Form 1042 S

Form 1042 S - Source income subject to withholding, to report amounts paid to foreign persons that are described under amounts subject to nra withholding and reporting, even if withholding is not required on the payments. Source income of foreign persons, including recent updates, related forms, and instructions on how to file. Source income subject to withholding, is used to report any payments made to foreign persons. Amounts paid to foreign persons from u.s. Source income subject to withholding, under the irc sections named above. Sources that are reportable under chapter 3 or 4 (regardless of whether withholding was required or not); Web information about form 1042, annual withholding tax return for u.s. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Income, including income that is effectively connected with the conduct of a trade or business in the united states, must file a u.s. Web use form 1042 to report the following.

Income, including income that is effectively connected with the conduct of a trade or business in the united states, must file a u.s. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Sources that are reportable under chapter 3 or 4 (regardless of whether withholding was required or not); Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Use form 1042 to report tax withheld on certain income of foreign persons. Web use form 1042 to report the following. Source income subject to withholding, is used to report any payments made to foreign persons. Source income of foreign persons, including recent updates, related forms, and instructions on how to file. Web information about form 1042, annual withholding tax return for u.s. Source income subject to withholding, is used to report amounts paid to foreign persons (including those presumed to be foreign) by a united states based institution or business.

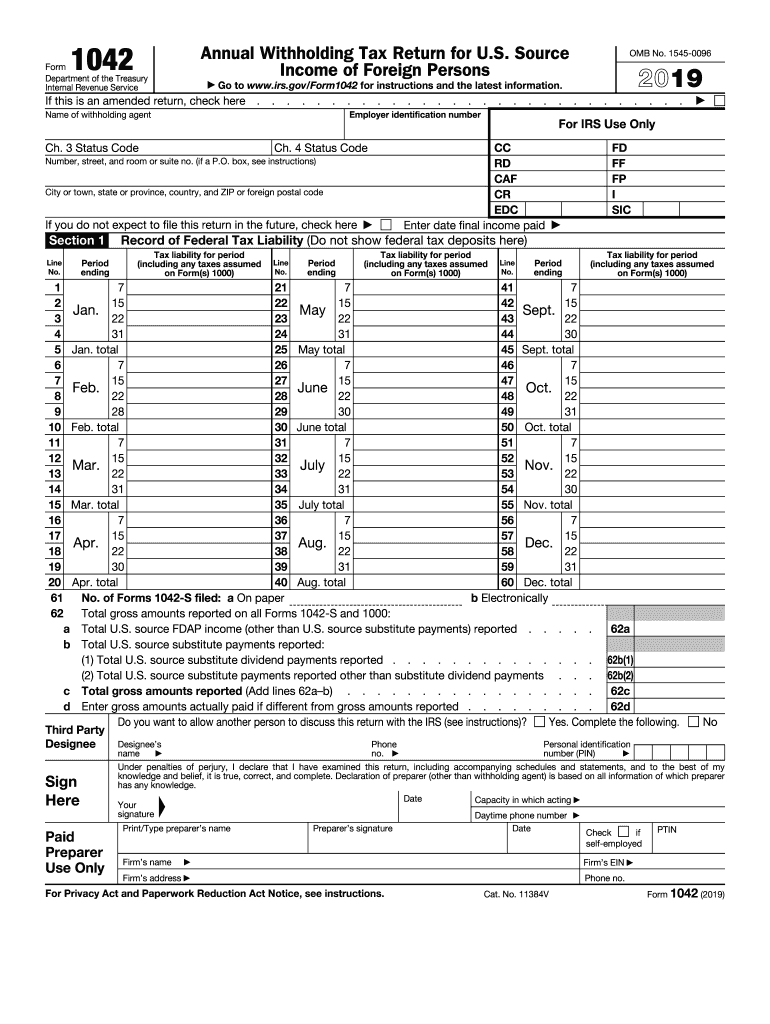

Web information about form 1042, annual withholding tax return for u.s. Source income subject to withholding, is used to report amounts paid to foreign persons (including those presumed to be foreign) by a united states based institution or business. Source income subject to withholding, under the irc sections named above. Source income subject to withholding, is used to report any payments made to foreign persons. Amounts paid to foreign persons from u.s. Income, including income that is effectively connected with the conduct of a trade or business in the united states, must file a u.s. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Web use form 1042 to report the following. Source income subject to withholding, to report amounts paid to foreign persons that are described under amounts subject to nra withholding and reporting, even if withholding is not required on the payments.

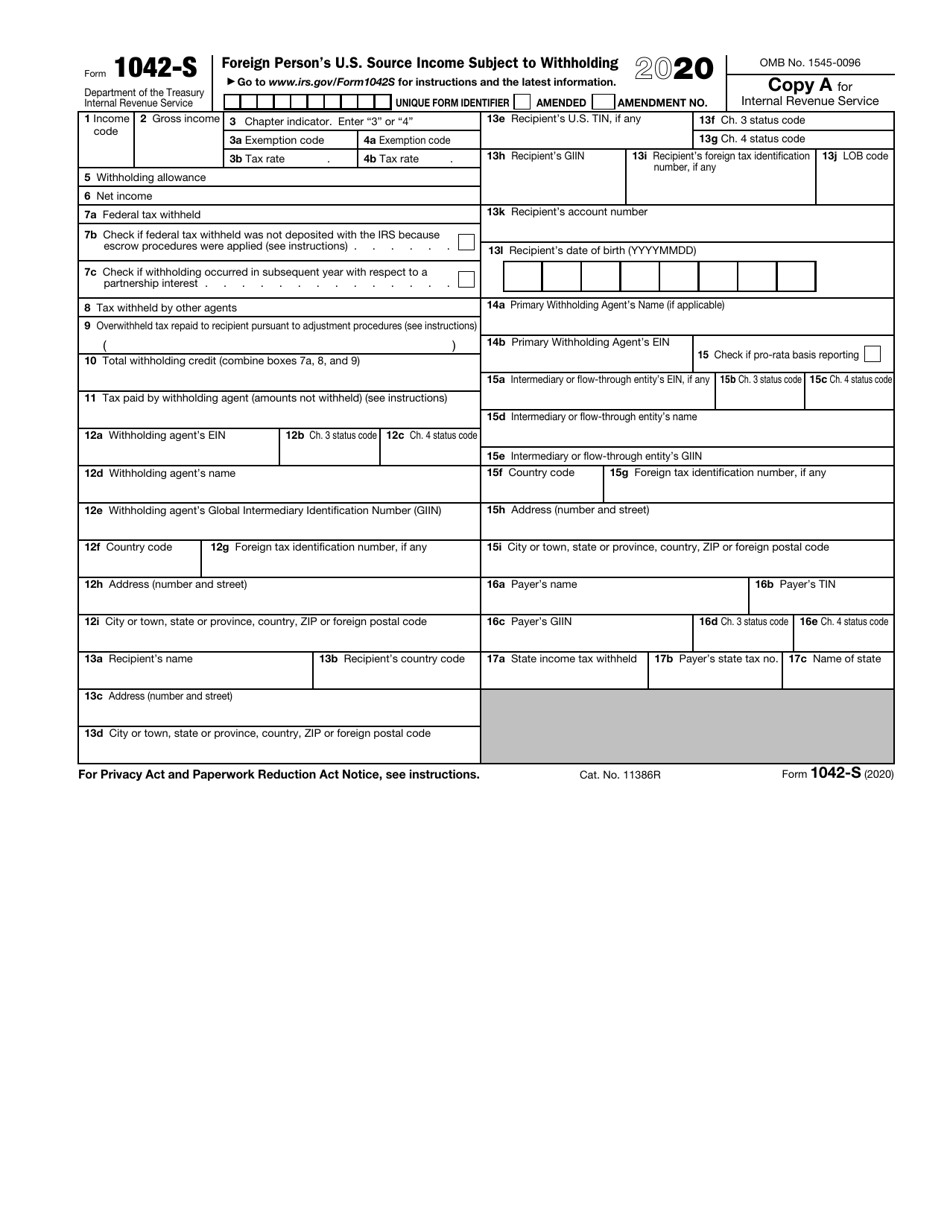

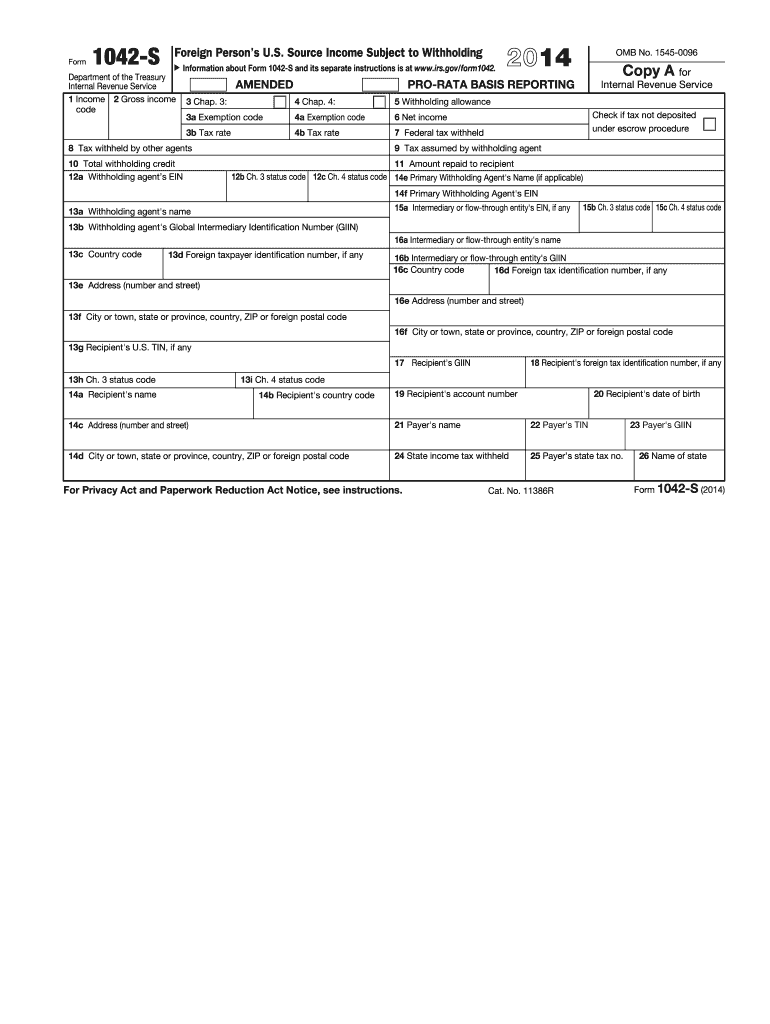

form 1042s 2021 instructions Fill Online, Printable, Fillable Blank

Source income of foreign persons, including recent updates, related forms, and instructions on how to file. Amounts paid to foreign persons from u.s. Source income subject to withholding, is used to report amounts paid to foreign persons (including those presumed to be foreign) by a united states based institution or business. The tax withheld under chapter 3 (excluding withholding under.

The Tax Times The Newly Issued Form 1042S Foreign Person's U.S

Source income subject to withholding, is used to report amounts paid to foreign persons (including those presumed to be foreign) by a united states based institution or business. Income, including income that is effectively connected with the conduct of a trade or business in the united states, must file a u.s. Income tax filing requirements generally, every nonresident alien individual,.

Understanding your 1042S » Payroll Boston University

Sources that are reportable under chapter 3 or 4 (regardless of whether withholding was required or not); Web information about form 1042, annual withholding tax return for u.s. Use form 1042 to report tax withheld on certain income of foreign persons. Web use form 1042 to report the following. Source income subject to withholding, is used to report any payments.

1042 S Form slideshare

Use form 1042 to report tax withheld on certain income of foreign persons. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts. Web use form 1042 to report the following. Income, including income that.

1042 S Form slideshare

Sources that are reportable under chapter 3 or 4 (regardless of whether withholding was required or not); The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts. Source income subject to withholding, including recent updates,.

IRS Form 1042S Download Fillable PDF or Fill Online Foreign Person's U

Sources that are reportable under chapter 3 or 4 (regardless of whether withholding was required or not); Source income subject to withholding, to report amounts paid to foreign persons that are described under amounts subject to nra withholding and reporting, even if withholding is not required on the payments. Source income subject to withholding, is used to report amounts paid.

Form 1042 S Fill Out and Sign Printable PDF Template signNow

Use form 1042 to report tax withheld on certain income of foreign persons. Web use form 1042 to report the following. Source income subject to withholding, is used to report amounts paid to foreign persons (including those presumed to be foreign) by a united states based institution or business. Source income subject to withholding, is used to report any payments.

2019 Form IRS 1042 Fill Online, Printable, Fillable, Blank pdfFiller

Source income subject to withholding, under the irc sections named above. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated.

Form 1042S USEReady

Web use form 1042 to report the following. Amounts paid to foreign persons from u.s. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts. Source income of foreign persons, including recent updates, related forms,.

Form 1042S Explained (Foreign Person's U.S. Source Subject to

Web use form 1042 to report the following. Source income of foreign persons, including recent updates, related forms, and instructions on how to file. Source income subject to withholding, to report amounts paid to foreign persons that are described under amounts subject to nra withholding and reporting, even if withholding is not required on the payments. Sources that are reportable.

Amounts Paid To Foreign Persons From U.s.

Source income of foreign persons, including recent updates, related forms, and instructions on how to file. Source income subject to withholding, is used to report any payments made to foreign persons. Source income subject to withholding, to report amounts paid to foreign persons that are described under amounts subject to nra withholding and reporting, even if withholding is not required on the payments. Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s.

Use Form 1042 To Report Tax Withheld On Certain Income Of Foreign Persons.

Source income subject to withholding, under the irc sections named above. Sources that are reportable under chapter 3 or 4 (regardless of whether withholding was required or not); Web use form 1042 to report the following. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts.

Source Income Subject To Withholding, Including Recent Updates, Related Forms, And Instructions On How To File.

Income, including income that is effectively connected with the conduct of a trade or business in the united states, must file a u.s. Web information about form 1042, annual withholding tax return for u.s. Source income subject to withholding, is used to report amounts paid to foreign persons (including those presumed to be foreign) by a united states based institution or business.