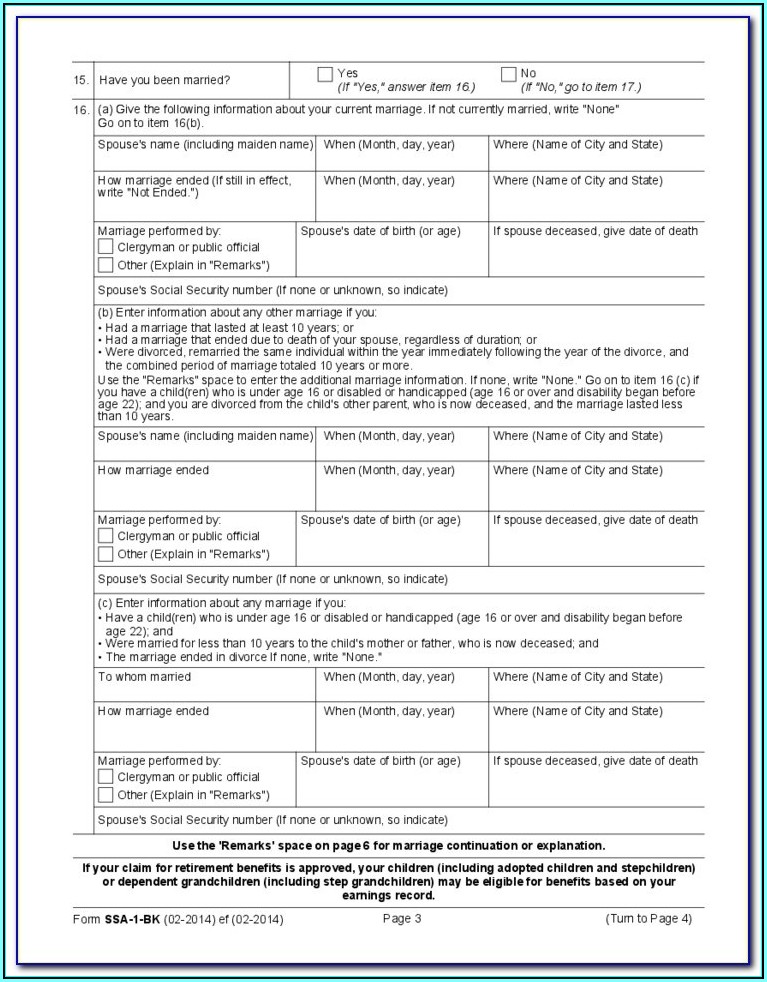

Empower Retirement Withdrawal Request Form

Empower Retirement Withdrawal Request Form - Please complete and fax or email to empower retirement. Not available for plans offering a qualified joint and survivor annuity (qjsa) payout option. Those taken during retirement to meet living expenses, and those taken before retirement for emergencies or major life changes. Reach out if you have questions about your workplace retirement plan. If you need to send us confidential. Greenwood village, co 80111 fax: Plan provides hardship approval empower reviews the hardship request to ensure it is complete. Empower reviews withdrawal requests and returns requests that lack required information to participants. Web 1 funds rolled over from a pretax retirement account to a roth account are subject to income tax. These include 401(k), 403(b) and more.

Web 1 notify empower when we learn an account holder has passed we immediately limit account access for enhanced security. Web 1 funds rolled over from a pretax retirement account to a roth account are subject to income tax. Plan provides hardship approval empower reviews the hardship request to ensure it is complete. Empower reviews withdrawal requests and returns requests that lack required information to participants. Web in general, there are two types of withdrawals: Web obtains a hardship distribution request form online or by speaking with a service center representative. These include 401(k), 403(b) and more. Reach out if you have questions about your workplace retirement plan. Not available for plans offering a qualified joint and survivor annuity (qjsa) payout option. Complete the notification form and send via:

Greenwood village, co 80111 fax: If the plan has pay centers and/or divisions with different contacts, please complete one login form for each pay center and/or division. Complete the notification form and send via: Not available for plans offering a qualified joint and survivor annuity (qjsa) payout option. Empower reviews withdrawal requests and returns requests that lack required information to participants. Plan provides hardship approval empower reviews the hardship request to ensure it is complete. Please complete and fax or email to empower retirement. Web in general, there are two types of withdrawals: Web 1 funds rolled over from a pretax retirement account to a roth account are subject to income tax. Web withdrawal options1 when you begin making withdrawals from either a traditional or roth ira account, your options include:

Nationwide 401k Withdrawal Form Universal Network

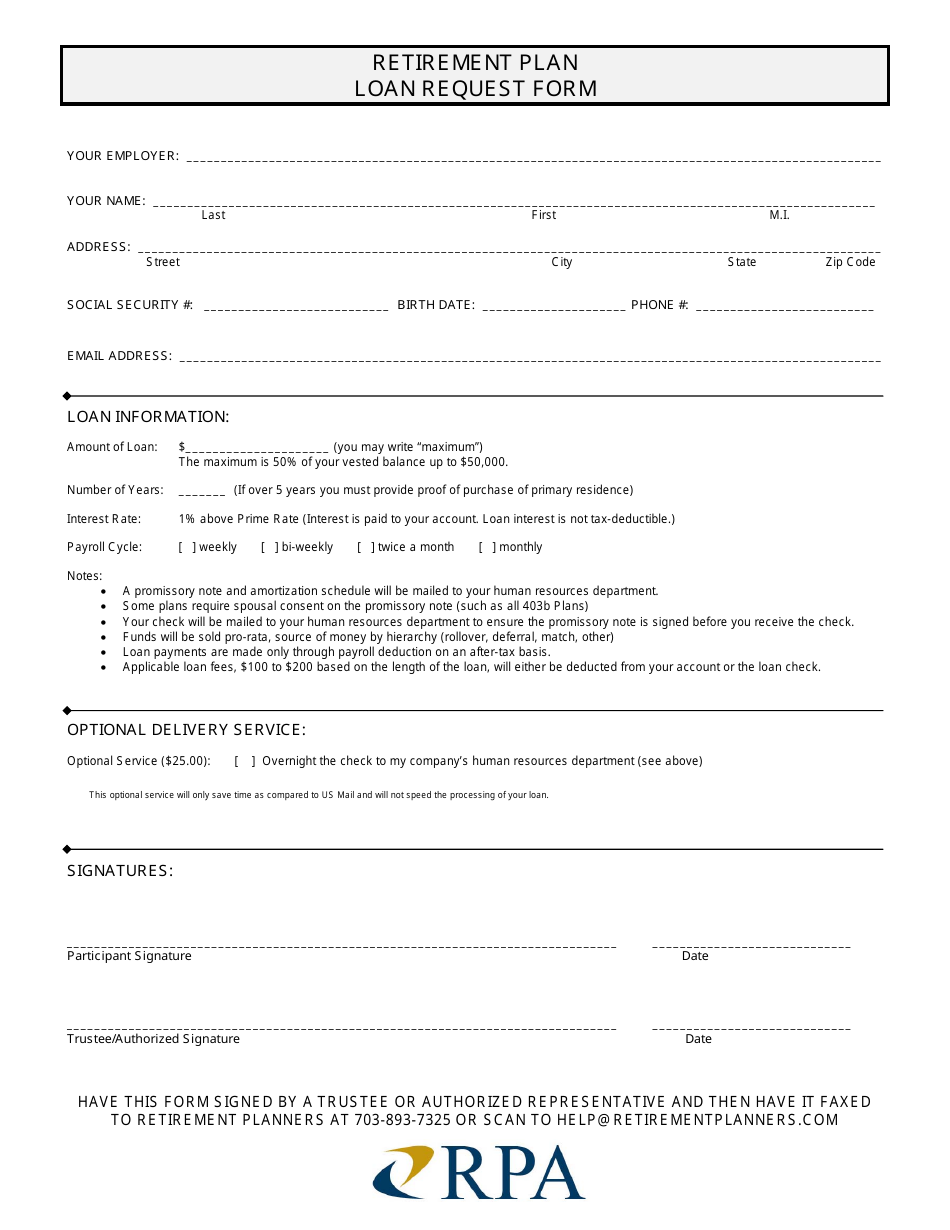

Web obtains a hardship distribution request form online or by speaking with a service center representative. Not available for plans offering a qualified joint and survivor annuity (qjsa) payout option. Web 1 funds rolled over from a pretax retirement account to a roth account are subject to income tax. Complete the notification form and send via: Plan provides hardship approval.

Empower retirement early withdrawal 401k Early Retirement

Complete the notification form and send via: Web 1 notify empower when we learn an account holder has passed we immediately limit account access for enhanced security. Plan provides hardship approval empower reviews the hardship request to ensure it is complete. These include 401(k), 403(b) and more. Not available for plans offering a qualified joint and survivor annuity (qjsa) payout.

Mutual Of America Withdrawal And Rollover Request Form Pdf Fill

Web 1 funds rolled over from a pretax retirement account to a roth account are subject to income tax. If you need to send us confidential. Plan provides hardship approval empower reviews the hardship request to ensure it is complete. Greenwood village, co 80111 fax: Web withdrawal options1 when you begin making withdrawals from either a traditional or roth ira.

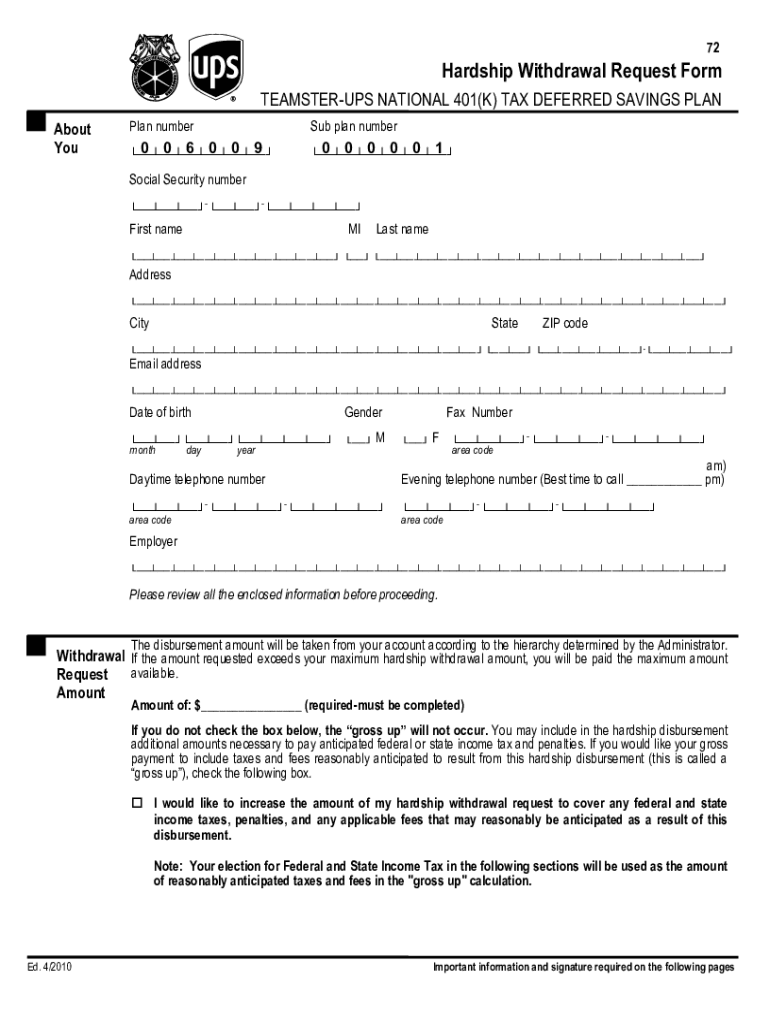

request for withdrawal form Equal Employment Opportunity Commission

Web withdrawal options1 when you begin making withdrawals from either a traditional or roth ira account, your options include: Complete the notification form and send via: Web obtains a hardship distribution request form online or by speaking with a service center representative. If the plan has pay centers and/or divisions with different contacts, please complete one login form for each.

Retirement Withdrawal Spreadsheet Throughout 50 30 20 Rule Spreadsheet

Plan provides hardship approval empower reviews the hardship request to ensure it is complete. Web obtains a hardship distribution request form online or by speaking with a service center representative. Web in general, there are two types of withdrawals: Complete the notification form and send via: Not available for plans offering a qualified joint and survivor annuity (qjsa) payout option.

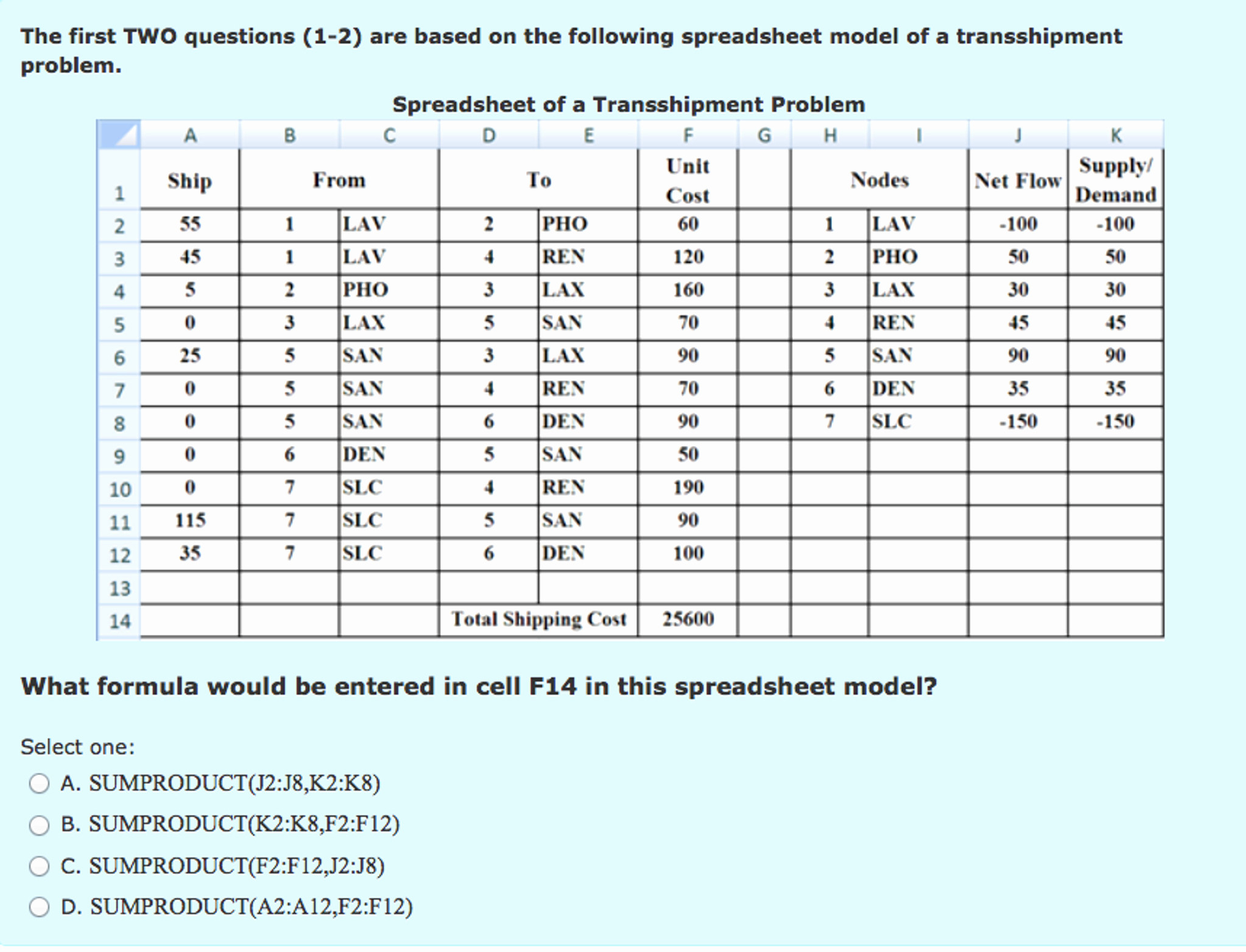

Retirement Plan Loan Request Form Rpa Download Fillable PDF

Web obtains a hardship distribution request form online or by speaking with a service center representative. Complete the notification form and send via: Reach out if you have questions about your workplace retirement plan. If you need to send us confidential. Greenwood village, co 80111 fax:

Prudential Withdrawal Form Fill Out and Sign Printable PDF Template

Those taken during retirement to meet living expenses, and those taken before retirement for emergencies or major life changes. Web obtains a hardship distribution request form online or by speaking with a service center representative. Complete the notification form and send via: Empower reviews withdrawal requests and returns requests that lack required information to participants. Web 1 funds rolled over.

FREE 9+ Sample Retirement Withdrawal Calculator Templates in PDF

Empower reviews withdrawal requests and returns requests that lack required information to participants. Reach out if you have questions about your workplace retirement plan. Web withdrawal options1 when you begin making withdrawals from either a traditional or roth ira account, your options include: These include 401(k), 403(b) and more. If you need to send us confidential.

Empower Retirement Plan Forms Form Resume Examples edV16kB2q6

If you need to send us confidential. Please complete and fax or email to empower retirement. Web withdrawal options1 when you begin making withdrawals from either a traditional or roth ira account, your options include: Plan provides hardship approval empower reviews the hardship request to ensure it is complete. Greenwood village, co 80111 fax:

2020 Form MetLife NonErisa 403(b) Withdrawal Request Fill Online

Reach out if you have questions about your workplace retirement plan. Not available for plans offering a qualified joint and survivor annuity (qjsa) payout option. Empower reviews withdrawal requests and returns requests that lack required information to participants. If you need to send us confidential. These include 401(k), 403(b) and more.

Those Taken During Retirement To Meet Living Expenses, And Those Taken Before Retirement For Emergencies Or Major Life Changes.

These include 401(k), 403(b) and more. Plan provides hardship approval empower reviews the hardship request to ensure it is complete. If the plan has pay centers and/or divisions with different contacts, please complete one login form for each pay center and/or division. If you need to send us confidential.

Web Obtains A Hardship Distribution Request Form Online Or By Speaking With A Service Center Representative.

Empower reviews withdrawal requests and returns requests that lack required information to participants. Reach out if you have questions about your workplace retirement plan. Web withdrawal options1 when you begin making withdrawals from either a traditional or roth ira account, your options include: Web 1 notify empower when we learn an account holder has passed we immediately limit account access for enhanced security.

Web In General, There Are Two Types Of Withdrawals:

Complete the notification form and send via: Submits hardship request with appropriate supporting documentation to empower. Greenwood village, co 80111 fax: Not available for plans offering a qualified joint and survivor annuity (qjsa) payout option.

Please Complete And Fax Or Email To Empower Retirement.

Web 1 funds rolled over from a pretax retirement account to a roth account are subject to income tax.