Form 103 Long Indiana

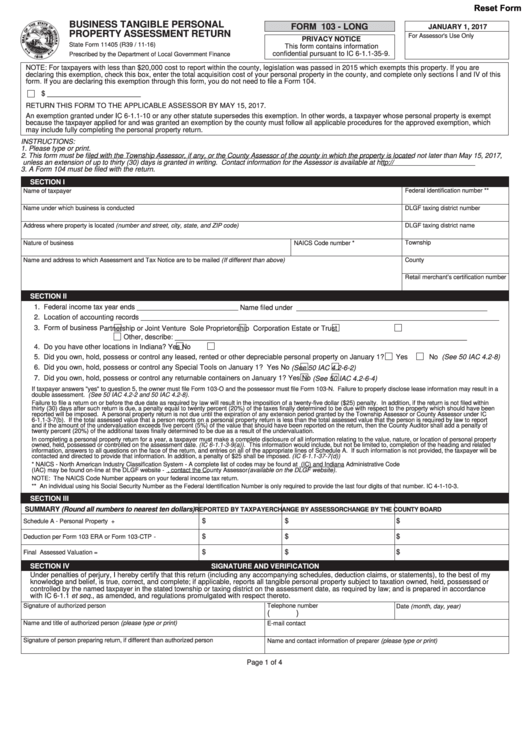

Form 103 Long Indiana - Web the form 104 is filed with a 102 or 103. The businessstartedin november 1, 2010. Web official site government site. Download this form print this form more about the. Web this form must be filed with the township assessor, if any, or the county assessor of the county in which the property is located not later than may 17, 2021, unless an extension. This form is for income earned in tax year 2022, with tax returns due in. In a matter of seconds, receive an. Web here we aregoing tofill out a form103 for a newsmall business. Download / view document file. Theirfederal tax yearends december 31, 2010.

Yes no if you answered “no”, round the true tax value above to the nearest $10 and enter that amount. Web date of record:07/06/18 13:47. Web the form 104 is filed with a 102 or 103. Web official site government site. Web here we aregoing tofill out a form103 for a newsmall business. If filer wishes to claim deductions. January 1, 2021 for assessor's use only note: Web this form must be filed with the township assessor, if any, or the county assessor of the county in which the property is located not later than may 17, 2021, unless an extension. Download this form print this form more about the. Features county services, departments, officials and includes event calendar and community links.

This form is for income earned in tax year 2022, with tax returns due in. For use by manufacturers or processors; Choose either the long or short form. In a matter of seconds, receive an. Web this form must be filed with the township assessor, if any, or the county assessor of the county in which the property is located not later than may 17, 2021, unless an extension. Web the form 104 is filed with a 102 or 103. If business personal property is greater than $150,000; If filer wishes to claim deductions. Web official site government site. January 1, 2021 for assessor's use only note:

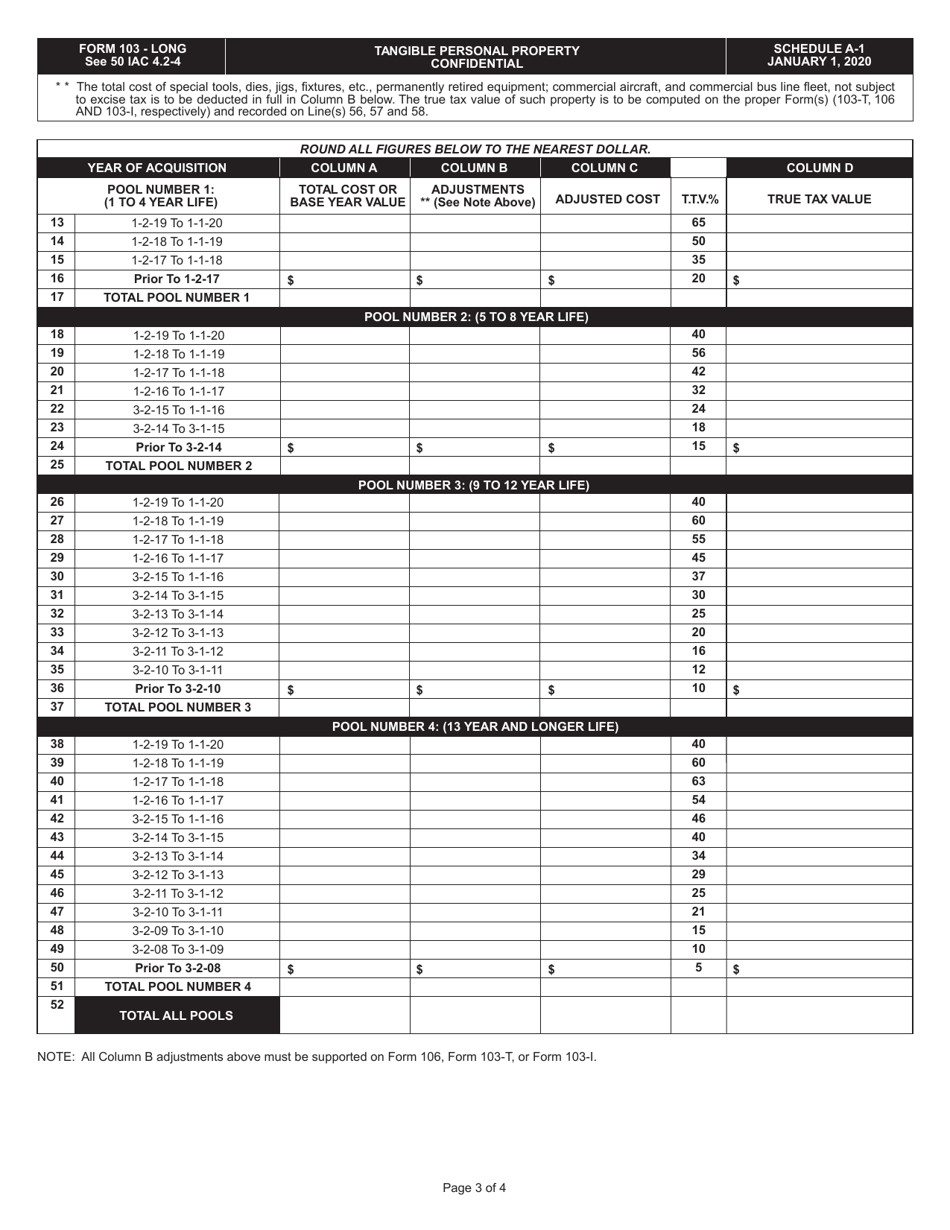

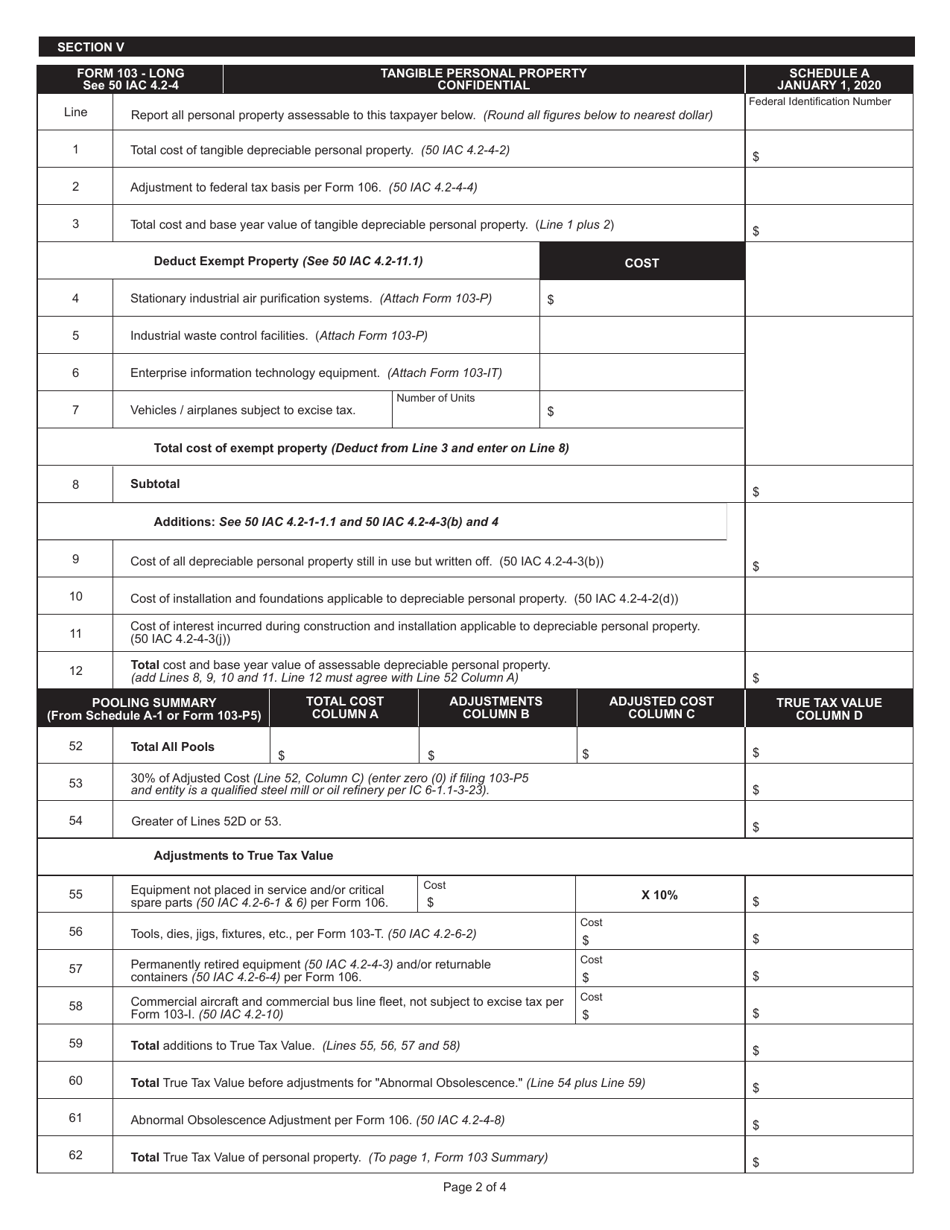

State Form 11405 (103LONG) Download Fillable PDF or Fill Online

Web the form 104 is filed with a 102 or 103. In a matter of seconds, receive an. Farmer's tangible personal property assessment return. If filer wishes to claim deductions. January 1, 2021 for assessor's use only note:

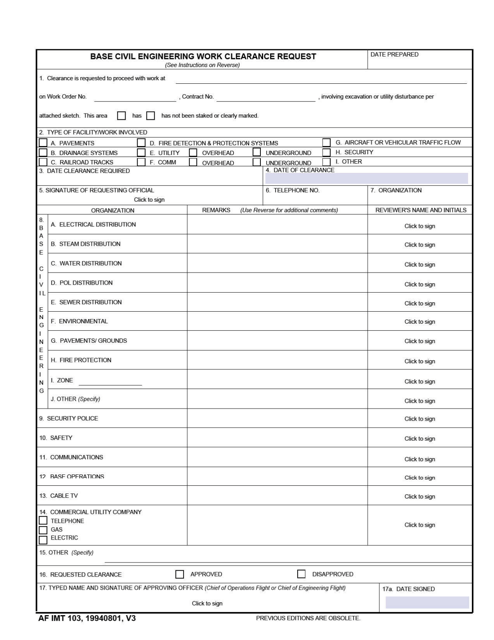

AF IMT Form 103 Fill Out, Sign Online and Download Fillable PDF

If business personal property is greater than $150,000; Theirfederal tax yearends december 31, 2010. January 1, 2021 for assessor's use only note: Web this form must be filed with the township assessor, if any, or the county assessor of the county in which the property is located not later than may 17, 2021, unless an extension. Farmer's tangible personal property.

Hawaii R Duty Reserve Fill Online, Printable, Fillable, Blank pdfFiller

Web this form must be filed with the township assessor, if any, or the county assessor of the county in which the property is located not later than may 17, 2021, unless an extension. Features county services, departments, officials and includes event calendar and community links. January 1, 2021 for assessor's use only note: Yes no if you answered “no”,.

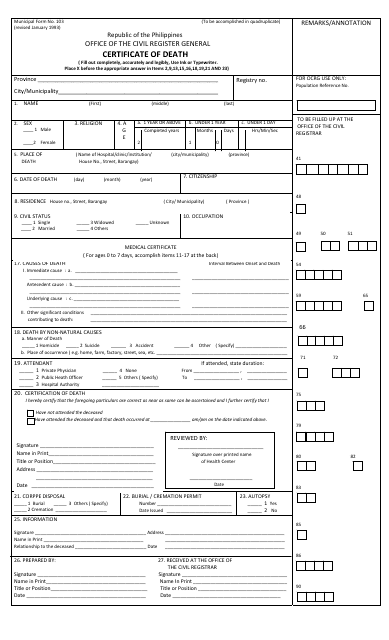

Breanna Death Certificate Form 2

Features county services, departments, officials and includes event calendar and community links. Web this form must be filed with the township assessor, if any, or the county assessor of the county in which the property is located not later than may 17, 2021, unless an extension. Web the form 104 is filed with a 102 or 103. The businessstartedin november.

Buyer’s Listing Agreement Specific Property Acquisition RPI Form

The businessstartedin november 1, 2010. Web the form 104 is filed with a 102 or 103. Download / view document file. Web official site government site. Theirfederal tax yearends december 31, 2010.

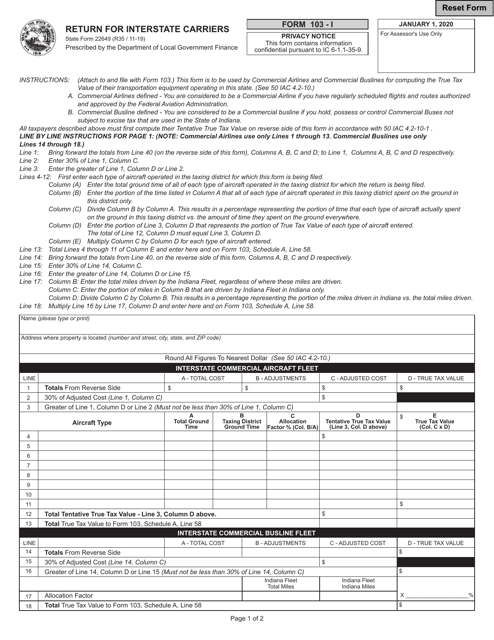

State Form 22649 (103I) Download Fillable PDF or Fill Online Return

If filer wishes to claim deductions. Web here we aregoing tofill out a form103 for a newsmall business. Web the form 104 is filed with a 102 or 103. The businessstartedin november 1, 2010. Theirfederal tax yearends december 31, 2010.

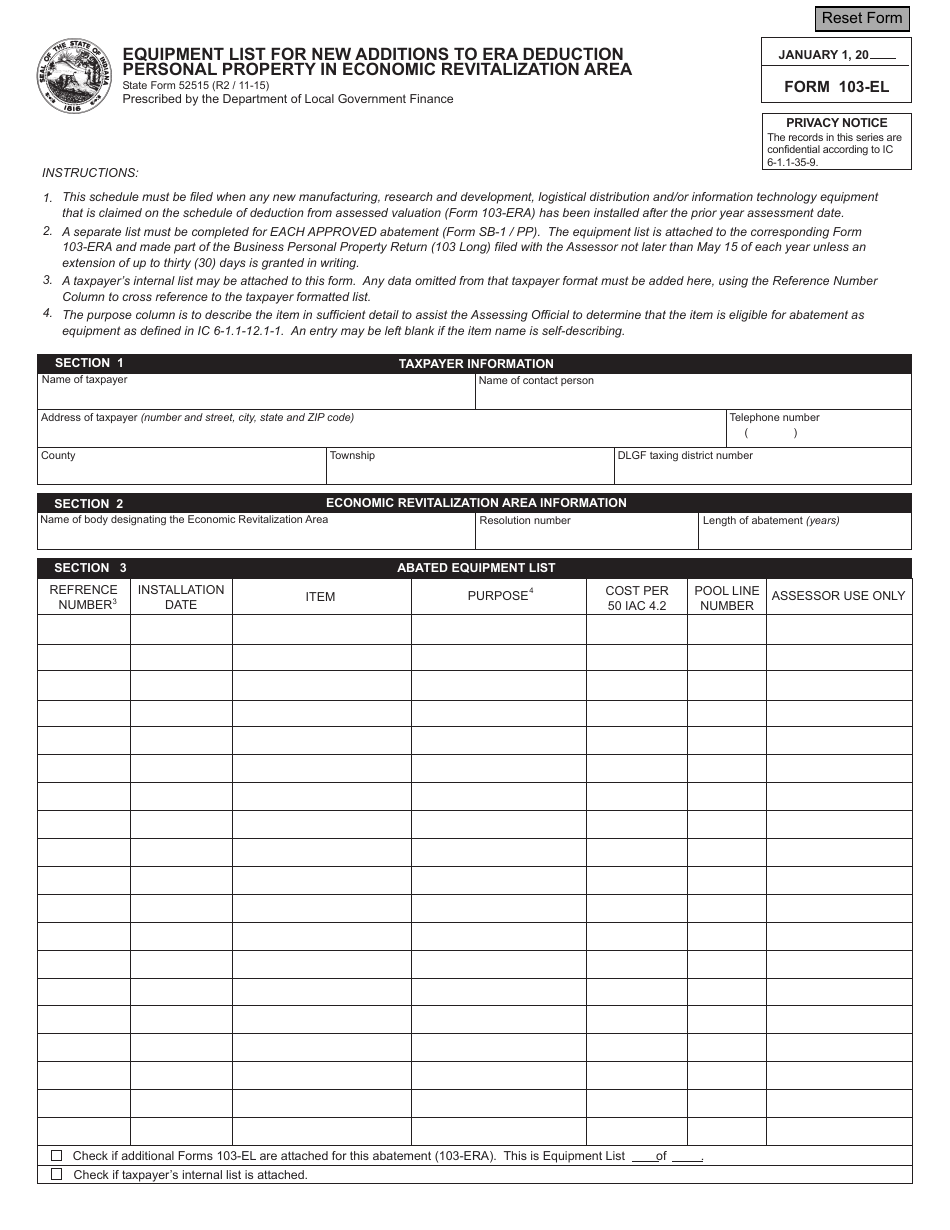

Form 103EL (State Form 52515) Download Fillable PDF or Fill Online

For use by manufacturers or processors; Download this form print this form more about the. Download / view document file. Web date of record:07/06/18 13:47. If business personal property is greater than $150,000;

AFTO Form 103 Download Fillable PDF or Fill Online Aircraft/Missile

Features county services, departments, officials and includes event calendar and community links. Web official site government site. Web the form 104 is filed with a 102 or 103. Web here we aregoing tofill out a form103 for a newsmall business. Download this form print this form more about the.

State Form 11405 (103LONG) Download Fillable PDF or Fill Online

Yes no if you answered “no”, round the true tax value above to the nearest $10 and enter that amount. Web official site government site. Web this form must be filed with the township assessor, if any, or the county assessor of the county in which the property is located not later than may 17, 2021, unless an extension. If.

Fillable Form 103 Long Business Tangible Personal Property Assessment

The businessstartedin november 1, 2010. Web date of record:07/06/18 13:47. Yes no if you answered “no”, round the true tax value above to the nearest $10 and enter that amount. If business personal property is greater than $150,000; January 1, 2021 for assessor's use only note:

Choose Either The Long Or Short Form.

Download / view document file. This form is for income earned in tax year 2022, with tax returns due in. If business personal property is greater than $150,000; Features county services, departments, officials and includes event calendar and community links.

Web Date Of Record:07/06/18 13:47.

Download this form print this form more about the. Yes no if you answered “no”, round the true tax value above to the nearest $10 and enter that amount. Web here we aregoing tofill out a form103 for a newsmall business. If filer wishes to claim deductions.

January 1, 2021 For Assessor's Use Only Note:

Theirfederal tax yearends december 31, 2010. For use by manufacturers or processors; Web the form 104 is filed with a 102 or 103. In a matter of seconds, receive an.

Web Official Site Government Site.

Web this form must be filed with the township assessor, if any, or the county assessor of the county in which the property is located not later than may 17, 2021, unless an extension. The businessstartedin november 1, 2010. Farmer's tangible personal property assessment return.