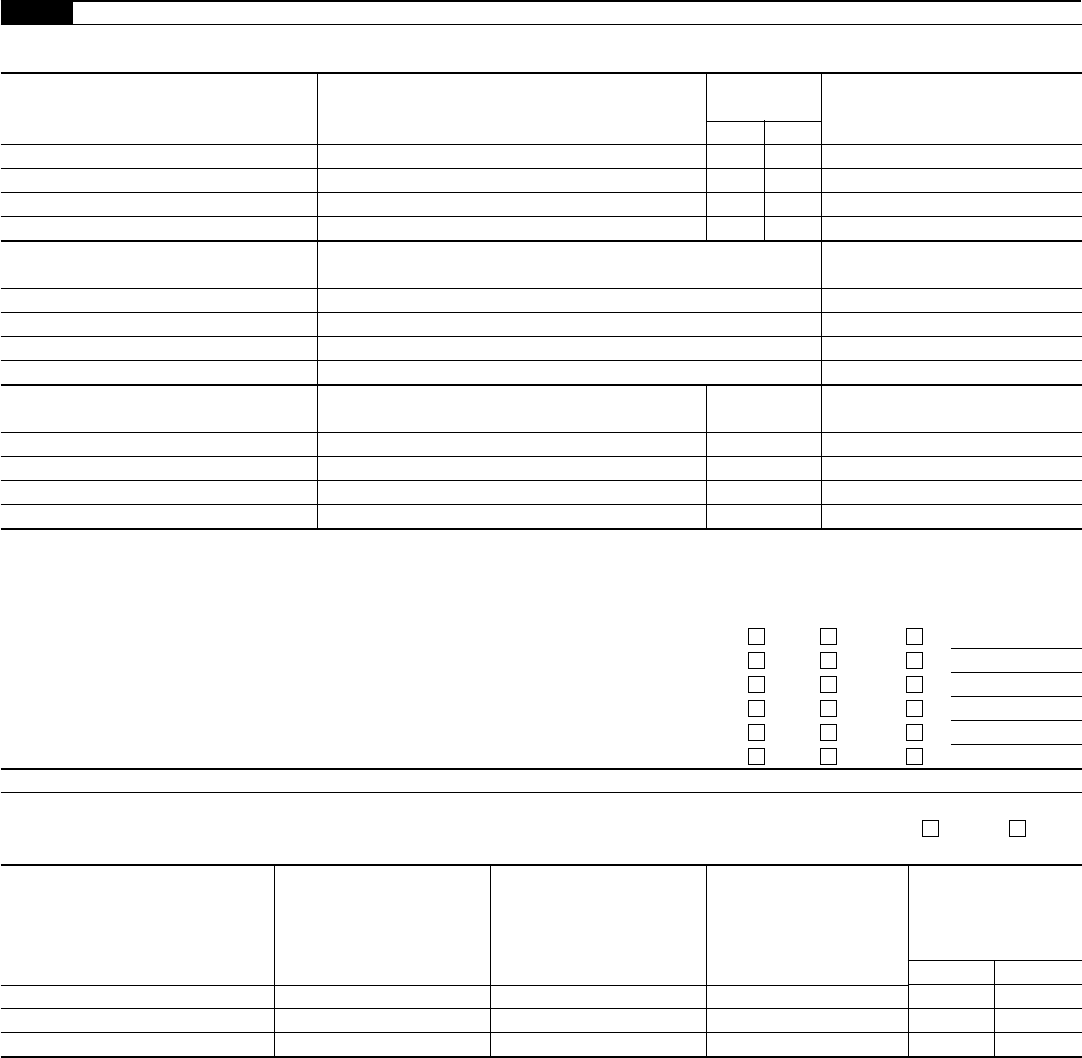

File Form 3520 Online

File Form 3520 Online - Transferor who, directly or indirectly, transferred money or other property during the. Web the internal revenue service would like to remind all u.s. Web for errors on form 3520 or late filing, you can face penalties of either $10,000 or 35% of your inheritance, whichever amount is greater. Web form 3520, also known as th e annual return to report transactions with foreign trusts and receipt of certain foreign gifts, is an informational return used to report. Try it for free now! Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related forms,. Complete, edit or print tax forms instantly. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Upload, modify or create forms. Send form 3520 to the.

Citizen or resident and live outside the united states and puerto rico or if you are in the military or naval service on duty outside the united states and puerto. Web the internal revenue service would like to remind all u.s. Taxpayer transactions with a foreign trust. Web for errors on form 3520 or late filing, you can face penalties of either $10,000 or 35% of your inheritance, whichever amount is greater. Web if you are a u.s. Send form 3520 to the. Web form 3520, also known as th e annual return to report transactions with foreign trusts and receipt of certain foreign gifts, is an informational return used to report. Web if you have to file form 3520 this year (annual return to report transactions with foreign trusts and receipt of certain foreign gifts), you can do that manually, by. Try it for free now! Ad talk to our skilled attorneys by scheduling a free consultation today.

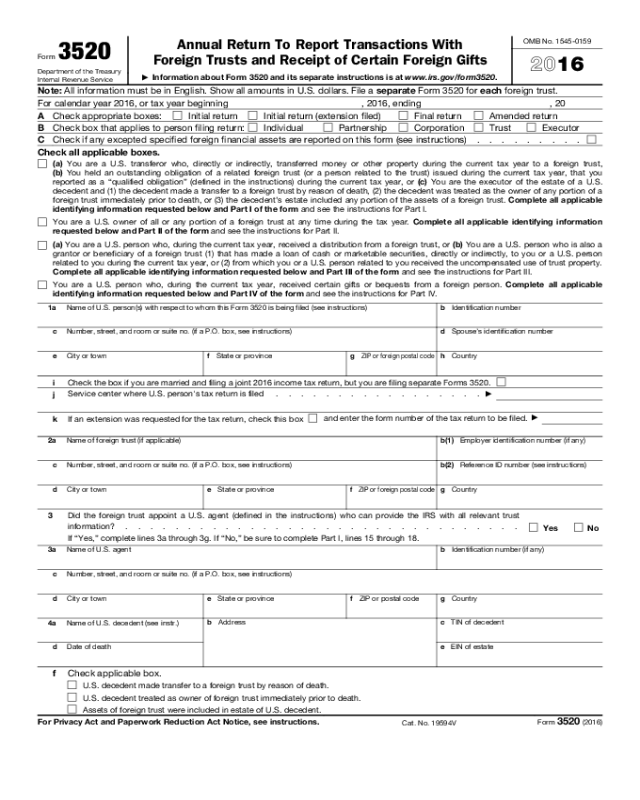

Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign. Web for errors on form 3520 or late filing, you can face penalties of either $10,000 or 35% of your inheritance, whichever amount is greater. Ad talk to our skilled attorneys by scheduling a free consultation today. Send form 3520 to the. There are three main types of transactions with a foreign trust you need to report on: Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Transferor who, directly or indirectly, transferred money or other property during the. Web if you are a u.s. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Try it for free now!

Form 3520 2012 Edit, Fill, Sign Online Handypdf

Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related forms,. There are three main types of transactions with a foreign trust you need to report on: Web file a separate form 3520 for each foreign trust. Web form 3520, also known as th e annual return.

Form 3520 Edit, Fill, Sign Online Handypdf

Complete, edit or print tax forms instantly. Web for errors on form 3520 or late filing, you can face penalties of either $10,000 or 35% of your inheritance, whichever amount is greater. Try it for free now! Web form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts; This information includes its u.s.

US Taxes and Offshore Trusts Understanding Form 3520

Web form 3520 for u.s. Citizen or resident and live outside the united states and puerto rico or if you are in the military or naval service on duty outside the united states and puerto. Americans who are required to file other. Ad upload, modify or create forms. Web form 3520, annual return to report transactions with foreign trusts and.

2019 Form IRS 3520 Fill Online, Printable, Fillable, Blank PDFfiller

Web form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts; Try it for free now! Transferor who, directly or indirectly, transferred money or other property during the. Ad upload, modify or create forms. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues.

Do I need to file IRS Form 3520 and 3520A for my TFSA and RESP?

Get ready for tax season deadlines by completing any required tax forms today. Web form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts; It does not have to be a “foreign gift.” rather, if a. Send form 3520 to the. Web form 3520 & instructions:

Form 3520 2013 Edit, Fill, Sign Online Handypdf

There are three main types of transactions with a foreign trust you need to report on: This information includes its u.s. Web form 3520 for u.s. Get ready for tax season deadlines by completing any required tax forms today. Web form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts;

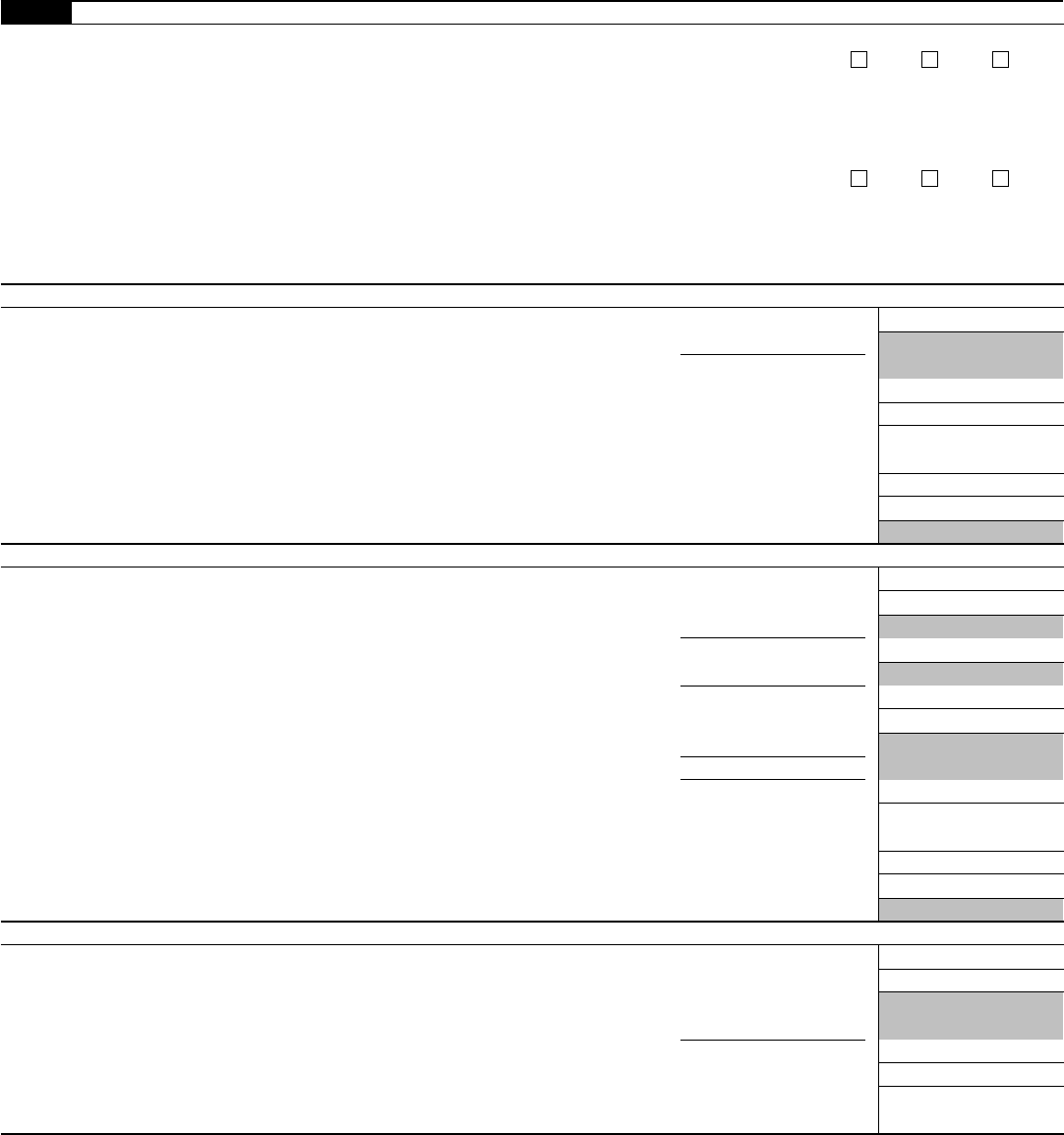

Fillable Form 3520A 2006 Foreign Grantor Trust Owner Statement

There are three main types of transactions with a foreign trust you need to report on: Web file a separate form 3520 for each foreign trust. Web form 3520 filing requirements. Web the internal revenue service would like to remind all u.s. Try it for free now!

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Web file a separate form 3520 for each foreign trust. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Web form 3520 for u.s. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Complete, edit or print.

The Tax Times Foreign Trust Form 3520A Filing Date Reminder & Tips To

Ad talk to our skilled attorneys by scheduling a free consultation today. Complete, edit or print tax forms instantly. Web form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts; Send form 3520 to the. Ad upload, modify or create forms.

3520 1 Form Fill Online, Printable, Fillable, Blank pdfFiller

Complete, edit or print tax forms instantly. Web file a separate form 3520 for each foreign trust. Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates,.

Web Form 3520, Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts;

Web form 3520 & instructions: Web if you are a u.s. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Get ready for tax season deadlines by completing any required tax forms today.

Try It For Free Now!

Ad upload, modify or create forms. There are three main types of transactions with a foreign trust you need to report on: Web for errors on form 3520 or late filing, you can face penalties of either $10,000 or 35% of your inheritance, whichever amount is greater. Transferor who, directly or indirectly, transferred money or other property during the.

Web Form 3520 Filing Requirements.

Web form 3520, also known as th e annual return to report transactions with foreign trusts and receipt of certain foreign gifts, is an informational return used to report. Web form 3520 for u.s. Taxpayer transactions with a foreign trust. Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign.

Don’t Feel Alone If You’re Dealing With Irs Form 3520 Penalty Abatement Issues.

Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related forms,. Web if you have to file form 3520 this year (annual return to report transactions with foreign trusts and receipt of certain foreign gifts), you can do that manually, by. Try it for free now! Send form 3520 to the.