Etrade Supplemental Form

Etrade Supplemental Form - Cost basis is the total amount that you pay to buy a security. The portfolios, watchlists, gains & losses, and estimated income webpages on etrade.com are provided as tools to assist you with your financial management. Web feb 15 at 6:55 @littleadv there is one form that includes all the stock plans (in my case, espp and rsu). Web i have a supplemental form from etrade, which has 2 columns for each rsu sale: Move funds from your individual 401(k) to your roth individual 401(k) download pdf: Web what is cost basis? Submit online / download pdf Adjusted cost basis and cost basis. File_download for stock plan participants. New applications | add account features | deposit and withdrawals | transfers and distributions | tax and legal | account agreements and disclosures.

Web what is cost basis? Throughout 2023, e*trade securities and e*trade capital management will be transitioning existing clients to morgan stanley smith barney llc. Web transfer foreign stock certificates into your e*trade brokerage account: E*trade does not provide tax advice. File_download for new e*trade customers. Adjusted cost basis and cost basis. Web tax records check out the tax center here to find relevant tax documents and other resources. Web all forms and applications. Web feb 15 at 6:55 @littleadv there is one form that includes all the stock plans (in my case, espp and rsu). Employee stock plan outgoing share transfer:

Web transfer foreign stock certificates into your e*trade brokerage account: Web how to pull your e*trade supplemental tax form. Cost basis is the total amount that you pay to buy a security. Web tax records check out the tax center here to find relevant tax documents and other resources. The portfolios, watchlists, gains & losses, and estimated income webpages on etrade.com are provided as tools to assist you with your financial management. So i tried to correct it to enter adjusted cost basis. It is absolutely essential for us to have this form so we can make sure your tax return is correct. Where and how do i enter this income? E*trade does not provide tax advice. Adjusted cost basis and cost basis.

Is ETRADE Safe, Insured, Legitimate? Is ETRADE Scam? BBB Rating 2019

New applications | add account features | deposit and withdrawals | transfers and distributions | tax and legal | account agreements and disclosures. Adjusted cost basis and cost basis. I am using tt premier which takes cost basis by default. Web i have a supplemental form from etrade, which has 2 columns for each rsu sale: The portfolios, watchlists, gains.

Supplemental Written Statement Format

Web transfer foreign stock certificates into your e*trade brokerage account: Transfer stock plan shares from e*trade securities: Web tax records check out the tax center here to find relevant tax documents and other resources. Adjusted cost basis and cost basis. Web what is cost basis?

Etrade Trust Account Fill Online, Printable, Fillable, Blank pdfFiller

File_download for stock plan participants. If you have rsus or stock options at docusign, square, spotify, and more…you will probably need to log into e*trade and pull a supplement tax form called a 1099. So i tried to correct it to enter adjusted cost basis. Throughout 2023, e*trade securities and e*trade capital management will be transitioning existing clients to morgan.

2011 ETrade IRA Distribution Request Form Fill Online, Printable

It is absolutely essential for us to have this form so we can make sure your tax return is correct. Move funds from your individual 401(k) to your roth individual 401(k) download pdf: Web transfer foreign stock certificates into your e*trade brokerage account: Employee stock plan outgoing share transfer: E*trade does not provide tax advice.

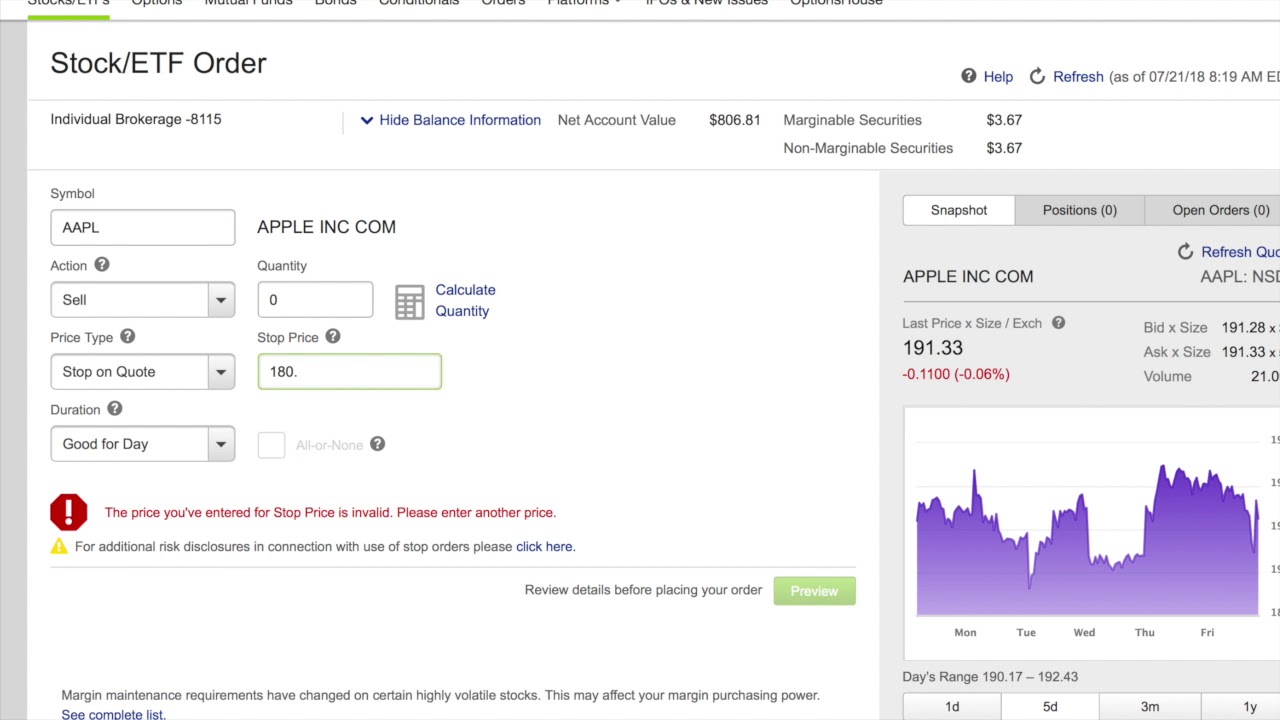

Price Types W/ Etrade YouTube

Submit online / download pdf Web tax records check out the tax center here to find relevant tax documents and other resources. Throughout 2023, e*trade securities and e*trade capital management will be transitioning existing clients to morgan stanley smith barney llc. Move funds from your individual 401(k) to your roth individual 401(k) download pdf: Web what is cost basis?

Is Etrade Good for Beginners? Is Etrade Good Way To Invest, Free?

Web i have a supplemental form from etrade, which has 2 columns for each rsu sale: So i tried to correct it to enter adjusted cost basis. New applications | add account features | deposit and withdrawals | transfers and distributions | tax and legal | account agreements and disclosures. Web tax records check out the tax center here to.

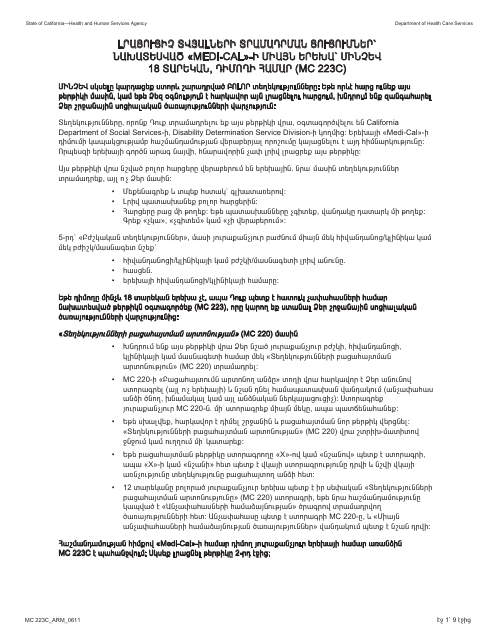

Form MC223 C Fill Out, Sign Online and Download Printable PDF

Where and how do i enter this income? Web feb 15 at 6:55 @littleadv there is one form that includes all the stock plans (in my case, espp and rsu). It is categorized as partnership distribution. File_download for stock plan participants. Web all forms and applications.

Etrade Level 2 Everything You Need to Know

Web feb 15 at 6:55 @littleadv there is one form that includes all the stock plans (in my case, espp and rsu). Submit online / download pdf Employee stock plan outgoing share transfer: Adjusted cost basis and cost basis. The portfolios, watchlists, gains & losses, and estimated income webpages on etrade.com are provided as tools to assist you with your.

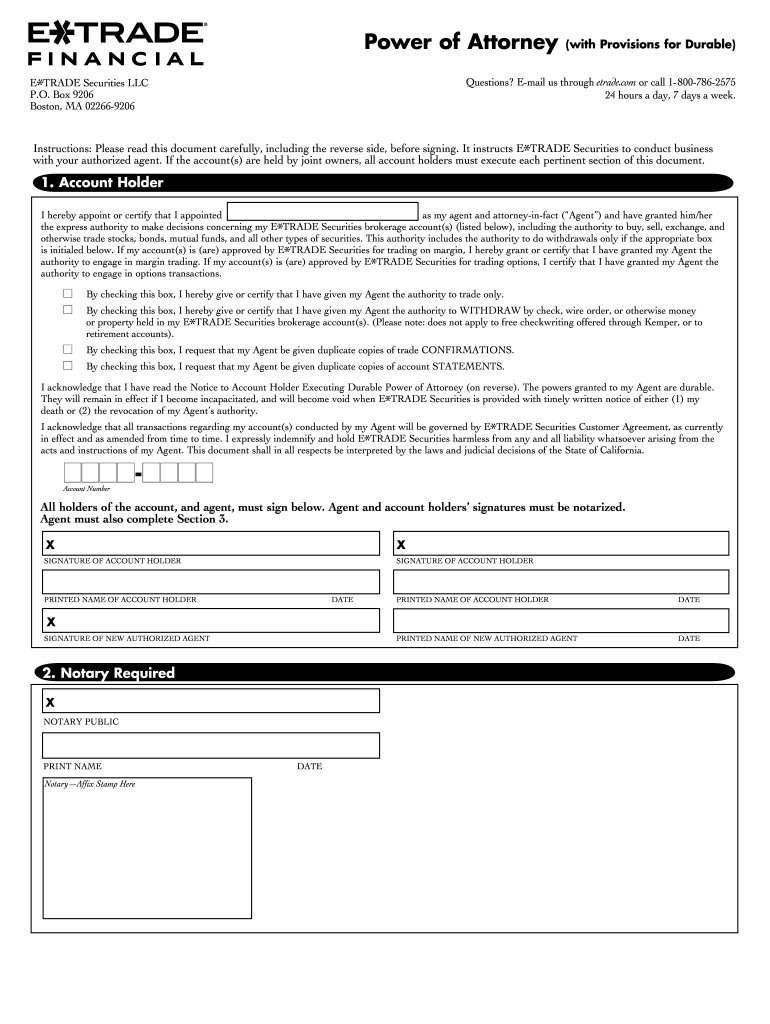

Etrade Power of Attorney Form Fill Out and Sign Printable PDF

Cost basis is the total amount that you pay to buy a security. E*trade does not provide tax advice. Move funds from your individual 401(k) to your roth individual 401(k) download pdf: Employee stock plan outgoing share transfer: Submit online / download pdf

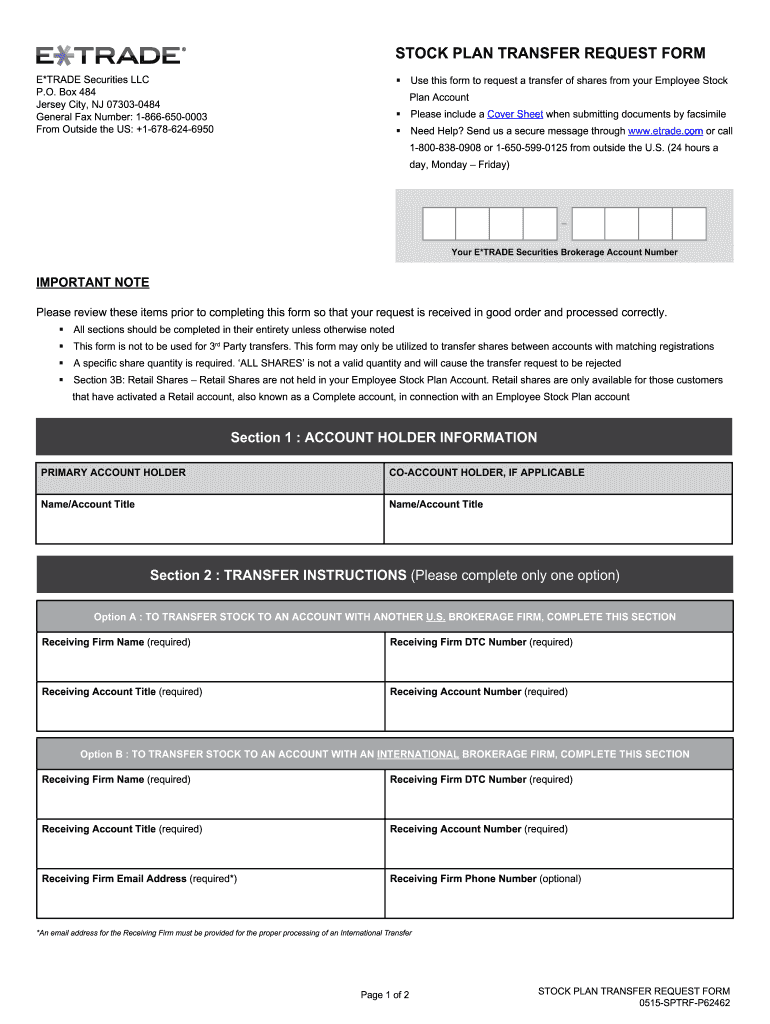

Etrade Stock Plan Transfer Request Form Fill Online, Printable

Submit online / download pdf File_download for stock plan participants. Web all forms and applications. Transfer stock plan shares from e*trade securities: Move funds from your individual 401(k) to your roth individual 401(k) download pdf:

File_Download For Stock Plan Participants.

If you have rsus or stock options at docusign, square, spotify, and more…you will probably need to log into e*trade and pull a supplement tax form called a 1099. Transfer stock plan shares from e*trade securities: It is categorized as partnership distribution. Web download and print for important tax dates and more information:

Web How To Pull Your E*Trade Supplemental Tax Form.

Web all forms and applications. The portfolios, watchlists, gains & losses, and estimated income webpages on etrade.com are provided as tools to assist you with your financial management. It includes the price of the security, plus adjustments for broker commissions, fees, wash sales, corporate action events, and other items that may affect your investment. Web i have a supplemental form from etrade, which has 2 columns for each rsu sale:

I Am Using Tt Premier Which Takes Cost Basis By Default.

So i tried to correct it to enter adjusted cost basis. Web feb 15 at 6:55 @littleadv there is one form that includes all the stock plans (in my case, espp and rsu). File_download for new e*trade customers. Adjusted cost basis and cost basis.

Web What Is Cost Basis?

Web transfer foreign stock certificates into your e*trade brokerage account: It is absolutely essential for us to have this form so we can make sure your tax return is correct. Throughout 2023, e*trade securities and e*trade capital management will be transitioning existing clients to morgan stanley smith barney llc. Submit online / download pdf