Does Depreciation Expense Go On The Balance Sheet

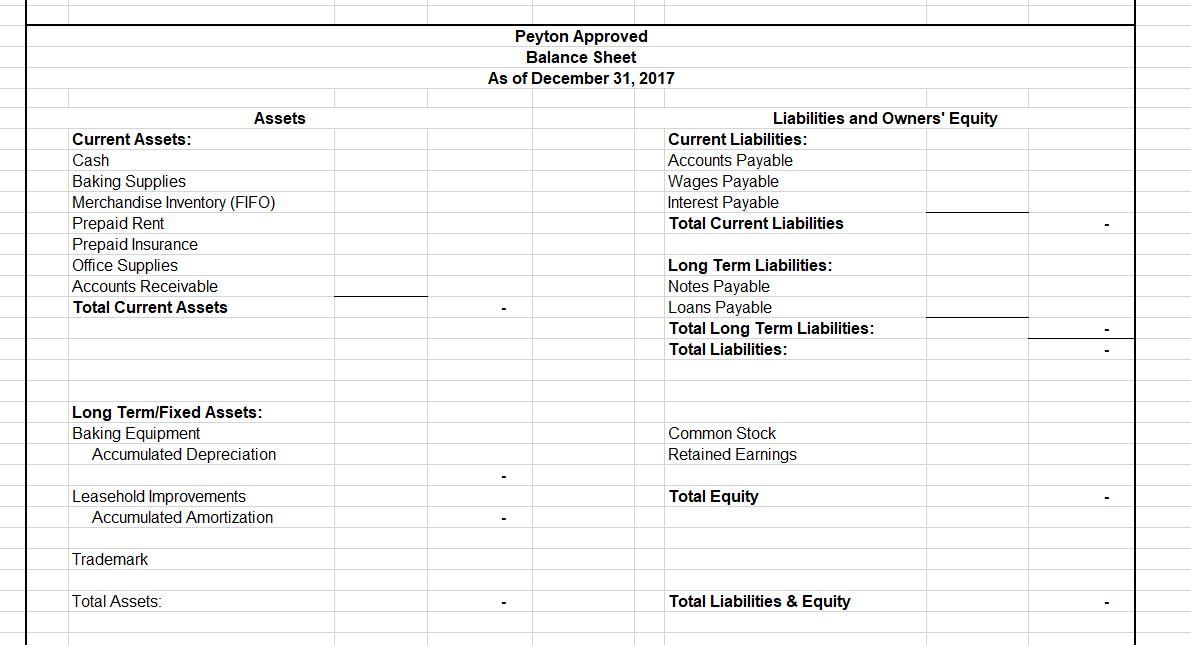

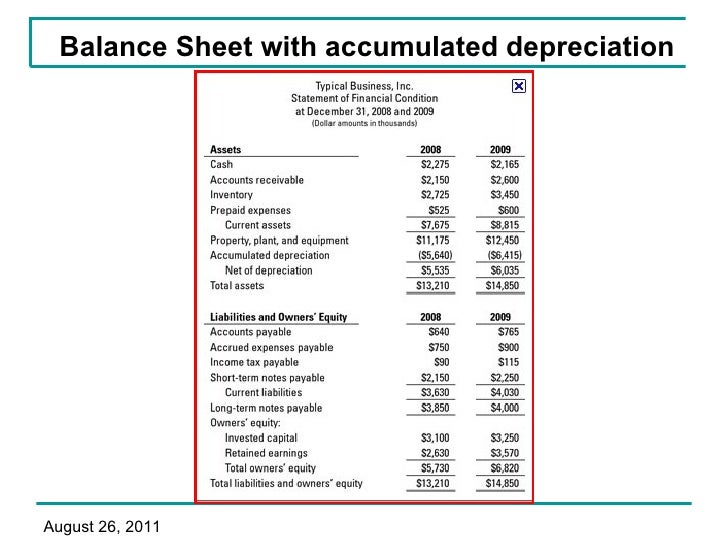

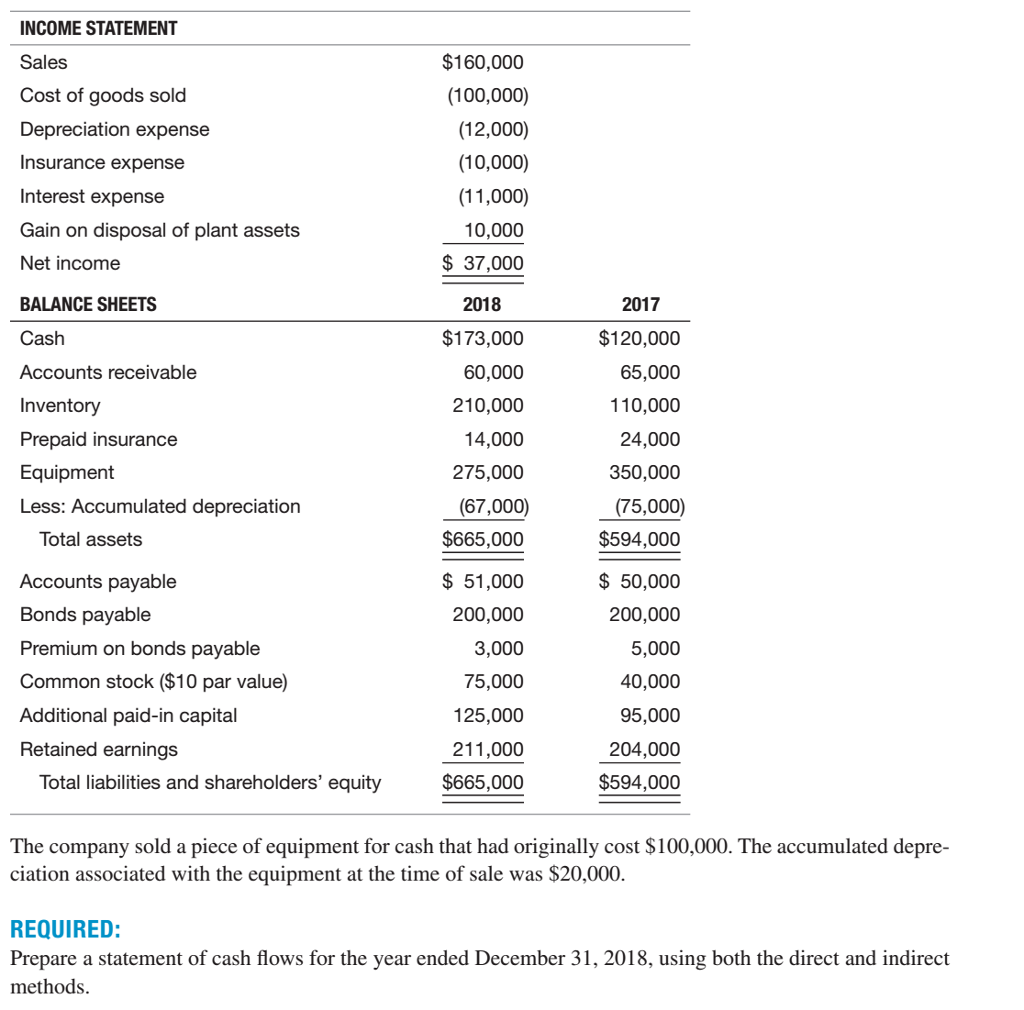

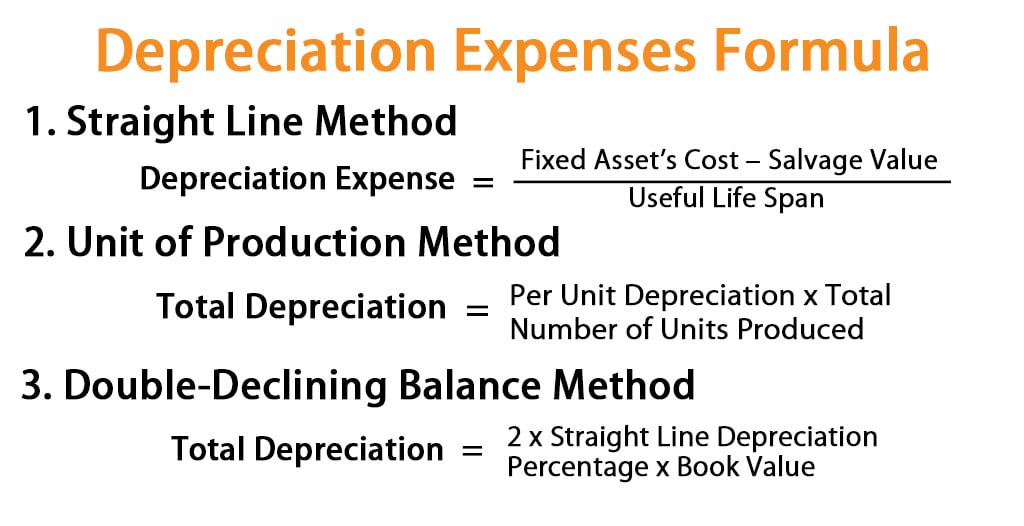

Does Depreciation Expense Go On The Balance Sheet - It accounts for depreciation charged to expense for the income reporting period. It is reported on the income statement along with other normal business expenses. The balance sheet of a business shows the value of the assets of the business against the value of the liabilities and owner's equity or retained earnings. Web for income statements, depreciation is listed as an expense. Accumulated depreciation is not recorded separately on the balance sheet. On the other hand, when it’s listed on the balance sheet, it accounts for total. Web depreciation expense is recorded on the income statement as an expense or debit, reducing net income. The cost for each year you own the asset becomes a business expense for that. Accumulated depreciation is listed on the balance sheet. Web depreciation on your balance sheet.

The cost for each year you own the asset becomes a business expense for that. It accounts for depreciation charged to expense for the income reporting period. It is reported on the income statement along with other normal business expenses. Web for income statements, depreciation is listed as an expense. Web depreciation expense is recorded on the income statement as an expense or debit, reducing net income. Depreciation expense is not a current asset; Accumulated depreciation is not recorded separately on the balance sheet. The balance sheet of a business shows the value of the assets of the business against the value of the liabilities and owner's equity or retained earnings. Web depreciation on your balance sheet. Accumulated depreciation is listed on the balance sheet.

Accumulated depreciation is listed on the balance sheet. Depreciation expense is not a current asset; Web depreciation on your balance sheet. It is reported on the income statement along with other normal business expenses. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. The balance sheet of a business shows the value of the assets of the business against the value of the liabilities and owner's equity or retained earnings. On the other hand, when it’s listed on the balance sheet, it accounts for total. Accumulated depreciation is not recorded separately on the balance sheet. Web for income statements, depreciation is listed as an expense. The cost for each year you own the asset becomes a business expense for that.

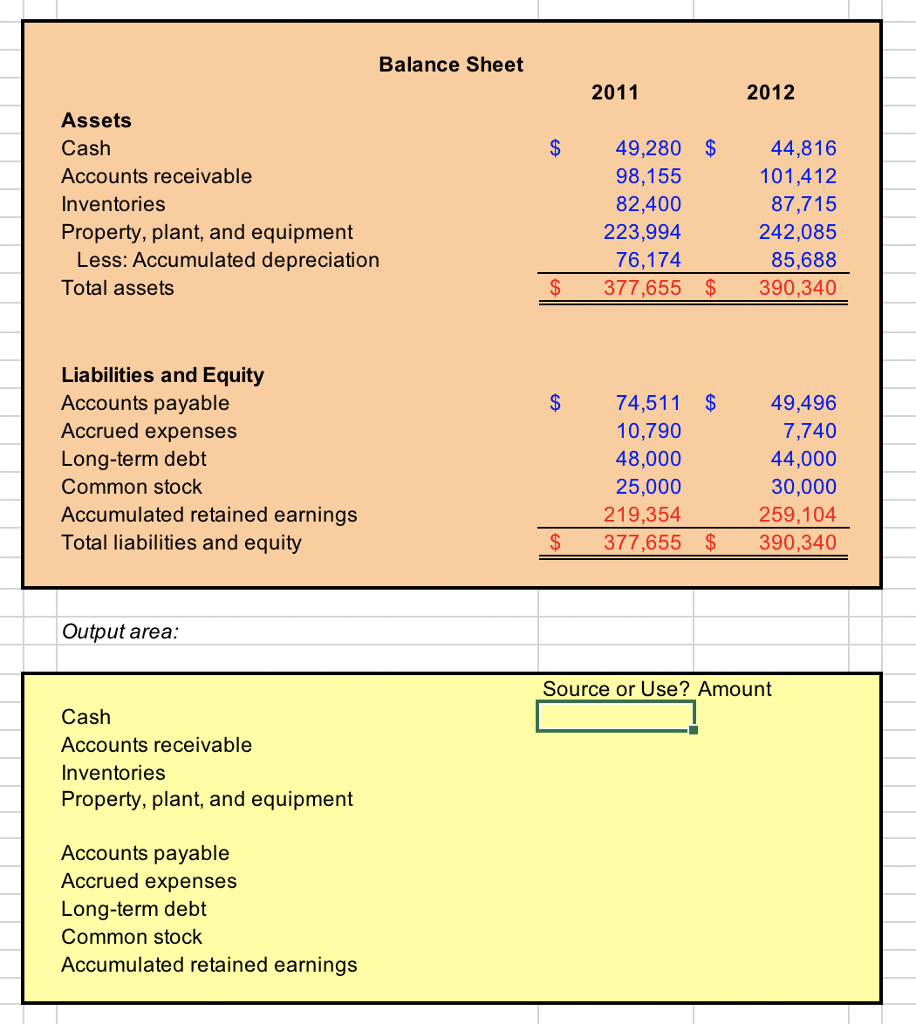

Solved Excluding accumulated depreciation, determine whether

On the other hand, when it’s listed on the balance sheet, it accounts for total. Web depreciation on your balance sheet. The cost for each year you own the asset becomes a business expense for that. It is reported on the income statement along with other normal business expenses. It accounts for depreciation charged to expense for the income reporting.

😍 State the formula for the accounting equation. What Is the Accounting

It accounts for depreciation charged to expense for the income reporting period. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Accumulated depreciation is listed on the balance sheet. Web depreciation expense is recorded on the income statement as an expense or debit, reducing net income. The.

Raise yourself courage zero asset depreciation table Adolescent Brim Accord

The cost for each year you own the asset becomes a business expense for that. Accumulated depreciation is not recorded separately on the balance sheet. On the other hand, when it’s listed on the balance sheet, it accounts for total. Accumulated depreciation is listed on the balance sheet. Web accumulated depreciation is the total decrease in the value of an.

Pourquoi l'amortissement cumulé estil un solde créditeur

It accounts for depreciation charged to expense for the income reporting period. On the other hand, when it’s listed on the balance sheet, it accounts for total. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Accumulated depreciation is not recorded separately on the balance sheet. Web.

Solved Please help with these tables below. In your final

Accumulated depreciation is listed on the balance sheet. The cost for each year you own the asset becomes a business expense for that. The balance sheet of a business shows the value of the assets of the business against the value of the liabilities and owner's equity or retained earnings. Accumulated depreciation is not recorded separately on the balance sheet..

Depreciation

Web depreciation expense is recorded on the income statement as an expense or debit, reducing net income. The balance sheet of a business shows the value of the assets of the business against the value of the liabilities and owner's equity or retained earnings. The cost for each year you own the asset becomes a business expense for that. Depreciation.

Depreciation Turns Capital Expenditures into Expenses Over Time

Web depreciation on your balance sheet. Depreciation expense is not a current asset; Web depreciation expense is recorded on the income statement as an expense or debit, reducing net income. Accumulated depreciation is listed on the balance sheet. The balance sheet of a business shows the value of the assets of the business against the value of the liabilities and.

What is Accumulated Depreciation? Formula + Calculator

On the other hand, when it’s listed on the balance sheet, it accounts for total. It is reported on the income statement along with other normal business expenses. Web for income statements, depreciation is listed as an expense. Accumulated depreciation is listed on the balance sheet. Accumulated depreciation is not recorded separately on the balance sheet.

Solved STATEMENT Sales Cost of goods sold

Accumulated depreciation is listed on the balance sheet. Web for income statements, depreciation is listed as an expense. Web depreciation on your balance sheet. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. It accounts for depreciation charged to expense for the income reporting period.

How To Calculate Depreciation Cost Of Vehicle Haiper

On the other hand, when it’s listed on the balance sheet, it accounts for total. Web depreciation expense is recorded on the income statement as an expense or debit, reducing net income. Accumulated depreciation is listed on the balance sheet. Web for income statements, depreciation is listed as an expense. Depreciation expense is not a current asset;

It Accounts For Depreciation Charged To Expense For The Income Reporting Period.

On the other hand, when it’s listed on the balance sheet, it accounts for total. It is reported on the income statement along with other normal business expenses. Web depreciation expense is recorded on the income statement as an expense or debit, reducing net income. Depreciation expense is not a current asset;

The Balance Sheet Of A Business Shows The Value Of The Assets Of The Business Against The Value Of The Liabilities And Owner's Equity Or Retained Earnings.

Web for income statements, depreciation is listed as an expense. Accumulated depreciation is not recorded separately on the balance sheet. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. The cost for each year you own the asset becomes a business expense for that.

Web Depreciation On Your Balance Sheet.

Accumulated depreciation is listed on the balance sheet.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)