File Form 8379 Electronically

File Form 8379 Electronically - Web yes, you can file form 8379 electronically with your tax return. If you file form 8379 by. Web paper file separately (form 8379 on its own) if the client filed their original return on paper then mail form 8379 by itself to the service center where they filed their original return. Ad don't leave it to the last minute. Web file form 8379 with your joint tax return amendment (note: Web generally, if you file form 8379 with a joint return on paper, the time needed to process it is about 14 weeks (11 weeks if filed electronically). Ad file your taxes late. Ad access irs tax forms. Try it for free now! Prepare and mail federal taxes free.

Get irs approved instant schedule 1 copy. Web paper file separately (form 8379 on its own) if the client filed their original return on paper then mail form 8379 by itself to the service center where they filed their original return. Yes, and the irs will process your injured spouse allocation faster if it is sent online. Write or enter injured spouse in the top left corner of the first page of the joint return). Web file form 8379 with your joint tax return amendment (note: You can file this form before or after the offset occurs,. File your form 2290 online & efile with the irs. Ad file your taxes late. Complete, edit or print tax forms instantly. If you file form 8379 by.

Web can i file form 8379 electronically? File your form 2290 online & efile with the irs. Generally, if you file form 8379 with a joint return on paper, the time needed to process it is about 14 weeks (11 weeks if filed electronically). If you file form 8379 by itself after a. Web paper file separately (form 8379 on its own) if the client filed their original return on paper then mail form 8379 by itself to the service center where they filed their original return. Ad file your taxes late. It states that if you file form 8379 by itself after you filed your original joint return electronically,. Submit the form later (the irs. To file your taxes as an injured spouse, follow the steps below: Web you need to file form 8379 for each year you’re an injured spouse and want your portion of the refund.

Can File Form 8379 Electronically hqfilecloud

2 enter the tax year for which you are filing this claim' 19____ if all three of the above apply and you want your share. Always free federal, always simple, always right. Ad don't leave it to the last minute. Upload, modify or create forms. Generally, if you file form 8379 with a joint return on paper, the time needed.

Everything You Need to Know about Injured Spouse Tax Relief (IRS Form

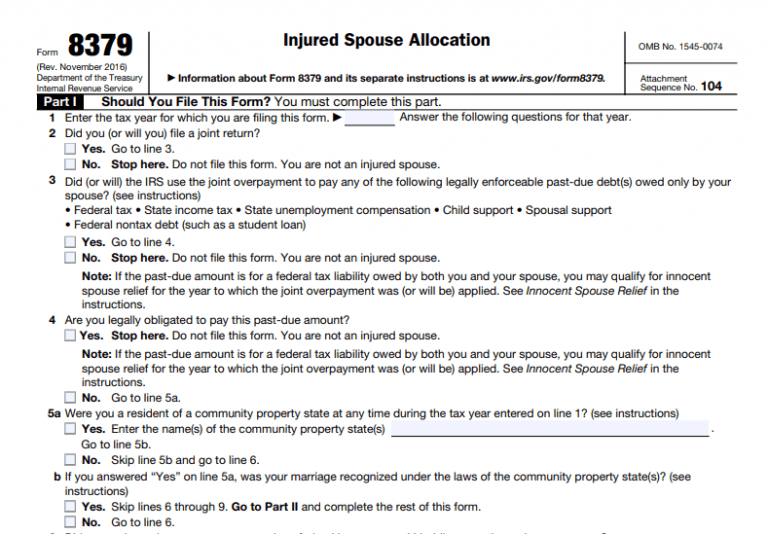

Ad download or email irs 8379 & more fillable forms, register and subscribe now! Web if you are filing form 8379 with your tax return, skip to line 5. Web form 8379 is used by injured spouses to compute their share of a joint tax refund. Always free federal, always simple, always right. Yes, and the irs will process your.

Irs Form 8379 Innocent Spouse Relief Universal Network

If you file form 8379 by itself after a. Web can i file form 8379 electronically? Prepare & file prior year taxes fast. File your form 2290 today avoid the rush. Write or enter injured spouse in the top left corner of the first page of the joint return).

IRS Form 8379 Fill it Right

Web you need to file form 8379 for each year you’re an injured spouse and want your portion of the refund. If you file form 8379 with a joint return electronically, the time needed to. Generally, if you file form 8379 with a joint return on paper, the time needed to process it is about 14 weeks (11 weeks if.

File Form 8379 to Recover Tax Refund Losses by sedatedetention30 issuu

Generally, if you file form 8379 with a joint return on paper, the time needed to process it is about 14 weeks (11 weeks if filed electronically). If you file form 8379 by itself after a. From within your taxact return (online or desktop) click federal (on smaller devices, click in the top left corner of your screen,. Web if.

Can File Form 8379 Electronically hqfilecloud

Ad file your taxes late. Prepare & file prior year taxes fast. Web a jointly filed tax return injured spouse has the option to file form 8379 in order to claim their share of a joint refund that was taken in order to satisfy the other. Get irs approved instant schedule 1 copy. File your form 2290 online & efile.

Form 8379 Edit, Fill, Sign Online Handypdf

Ad don't leave it to the last minute. It states that if you file form 8379 by itself after you filed your original joint return electronically,. If you file form 8379 with a joint return electronically, the time needed to. Ad file your taxes late. Web you will see a chart on the first page that says where to file.

Inured spouse form 8379 TurboTax® Support

From within your taxact return (online or desktop) click federal (on smaller devices, click in the top left corner of your screen,. Web paper file separately (form 8379 on its own) if the client filed their original return on paper then mail form 8379 by itself to the service center where they filed their original return. Web generally, if you.

Irs Form 8379 Line 20 Universal Network

The injured spouse on a jointly filed tax return files form 8379 to get. Always free federal, always simple, always right. File your form 2290 online & efile with the irs. File your form 2290 today avoid the rush. Web paper file separately (form 8379 on its own) if the client filed their original return on paper then mail form.

Irs Form 8379 Line 20 Universal Network

Yes, and the irs will process your injured spouse allocation faster if it is sent online. Upload, modify or create forms. Web if you are filing form 8379 with your tax return, skip to line 5. Try it for free now! Ad download or email irs 8379 & more fillable forms, register and subscribe now!

Ad File Your Taxes Late.

Ad access irs tax forms. If you file form 8379 with a joint return electronically, the time needed to. Upload, modify or create forms. File your form 2290 today avoid the rush.

Web You Need To File Form 8379 For Each Year You’re An Injured Spouse And Want Your Portion Of The Refund.

If you file form 8379 by itself after a. Ad download or email irs 8379 & more fillable forms, register and subscribe now! It states that if you file form 8379 by itself after you filed your original joint return electronically,. Get irs approved instant schedule 1 copy.

Ad Don't Leave It To The Last Minute.

Web paper file separately (form 8379 on its own) if the client filed their original return on paper then mail form 8379 by itself to the service center where they filed their original return. Prepare and mail federal taxes free. If you file form 8379 by. Try it for free now!

Web Yes, You Can File Form 8379 Electronically With Your Tax Return.

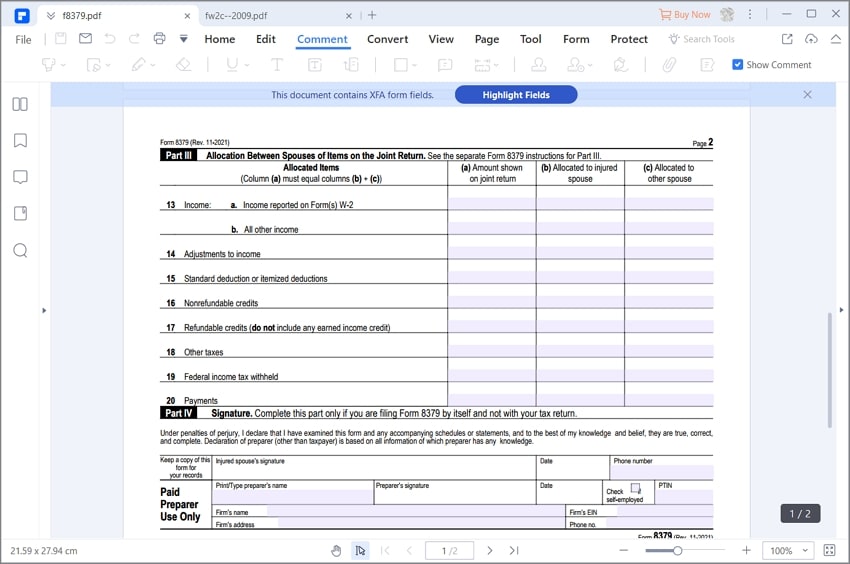

Generally, if you file form 8379 with a joint return on paper, the time needed to process it is about 14 weeks (11 weeks if filed electronically). Web to complete form 8379 in your taxact program: Web if you are filing form 8379 with your tax return, skip to line 5. Web form 8379 is used by injured spouses to compute their share of a joint tax refund.