Erp Phase 2 Fact Sheet

Erp Phase 2 Fact Sheet - Web erp phase 2 is a tax year based certification program that provides assistance for producers who suffered a loss in revenue. Web erp phase two provides payments if you sufered eligible revenue losses due to qualifying disaster events, such as. Web fsa.usda.gov/erp emergency relief program (erp) 1 factsheet • october 2023 special provision for dafp approved.

Web erp phase 2 is a tax year based certification program that provides assistance for producers who suffered a loss in revenue. Web erp phase two provides payments if you sufered eligible revenue losses due to qualifying disaster events, such as. Web fsa.usda.gov/erp emergency relief program (erp) 1 factsheet • october 2023 special provision for dafp approved.

Web erp phase 2 is a tax year based certification program that provides assistance for producers who suffered a loss in revenue. Web fsa.usda.gov/erp emergency relief program (erp) 1 factsheet • october 2023 special provision for dafp approved. Web erp phase two provides payments if you sufered eligible revenue losses due to qualifying disaster events, such as.

Emergency Relief Program (ERP) Phase 2 Everything To Know About

Web erp phase 2 is a tax year based certification program that provides assistance for producers who suffered a loss in revenue. Web erp phase two provides payments if you sufered eligible revenue losses due to qualifying disaster events, such as. Web fsa.usda.gov/erp emergency relief program (erp) 1 factsheet • october 2023 special provision for dafp approved.

Key Differences Between ERP Phase 2 and PARP

Web erp phase two provides payments if you sufered eligible revenue losses due to qualifying disaster events, such as. Web erp phase 2 is a tax year based certification program that provides assistance for producers who suffered a loss in revenue. Web fsa.usda.gov/erp emergency relief program (erp) 1 factsheet • october 2023 special provision for dafp approved.

Go Live Erp Cycle Diagram

Web erp phase two provides payments if you sufered eligible revenue losses due to qualifying disaster events, such as. Web fsa.usda.gov/erp emergency relief program (erp) 1 factsheet • october 2023 special provision for dafp approved. Web erp phase 2 is a tax year based certification program that provides assistance for producers who suffered a loss in revenue.

What’s the Deal with ERP Phase 2? Oklahoma Farm Report

Web erp phase two provides payments if you sufered eligible revenue losses due to qualifying disaster events, such as. Web erp phase 2 is a tax year based certification program that provides assistance for producers who suffered a loss in revenue. Web fsa.usda.gov/erp emergency relief program (erp) 1 factsheet • october 2023 special provision for dafp approved.

Comparison Fact Sheet Between ERP Phase 2 and PARP AgWeb

Web erp phase two provides payments if you sufered eligible revenue losses due to qualifying disaster events, such as. Web fsa.usda.gov/erp emergency relief program (erp) 1 factsheet • october 2023 special provision for dafp approved. Web erp phase 2 is a tax year based certification program that provides assistance for producers who suffered a loss in revenue.

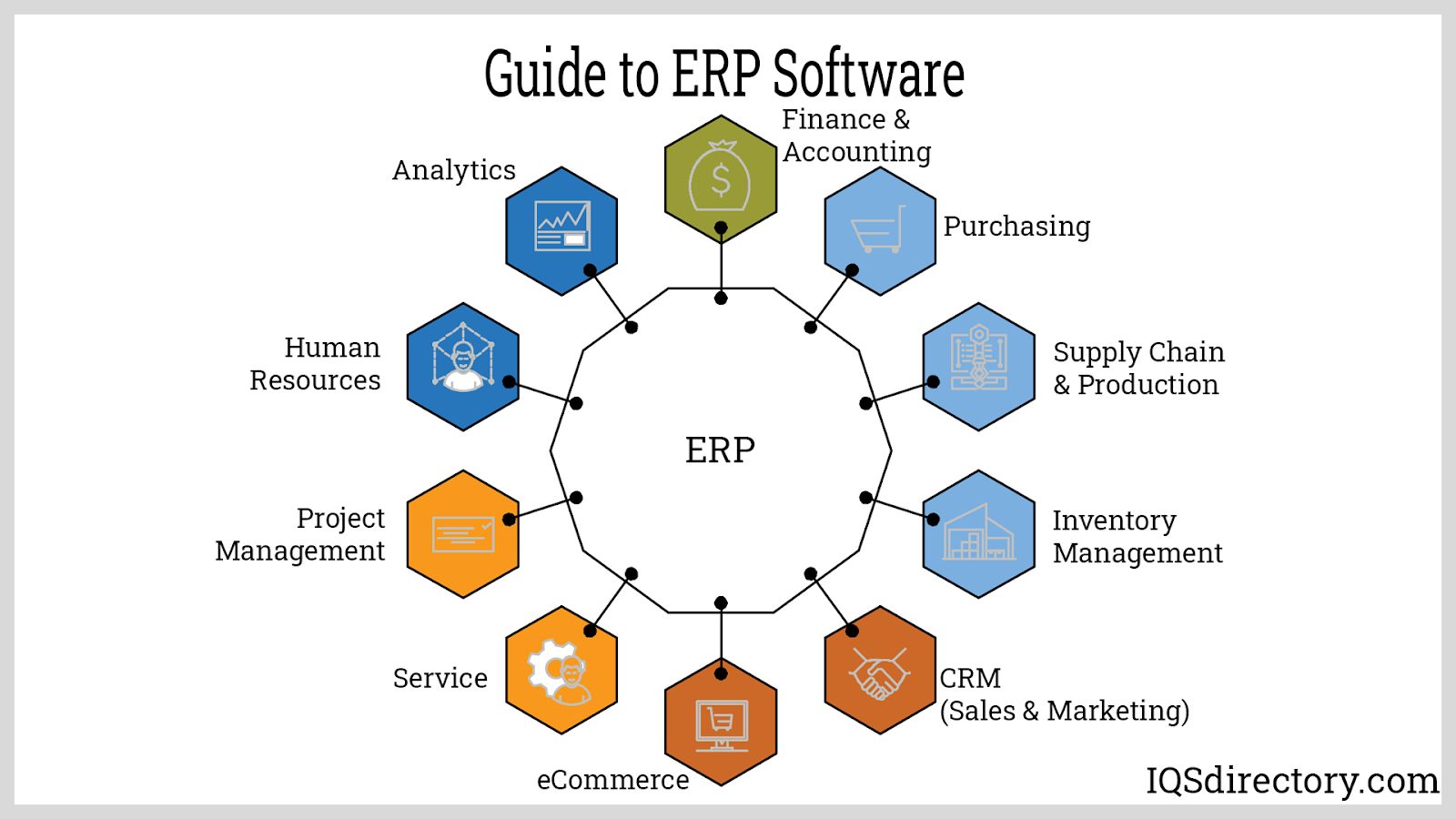

Manufacturing ERP and MRP Software Principles, Examples, Applications

Web fsa.usda.gov/erp emergency relief program (erp) 1 factsheet • october 2023 special provision for dafp approved. Web erp phase 2 is a tax year based certification program that provides assistance for producers who suffered a loss in revenue. Web erp phase two provides payments if you sufered eligible revenue losses due to qualifying disaster events, such as.

ERP contract Archives • EMax Systems

Web fsa.usda.gov/erp emergency relief program (erp) 1 factsheet • october 2023 special provision for dafp approved. Web erp phase two provides payments if you sufered eligible revenue losses due to qualifying disaster events, such as. Web erp phase 2 is a tax year based certification program that provides assistance for producers who suffered a loss in revenue.

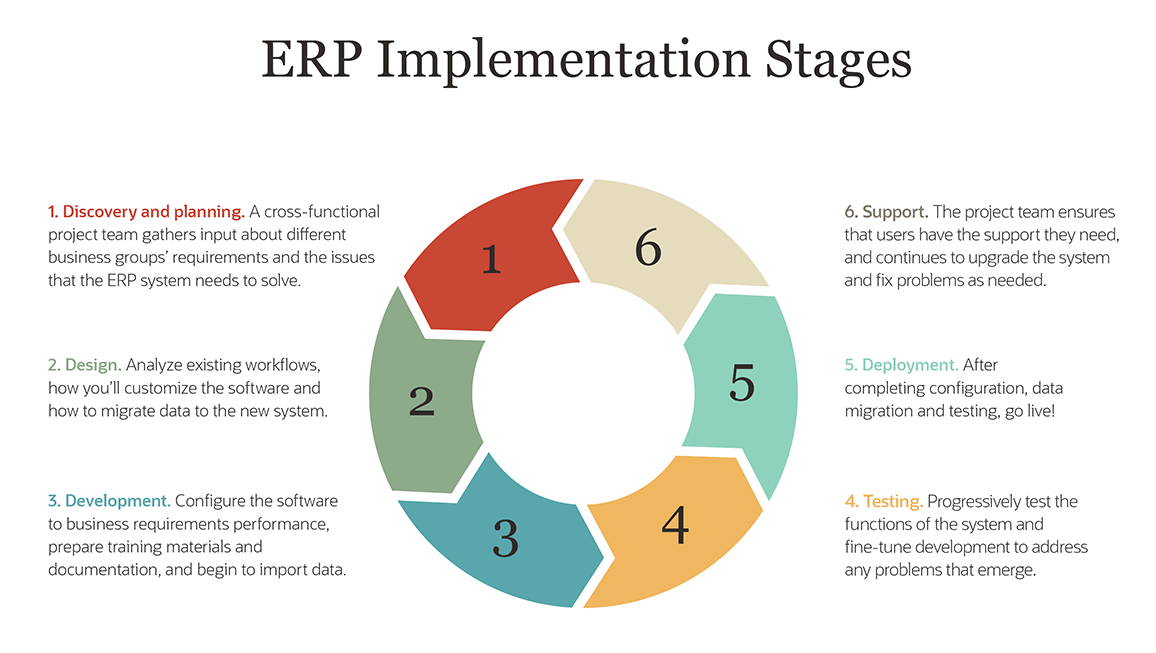

4 Key ERP Implementation Strategies NetSuite

Web fsa.usda.gov/erp emergency relief program (erp) 1 factsheet • october 2023 special provision for dafp approved. Web erp phase two provides payments if you sufered eligible revenue losses due to qualifying disaster events, such as. Web erp phase 2 is a tax year based certification program that provides assistance for producers who suffered a loss in revenue.

Key Differences Between ERP Phase 2 and PARP AgWeb

Web erp phase two provides payments if you sufered eligible revenue losses due to qualifying disaster events, such as. Web fsa.usda.gov/erp emergency relief program (erp) 1 factsheet • october 2023 special provision for dafp approved. Web erp phase 2 is a tax year based certification program that provides assistance for producers who suffered a loss in revenue.

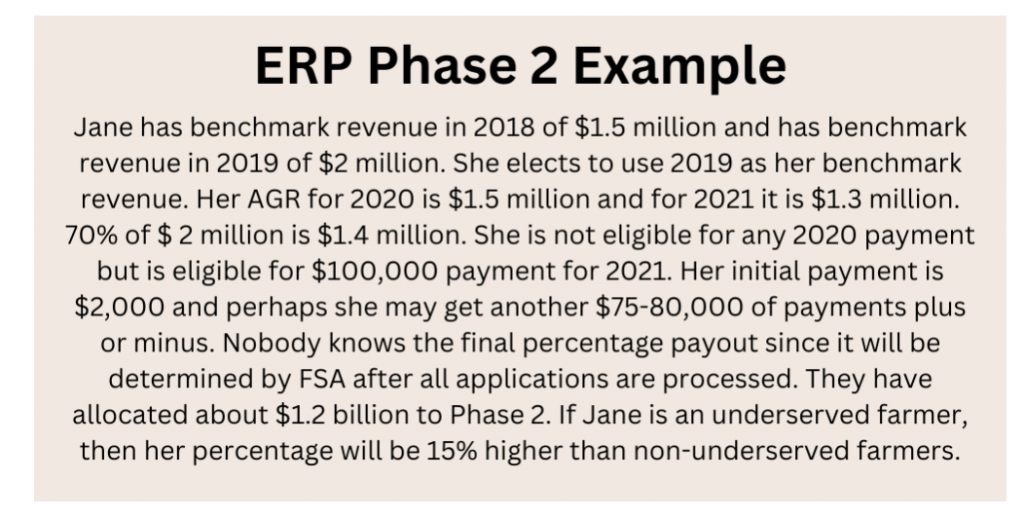

ERP Phase 2 Questions by Paul Neiffer Farm CPA Report

Web erp phase two provides payments if you sufered eligible revenue losses due to qualifying disaster events, such as. Web fsa.usda.gov/erp emergency relief program (erp) 1 factsheet • october 2023 special provision for dafp approved. Web erp phase 2 is a tax year based certification program that provides assistance for producers who suffered a loss in revenue.

Web Erp Phase Two Provides Payments If You Sufered Eligible Revenue Losses Due To Qualifying Disaster Events, Such As.

Web fsa.usda.gov/erp emergency relief program (erp) 1 factsheet • october 2023 special provision for dafp approved. Web erp phase 2 is a tax year based certification program that provides assistance for producers who suffered a loss in revenue.