Florida Form F 1065

Florida Form F 1065 - A limited liability company with a corporate partner, if classified as a partnership for federal tax purposes,. If the due date falls on a saturday, sunday, or federal or state holiday,. Advantages of this business entity include:. Florida corporate income/franchise tax return for 2022 tax year. A limited liability company with a corporate partner,. Complete, edit or print tax forms instantly. Every florida partnership having any partner subject to the florida corporate income tax code is required to file form f. A limited liability company with a corporate partner,. Florida partnership information return with instructions: Ad get ready for tax season deadlines by completing any required tax forms today.

A limited liability company with a corporate partner,. Web form 1065 2021 u.s. Florida partnership information return with instructions: Ad get ready for tax season deadlines by completing any required tax forms today. Florida corporate income/franchise tax return for 2022 tax year. Advantages of this business entity include:. If the due date falls on a saturday, sunday, or federal or state holiday,. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web 5 rows we last updated the florida partnership information return with instructions r.01/16 in january.

Florida corporate income/franchise tax return for 2022 tax year. Every florida partnership having any partner subject to the florida corporate income tax code is required to file form f. Florida partnership information return with instructions: 2.6k views 9 years ago. A limited liability company with a corporate partner,. In addition, the corporate owner of an llc classified as a partnership for florida and. Web benefits of forming a florida llc to enjoy statutory protection for your florida business, you must establish an llc. A limited liability company with a corporate partner,. Web form f 1065 florida partnership information return. Web form 1065 2021 u.s.

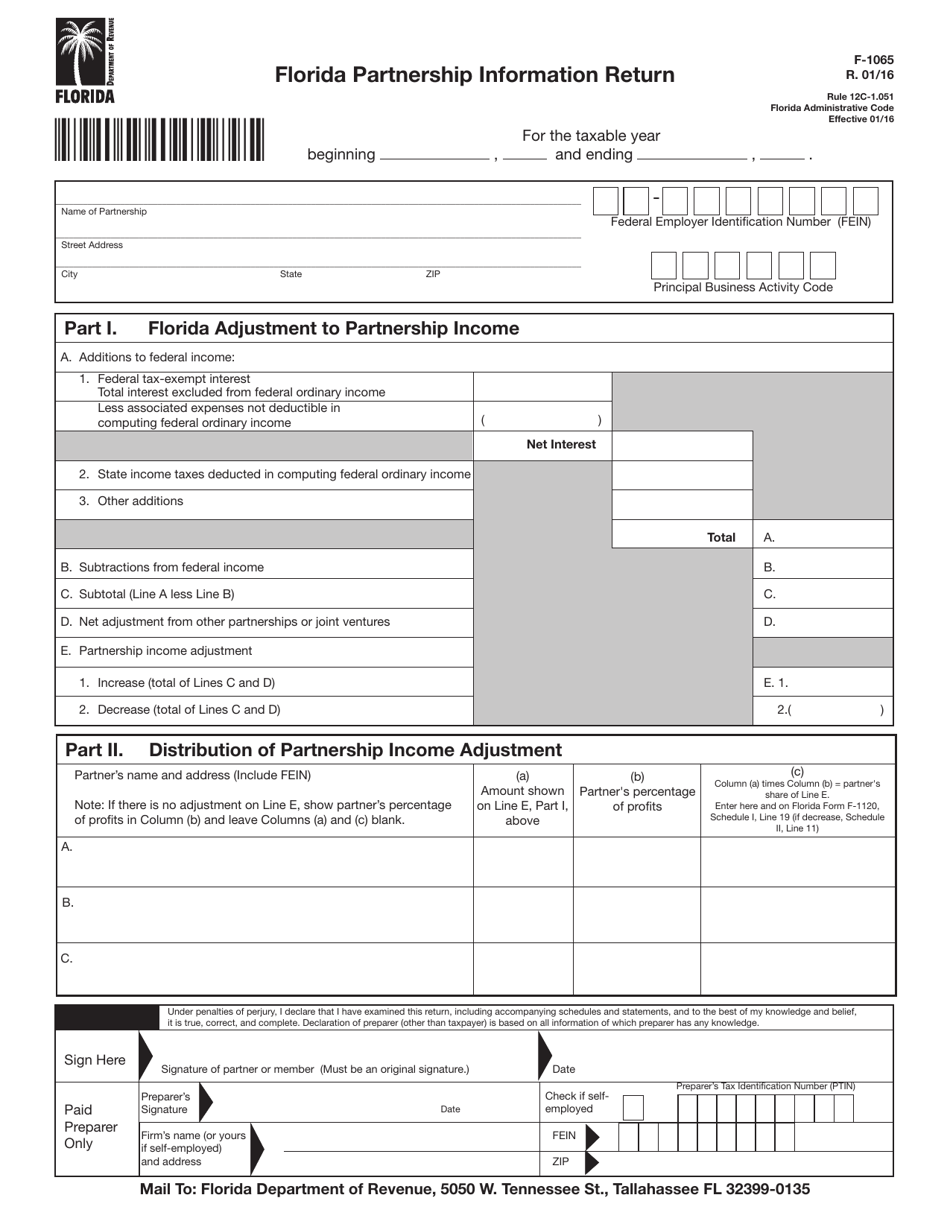

Form F1065 Download Printable PDF or Fill Online Florida Partnership

Every florida partnership having any partner subject to the florida corporate income tax code is required to file form f. Advantages of this business entity include:. In addition, the corporate owner of an llc classified as a partnership for florida and. Complete, edit or print tax forms instantly. Florida corporate income/franchise tax return for 2022 tax year.

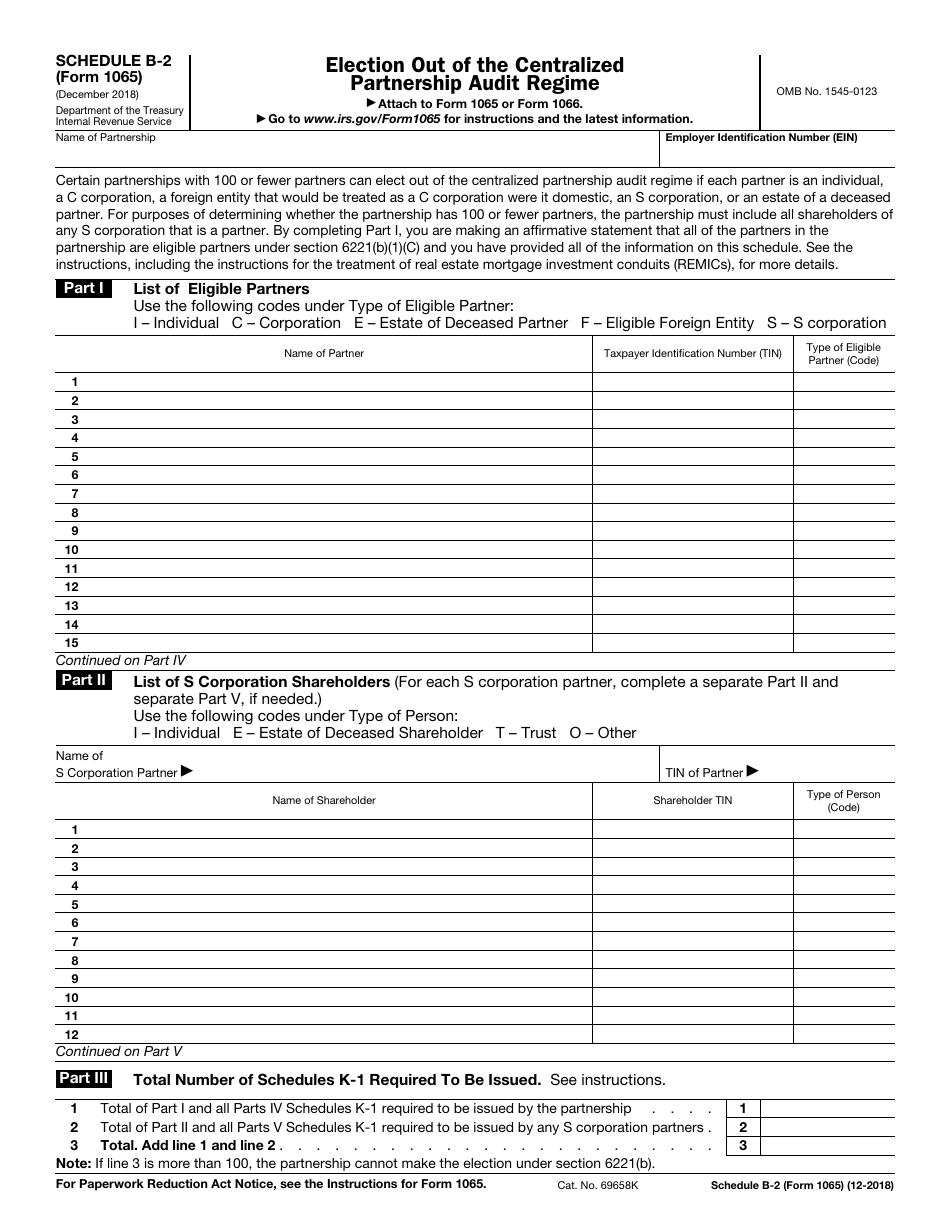

IRS Form 1065 Schedule B2 Download Fillable PDF or Fill Online

Florida corporate income/franchise tax return for 2022 tax year. A limited liability company with a corporate partner,. Web benefits of forming a florida llc to enjoy statutory protection for your florida business, you must establish an llc. Florida partnership information return with instructions: If the due date falls on a saturday, sunday, or federal or state holiday,.

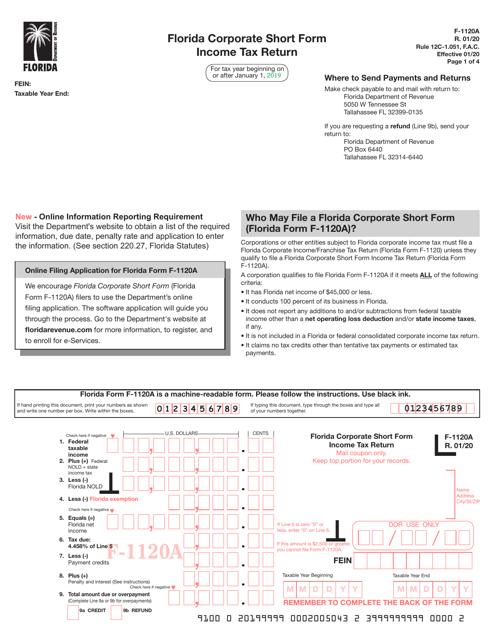

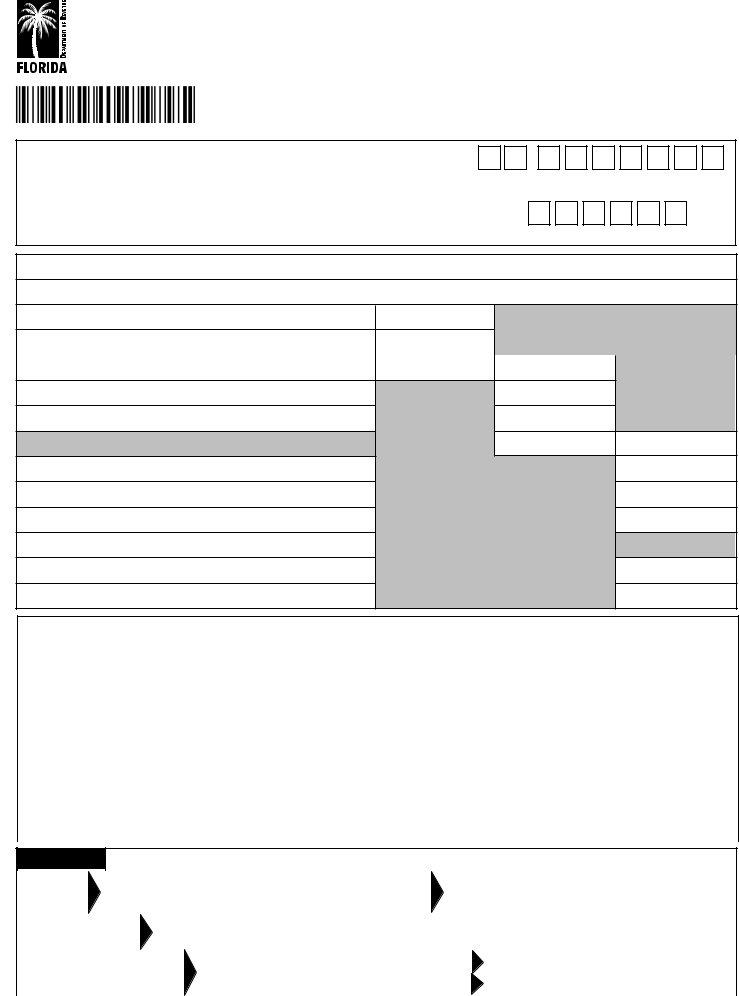

2019 Form FL F1120A Fill Online, Printable, Fillable, Blank pdfFiller

Web form f 1065 florida partnership information return. Ad get ready for tax season deadlines by completing any required tax forms today. Florida partnership information return with instructions: Every florida partnership having any partner subject to the florida corporate income tax code is required to file form f. Advantages of this business entity include:.

Form F 1120 Fill Out and Sign Printable PDF Template signNow

If the due date falls on a saturday, sunday, or federal or state holiday,. Every florida partnership having any partner subject to the florida corporate income tax code is required to file form f. 2.6k views 9 years ago. Web benefits of forming a florida llc to enjoy statutory protection for your florida business, you must establish an llc. A.

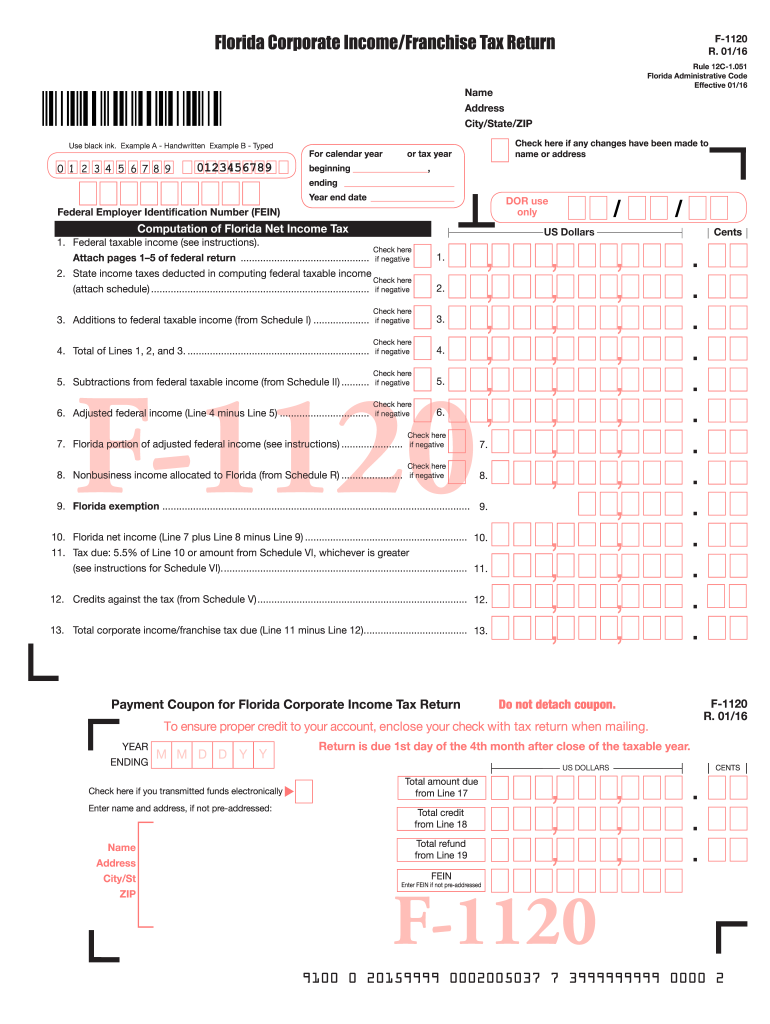

Form F1120A Download Printable PDF or Fill Online Florida Corporate

Web benefits of forming a florida llc to enjoy statutory protection for your florida business, you must establish an llc. Every florida partnership having any partner subject to the florida corporate income tax code is required to file form f. Web form 1065 2021 u.s. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for.

f1065 Fill Online, Printable, Fillable Blank form1065

If the due date falls on a saturday, sunday, or federal or. 2.6k views 9 years ago. Every florida partnership having any partner subject to the florida corporate income tax code is required to file form f. In addition, the corporate owner of an llc classified as a partnership for florida and. Return of partnership income department of the treasury.

Florida Form F 1065 ≡ Fill Out Printable PDF Forms Online

A limited liability company with a corporate partner, if classified as a partnership for federal tax purposes,. If the due date falls on a saturday, sunday, or federal or state holiday,. Web 5 rows we last updated the florida partnership information return with instructions r.01/16 in january. Florida partnership information return with instructions: Florida corporate income/franchise tax return for 2022.

F 1120 2016 form Fill out & sign online DocHub

If the due date falls on a saturday, sunday, or federal or. 2.6k views 9 years ago. Ad get ready for tax season deadlines by completing any required tax forms today. Web benefits of forming a florida llc to enjoy statutory protection for your florida business, you must establish an llc. In addition, the corporate owner of an llc classified.

U.S Tax Return for Partnership , Form 1065 Meru Accounting

Every florida partnership having any partner subject to the florida corporate income tax code is required to file form f. In addition, the corporate owner of an llc classified as a partnership for florida and. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Ad get ready for tax.

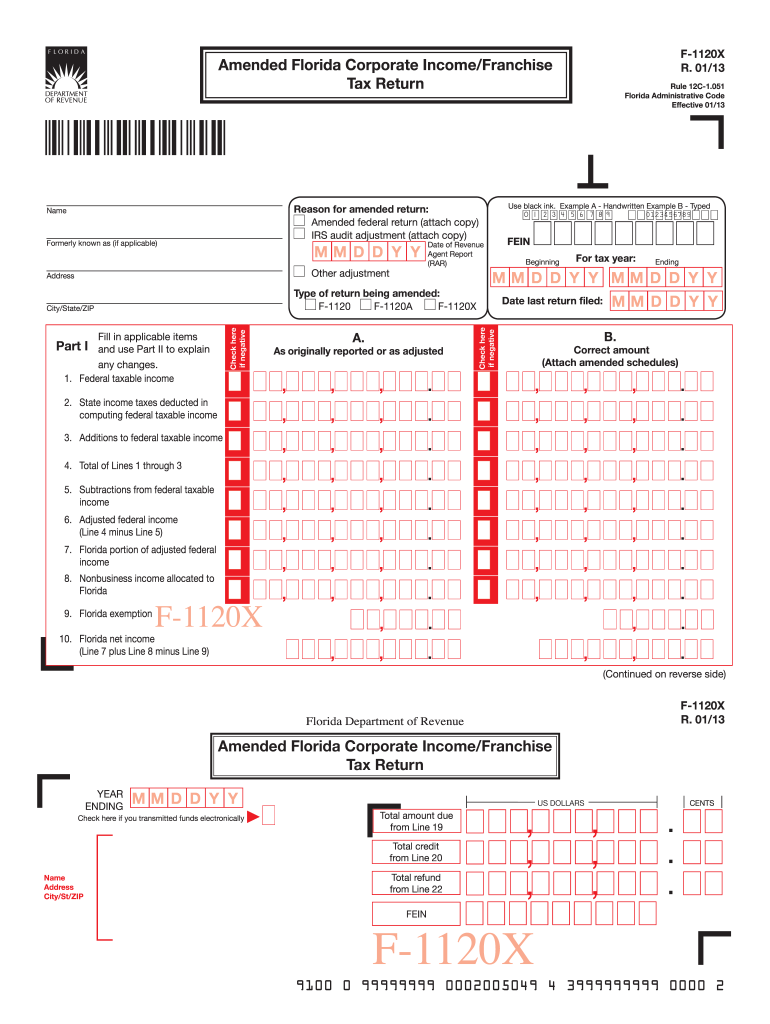

Form F1120x Amended Florida Corporate Tax Return

Complete, edit or print tax forms instantly. Florida corporate income/franchise tax return for 2022 tax year. 2.6k views 9 years ago. Complete, edit or print tax forms instantly. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

A limited liability company with a corporate partner, if classified as a partnership for federal tax purposes,. Web 5 rows we last updated the florida partnership information return with instructions r.01/16 in january. Complete, edit or print tax forms instantly. If the due date falls on a saturday, sunday, or federal or state holiday,.

A Limited Liability Company With A Corporate Partner,.

Get ready for tax season deadlines by completing any required tax forms today. Every florida partnership having any partner subject to the florida corporate income tax code is required to file form f. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Florida partnership information return with instructions:

Web Form 1065 2021 U.s.

Advantages of this business entity include:. Web benefits of forming a florida llc to enjoy statutory protection for your florida business, you must establish an llc. A limited liability company with a corporate partner,. Complete, edit or print tax forms instantly.

Web Form F 1065 Florida Partnership Information Return.

If the due date falls on a saturday, sunday, or federal or. 2.6k views 9 years ago. Florida corporate income/franchise tax return for 2022 tax year. In addition, the corporate owner of an llc classified as a partnership for florida and.