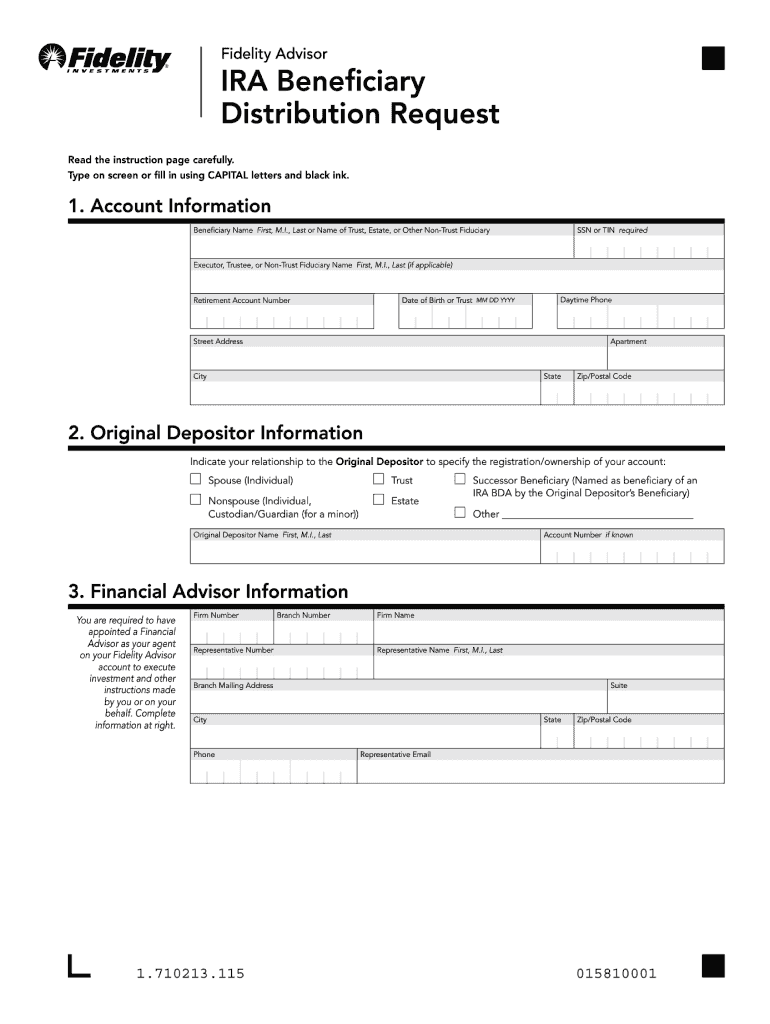

Fidelity Ira Beneficiary Form

Fidelity Ira Beneficiary Form - Use this form if you are a beneficiary and wish to have assets transferred to a beneficiary account in your name or request a distribution. Web fidelity does not sell your information to third parties for monetary consideration. Top what is a transfer on death. Web use this form to add or change beneficiary information, at an account level, for an existing ira(s) including: Most of the time you can add, change, or delete your beneficiaries online. Ad with fidelity go, we manage your ira so you don't have to. Web if you elect to calculate your mrd each year, you must submit a fidelity advisor ira beneficiary distribution request form with the appropriate dollar amount specified. Learn about the rules that apply to these accounts here. General instructions please complete this form and sign it on the back. Start investing & planning for your retirement with help from fidelity.

Web if you would like to add more than 8 primary or contingent beneficiaries, please download and complete a beneficiary designation form. However, we and our marketing and advertising providers (providers) collect certain information. Address & personal information change: Web use this form to establish a fidelity advisor ira beneficiary distribution account (bda), which allows a beneficiary who inherits a traditional ira, rollover ira, sep/sarsep. Web if you elect to calculate your mrd each year, you must submit a fidelity advisor ira beneficiary distribution request form with the appropriate dollar amount specified. General instructions please complete this form and sign it on the back. Learn about the rules that apply to these accounts here. Web inherited iras are for beneficiaries of an ira or a 401k plan. Web a losing a loved one if you've recently experienced a loss, we can help you navigate the important financial steps to take in this difficult time. Start investing & planning for your retirement with help from fidelity.

Top what is a transfer on death. To get started, please provide:. Start investing & planning for your retirement with help from fidelity. Web inherit an ira as an entity, estate, or trust. Web a losing a loved one if you've recently experienced a loss, we can help you navigate the important financial steps to take in this difficult time. Web fidelity does not sell your information to third parties for monetary consideration. In the future, you may revoke the beneficiary designation and designate a different. Web use this form to add or change beneficiary information, at an account level, for an existing ira(s) including: General instructions please complete this form and sign it on the back. Web if you've inherited a 401(k) from a parent, spouse, or someone else, here are the rules to know.

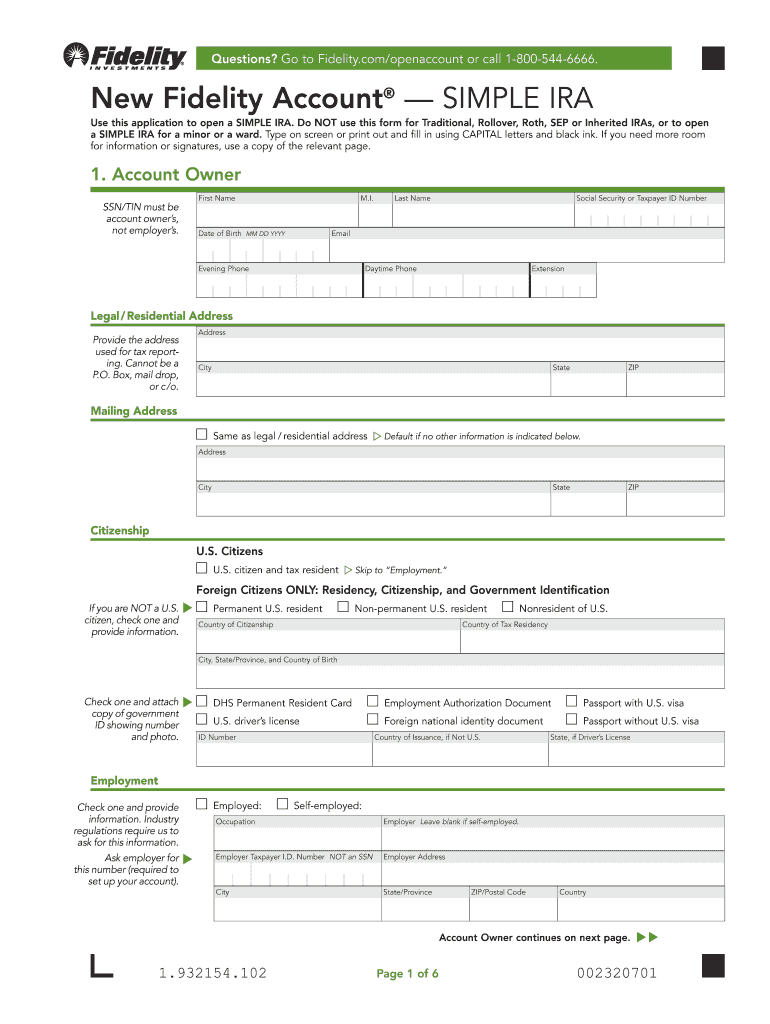

Fidelity Roth Ira Form Universal Network

Web a losing a loved one if you've recently experienced a loss, we can help you navigate the important financial steps to take in this difficult time. Top what is a transfer on death. Web if you've inherited a 401(k) from a parent, spouse, or someone else, here are the rules to know. The university of california is enhancing the.

Fidelity Ira Change Of Beneficiary form Unique Doc 1e

Use this form if you are a beneficiary and wish to have assets transferred to a beneficiary account in your name or request a distribution. Address & personal information change: Web use this form to establish a fidelity advisor ira beneficiary distribution account (bda), which allows a beneficiary who inherits a traditional ira, rollover ira, sep/sarsep. Web if you've inherited.

Fidelity IRA Review ROTH, Fees, Account Performance (2022)

Web inherited iras are for beneficiaries of an ira or a 401k plan. However, we and our marketing and advertising providers (providers) collect certain information. Web if you elect to calculate your mrd each year, you must submit a fidelity advisor ira beneficiary distribution request form with the appropriate dollar amount specified. Web tuesday, august 1, 2023. Use this form.

IRA Inheritance NonSpouse IRA Beneficiary Fidelity Ira

General instructions please complete this form and sign it on the back. Web beneficiaries — ira /hsa use this form to add or change the beneficiaries of your fidelity ira (including traditional, rollover, sep, simple, roth, and inherited ira) or. Web inherit an ira as an entity, estate, or trust. Start investing & planning for your retirement with help from.

About Privacy Policy Copyright TOS Contact Sitemap

Web fidelity does not sell your information to third parties for monetary consideration. Web if you elect to calculate your mrd each year, you must submit a fidelity advisor ira beneficiary distribution request form with the appropriate dollar amount specified. In the future, you may revoke the beneficiary designation and designate a different. The university of california is enhancing the.

Fidelity Ira Change Of Beneficiary form Brilliant References Resume Sample

Web fa ira beneficiary designation form this form is to add, delete, or change beneficiaries and/or beneficiary share percentages on a fidelity advisor ira. Learn about the rules that apply to these accounts here. Open an inherited ira account to transfer funds from an ira owner who has named your entity, estate, or trust as their beneficiary. To get started,.

fidelity advisor ira beneficiary distribution request form Fill out

Web you'll need to assign at least one beneficiary for each account; Web if you've inherited a 401(k) from a parent, spouse, or someone else, here are the rules to know. Top what is a transfer on death. Address & personal information change: Web inherited iras are for beneficiaries of an ira or a 401k plan.

Ira Rollover Form Fidelity Universal Network

Web you'll need to assign at least one beneficiary for each account; In the future, you may revoke the beneficiary designation and designate a different. Web if you would like to add more than 8 primary or contingent beneficiaries, please download and complete a beneficiary designation form. General instructions please complete this form and sign it on the back. However,.

Fidelity Simple Ira Salary Reduction Agreement Form

Top what is a transfer on death. To get started, please provide:. Web inherited iras are for beneficiaries of an ira or a 401k plan. Learn about the rules that apply to these accounts here. Start investing & planning for your retirement with help from fidelity.

Fidelity Simple Ira Enrollment Form Fill Online, Printable, Fillable

Most of the time you can add, change, or delete your beneficiaries online. No advisory fees under $25k. Web tuesday, august 1, 2023. Web use this form to add or change beneficiary information, at an account level, for an existing ira(s) including: Web if you elect to calculate your mrd each year, you must submit a fidelity advisor ira beneficiary.

The University Of California Is Enhancing The Uc Retirement Savings Program With A New Roth Contribution Option For The Uc 403 (B).

Web beneficiaries — ira /hsa use this form to add or change the beneficiaries of your fidelity ira (including traditional, rollover, sep, simple, roth, and inherited ira) or. Web you'll need to assign at least one beneficiary for each account; Web tuesday, august 1, 2023. Open an inherited ira account to transfer funds from an ira owner who has named your entity, estate, or trust as their beneficiary.

Use This Form If You Are A Beneficiary And Wish To Have Assets Transferred To A Beneficiary Account In Your Name Or Request A Distribution.

Web a losing a loved one if you've recently experienced a loss, we can help you navigate the important financial steps to take in this difficult time. Web if you've inherited a 401(k) from a parent, spouse, or someone else, here are the rules to know. To report a death to fidelity, fill out. Address & personal information change:

Web Fidelity Does Not Sell Your Information To Third Parties For Monetary Consideration.

General instructions please complete this form and sign it on the back. Web if you would like to add more than 8 primary or contingent beneficiaries, please download and complete a beneficiary designation form. To get started, please provide:. Web inherit an ira as an entity, estate, or trust.

Web Inherited Iras Are For Beneficiaries Of An Ira Or A 401K Plan.

Start investing & planning for your retirement with help from fidelity. Ad with fidelity go, we manage your ira so you don't have to. However, we and our marketing and advertising providers (providers) collect certain information. Most of the time you can add, change, or delete your beneficiaries online.