Form 1099-R Pdf

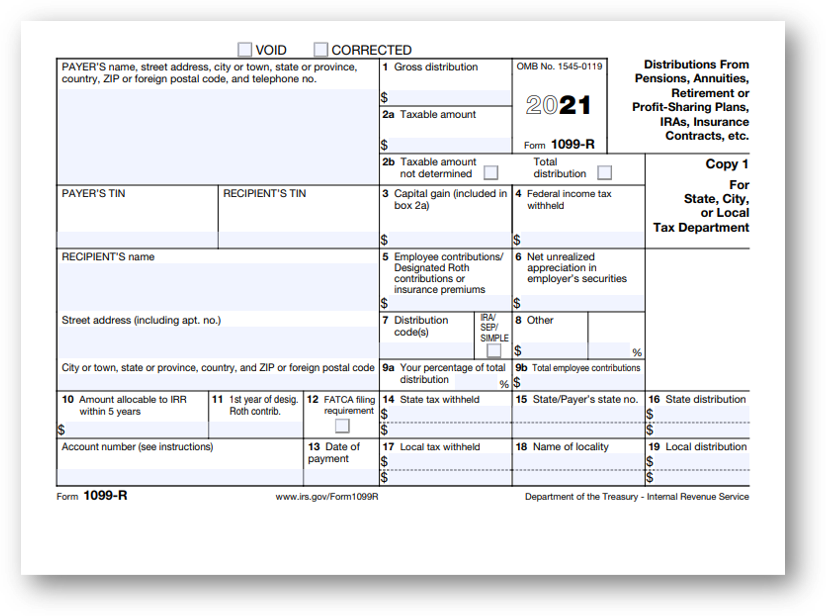

Form 1099-R Pdf - Web taxable amount may have to be determined using simplified method. If your annuity starting date is after 1997, you must use the. Web to ease statement furnishing requirements, copies b, c, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099r and irs.gov/form5498. For distributions from a traditional individual retirement arrangement (ira), simplified employee pension (sep), or savings incentive match plan for employees (simple),. Go to www.irs.gov/freefile to see. Complete, edit or print tax forms instantly. Generally, for a joint and survivor annuity, use the combined ages to calculate the taxable amount for the. This important document is used to report retirement or pension distributions. Job aid for vita/tce volunteers: Complete, edit or print tax forms instantly.

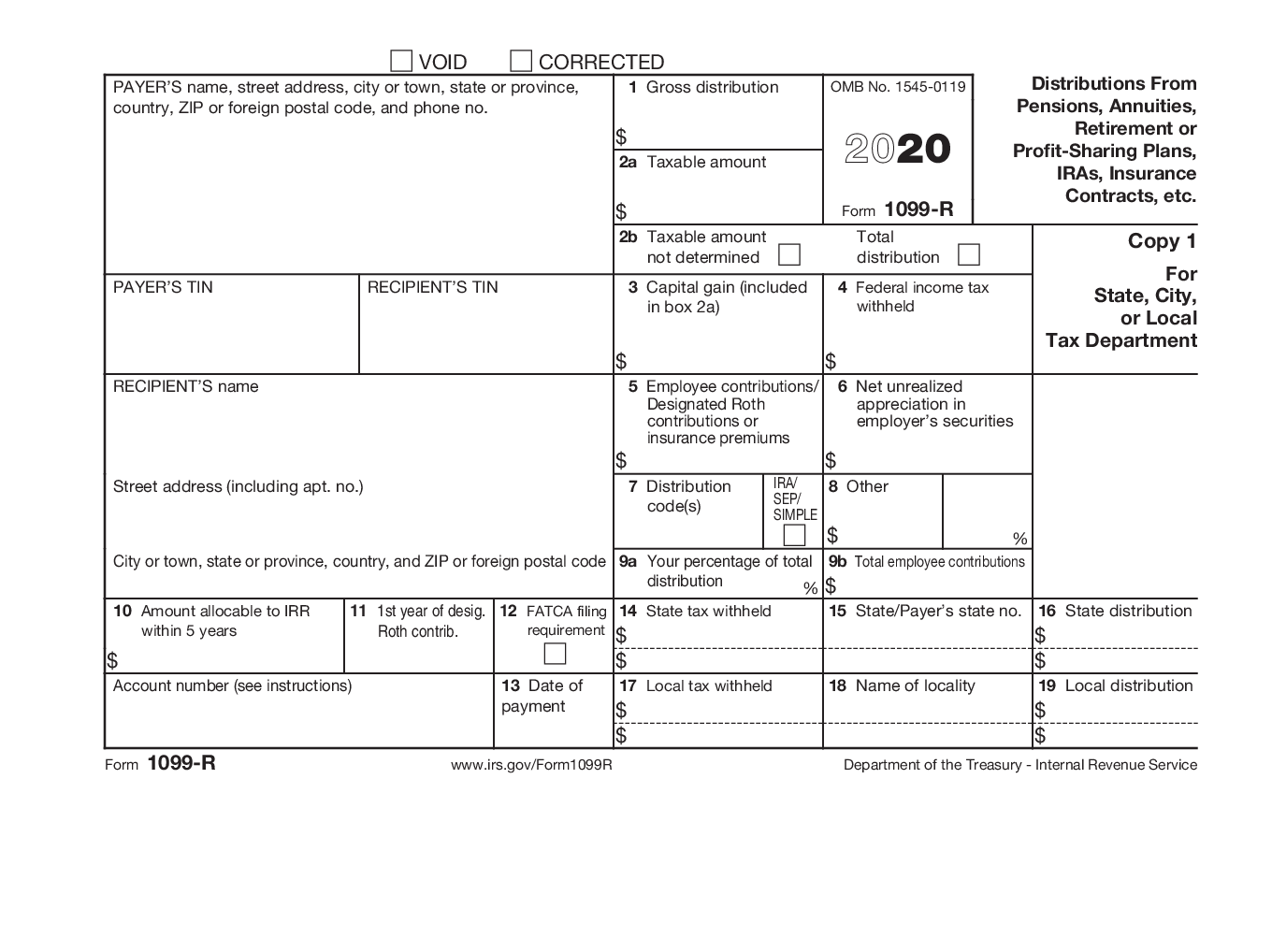

Web to ease statement furnishing requirements, copies b, c, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099r and irs.gov/form5498. Go to www.irs.gov/freefile to see. Web taxable amount may have to be determined using simplified method. A copy of the form should be included with. For distributions from a traditional individual retirement arrangement (ira), simplified employee pension (sep), or savings incentive match plan for employees (simple),. This important document is used to report retirement or pension distributions. Qualified plans and section 403(b) plans. Get ready for tax season deadlines by completing any required tax forms today. Web explained in the sample form below. Qualified plans and section 403(b) plans.

He can also find instructions on completing the. If your annuity starting date is after 1997, you must use the. Get ready for tax season deadlines by completing any required tax forms today. Web taxable amount may have to be determined using simplified method. For distributions from a traditional individual retirement arrangement (ira), simplified employee pension (sep), or savings incentive match plan for employees (simple),. Complete, edit or print tax forms instantly. Web explained in the sample form below. Go to www.irs.gov/freefile to see. Ad access irs tax forms. A copy of the form should be included with.

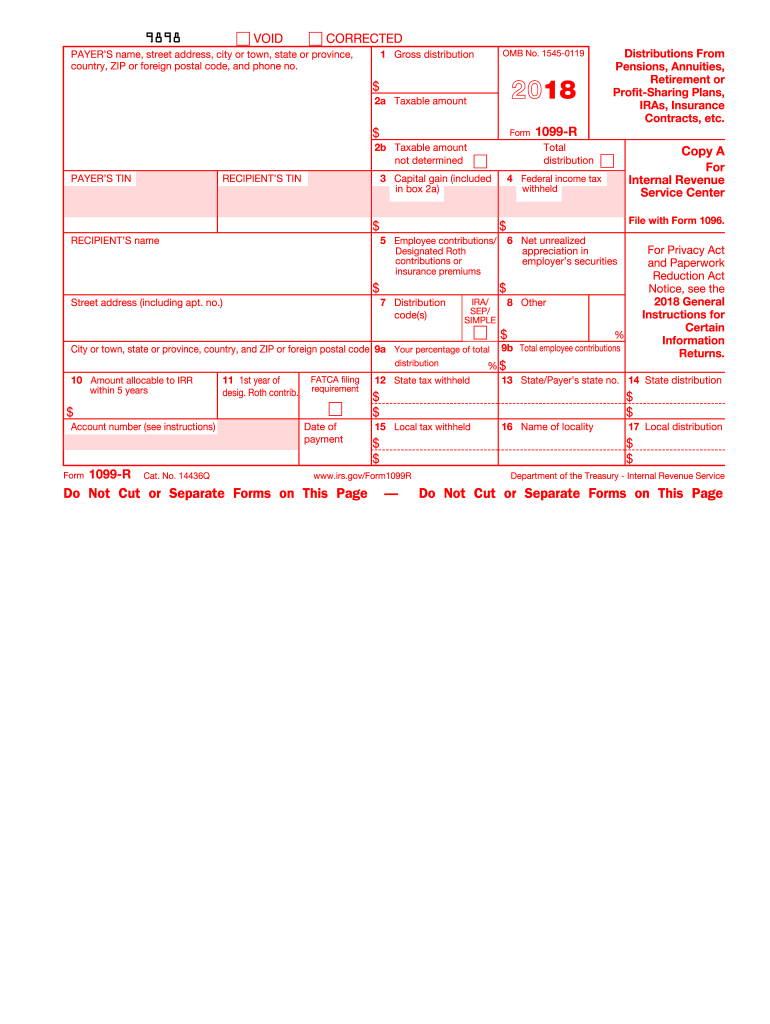

2018 Form IRS 1099R Fill Online, Printable, Fillable, Blank pdfFiller

Get ready for tax season deadlines by completing any required tax forms today. Go to www.irs.gov/freefile to see. For distributions from a traditional individual retirement arrangement (ira), simplified employee pension (sep), or savings incentive match plan for employees (simple),. This important document is used to report retirement or pension distributions. If your annuity starting date is after 1997, you must.

Seven Form 1099R Mistakes to Avoid Retirement Daily on TheStreet

Go to www.irs.gov/freefile to see. For distributions from a traditional individual retirement arrangement (ira), simplified employee pension (sep), or savings incentive match plan for employees (simple),. Qualified plans and section 403(b) plans. Qualified plans and section 403(b) plans. Relevant to irs 1099 int form 2022 printable.

1099 Form Printable 📝 Get IRS Form 1099 Printable for 2021 in PDF

Web taxable amount may have to be determined using simplified method. Web explained in the sample form below. A copy of the form should be included with. Job aid for vita/tce volunteers: Ad access irs tax forms.

How to Print and File 1099R

Web explained in the sample form below. Qualified plans and section 403(b) plans. A copy of the form should be included with. Relevant to irs 1099 int form 2022 printable. What if the taxpayer has an.

Fillable Form 1099 S Form Resume Examples v19xKBO27E

Ad access irs tax forms. Complete, edit or print tax forms instantly. Web taxable amount may have to be determined using simplified method. Railroad retirement board (rrb) and represents payments made to you in the tax. A copy of the form should be included with.

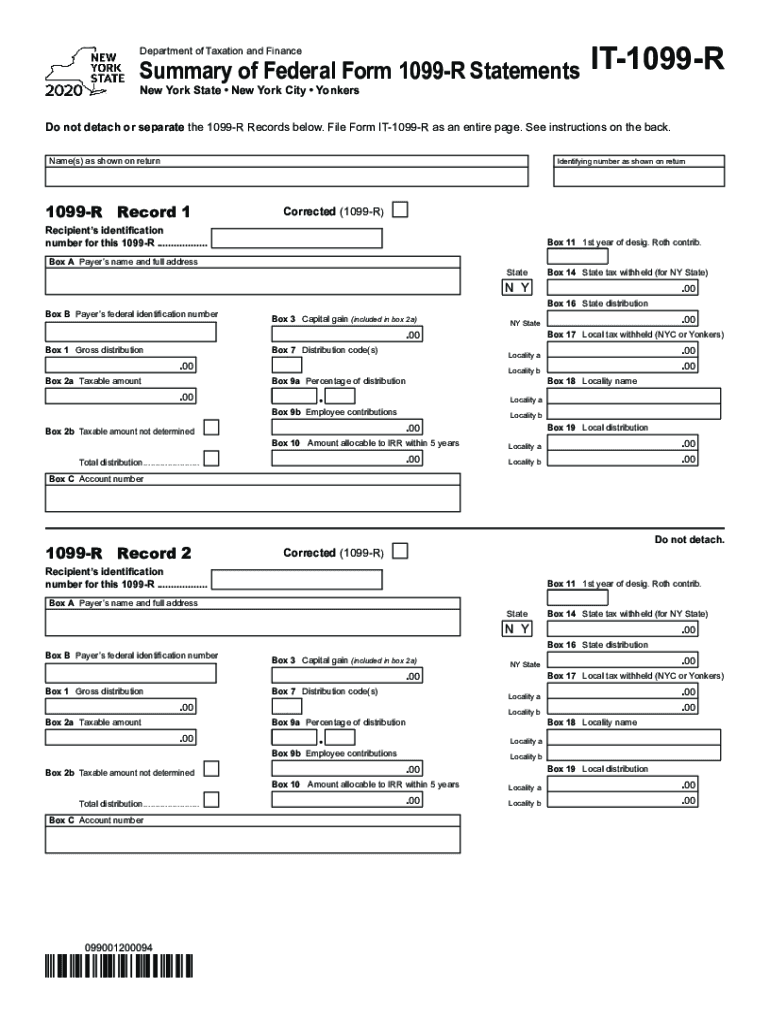

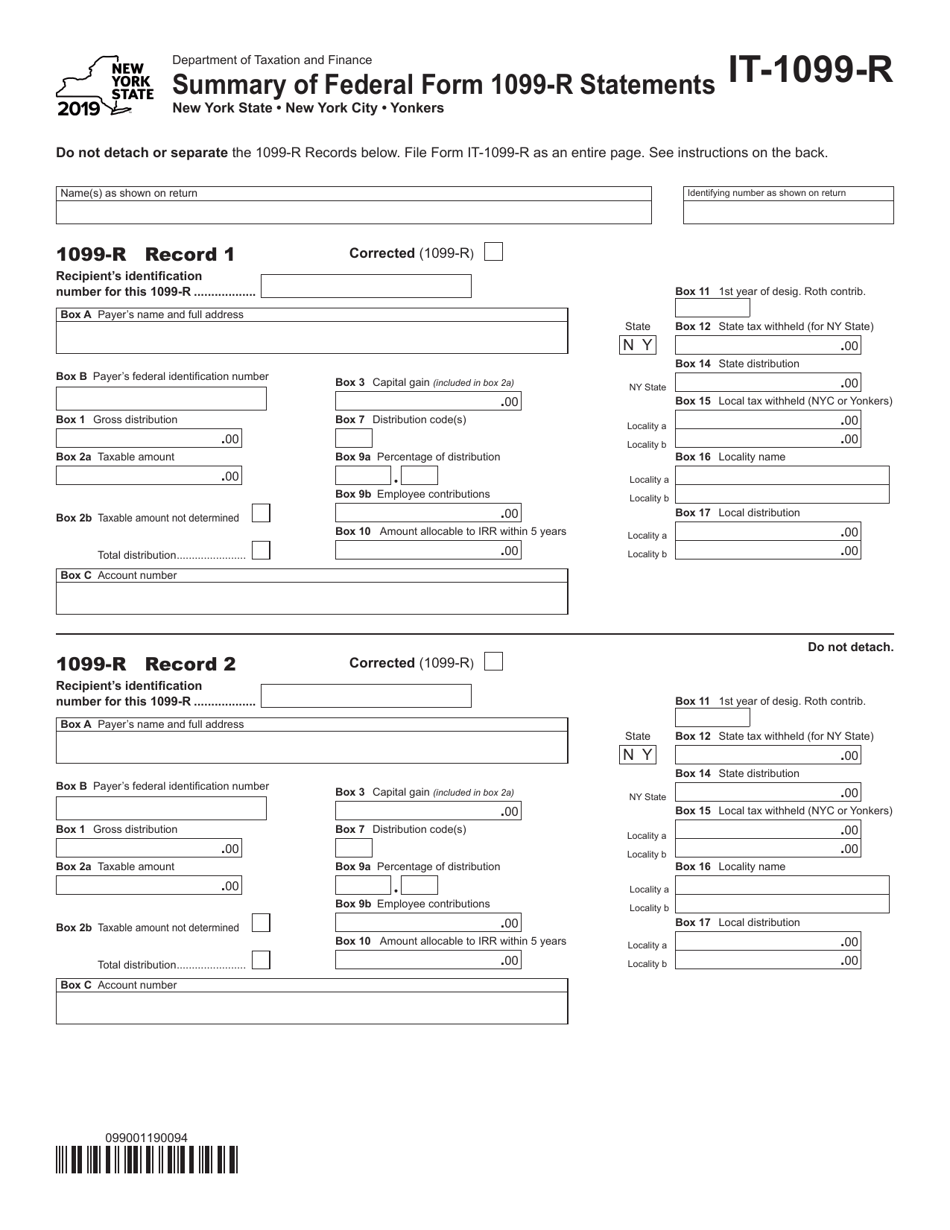

It 1099 R Fill Out and Sign Printable PDF Template signNow

Web explained in the sample form below. What if the taxpayer has an. Get ready for tax season deadlines by completing any required tax forms today. Generally, for a joint and survivor annuity, use the combined ages to calculate the taxable amount for the. Complete, edit or print tax forms instantly.

Form 1099R Distributions From Pensions, Annuities, Retirement or

If your annuity starting date is after 1997, you must use the. If your annuity starting date is after 1997, you must use the. Ad access irs tax forms. Web explained in the sample form below. Web to ease statement furnishing requirements, copies b, c, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099r.

Form IT1099R Download Printable PDF or Fill Online Summary of Federal

Qualified plans and section 403(b) plans. A copy of the form should be included with. For distributions from a traditional individual retirement arrangement (ira), simplified employee pension (sep), or savings incentive match plan for employees (simple),. Web taxable amount may have to be determined using simplified method. Railroad retirement board (rrb) and represents payments made to you in the tax.

Form 1099R

Ad access irs tax forms. Relevant to irs 1099 int form 2022 printable. Web taxable amount may have to be determined using simplified method. Qualified plans and section 403(b) plans. Get ready for tax season deadlines by completing any required tax forms today.

Tax Form Focus IRS Form 1099R » STRATA Trust Company

Generally, for a joint and survivor annuity, use the combined ages to calculate the taxable amount for the. Relevant to irs 1099 int form 2022 printable. Web taxable amount may have to be determined using simplified method. For distributions from a traditional individual retirement arrangement (ira), simplified employee pension (sep), or savings incentive match plan for employees (simple),. If your.

Qualified Plans And Section 403(B) Plans.

He can also find instructions on completing the. If your annuity starting date is after 1997, you must use the. Web to ease statement furnishing requirements, copies b, c, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099r and irs.gov/form5498. If your annuity starting date is after 1997, you must use the.

Job Aid For Vita/Tce Volunteers:

Qualified plans and section 403(b) plans. Complete, edit or print tax forms instantly. Railroad retirement board (rrb) and represents payments made to you in the tax. A copy of the form should be included with.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Go to www.irs.gov/freefile to see. Web explained in the sample form below. Generally, for a joint and survivor annuity, use the combined ages to calculate the taxable amount for the. Web taxable amount may have to be determined using simplified method.

This Important Document Is Used To Report Retirement Or Pension Distributions.

For distributions from a traditional individual retirement arrangement (ira), simplified employee pension (sep), or savings incentive match plan for employees (simple),. Relevant to irs 1099 int form 2022 printable. Complete, edit or print tax forms instantly. What if the taxpayer has an.