Form 1098-C 2022

Form 1098-C 2022 - Try it for free now! To claim a deduction for donation of a motor vehicle, use screen. Upload, modify or create forms. Recipient fields common to all form types. Make changes to your 2022 tax. Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Web this statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified tuition. Type in the recipient in. See the current general instructions for certain.

Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Web answer yes when asked if you made any donations to charity in 2022 answer yes when asked do you want to enter your donations for 2022? Web instructions for donor caution: Recipient copy 30 days from the date of the sale or contribution. Web this statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified tuition. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Web filer fields common to all form types. To claim a deduction for donation of a motor vehicle, use screen. Recipient fields common to all form types. See the current general instructions for certain.

Recipient copy 30 days from the date of the sale or contribution. Web answer yes when asked if you made any donations to charity in 2022 answer yes when asked do you want to enter your donations for 2022? Web this statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified tuition. Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Type in the recipient in. Make changes to your 2022 tax. Web instructions for donor caution: Try it for free now! To claim a deduction for donation of a motor vehicle, use screen. Web filer fields common to all form types.

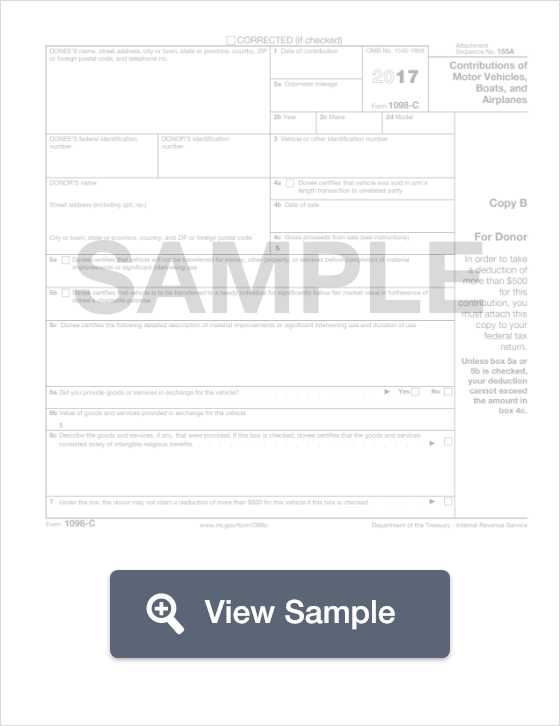

Fillable Form 1098C Vehicle Donation Deductions PDF FormSwift

Try it for free now! Type in the recipient in. Recipient fields common to all form types. Each contribution constitutes a new form. Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information.

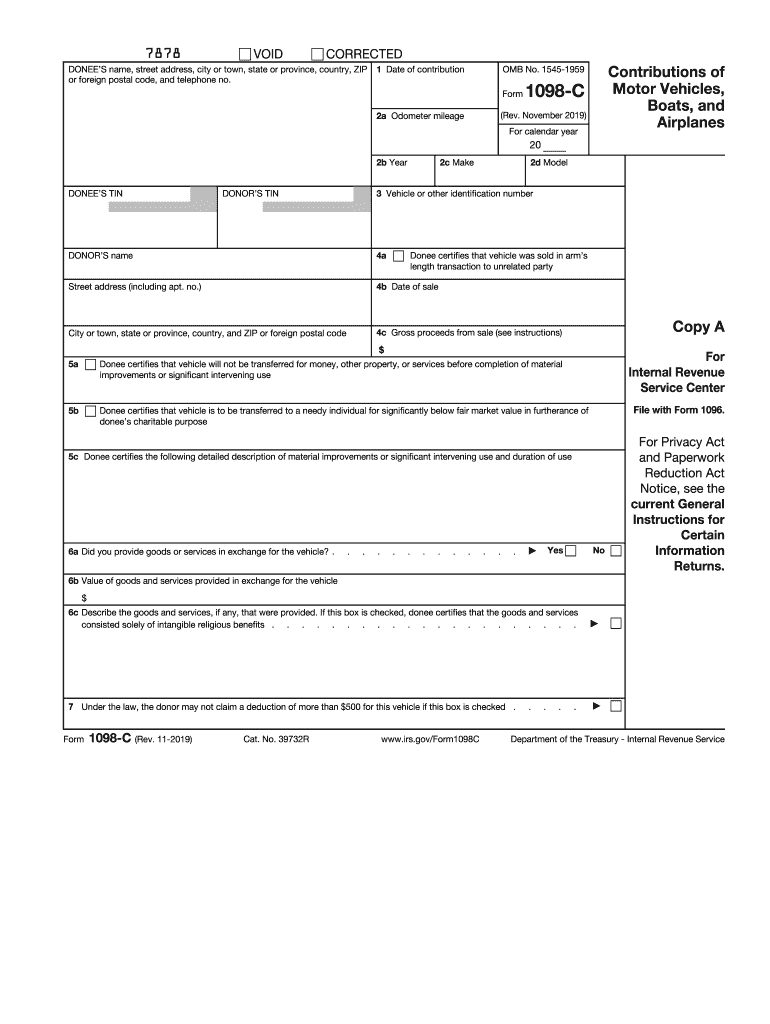

20192022 Form IRS 1098C Fill Online, Printable, Fillable, Blank

Type in the recipient in. Recipient fields common to all form types. Web filer fields common to all form types. Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient. Try it for free now!

Form 1098CContributions of Motor Vehicles, Boats, and Airplanes

Web filer fields common to all form types. To claim a deduction for donation of a motor vehicle, use screen. Upload, modify or create forms. Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient. Donee certifies that vehicle was sold in arm's length.

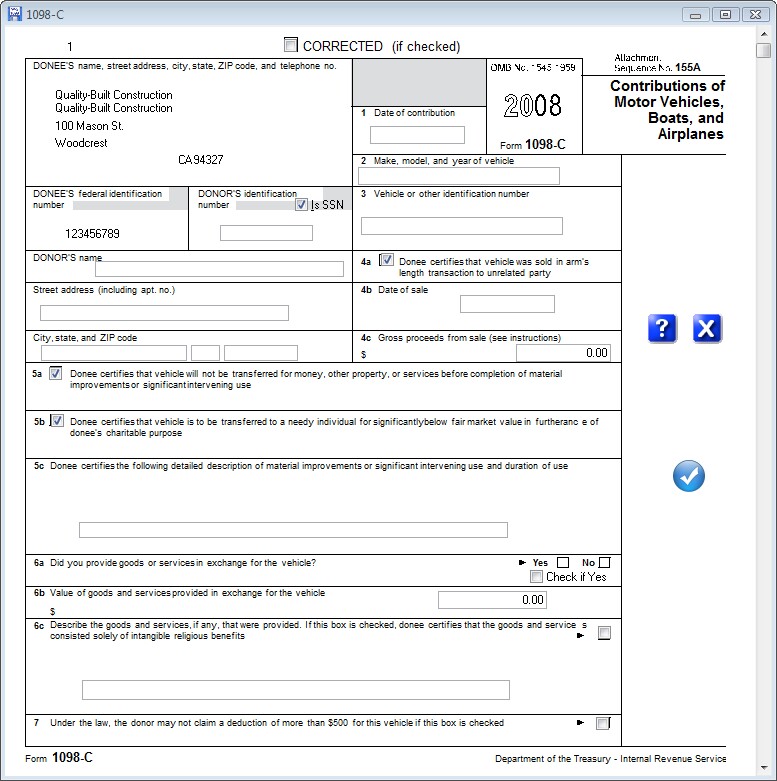

Entering & Editing Data > Form 1098C

Donee certifies that vehicle was sold in arm's length. Web answer yes when asked if you made any donations to charity in 2022 answer yes when asked do you want to enter your donations for 2022? Make changes to your 2022 tax. Recipient copy 30 days from the date of the sale or contribution. Web this statement has been furnished.

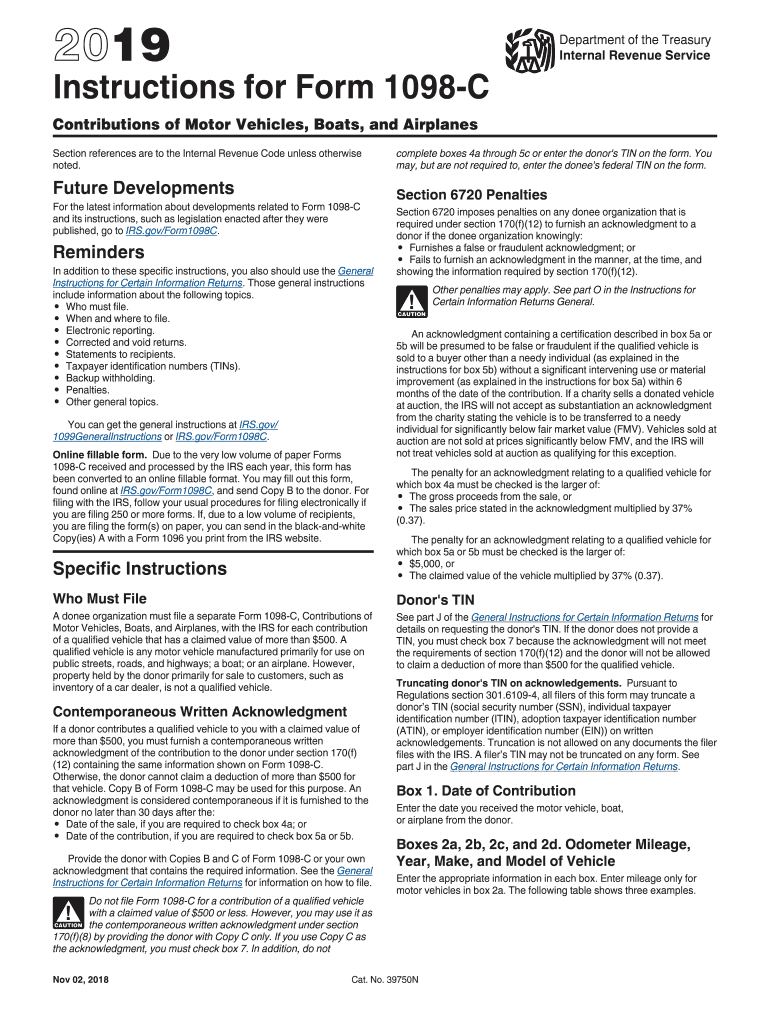

20192022 Form IRS Instruction 1098C Fill Online, Printable Fill

Each contribution constitutes a new form. Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient. Recipient fields common to all form types. See the current general instructions for certain. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of.

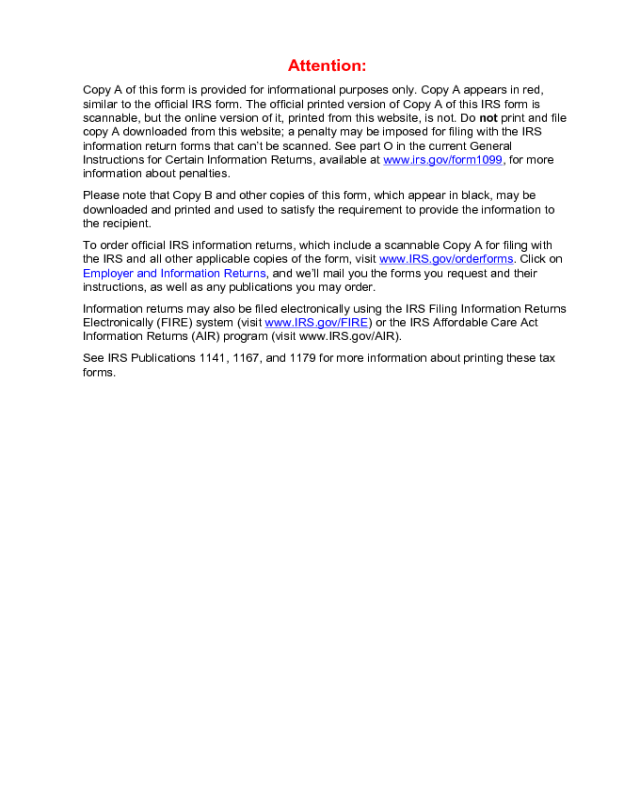

How to Print and File Tax Form 1098C, Contributions of Motor Vehicles

Web answer yes when asked if you made any donations to charity in 2022 answer yes when asked do you want to enter your donations for 2022? Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Upload, modify.

Form 1098C Edit, Fill, Sign Online Handypdf

To claim a deduction for donation of a motor vehicle, use screen. Web instructions for donor caution: Upload, modify or create forms. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Donee certifies that vehicle was sold in.

1098C Software to Print and Efile Form 1098C

Recipient fields common to all form types. Web this statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified tuition. Each contribution constitutes a new form. Type in the recipient in. See the current general instructions for certain.

IRS Instruction 1098C 20192022 Fill out Tax Template Online US

Recipient fields common to all form types. Each contribution constitutes a new form. Web this statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified tuition. Make changes to your 2022 tax. Upload, modify or create forms.

Irs Form 1098 Instructions Universal Network

Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient. Make changes to your 2022 tax. Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Type in the recipient in. Web.

Donee Certifies That Vehicle Was Sold In Arm's Length.

See the current general instructions for certain. Web answer yes when asked if you made any donations to charity in 2022 answer yes when asked do you want to enter your donations for 2022? Try it for free now! Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient.

To Claim A Deduction For Donation Of A Motor Vehicle, Use Screen.

Web filer fields common to all form types. Web instructions for donor caution: Web this statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified tuition. Type in the recipient in.

Upload, Modify Or Create Forms.

Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Make changes to your 2022 tax. Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Each contribution constitutes a new form.

Recipient Copy 30 Days From The Date Of The Sale Or Contribution.

Recipient fields common to all form types.