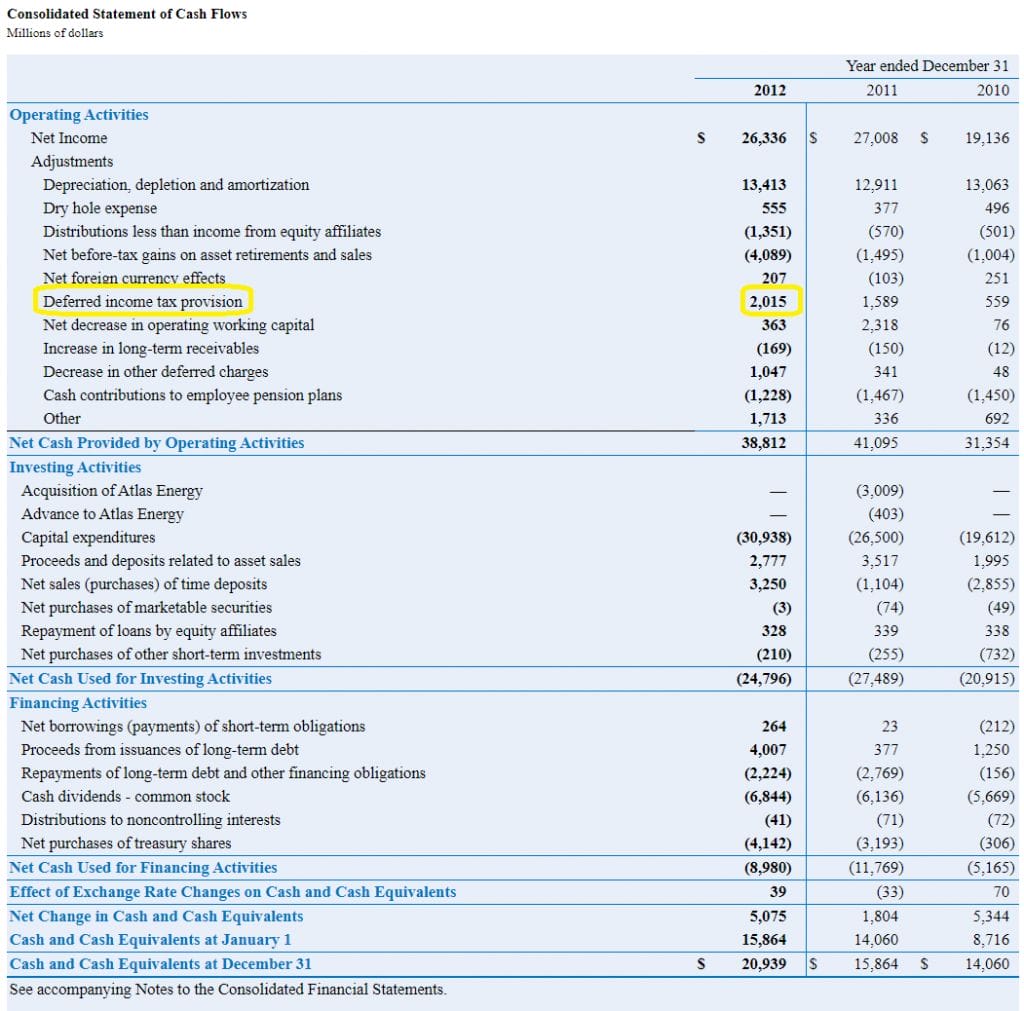

Bookkeeping To Trial Balance Example Of Deferred Tax Liability

It is the opposite of a deferred tax liability, which represents. Deferred tax assets and liabilities, along. Web a deferred tax liability is a listing on a company's balance sheet that records taxes that are owed but are not due to be paid until a future date. Web common types of deferred taxes fixed assets. Web a deferred income tax.

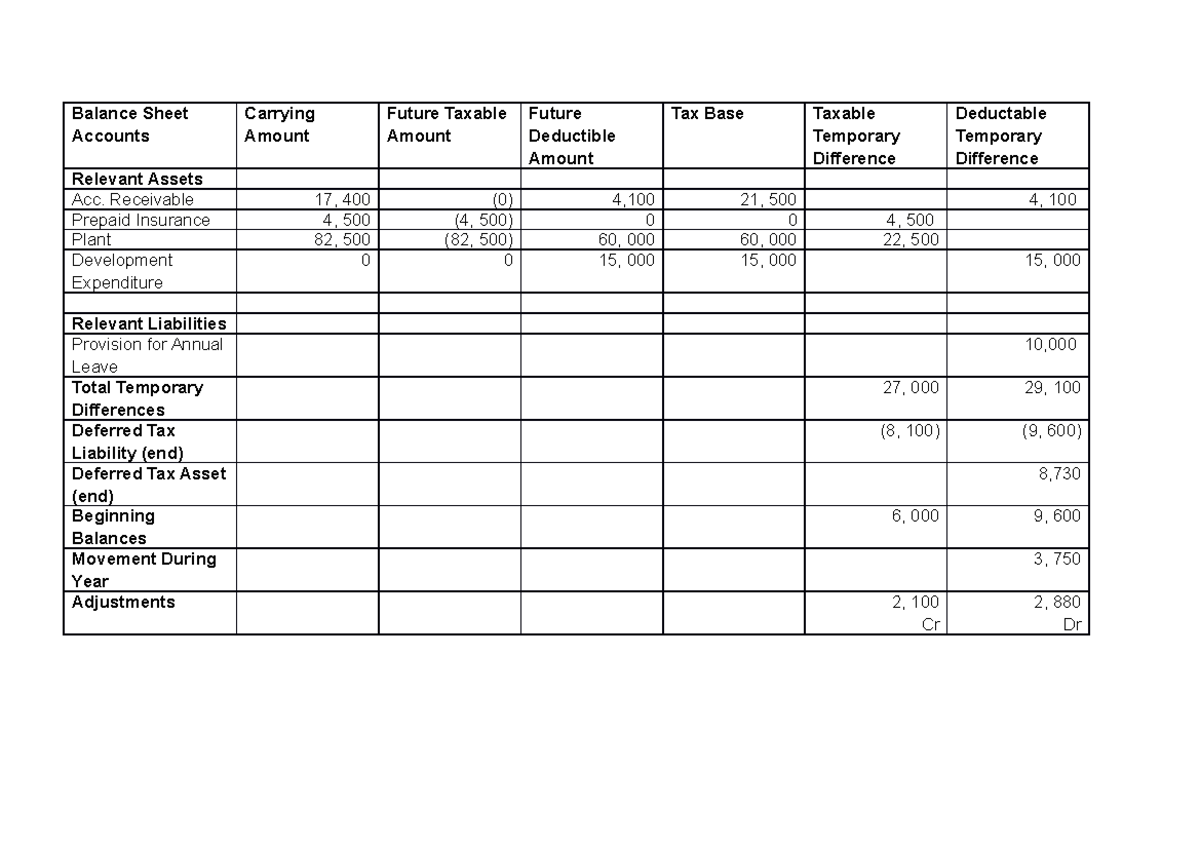

Deferred tax and temporary differences The Footnotes Analyst

Web key takeaways a deferred tax asset is an item on the balance sheet that results from an overpayment or advance payment of taxes. Deferred tax assets and liabilities, along. Web common types of deferred taxes fixed assets. The liability is deferred due to a. Web a deferred tax liability is a listing on a company's balance sheet that records.

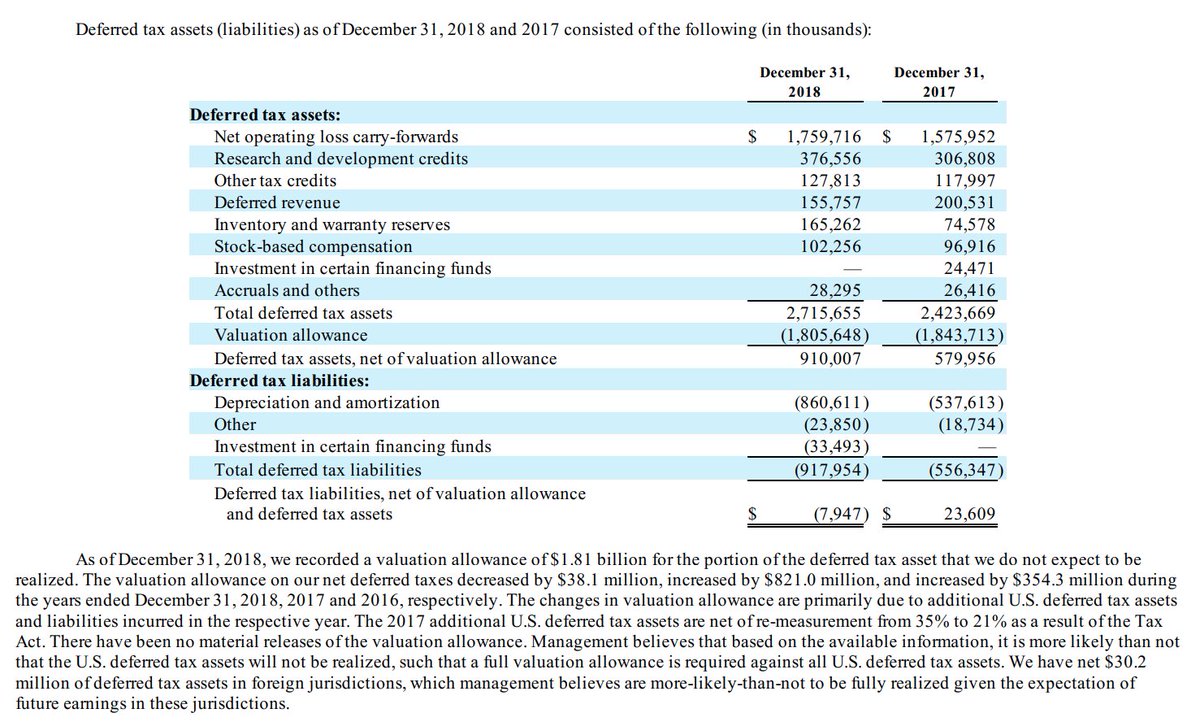

Thread by ReflexFunds Some thoughts on the advantages of TSLA's

It is the opposite of a deferred tax liability, which represents. Web a deferred tax liability is a listing on a company's balance sheet that records taxes that are owed but are not due to be paid until a future date. Web key takeaways a deferred tax asset is an item on the balance sheet that results from an overpayment.

Deferred Tax Liabilities Explained (with RealLife Example in a

Web key takeaways a deferred tax asset is an item on the balance sheet that results from an overpayment or advance payment of taxes. Web common types of deferred taxes fixed assets. In many cases, tax basis may be less than the respective book carrying value, given accelerated cost. The liability is deferred due to a. It is the opposite.

Deferred Tax Worksheet Balance Sheet Accounts Carrying Amount Future

Web key takeaways a deferred tax asset is an item on the balance sheet that results from an overpayment or advance payment of taxes. Deferred tax assets and liabilities, along. It is the opposite of a deferred tax liability, which represents. In many cases, tax basis may be less than the respective book carrying value, given accelerated cost. Web a.

Net Operating Losses & Deferred Tax Assets Tutorial

Web key takeaways a deferred tax asset is an item on the balance sheet that results from an overpayment or advance payment of taxes. Web common types of deferred taxes fixed assets. The liability is deferred due to a. Tax basis may differ from the. In many cases, tax basis may be less than the respective book carrying value, given.

deferred tax assets meaning JWord サーチ

Tax basis may differ from the. Web common types of deferred taxes fixed assets. It is the opposite of a deferred tax liability, which represents. Web a deferred income tax is a liability recorded on a balance sheet resulting from a difference in income recognition between tax laws and the company’s accounting methods. Deferred tax assets and liabilities, along.

Tariq PDF Deferred Tax Balance Sheet

The liability is deferred due to a. In many cases, tax basis may be less than the respective book carrying value, given accelerated cost. Web common types of deferred taxes fixed assets. It is the opposite of a deferred tax liability, which represents. Tax basis may differ from the.

Nice Deferred Tax Liability On Balance Sheet Finance Department Positions

The liability is deferred due to a. Deferred tax assets and liabilities, along. Web key takeaways a deferred tax asset is an item on the balance sheet that results from an overpayment or advance payment of taxes. Web a deferred tax liability is a listing on a company's balance sheet that records taxes that are owed but are not due.

Web A Deferred Tax Liability Is A Listing On A Company's Balance Sheet That Records Taxes That Are Owed But Are Not Due To Be Paid Until A Future Date.

Web a deferred income tax is a liability recorded on a balance sheet resulting from a difference in income recognition between tax laws and the company’s accounting methods. Tax basis may differ from the. Web key takeaways a deferred tax asset is an item on the balance sheet that results from an overpayment or advance payment of taxes. It is the opposite of a deferred tax liability, which represents.

Deferred Tax Assets And Liabilities, Along.

The liability is deferred due to a. Web common types of deferred taxes fixed assets. In many cases, tax basis may be less than the respective book carrying value, given accelerated cost.

:max_bytes(150000):strip_icc()/deferredincometax-v3-b8dc55e780ab4f47a0987161ece97060.png)