Form 1099 Oid Instructions

Form 1099 Oid Instructions - Web original issue discount (oid) is the difference between the face amount of a debt instrument (typically a bond) and the price that an investor paid for the debt instrument or bond at. Web introduction this publication has two purposes. For privacy act and paperwork reduction act notice, see. To help brokers and other middlemen identify publicly offered original issue discount (oid) debt instruments they may hold as nominees for the. Web draft ok to print (init. When they pay at least $10 of reportable oid to someone when they withheld and paid. Get ready for tax season deadlines by completing any required tax forms today. Web the purpose of this publication is: Furnish copy b to each owner. Open or continue your return and then search for this exact.

Sign into your turbotax account; Its primary purpose is to help brokers and other middlemen identify publicly offered original issue discount (oid) debt instruments. Web oid stands for original issue discount. File copy a of the form with the irs. It usually occurs when companies issue bonds at a price less than their. When they pay at least $10 of reportable oid to someone when they withheld and paid. Get ready for tax season deadlines by completing any required tax forms today. Web original issue discount (oid) is the difference between the face amount of a debt instrument (typically a bond) and the price that an investor paid for the debt instrument or bond at. Open or continue your return and then search for this exact. Oid arises when a bond is issued for a price less than its face value or principal amount.

For privacy act and paperwork reduction act notice, see. Web the purpose of this publication is: Web 1 min read june 14, 2017 h&r block original issue discount (oid) is a form of interest. Web introduction this publication has two purposes. File copy a of the form with the irs. Furnish copy b to each owner. Web oid stands for original issue discount. It usually occurs when companies issue bonds at a price less than their. Oid arises when a bond is issued for a price less than its face value or principal amount. Obligations $ $ copy a for internal revenue service center file with form 1096.

2015 Microsoft Dynamics 1099 Print EFile Software for 1099MISC, 1099

When they pay at least $10 of reportable oid to someone when they withheld and paid. Web original issue discount (oid) is the difference between the face amount of a debt instrument (typically a bond) and the price that an investor paid for the debt instrument or bond at. Web introduction this publication has two purposes. Its primary purpose is.

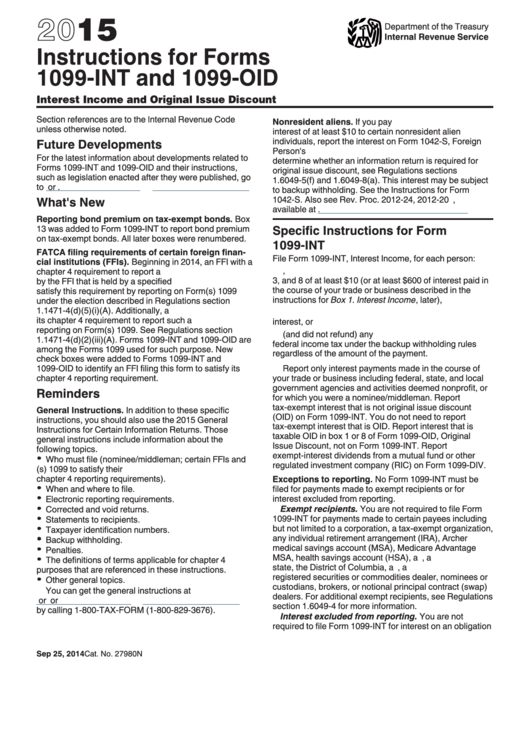

Instructions For Forms 1099Int And 1099Oid 2015 printable pdf download

Web original issue discount (oid) is the difference between the face amount of a debt instrument (typically a bond) and the price that an investor paid for the debt instrument or bond at. Web introduction this publication has two purposes. Sign into your turbotax account; Get ready for tax season deadlines by completing any required tax forms today. Oid arises.

Form 1099OID Original Issue Discount Definition

Furnish copy b to each owner. Sign into your turbotax account; Open or continue your return and then search for this exact. When they pay at least $10 of reportable oid to someone when they withheld and paid. To help brokers and other middlemen identify publicly offered original issue discount (oid) debt instruments they may hold as nominees for the.

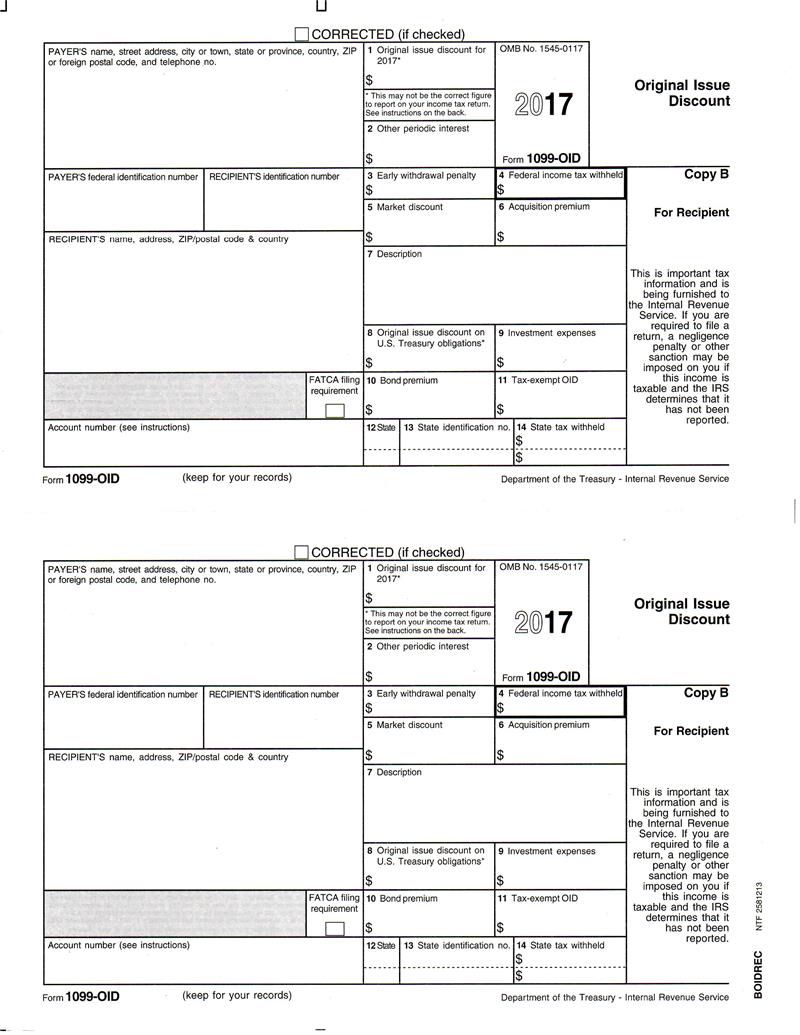

Form 1099OID, Original Issue Discount, Recipient Copy B

Web original issue discount (oid) is the difference between the face amount of a debt instrument (typically a bond) and the price that an investor paid for the debt instrument or bond at. Furnish copy b to each owner. Get ready for tax season deadlines by completing any required tax forms today. Web introduction this publication has two purposes. Web.

IRS Form 1099OID 2019 2020 Fill out and Edit Online PDF Template

Furnish copy b to each owner. Open or continue your return and then search for this exact. Web 1 min read june 14, 2017 h&r block original issue discount (oid) is a form of interest. Web oid stands for original issue discount. It usually occurs when companies issue bonds at a price less than their.

Entering & Editing Data > Form 1099OID

Get ready for tax season deadlines by completing any required tax forms today. File copy a of the form with the irs. Web the purpose of this publication is: Oid arises when a bond is issued for a price less than its face value or principal amount. For privacy act and paperwork reduction act notice, see.

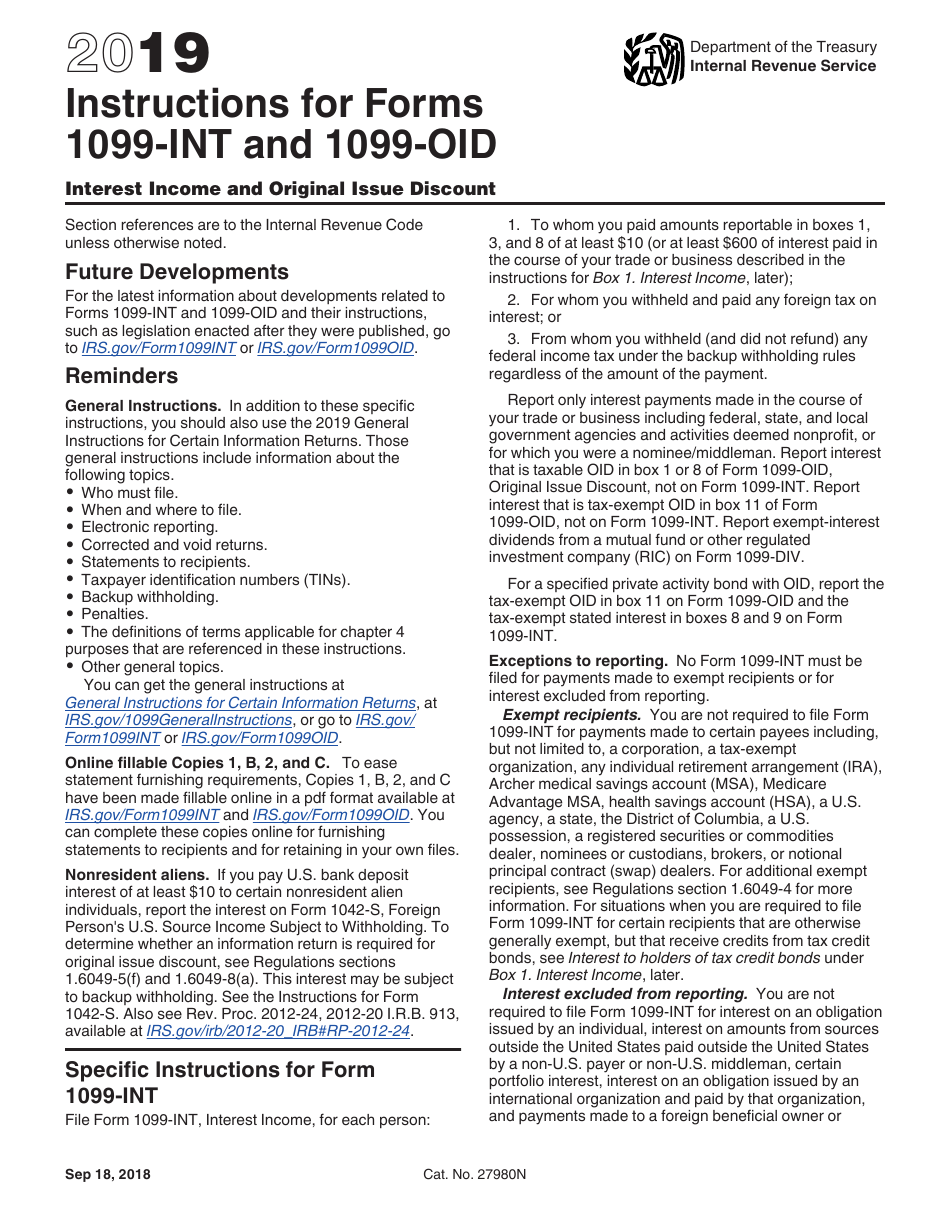

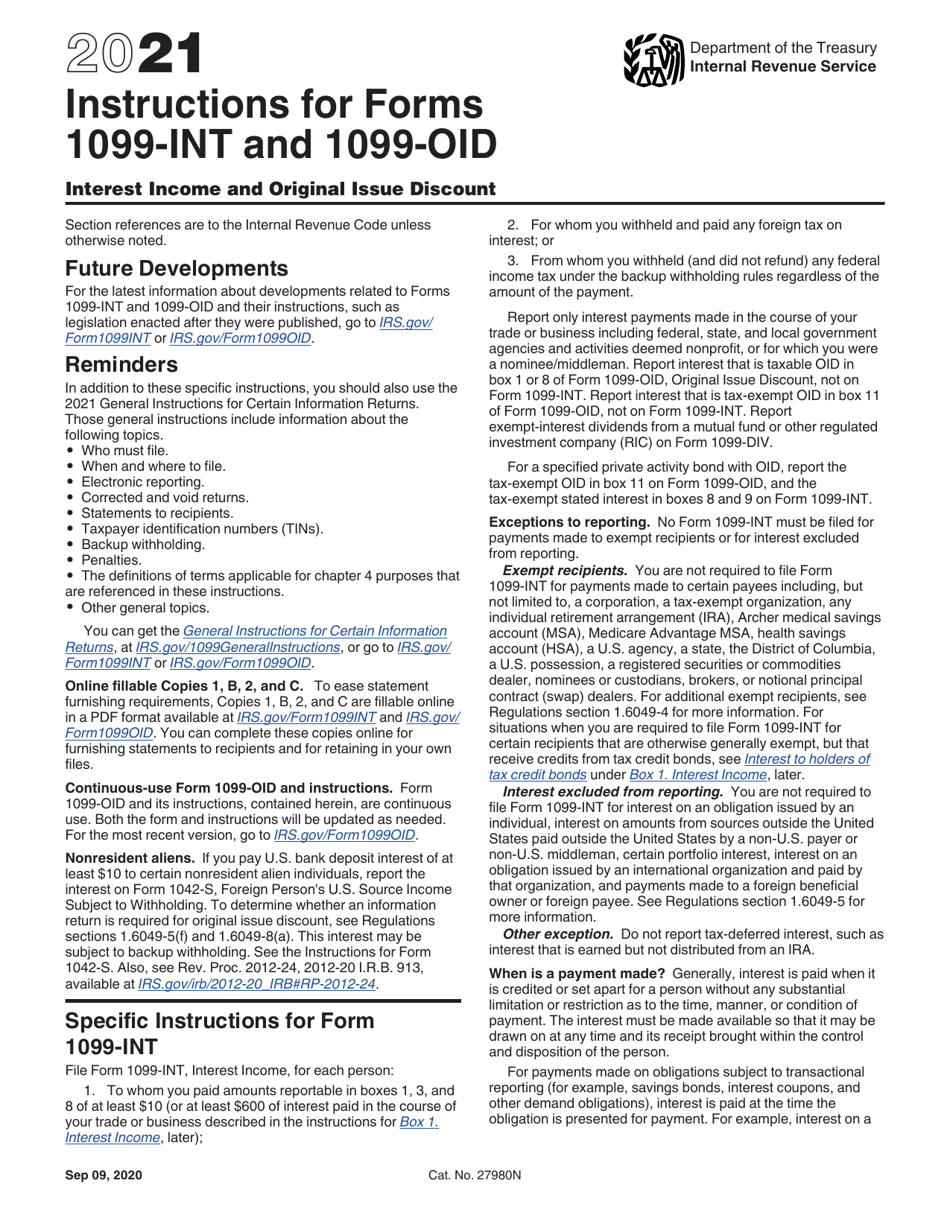

Download Instructions for IRS Form 1099INT, 1099OID Interest

Oid arises when a bond is issued for a price less than its face value or principal amount. For privacy act and paperwork reduction act notice, see. Get ready for tax season deadlines by completing any required tax forms today. Obligations $ $ copy a for internal revenue service center file with form 1096. Sign into your turbotax account;

Form 1099OID, Original Issue Discount, Recipient Copy B

File copy a of the form with the irs. Web the purpose of this publication is: When they pay at least $10 of reportable oid to someone when they withheld and paid. Obligations $ $ copy a for internal revenue service center file with form 1096. Sign into your turbotax account;

Sample 1099Oid PDF

For privacy act and paperwork reduction act notice, see. Obligations $ $ copy a for internal revenue service center file with form 1096. Web original issue discount (oid) is the difference between the face amount of a debt instrument (typically a bond) and the price that an investor paid for the debt instrument or bond at. File copy a of.

Download Instructions for IRS Form 1099INT, 1099OID PDF, 2021

Its primary purpose is to help brokers and other middlemen identify publicly offered original issue discount (oid) debt instruments. Furnish copy b to each owner. Obligations $ $ copy a for internal revenue service center file with form 1096. Web the purpose of this publication is: Web draft ok to print (init.

Its Primary Purpose Is To Help Brokers And Other Middlemen Identify Publicly Offered Original Issue Discount (Oid) Debt Instruments.

For privacy act and paperwork reduction act notice, see. Web the purpose of this publication is: To help brokers and other middlemen identify publicly offered original issue discount (oid) debt instruments they may hold as nominees for the. Obligations $ $ copy a for internal revenue service center file with form 1096.

Furnish Copy B To Each Owner.

Web 1 min read june 14, 2017 h&r block original issue discount (oid) is a form of interest. Web introduction this publication has two purposes. Web draft ok to print (init. Get ready for tax season deadlines by completing any required tax forms today.

When They Pay At Least $10 Of Reportable Oid To Someone When They Withheld And Paid.

Web original issue discount (oid) is the difference between the face amount of a debt instrument (typically a bond) and the price that an investor paid for the debt instrument or bond at. Oid arises when a bond is issued for a price less than its face value or principal amount. It usually occurs when companies issue bonds at a price less than their. Web oid stands for original issue discount.

File Copy A Of The Form With The Irs.

Open or continue your return and then search for this exact. Sign into your turbotax account;

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png)