Does Form 1310 Need To Be Mailed

Does Form 1310 Need To Be Mailed - Then you have to provide all other required information in the. Web line a check the box on line a if you received a refund check in your name and your deceased spouse's name. Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Web this information includes name, address, and the social security number of the person who is filing the tax return. Get ready for tax season deadlines by completing any required tax forms today. You can prepare the form and then mail it in to the same irs service center as the decedent's tax return would be mailed to. However, you must attach to his return a copy of the. Personal representatives must file a. Web support community discussions taxes get your taxes done still need to file?

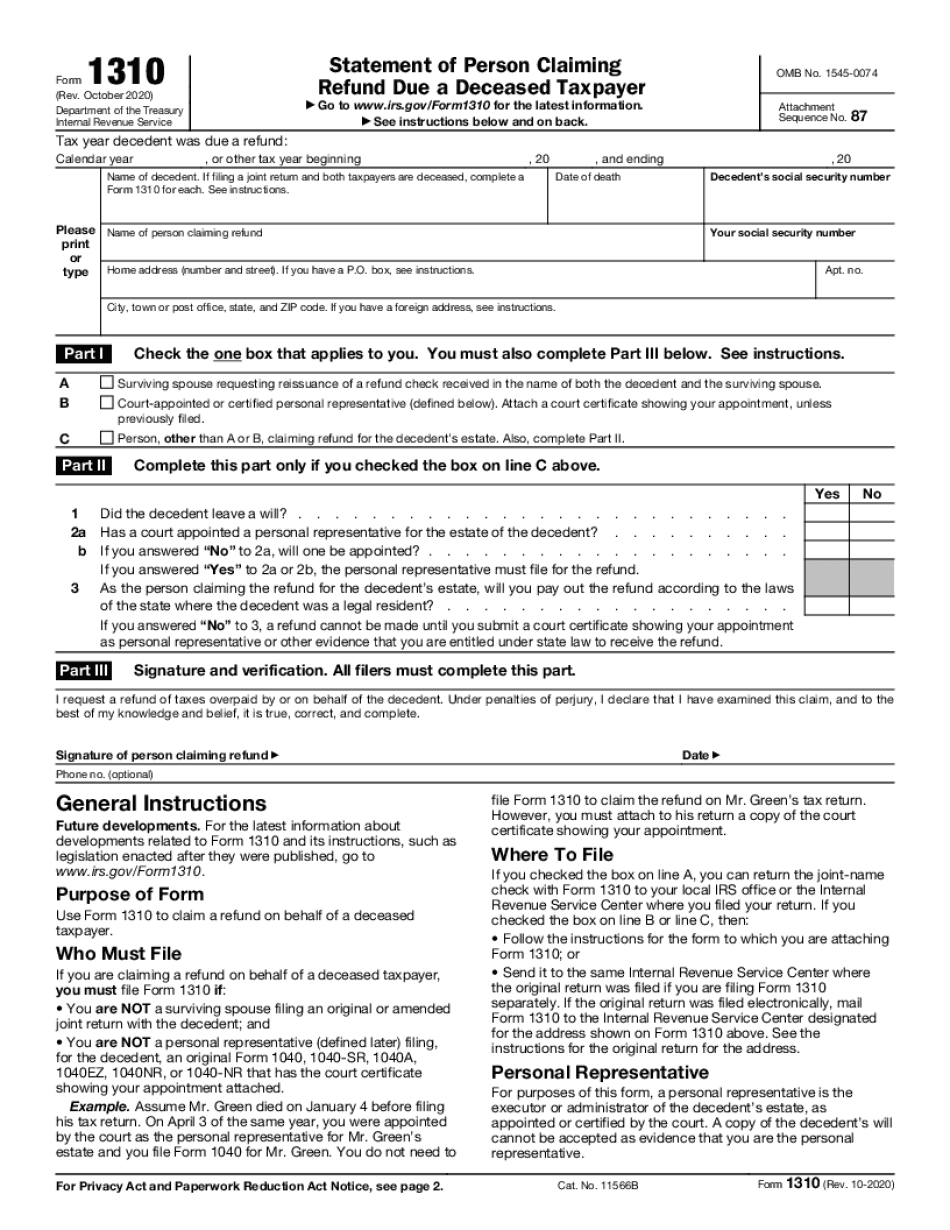

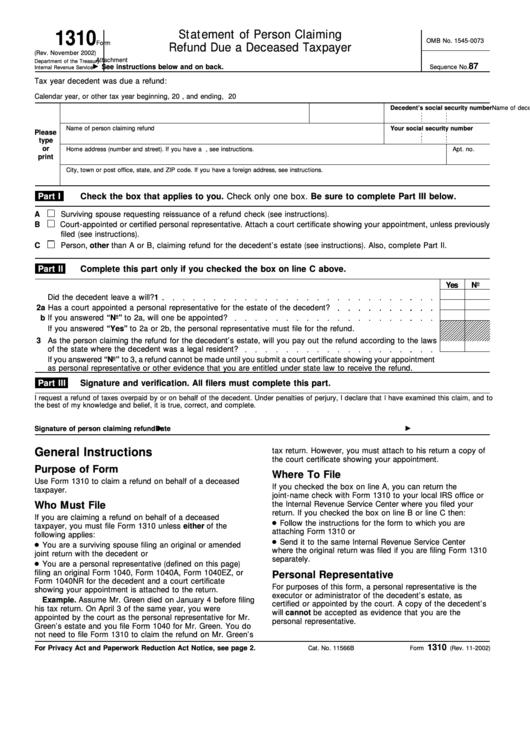

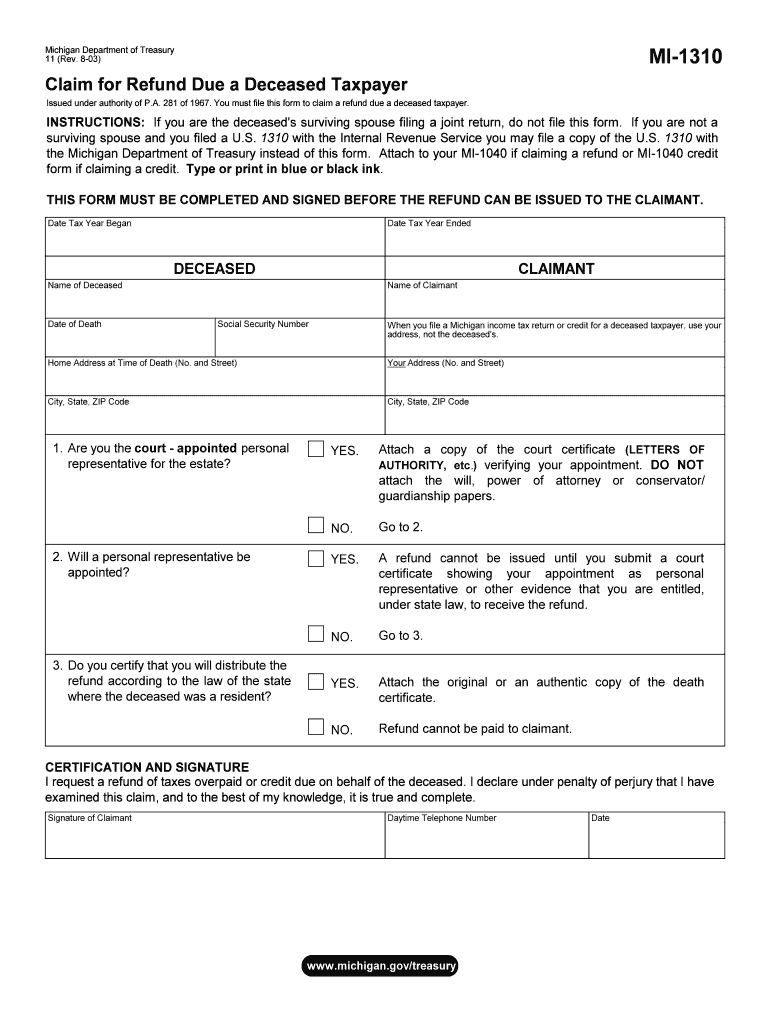

Generally, a person who is filing a return for a decedent and claiming a refund must file form 1310 statement of person claiming. Green died on january 4 before filing his tax return. Get started > samhouston76 new member. Web if you filed a tax return with a spouse who died in 2020 and you want to change the name of the taxpayer on the refund check, you must file form 1310 statement of person claiming. Web the “statement of person claiming refund due a deceased taxpayer” can be used by a deceased taxpayer’s surviving spouse, the decedent’s estate executor or administrator,. Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Ad access irs tax forms. Web in general, file and prepare the final individual income tax return of a deceased person the same way you would if the person were alive. Get ready for tax season deadlines by completing any required tax forms today. Web 9 rows surviving spouses must file form 1310 only when they request reissuance of a refund check in the surviving spouse's name.

Web if you filed a tax return with a spouse who died in 2020 and you want to change the name of the taxpayer on the refund check, you must file form 1310 statement of person claiming. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual. Get started > samhouston76 new member. Complete, edit or print tax forms instantly. Web estate and you file form 1040 for mr. However, you must attach to his return a copy of the. Get ready for tax season deadlines by completing any required tax forms today. Web support community discussions taxes get your taxes done still need to file? Web in general, file and prepare the final individual income tax return of a deceased person the same way you would if the person were alive. Complete, edit or print tax forms instantly.

Irs Form 1310 Printable Master of Documents

Web support community discussions taxes get your taxes done still need to file? Web this information includes name, address, and the social security number of the person who is filing the tax return. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to.

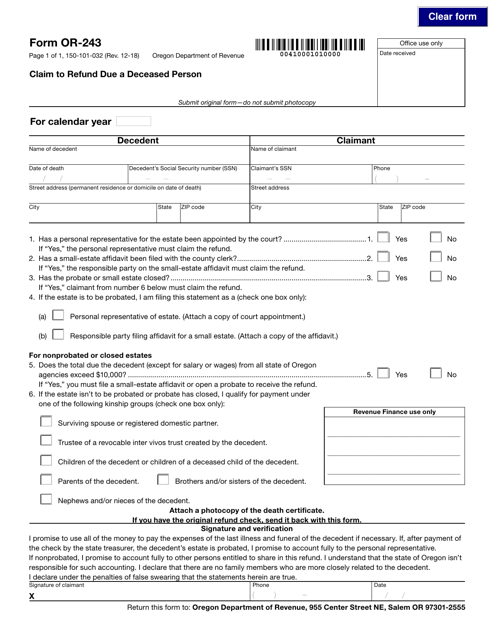

Mi 1310 Form Fill Out and Sign Printable PDF Template signNow

Web 9 rows surviving spouses must file form 1310 only when they request reissuance of a refund check in the surviving spouse's name. Please click below to claim. Web support community discussions taxes get your taxes done still need to file? Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of.

Breanna Form 2848 Irsgov

Web line a check the box on line a if you received a refund check in your name and your deceased spouse's name. However, you must attach to his return a copy of the. On april 3 of the same year, you. Web if you filed a tax return with a spouse who died in 2020 and you want to.

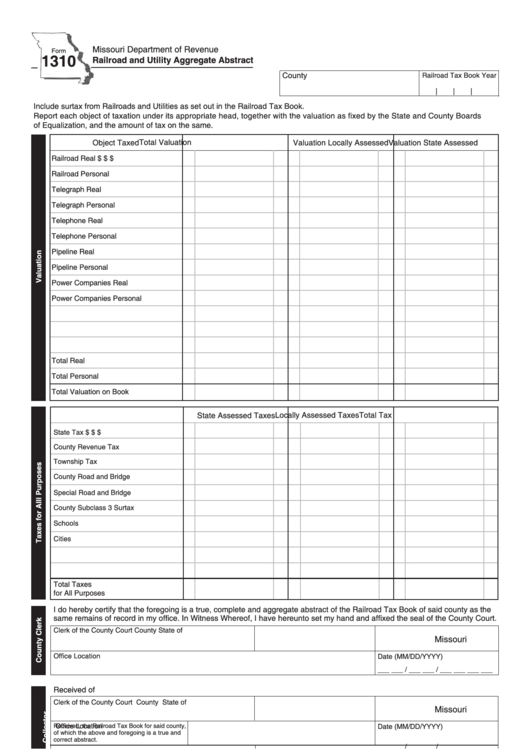

Fillable Form 1310 Railroad And Utility Aggregate Abstract printable

Ad access irs tax forms. On april 3 of the same year, you. Complete, edit or print tax forms instantly. Web 9 rows surviving spouses must file form 1310 only when they request reissuance of a refund check in the surviving spouse's name. Green died on january 4 before filing his tax return.

Irs Form 1310 Printable 2020 2021 Blank Sample to Fill out Online

Get ready for tax season deadlines by completing any required tax forms today. Please click below to claim. You can prepare the form and then mail it in to the same irs service center as the decedent's tax return would be mailed to. Web if you filed a tax return with a spouse who died in 2020 and you want.

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased

Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Then you have to provide all other required information in the. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge.

Mi 1310 Instructions Pdf Fill Out and Sign Printable PDF Template

Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual. Personal representatives must file a. Generally, a person who is filing a return for a decedent and claiming a refund must file form 1310 statement of person claiming. Web form 1310.

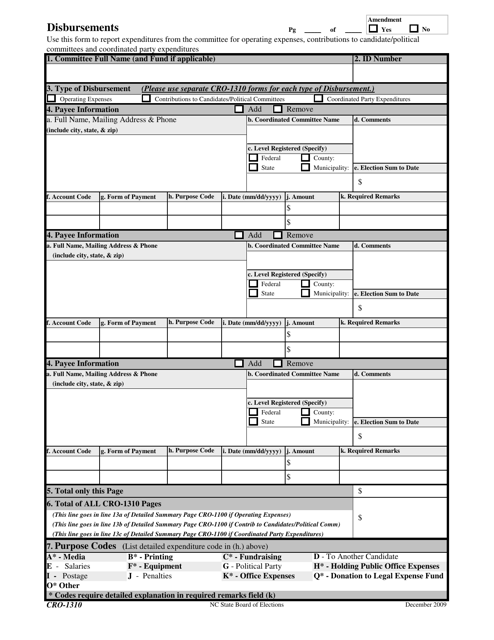

Form CRO1310 Download Printable PDF or Fill Online Disbursements North

However, you must attach to his return a copy of the. On april 3 of the same year, you. Web 9 rows surviving spouses must file form 1310 only when they request reissuance of a refund check in the surviving spouse's name. Web line a check the box on line a if you received a refund check in your name.

Download Fillable dd Form 1309

Web support community discussions taxes get your taxes done still need to file? Web if you filed a tax return with a spouse who died in 2020 and you want to change the name of the taxpayer on the refund check, you must file form 1310 statement of person claiming. Get ready for tax season deadlines by completing any required.

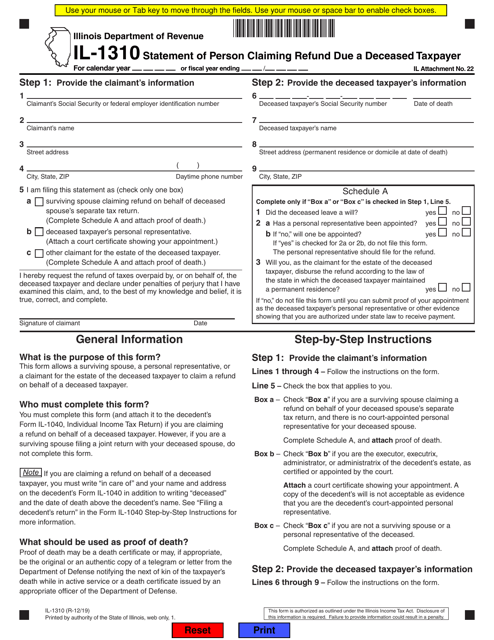

Form IL1310 Download Fillable PDF or Fill Online Statement of Person

Web this information includes name, address, and the social security number of the person who is filing the tax return. Web in general, file and prepare the final individual income tax return of a deceased person the same way you would if the person were alive. Ad access irs tax forms. Web 9 rows surviving spouses must file form 1310.

Web Support Community Discussions Taxes Get Your Taxes Done Still Need To File?

Get ready for tax season deadlines by completing any required tax forms today. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual. Our experts can get your taxes done right. Personal representatives must file a.

Web The “Statement Of Person Claiming Refund Due A Deceased Taxpayer” Can Be Used By A Deceased Taxpayer’s Surviving Spouse, The Decedent’s Estate Executor Or Administrator,.

Web in general, file and prepare the final individual income tax return of a deceased person the same way you would if the person were alive. Please click below to claim. Green died on january 4 before filing his tax return. Complete, edit or print tax forms instantly.

However, You Must Attach To His Return A Copy Of The.

Web if you filed a tax return with a spouse who died in 2020 and you want to change the name of the taxpayer on the refund check, you must file form 1310 statement of person claiming. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Web estate and you file form 1040 for mr. Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer).

Generally, A Person Who Is Filing A Return For A Decedent And Claiming A Refund Must File Form 1310 Statement Of Person Claiming.

Ad access irs tax forms. Ad access irs tax forms. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today.

/1310-RefundClaimDuetoDeceasedTaxpayer-1-292bd14843c94bf4abf09ea5d6eb9a4b.png)