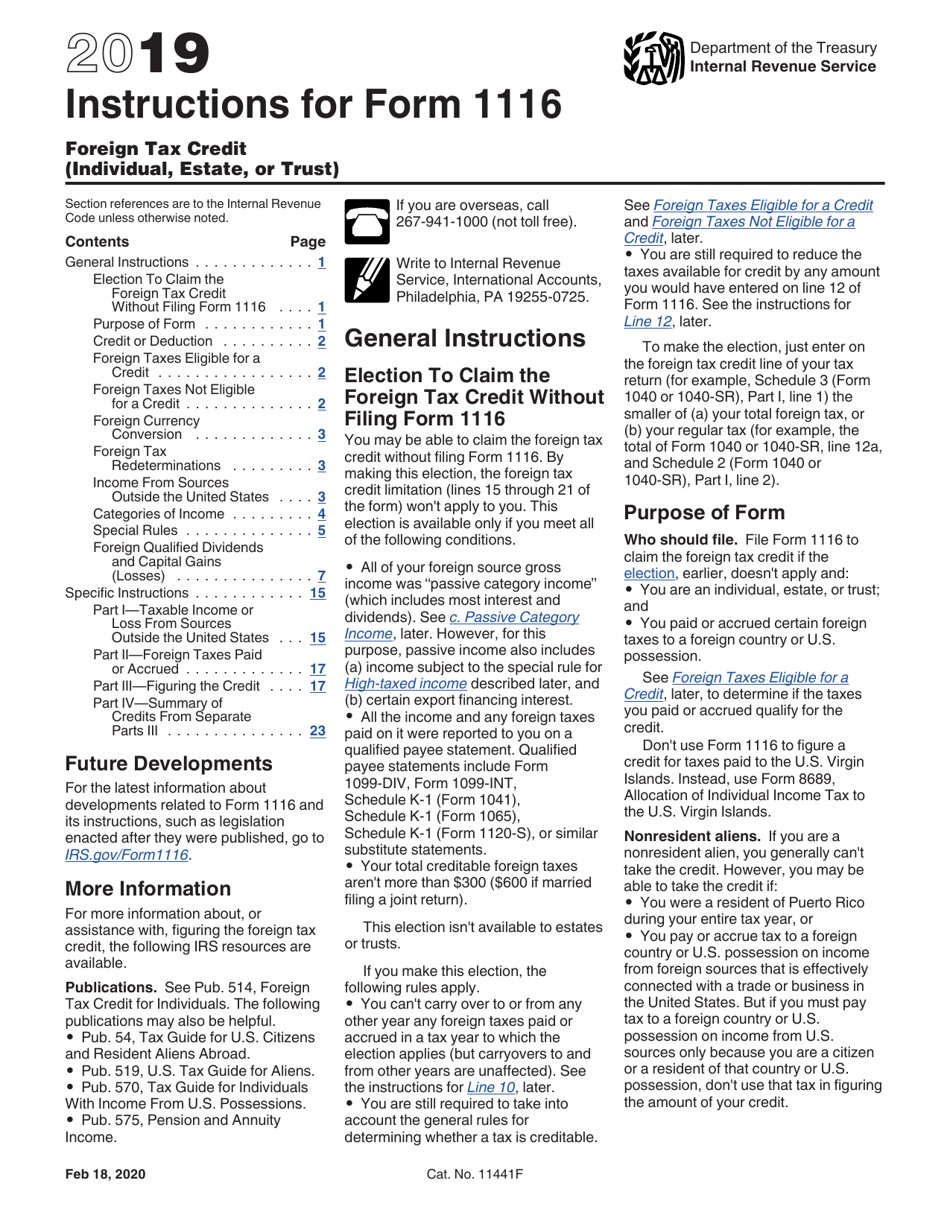

Form 1116 Instructions

Form 1116 Instructions - Go to www.irs.gov/form1116 for instructions and the latest information. As shown on page 1 of your tax return. See schedule c (form 1116) and its instructions, and foreign tax redeterminations, later, for more information. This requires filing an amended tax return for the prior year, and you might need to file form 1116 to be eligible for the credit. All form 1116 filers must choose how they regard their income: Taxpayers are therefore reporting running balances of their foreign tax carryovers showing all activity since the filing of their prior year income tax return. If you have only one type of foreign income, you complete just one form 1116. In a nutshell, the high tax passive income on page one, line 1a is backed out of the passive category form 1116 as a negative and then added to the general category form 1116 line 1a of the relevant column and then htko should be notated on our form, the. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web use schedule c (form 1116) to report foreign tax redeterminations that occurred in the current tax year and that relate to prior tax years.

A credit for foreign taxes can be claimed only for foreign tax imposed by a foreign country or u.s. Web overview of form 1116. All form 1116 filers must choose how they regard their income: Web the form 1116 instructions provide the mechanics of how the reclassification is done. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. On an accrual basis or a cash basis. What’s new line 1 of schedule b has been revised to instruct filers to enter the amounts from the appropriate columns of line 8 of the prior year schedule b. Web filing form 1116 must be referred to a volunteer with an international certification or a professional tax preparer. Go to www.irs.gov/form1116 for instructions and the latest information. If you record income when you earn it rather than when you get paid, you use the accrual method.

The “caution” at the top of the line 1 reconciliation If you record income when you earn it rather than when you get paid, you use the accrual method. As shown on page 1 of your tax return. If you have only one type of foreign income, you complete just one form 1116. Web you can use the $100 of unused foreign tax credits to reduce your tax bill on the prior and subsequent returns, leaving $25 of excess limit to be used in the future. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web filing form 1116 must be referred to a volunteer with an international certification or a professional tax preparer. What’s new line 1 of schedule b has been revised to instruct filers to enter the amounts from the appropriate columns of line 8 of the prior year schedule b. (form 1065) refers to the instructions to forms 1116 and 1118 for exceptions from the requirement to report gross income and taxes by foreign country or u.s. A credit for foreign taxes can be claimed only for foreign tax imposed by a foreign country or u.s.

Are capital loss deductions included on Form 1116 for Deductions and

(form 1065) refers to the instructions to forms 1116 and 1118 for exceptions from the requirement to report gross income and taxes by foreign country or u.s. Taxpayers are therefore reporting running balances of their foreign tax carryovers showing all activity since the filing of their prior year income tax return. See schedule c (form 1116) and its instructions, and.

Download Instructions for IRS Form 1116 Foreign Tax Credit (Individual

Additional information can be found in the form 1040 instructions, form 1116 instructions and publication 514. Go to www.irs.gov/form1116 for instructions and the latest information. Web you can use the $100 of unused foreign tax credits to reduce your tax bill on the prior and subsequent returns, leaving $25 of excess limit to be used in the future. Web schedule.

해외금융계좌 신고 5 Form 1116 Foreign Tax Credit Sample

Web the form 1116 instructions provide the mechanics of how the reclassification is done. Web schedule b (form 1116) and its instructions, such as legislation enacted after they were published, go to irs.gov/form1116. Web filing form 1116 must be referred to a volunteer with an international certification or a professional tax preparer. Web overview of form 1116. (form 1065) refers.

Form 1116 part 1 instructions

In a nutshell, the high tax passive income on page one, line 1a is backed out of the passive category form 1116 as a negative and then added to the general category form 1116 line 1a of the relevant column and then htko should be notated on our form, the. (form 1065) refers to the instructions to forms 1116 and.

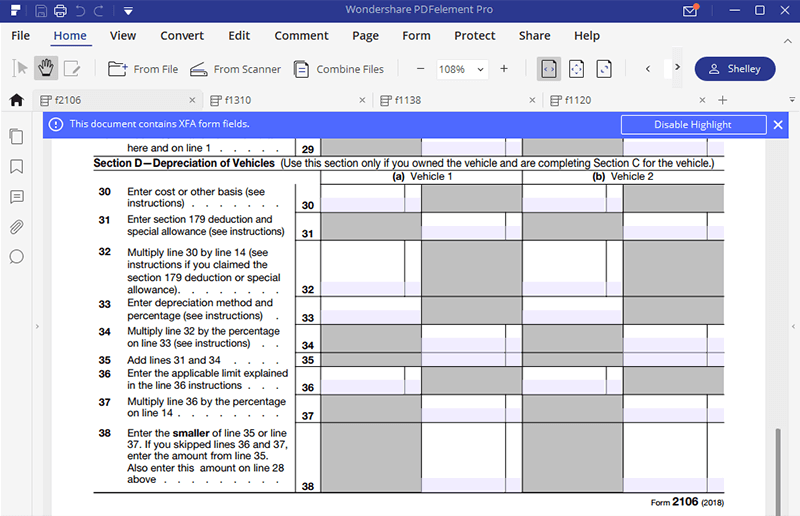

Breanna Form 2106 Instructions 2016

All form 1116 filers must choose how they regard their income: Web use schedule c (form 1116) to report foreign tax redeterminations that occurred in the current tax year and that relate to prior tax years. See schedule c (form 1116) and its instructions, and foreign tax redeterminations, later, for more information. Web filing form 1116 must be referred to.

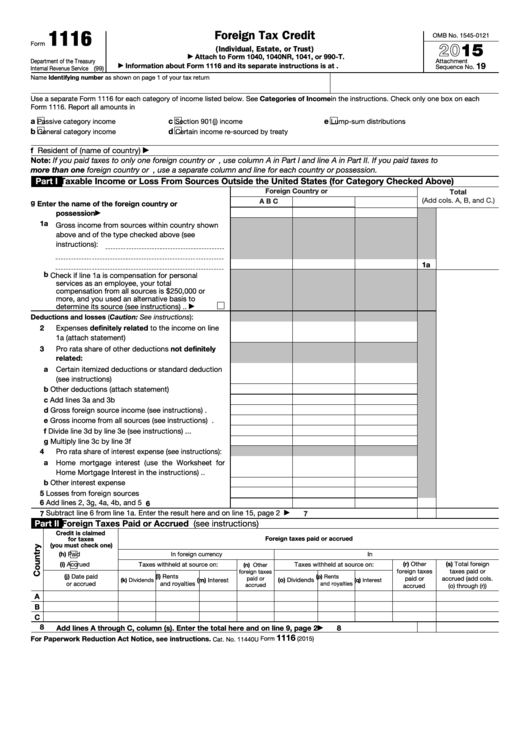

Form 1116Foreign Tax Credit

In a nutshell, the high tax passive income on page one, line 1a is backed out of the passive category form 1116 as a negative and then added to the general category form 1116 line 1a of the relevant column and then htko should be notated on our form, the. All form 1116 filers must choose how they regard their.

Form 1116 part 1 instructions

Web schedule b (form 1116) and its instructions, such as legislation enacted after they were published, go to irs.gov/form1116. Go to www.irs.gov/form1116 for instructions and the latest information. See schedule c (form 1116) and its instructions, and foreign tax redeterminations, later, for more information. Web use form 1116 to claim the foreign tax credit (ftc) and deduct the taxes you.

Form IT112C (Fillin) New York State Resident Credit for Taxes Paid

On an accrual basis or a cash basis. Go to www.irs.gov/form1116 for instructions and the latest information. If you have only one type of foreign income, you complete just one form 1116. (form 1065) refers to the instructions to forms 1116 and 1118 for exceptions from the requirement to report gross income and taxes by foreign country or u.s. Web.

Fillable Form 1116 Foreign Tax Credit printable pdf download

As shown on page 1 of your tax return. (form 1065) refers to the instructions to forms 1116 and 1118 for exceptions from the requirement to report gross income and taxes by foreign country or u.s. Use a separate form 1116 for each category of income listed below. A credit for foreign taxes can be claimed only for foreign tax.

Form 1116 Instructions 2021 2022 IRS Forms Zrivo

Use a separate form 1116 for each category of income listed below. The “caution” at the top of the line 1 reconciliation As shown on page 1 of your tax return. What’s new line 1 of schedule b has been revised to instruct filers to enter the amounts from the appropriate columns of line 8 of the prior year schedule.

See Schedule C (Form 1116) And Its Instructions, And Foreign Tax Redeterminations, Later, For More Information.

Web overview of form 1116. All form 1116 filers must choose how they regard their income: Web use form 1116 to claim the foreign tax credit (ftc) and deduct the taxes you paid to another country from what you owe to the irs. On an accrual basis or a cash basis.

If You Have Only One Type Of Foreign Income, You Complete Just One Form 1116.

In a nutshell, the high tax passive income on page one, line 1a is backed out of the passive category form 1116 as a negative and then added to the general category form 1116 line 1a of the relevant column and then htko should be notated on our form, the. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Go to www.irs.gov/form1116 for instructions and the latest information. What’s new line 1 of schedule b has been revised to instruct filers to enter the amounts from the appropriate columns of line 8 of the prior year schedule b.

This Requires Filing An Amended Tax Return For The Prior Year, And You Might Need To File Form 1116 To Be Eligible For The Credit.

A credit for foreign taxes can be claimed only for foreign tax imposed by a foreign country or u.s. (form 1065) refers to the instructions to forms 1116 and 1118 for exceptions from the requirement to report gross income and taxes by foreign country or u.s. Web you can use the $100 of unused foreign tax credits to reduce your tax bill on the prior and subsequent returns, leaving $25 of excess limit to be used in the future. Web filing form 1116 must be referred to a volunteer with an international certification or a professional tax preparer.

Use A Separate Form 1116 For Each Category Of Income Listed Below.

Web schedule b (form 1116) and its instructions, such as legislation enacted after they were published, go to irs.gov/form1116. As shown on page 1 of your tax return. Web the form 1116 instructions provide the mechanics of how the reclassification is done. Web use schedule c (form 1116) to report foreign tax redeterminations that occurred in the current tax year and that relate to prior tax years.