Form 1065 Schedule K-2 Instructions

Form 1065 Schedule K-2 Instructions - Rental activity income (loss) and portfolio income are not. This section of the program contains information for part iii of the. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web thomson reuters tax & accounting. The forms consist of specific. Return of partnership income , form 8865, return of u.s. They are extensions of schedule k and are used to report items of. Line 21 replaces line 16p for foreign taxes paid or accrued with respect to basis adjustments and income reconciliation. For a fiscal year or a short tax year, fill in the tax year. Web the new draft 2021 tax year irs schedules and instructions include:

The forms consist of specific. Web thomson reuters tax & accounting. Web schedule k (form 1065) is a summary schedule of all the partners’ share of income, credits, deductions, etc. (updated january 9, 2023) 2. Return of partnership income , form 8865, return of u.s. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Web the new draft 2021 tax year irs schedules and instructions include: For a fiscal year or a short tax year, fill in the tax year. Rental activity income (loss) and portfolio income are not. They are extensions of schedule k and are used to report items of.

This section of the program contains information for part iii of the. Web thomson reuters tax & accounting. For a fiscal year or a short tax year, fill in the tax year. See how to fill out the online and print it. The forms consist of specific. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Rental activity income (loss) and portfolio income are not. Return of partnership income, were first required to be filed for the 2021 tax year. Web the new draft 2021 tax year irs schedules and instructions include: Ad file partnership and llc form 1065 fed and state taxes with taxact® business.

Form 1065 (Schedule M3) Net (Loss) Reconciliation for Certain

Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Web thomson reuters tax & accounting. April 14, 2022 · 5 minute read. See how to fill out the online and print it. Web the new draft 2021 tax year irs schedules and instructions include:

Llc Tax Form 1065 Universal Network

Web thomson reuters tax & accounting. Return of partnership income , form 8865, return of u.s. (updated january 9, 2023) 2. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Ad file partnership and llc form 1065 fed and state taxes with taxact® business.

Form 1065 (Schedule D) Capital Gains and Losses (2014) Free Download

Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Return of partnership income , form 8865, return of u.s. (updated january 9, 2023) 2. Web thomson reuters tax & accounting.

Form 10 Filing Instructions 10 10 Various Ways To Do Form 10 Filing

Ad file partnership and llc form 1065 fed and state taxes with taxact® business. This section of the program contains information for part iii of the. See how to fill out the online and print it. Return of partnership income , form 8865, return of u.s. (updated january 9, 2023) 2.

Irs Form 1065 Year 2014 Form Resume Examples WjYDlz7YKB

Return of partnership income, were first required to be filed for the 2021 tax year. (updated january 9, 2023) 2. They are extensions of schedule k and are used to report items of. Web schedule k (form 1065) is a summary schedule of all the partners’ share of income, credits, deductions, etc. Return of partnership income , form 8865, return.

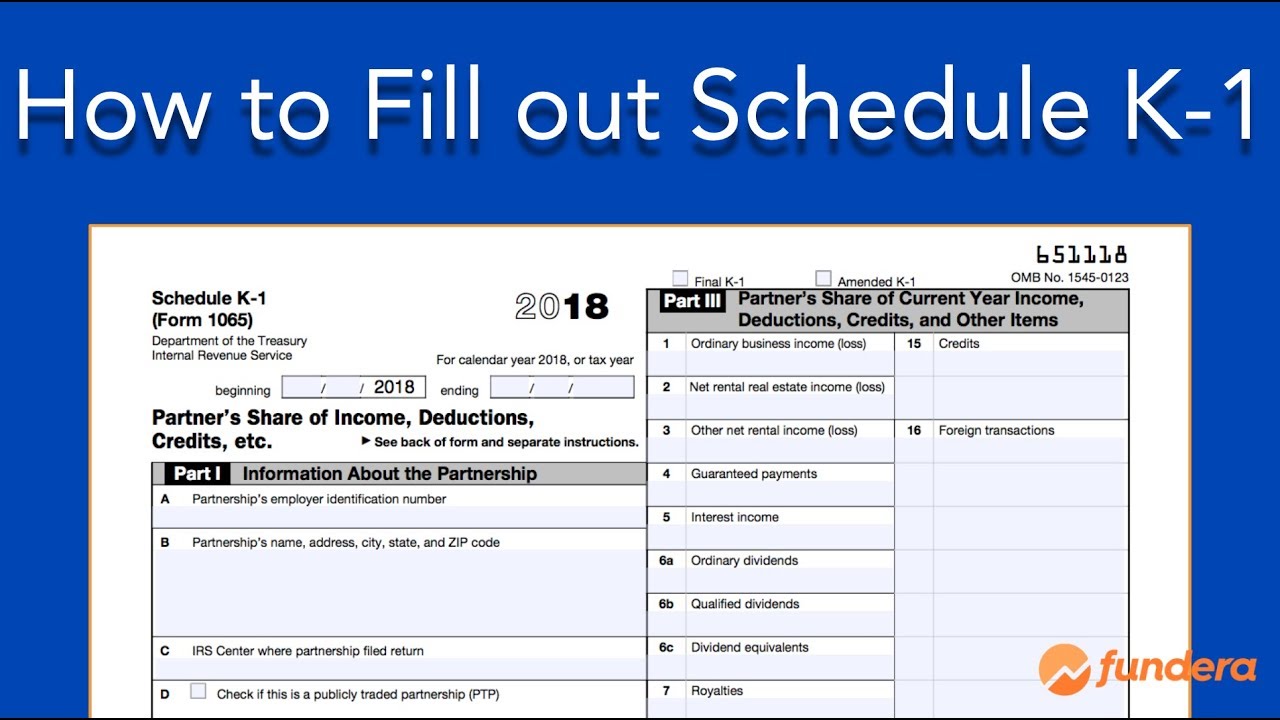

How to Fill out Schedule K1 (IRS Form 1065) YouTube

Return of partnership income, were first required to be filed for the 2021 tax year. The forms consist of specific. (updated january 9, 2023) 2. Web thomson reuters tax & accounting. This section of the program contains information for part iii of the.

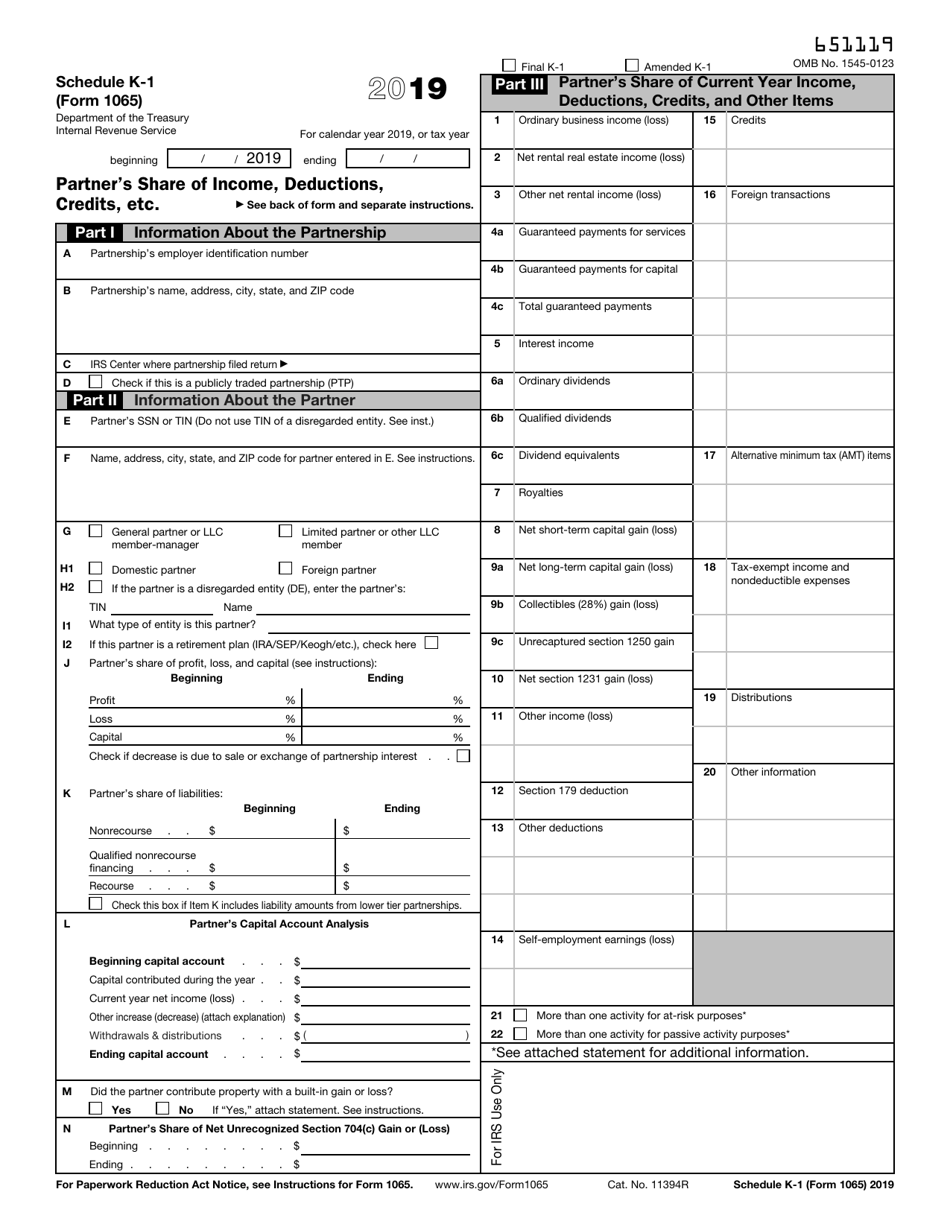

IRS Form 1065 Schedule K1 Download Fillable PDF or Fill Online Partner

Line 21 replaces line 16p for foreign taxes paid or accrued with respect to basis adjustments and income reconciliation. Web thomson reuters tax & accounting. This section of the program contains information for part iii of the. They are extensions of schedule k and are used to report items of. Web schedule k (form 1065) is a summary schedule of.

Box 14 Code A Of Irs Schedule K1 (form 1065) Fafsa Armando Friend's

Return of partnership income, were first required to be filed for the 2021 tax year. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Web thomson reuters tax & accounting. The forms consist of specific. Ad file partnership and llc form 1065 fed and state.

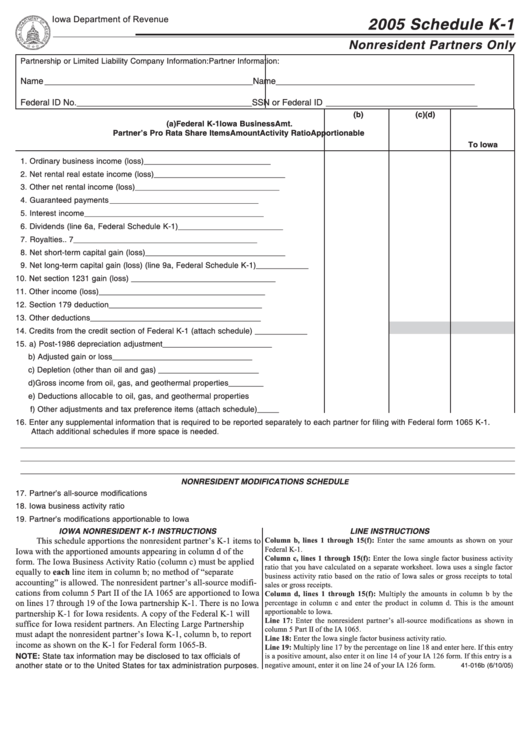

Fillable Form Ia 1065 Schedule K1 Nonresident Partners Only 2005

Web schedule k (form 1065) is a summary schedule of all the partners’ share of income, credits, deductions, etc. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. The forms consist of specific. April 14, 2022 · 5 minute read. For a fiscal year or a short tax year, fill in the tax year.

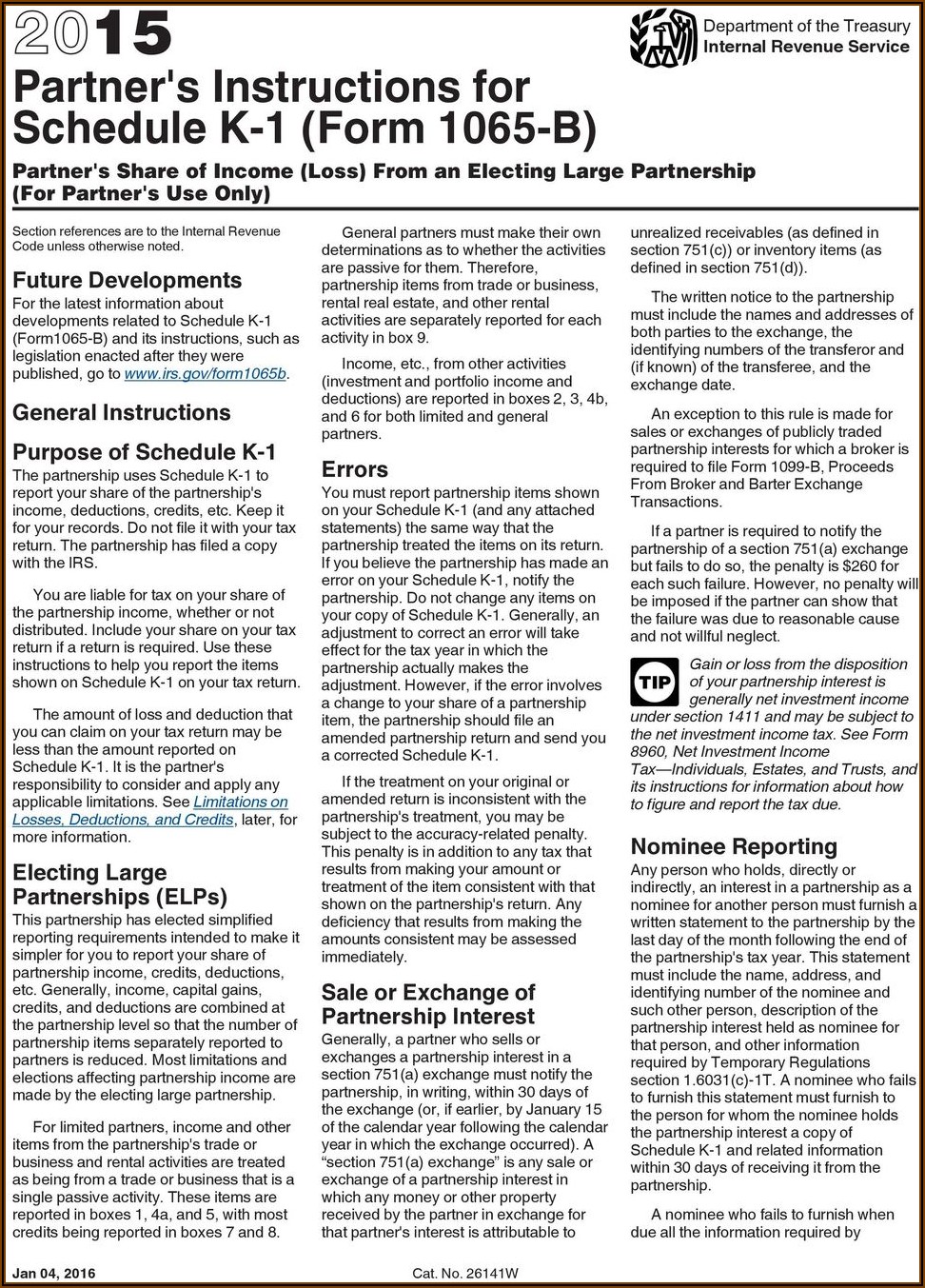

IRS Instructions 1065 (Schedule K1) 2018 2019 Printable & Fillable

This section of the program contains information for part iii of the. See how to fill out the online and print it. For a fiscal year or a short tax year, fill in the tax year. Return of partnership income , form 8865, return of u.s. Web the 2022 form 1065 is an information return for calendar year 2022 and.

Web The 2022 Form 1065 Is An Information Return For Calendar Year 2022 And Fiscal Years That Begin In 2022 And End In 2023.

Return of partnership income, were first required to be filed for the 2021 tax year. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. They are extensions of schedule k and are used to report items of. Web the new draft 2021 tax year irs schedules and instructions include:

Return Of Partnership Income , Form 8865, Return Of U.s.

For a fiscal year or a short tax year, fill in the tax year. Rental activity income (loss) and portfolio income are not. Web thomson reuters tax & accounting. See how to fill out the online and print it.

Line 21 Replaces Line 16P For Foreign Taxes Paid Or Accrued With Respect To Basis Adjustments And Income Reconciliation.

April 14, 2022 · 5 minute read. (updated january 9, 2023) 2. Web schedule k (form 1065) is a summary schedule of all the partners’ share of income, credits, deductions, etc. This section of the program contains information for part iii of the.