Florida Irrevocable Trust Form

Florida Irrevocable Trust Form - Free living will and designation of healthcare surrogate request information. An irrevocable trust is one that generally cannot be changed or canceled once it is set up without the consent of the beneficiary. Web irrevocable trust irrevocable trust agreement this agreement made and entered into the ___ day of __ , __ , by and between _____ , an adult resident of ___ ,. Ad instant download and complete your irrevocable trust forms, start now! 736.0412 nonjudicial modification of irrevocable trust.—. Ad draft legal documents through the cloud using a dynamic interview process. Web the trustee agrees to hold any property transferred to this trust, from whatever source, in trust under the following terms: Web if all or part of a living trust has become irrevocable after the death of a trustmaker, the successor trustee must obtain a federal taxpayer identification number. Web an irrevocable trust in florida can help you meet your estate planning and asset protection goals, such as: (1) after the settlor’s death, a trust may be modified.

This trust shall be known. Web in florida, courts are now permitted to judicially modify an irrevocable trust even when a trust is unambiguous. Web florida irrevocable trust form category: Web if you have questions about modifying an irrevocable trust created under florida law, we invite you to schedule a confidential consultation with a boca raton estate planning. Web the trustee agrees to hold any property transferred to this trust, from whatever source, in trust under the following terms: Web if all or part of a living trust has become irrevocable after the death of a trustmaker, the successor trustee must obtain a federal taxpayer identification number. Web irrevocable asset protection trusts for medicaid and va purposes. Pdffiller allows users to edit, sign, fill and share all type of documents online. Web this article discusses creating such an irrevocable trust and the treatment of such trusts for federal income tax, estate tax, ad valorem tax, and the treatment of such trusts for. Ad draft legal documents through the cloud using a dynamic interview process.

Web a revocable trust becomes a separate entity for federal income tax purposes when it becomes irrevocable, or stops reporting income under your social security number for. Web this article discusses creating such an irrevocable trust and the treatment of such trusts for federal income tax, estate tax, ad valorem tax, and the treatment of such trusts for. Web in florida, courts are now permitted to judicially modify an irrevocable trust even when a trust is unambiguous. Web irrevocable asset protection trusts for medicaid and va purposes. Web 2) give notice to the qualified beneficiaries within 60 days of the creation of an irrevocable trust or the date a formerly revocable trust has become irrevocable, [5] of the trust’s. An irrevocable trust is one that generally cannot be changed or canceled once it is set up without the consent of the beneficiary. Web if all or part of a living trust has become irrevocable after the death of a trustmaker, the successor trustee must obtain a federal taxpayer identification number. 736.0412 nonjudicial modification of irrevocable trust.—. Florida will and trust forms a living trust is an effective estate. Web florida irrevocable trust form category:

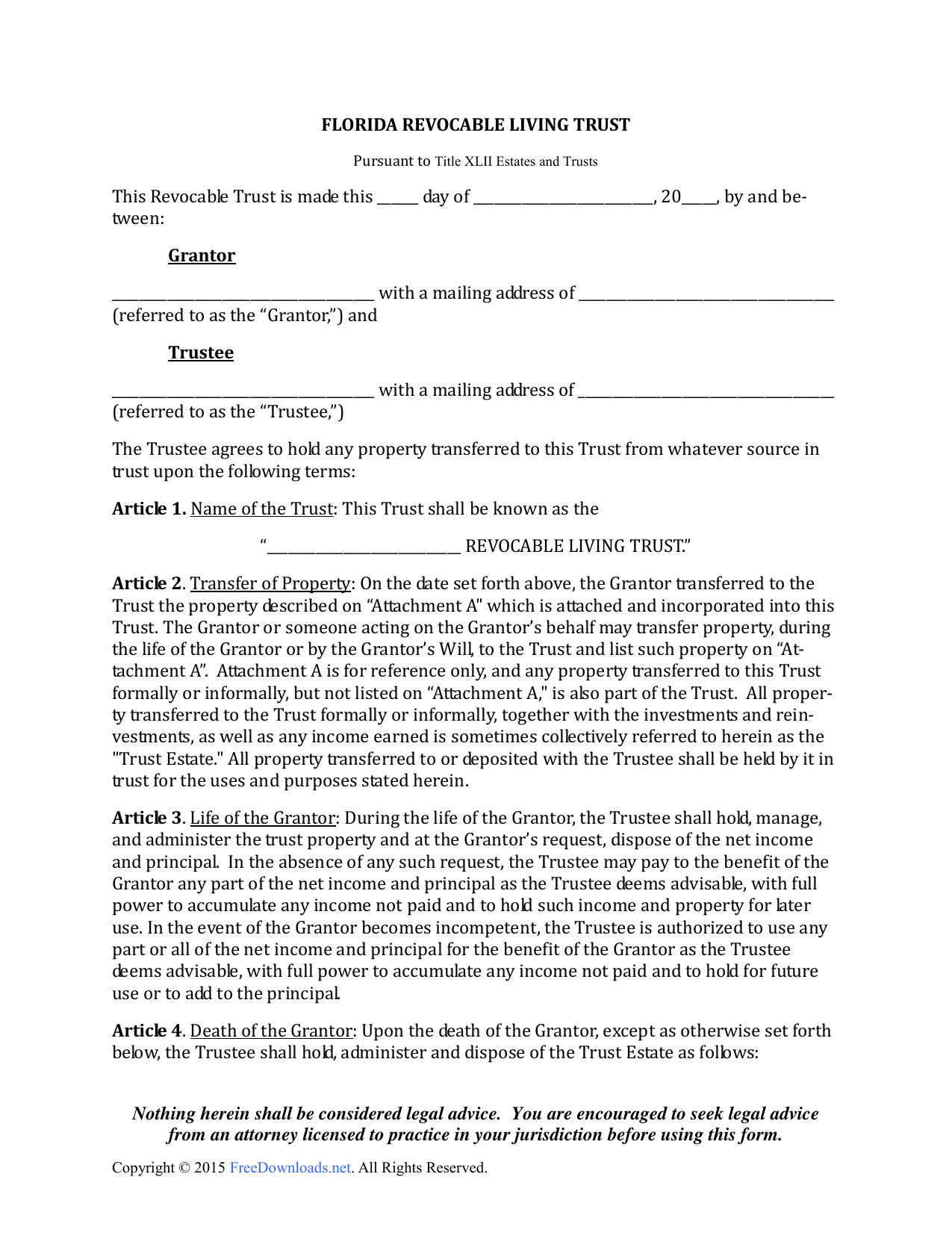

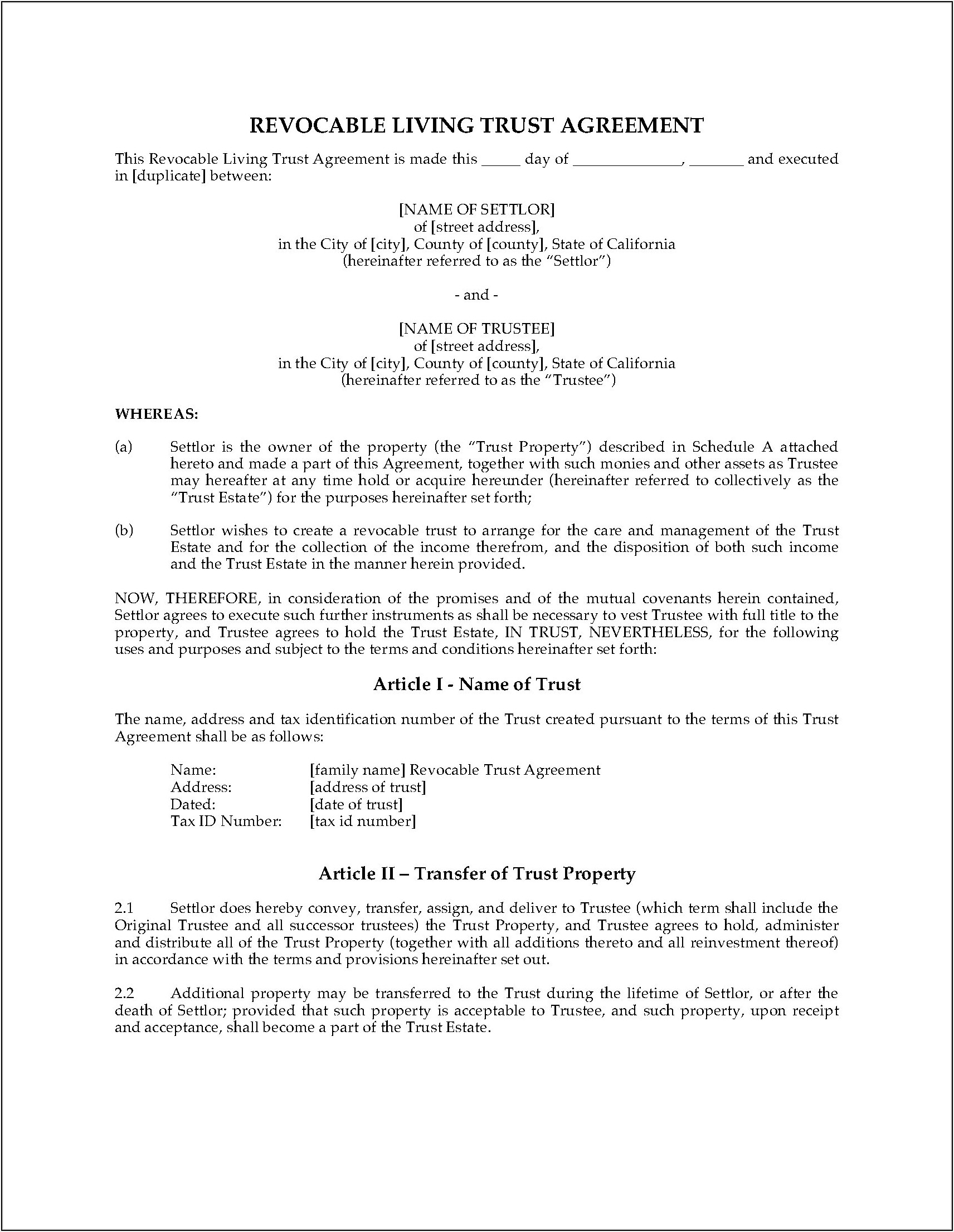

Download Florida Revocable Living Trust Form PDF RTF Word

Web in florida, courts are now permitted to judicially modify an irrevocable trust even when a trust is unambiguous. Pdffiller allows users to edit, sign, fill and share all type of documents online. Historically, courts held the belief that the intent of. Web an irrevocable trust in florida can help you meet your estate planning and asset protection goals, such.

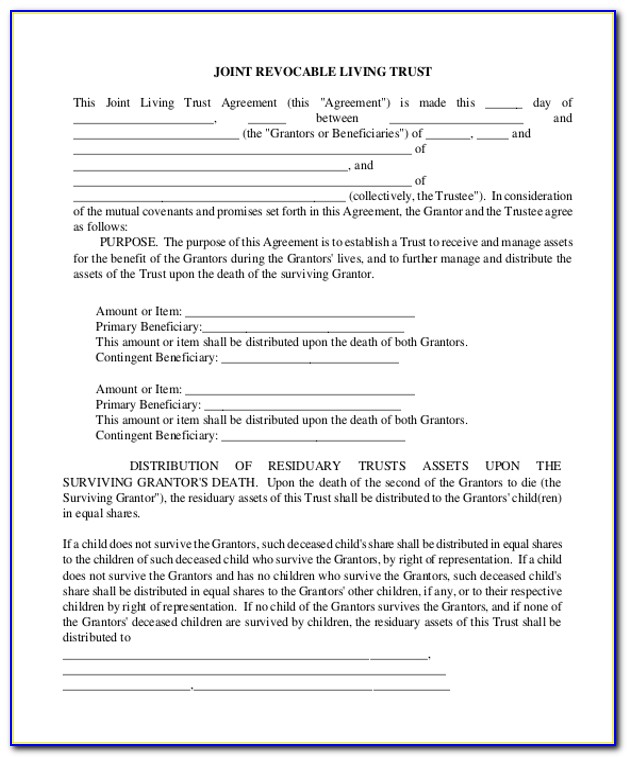

Irrevocable Living Trust Form Arizona

Web the trustee agrees to hold any property transferred to this trust, from whatever source, in trust under the following terms: This trust shall be known. Free living will and designation of healthcare surrogate request information. Best tool to create, edit & share pdfs. Web irrevocable trust irrevocable trust agreement this agreement made and entered into the ___ day of.

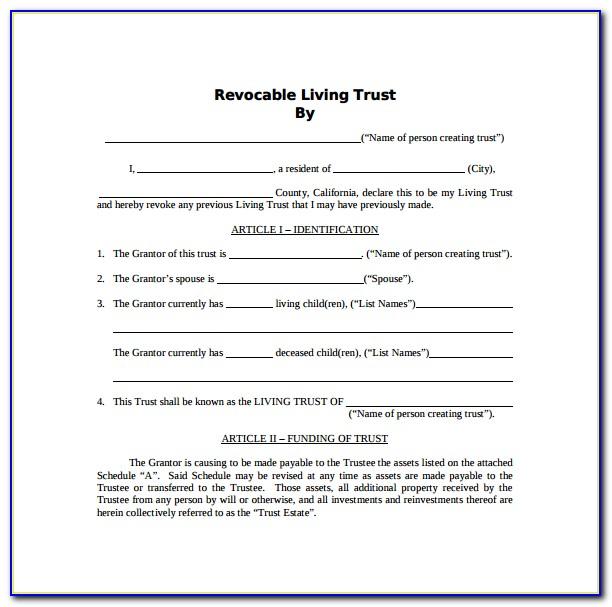

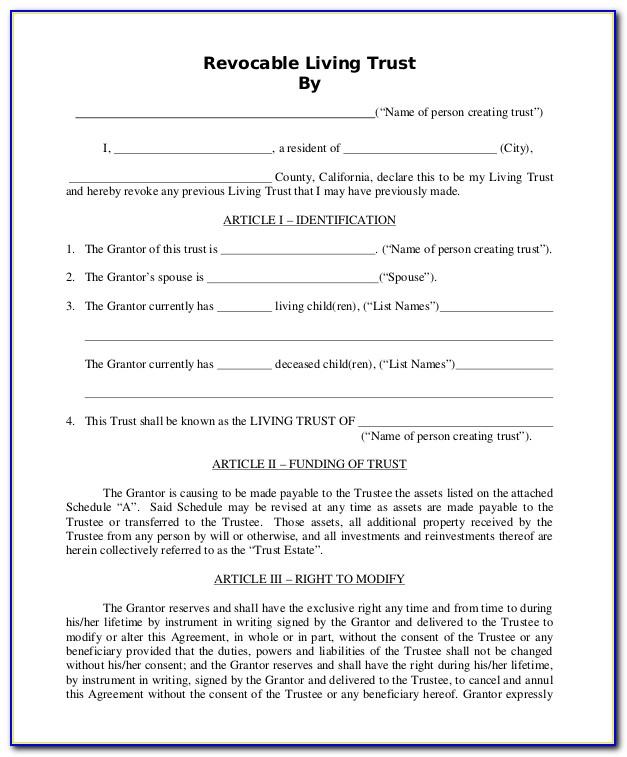

Free Revocable Living Trust Forms Florida

Web if you have questions about modifying an irrevocable trust created under florida law, we invite you to schedule a confidential consultation with a boca raton estate planning. Web in florida, courts are now permitted to judicially modify an irrevocable trust even when a trust is unambiguous. Web 2) give notice to the qualified beneficiaries within 60 days of the.

Florida Irrevocable Trust Execution Formalities Form Resume

Free living will and designation of healthcare surrogate request information. This trust shall be known. Web this article discusses creating such an irrevocable trust and the treatment of such trusts for federal income tax, estate tax, ad valorem tax, and the treatment of such trusts for. Web florida irrevocable trust law, including spendthrift provisions, execution, discretionary distribution, and alive trusts..

Irrevocable Trust Form Texas Universal Network

Best tool to create, edit & share pdfs. (1) after the settlor’s death, a trust may be modified. Web florida irrevocable trust form category: Florida will and trust forms a living trust is an effective estate. Ad draft legal documents through the cloud using a dynamic interview process.

Irrevocable Trust Form Colorado Universal Network

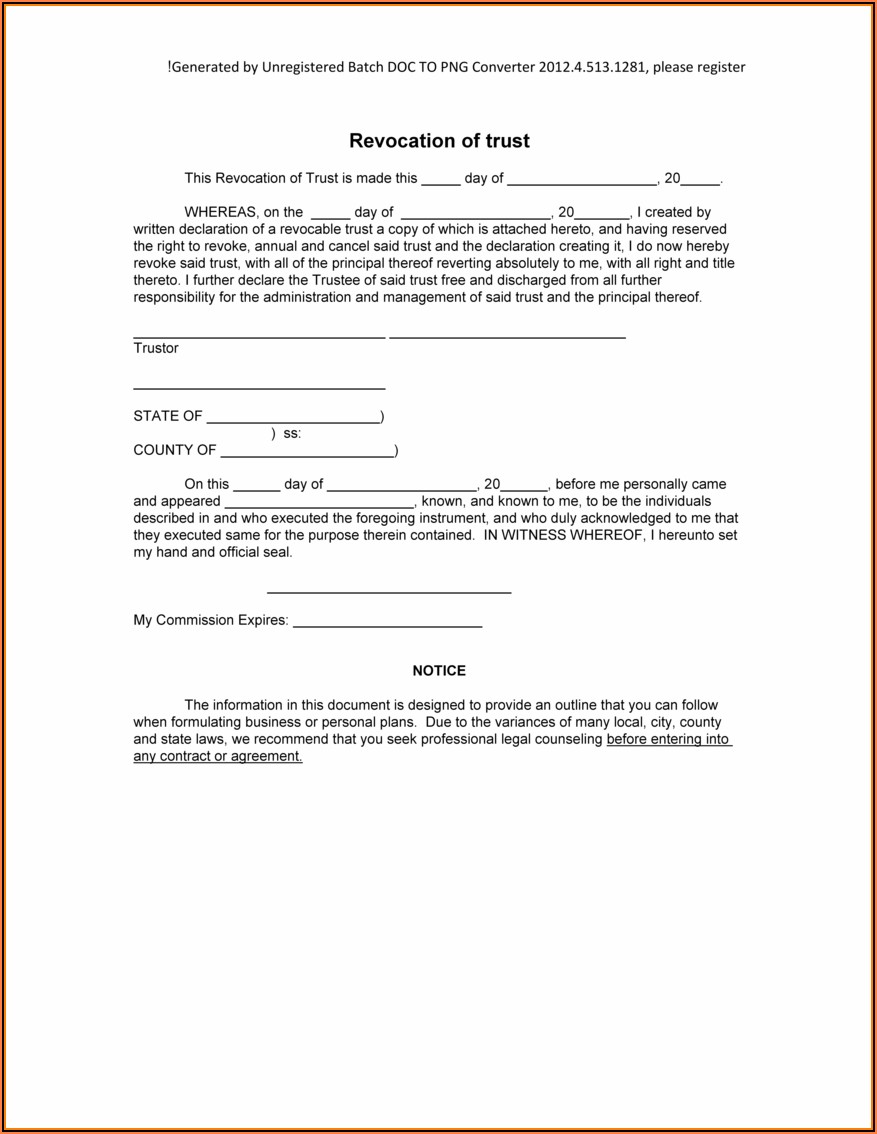

Web in florida, courts are now permitted to judicially modify an irrevocable trust even when a trust is unambiguous. Web if all or part of a living trust has become irrevocable after the death of a trustmaker, the successor trustee must obtain a federal taxpayer identification number. Web a revocable trust becomes a separate entity for federal income tax purposes.

Florida Nfa Gun Trust Form Universal Network

Pdffiller allows users to edit, sign, fill and share all type of documents online. Ad vast library of fillable legal documents. An irrevocable trust is one that generally cannot be changed or canceled once it is set up without the consent of the beneficiary. Web the trustee agrees to hold any property transferred to this trust, from whatever source, in.

Irrevocable Trust Template Nevada Template 1 Resume Examples

Web the trustee agrees to hold any property transferred to this trust, from whatever source, in trust under the following terms: Web it is settlor's desire, by this instrument, to create an inter vivos irrevocable special needs trust, whereby the property placed in trust shall be managed for the benefit of the. Web a revocable trust becomes a separate entity.

Florida Irrevocable Trust Execution Formalities Form Resume

Web if all or part of a living trust has become irrevocable after the death of a trustmaker, the successor trustee must obtain a federal taxpayer identification number. Pdffiller allows users to edit, sign, fill and share all type of documents online. Web florida trust code. Best tool to create, edit & share pdfs. Historically, courts held the belief that.

Irrevocable Trust Template Florida Template 1 Resume Examples

Pdffiller allows users to edit, sign, fill and share all type of documents online. (1) after the settlor’s death, a trust may be modified. Web florida trust code. Ad vast library of fillable legal documents. Web florida irrevocable trust law, including spendthrift provisions, execution, discretionary distribution, and alive trusts.

Ad Instant Download And Complete Your Irrevocable Trust Forms, Start Now!

Web in florida, courts are now permitted to judicially modify an irrevocable trust even when a trust is unambiguous. Best tool to create, edit & share pdfs. Web if all or part of a living trust has become irrevocable after the death of a trustmaker, the successor trustee must obtain a federal taxpayer identification number. Web florida irrevocable trust law, including spendthrift provisions, execution, discretionary distribution, and alive trusts.

Web This Article Discusses Creating Such An Irrevocable Trust And The Treatment Of Such Trusts For Federal Income Tax, Estate Tax, Ad Valorem Tax, And The Treatment Of Such Trusts For.

An irrevocable trust is one that generally cannot be changed or canceled once it is set up without the consent of the beneficiary. Web florida irrevocable trust form category: Pdffiller allows users to edit, sign, fill and share all type of documents online. Web 2) give notice to the qualified beneficiaries within 60 days of the creation of an irrevocable trust or the date a formerly revocable trust has become irrevocable, [5] of the trust’s.

Web Florida Trust Code.

736.0412 nonjudicial modification of irrevocable trust.—. Web a revocable trust becomes a separate entity for federal income tax purposes when it becomes irrevocable, or stops reporting income under your social security number for. Florida will and trust forms a living trust is an effective estate. Web irrevocable asset protection trusts for medicaid and va purposes.

Web It Is Settlor's Desire, By This Instrument, To Create An Inter Vivos Irrevocable Special Needs Trust, Whereby The Property Placed In Trust Shall Be Managed For The Benefit Of The.

Web if you have questions about modifying an irrevocable trust created under florida law, we invite you to schedule a confidential consultation with a boca raton estate planning. Historically, courts held the belief that the intent of. Web the trustee agrees to hold any property transferred to this trust, from whatever source, in trust under the following terms: Free living will and designation of healthcare surrogate request information.