Form 1041 For 2022

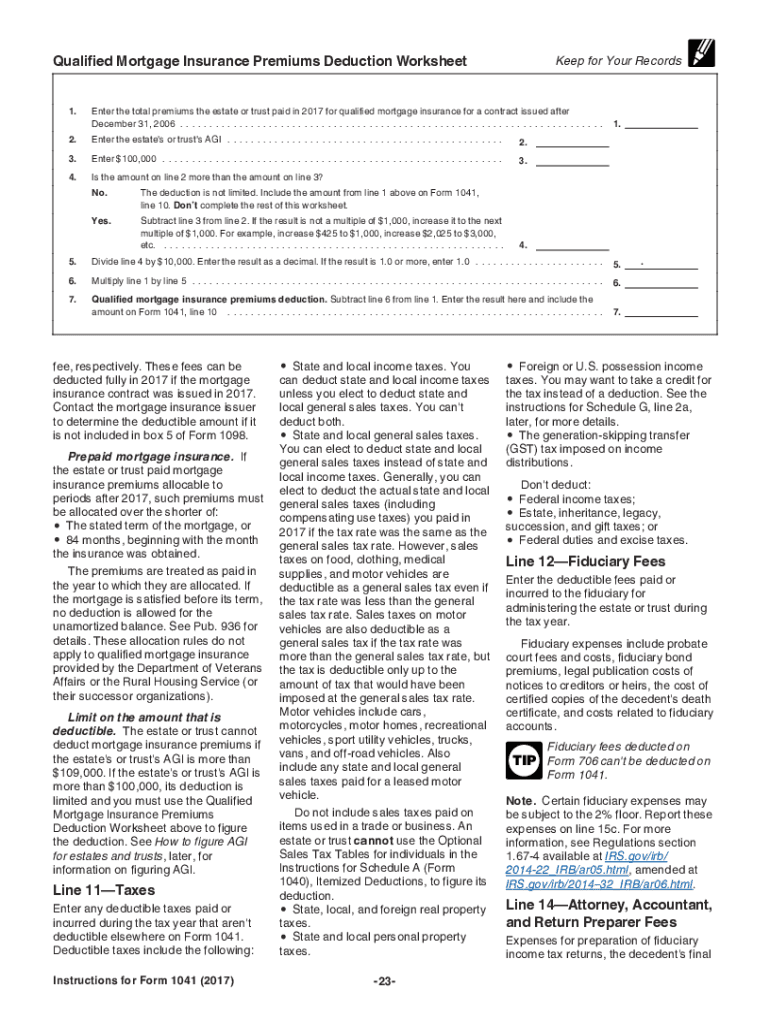

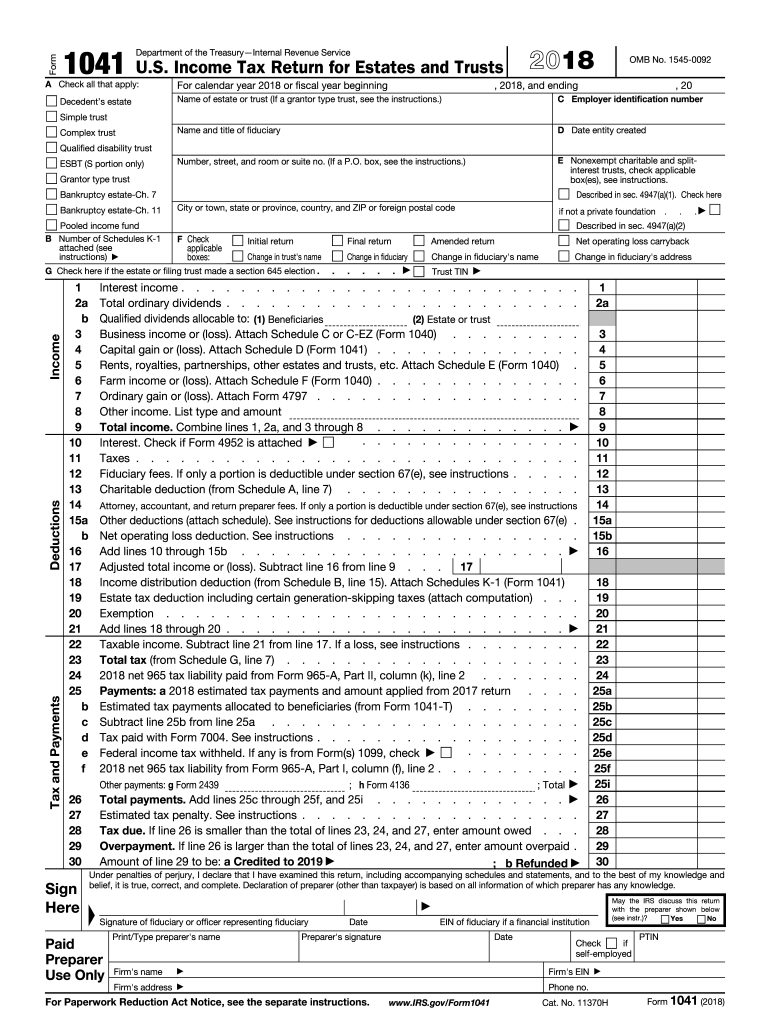

Form 1041 For 2022 - Web a draft version of form 941 for use in the second to fourth quarters of 2022 was issued april 14 by the internal revenue service. The deadline is the last day of the month following the end of the quarter. On january 31, 2020, ketuan zhan passed the reconsideration and successfully revoked wu jihan's legal person status as bitmain. Web the irs 1041 form for 2022 is updated to reflect the latest tax code changes and requirements, ensuring that fiduciaries accurately account for their financial obligations. Complete, edit or print tax forms instantly. Web 7 rows for the 2023 tax year, you can file 2022, 2021, and 2020 tax year returns. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. For tax year 2022, the 20% rate applies to. Form 1041 basics in the year of a person’s death, he or she leaves both personal income and, in some cases, estate income. Web the irs 1041 form for 2022 must be filed by estates with a gross income of $600 or more, and trusts required to distribute income currently or subject to the trust instrument or.

The draft form 941, employer’s. Ad download, print or email irs 1041 tax form on pdffiller for free. The deadline is the last day of the month following the end of the quarter. Web what’s new capital gains and qualified dividends. Web the tax shown on the 2022 tax return (110% of that amount if the estate’s or trust’s adjusted gross income (agi) on that return is more than $150,000, and less than 2 3 of gross. The estate's or trust's alternative minimum taxable income, the income distribution deduction. 1041 (2022) form 1041 (2022) page. 2 schedule a charitable deduction. Web the irs 1041 form for 2022 is updated to reflect the latest tax code changes and requirements, ensuring that fiduciaries accurately account for their financial obligations. Web “2nd quarter 2022,” “3rd quarter 2022,” or “4th quarter 2022”) on your check or money order.

Web the irs 1041 form for 2022 must be filed by estates with a gross income of $600 or more, and trusts required to distribute income currently or subject to the trust instrument or. On january 31, 2020, ketuan zhan passed the reconsideration and successfully revoked wu jihan's legal person status as bitmain. Get ready for tax season deadlines by completing any required tax forms today. Don’t complete for a simple trust or a pooled income fund. Web turbotax business is available for windows on cd or as a download. It's not available for mac or in our online versions of turbotax. Irs form 1041, get ready for tax deadlines by filling online any tax form for free. Bundle & save $ 124. Ad download, print or email irs 1041 tax form on pdffiller for free. Complete, edit or print tax forms instantly.

Form Instructions 1041 (Schedule K1) and Form 1041 Main Differences

Ad download, print or email irs 1041 tax form on pdffiller for free. Updated for tax year 2022 •. Web a draft version of form 941 for use in the second to fourth quarters of 2022 was issued april 14 by the internal revenue service. Complete, edit or print tax forms instantly. Web turbotax business is available for windows on.

Form 1041 Tax Fill Out and Sign Printable PDF Template signNow

Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Irs form 1041, get ready for tax deadlines by filling online any tax form for free. Updated for tax year 2022 •. That’s why the person dealing with. Web what’s new capital gains.

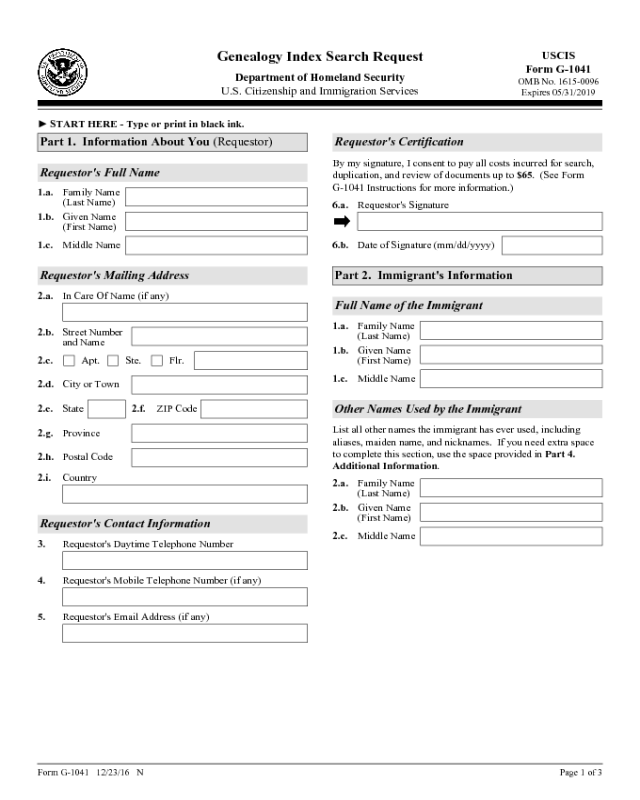

Form G1041 Edit, Fill, Sign Online Handypdf

Irs form 1041, get ready for tax deadlines by filling online any tax form for free. Web a draft version of form 941 for use in the second to fourth quarters of 2022 was issued april 14 by the internal revenue service. Updated for tax year 2022 •. Web “2nd quarter 2022,” “3rd quarter 2022,” or “4th quarter 2022”) on.

20192022 Form IRS 1041N Fill Online, Printable, Fillable, Blank

Web the irs 1041 form for 2022 must be filed by estates with a gross income of $600 or more, and trusts required to distribute income currently or subject to the trust instrument or. Web “2nd quarter 2022,” “3rd quarter 2022,” or “4th quarter 2022”) on your check or money order. Bundle & save $ 124. Complete, edit or print.

irs form 1041 Fill out & sign online DocHub

2 schedule a charitable deduction. The estate's or trust's alternative minimum taxable income, the income distribution deduction. 2022 estates with gross income below the annual filing threshold; Complete, edit or print tax forms instantly. Form 1041 basics in the year of a person’s death, he or she leaves both personal income and, in some cases, estate income.

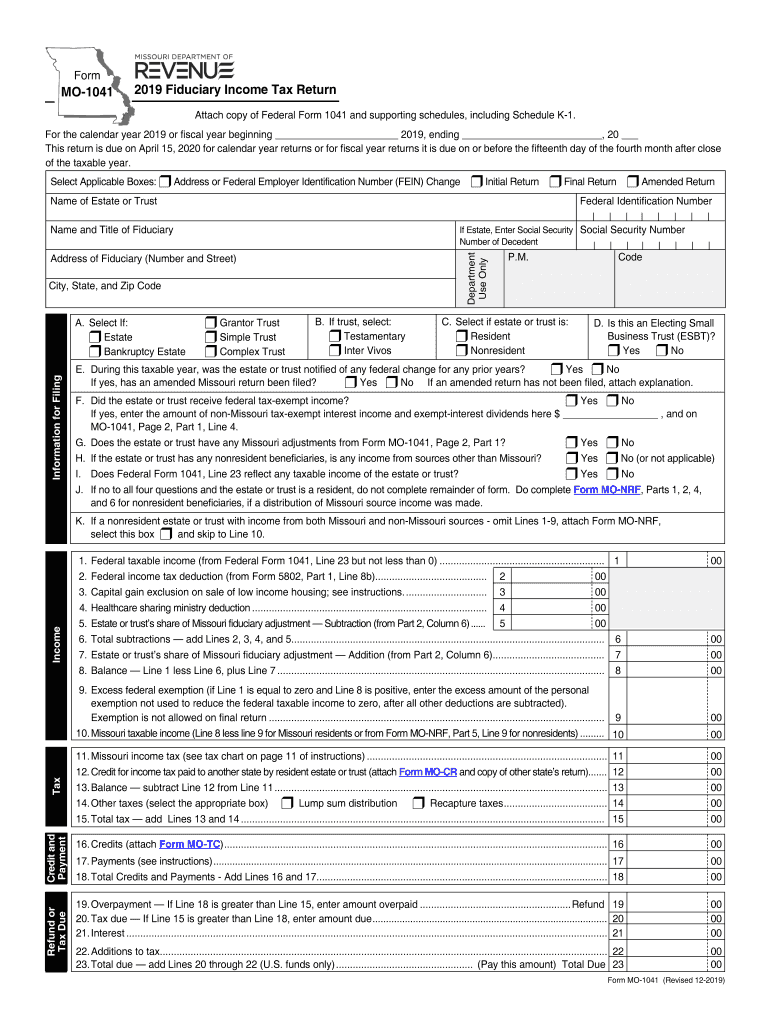

Missouri Form 1041 Fill Out and Sign Printable PDF Template signNow

Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. 2022 estates with gross income below the annual filing threshold; Web “2nd quarter 2022,” “3rd quarter 2022,” or “4th quarter 2022”) on your check or money order. Irs form 1041, get ready for.

Form 1041 (Schedule K1) Beneficiary's Share of Deductions

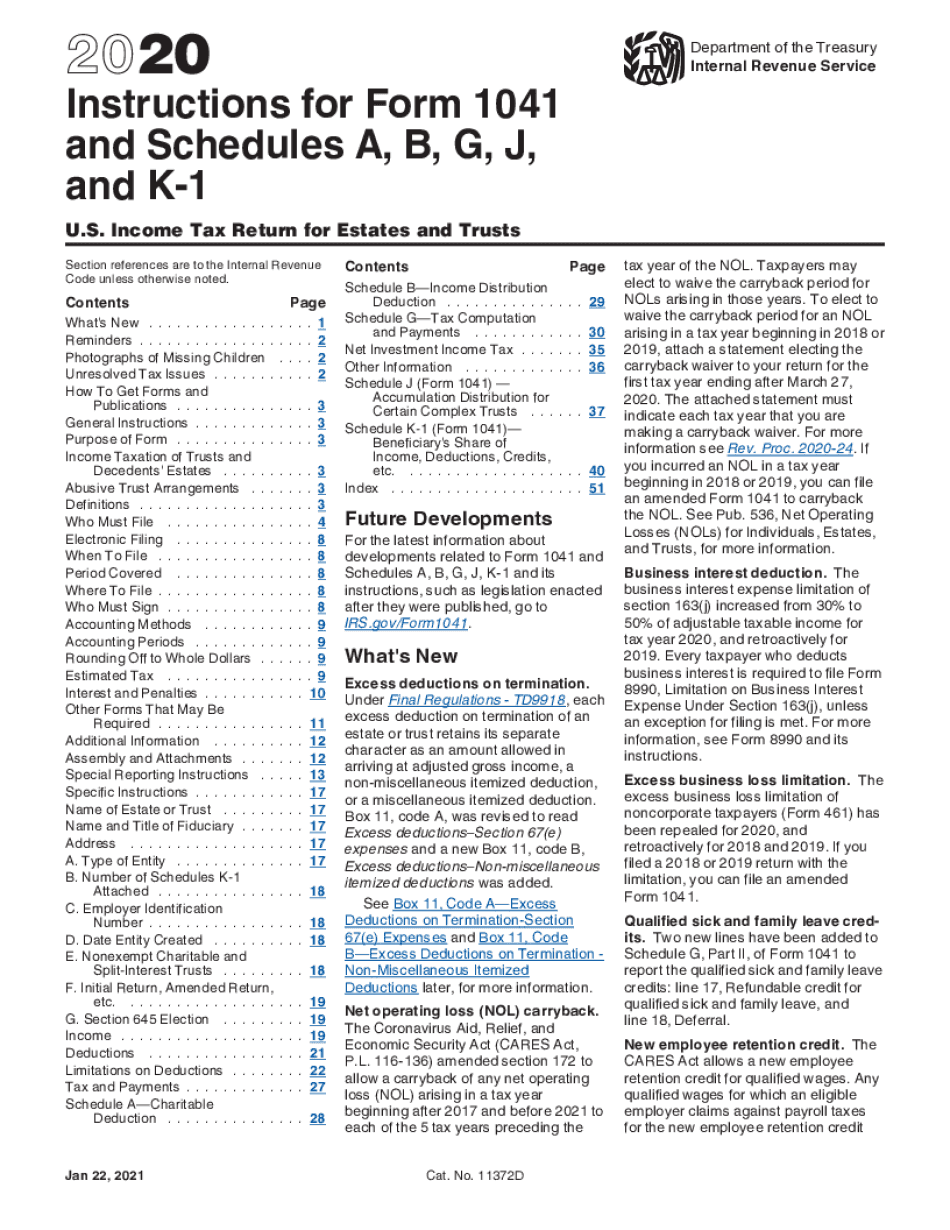

Web general instructions purpose of schedule use schedule i (form 1041) to figure: Web the irs 1041 form for 2022 must be filed by estates with a gross income of $600 or more, and trusts required to distribute income currently or subject to the trust instrument or. For tax year 2022, the 20% rate applies to. That’s why the person.

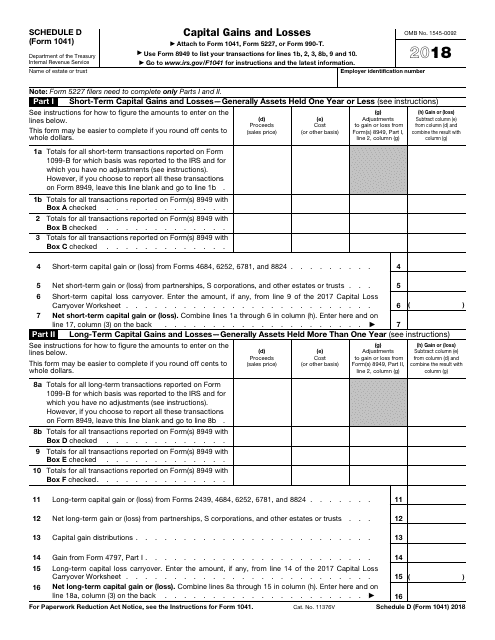

Form 1041 Schedule D

Written by a turbotax expert • reviewed by a turbotax cpa. However, the estate or trust must show its 2023 tax year on the 2022 form 1041. Complete, edit or print tax forms instantly. Updated for tax year 2022 •. Web the irs 1041 form for 2022 is updated to reflect the latest tax code changes and requirements, ensuring that.

IRS Form 1041 Schedule D Download Fillable PDF or Fill Online Capital

Web 7 rows for the 2023 tax year, you can file 2022, 2021, and 2020 tax year returns. Web a draft version of form 941 for use in the second to fourth quarters of 2022 was issued april 14 by the internal revenue service. However, the estate or trust must show its 2023 tax year on the 2022 form 1041..

form 1041 schedule d Fill Online, Printable, Fillable Blank form

Updated for tax year 2022 •. The draft form 941, employer’s. Web general instructions purpose of schedule use schedule i (form 1041) to figure: Web the 2023 form 1041 isn't available by the time the estate or trust is required to file its tax return. Web you file form 941 quarterly.

Irs Form 1041, Get Ready For Tax Deadlines By Filling Online Any Tax Form For Free.

Form 1041 basics in the year of a person’s death, he or she leaves both personal income and, in some cases, estate income. 2 schedule a charitable deduction. For tax year 2022, the 20% rate applies to. Updated for tax year 2022 •.

Web The 2023 Form 1041 Isn't Available By The Time The Estate Or Trust Is Required To File Its Tax Return.

It's not available for mac or in our online versions of turbotax. Web turbotax business is available for windows on cd or as a download. The deadline is the last day of the month following the end of the quarter. 1041 (2022) form 1041 (2022) page.

Web The Irs 1041 Form For 2022 Is Updated To Reflect The Latest Tax Code Changes And Requirements, Ensuring That Fiduciaries Accurately Account For Their Financial Obligations.

However, the estate or trust must show its 2023 tax year on the 2022 form 1041. Complete, edit or print tax forms instantly. That’s why the person dealing with. Web 7 rows for the 2023 tax year, you can file 2022, 2021, and 2020 tax year returns.

Web What’s New Capital Gains And Qualified Dividends.

Web the tax shown on the 2022 tax return (110% of that amount if the estate’s or trust’s adjusted gross income (agi) on that return is more than $150,000, and less than 2 3 of gross. Ad download, print or email irs 1041 tax form on pdffiller for free. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Get ready for tax season deadlines by completing any required tax forms today.