Form 1116 Schedule B

Form 1116 Schedule B - 75186f schedule b (form 1116) (rev. Web entering income for the foreign tax credit form 1116; Web starting with tax year 2021, the irs has expanded form 1116 to include a schedule b. Schedule b now standardizes what should go on line 10, both the carryover and carryback have been useful in taxes due to the limitation. Web use schedule b (form 1116) to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web summary form 1116 when you invest in these mutual funds and/or etfs in a regular taxable brokerage account, your broker will report to you the total foreign taxes you paid through all your funds and/or etfs. The irs allows a tax credit for the taxes you paid indirectly to foreign countries. Starting in tax year 2021, the irs released a new schedule b for form 1116 to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Check only one box on each schedule.check the box for the same separate category code as that shown on the form 1116 to which this schedule b is attached. Taxpayers are therefore reporting running balances of their foreign tax carryovers showing all activity since the filing of their prior year income tax return.lines 1 through 3.

Web first, the schedule b; Prior to 2021, taxpayers were instructed to attach a detailed computation on line 10 of the form 1116. Taxpayers are therefore reporting running balances of their foreign tax carryovers showing all activity since the filing of their prior year income tax return. 75186f schedule b (form 1116) (rev. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web entering income for the foreign tax credit form 1116; Schedule b now standardizes what should go on line 10, both the carryover and carryback have been useful in taxes due to the limitation. Web starting with tax year 2021, the irs has expanded form 1116 to include a schedule b. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. See schedule b (form 1116) and its instructions, and the instructions for line 10, later, for more information.

The irs allows a tax credit for the taxes you paid indirectly to foreign countries. See schedule b (form 1116) and its instructions, and the instructions for line 10, later, for more information. This new schedule is used to reconcile [the taxpayer's] prior year foreign tax carryover with [their] current year foreign tax carryover. a new screen has been added to drake21 to allow the schedule to be generated. Prior to 2021, taxpayers were instructed to attach a detailed computation on line 10 of the form 1116. Check only one box on each schedule.check the box for the same separate category code as that shown on the form 1116 to which this schedule b is attached. Web first, the schedule b; Web form 1116 schedule b i am getting a message from turbotax that form 1116 schedule b is not available but it will be available in a future release. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web use a separate schedule b (form 1116) for each applicable category of income listed below. 75186f schedule b (form 1116) (rev.

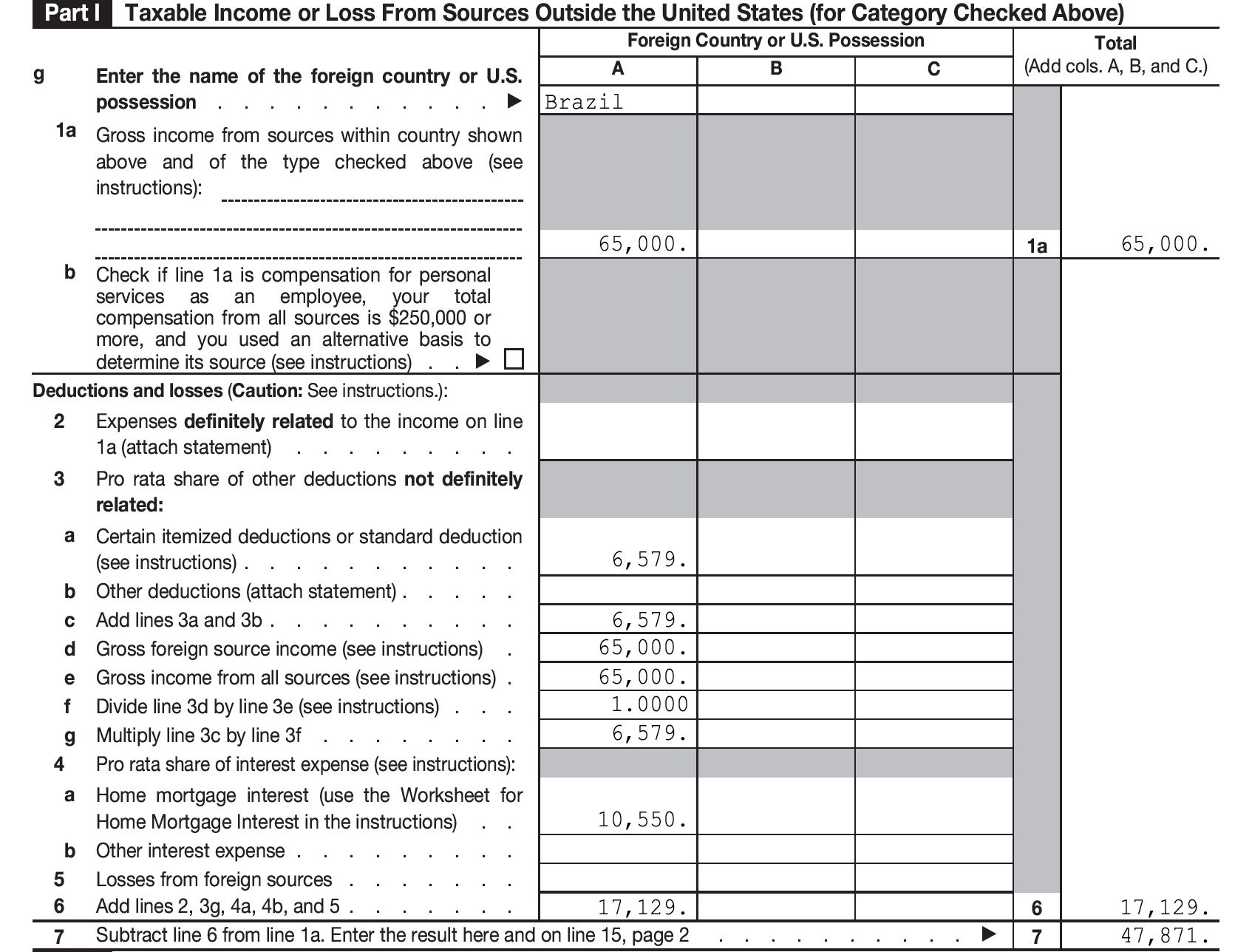

Form 1116 part 1 instructions

Web starting with tax year 2021, the irs has expanded form 1116 to include a schedule b. Web summary form 1116 when you invest in these mutual funds and/or etfs in a regular taxable brokerage account, your broker will report to you the total foreign taxes you paid through all your funds and/or etfs. Prior to 2021, taxpayers were instructed.

Casual What Is Form 1116 Explanation Statement? Proprietor Capital

Web first, the schedule b; Web starting with tax year 2021, the irs has expanded form 1116 to include a schedule b. Web use a separate schedule b (form 1116) for each applicable category of income listed below. Web summary form 1116 when you invest in these mutual funds and/or etfs in a regular taxable brokerage account, your broker will.

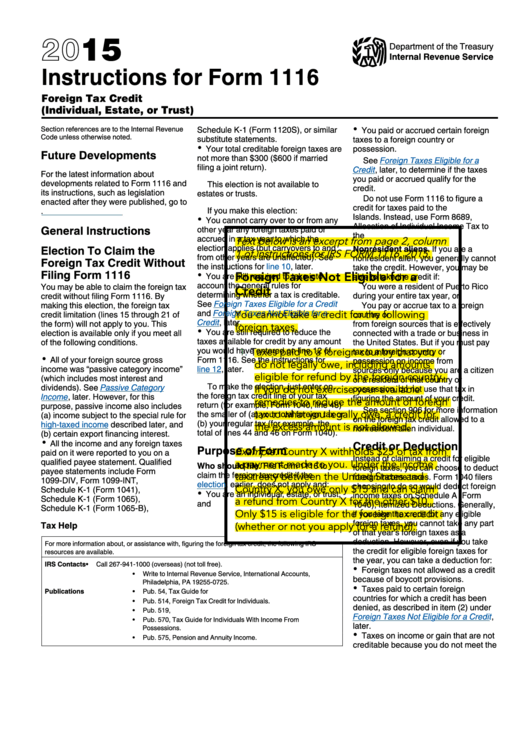

2015 Instructions For Form 1116 printable pdf download

Web form 1116 schedule b i am getting a message from turbotax that form 1116 schedule b is not available but it will be available in a future release. Taxpayers are therefore reporting running balances of their foreign tax carryovers showing all activity since the filing of their prior year income tax return. Web schedule b (form 1116) is used.

U.S. Expatriates Can Claim Foreign Tax Credit Filing Form 1116

Taxpayers are therefore reporting running balances of their foreign tax carryovers showing all activity since the filing of their prior year income tax return.lines 1 through 3. Check only one box on each schedule.check the box for the same separate category code as that shown on the form 1116 to which this schedule b is attached. Web use a separate.

Casual What Is Form 1116 Explanation Statement? Proprietor Capital

Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Taxpayers are therefore reporting running balances of their foreign tax carryovers showing all activity since the filing of their prior year income tax return. Check only one box on each schedule.check the box for the same separate category.

form 1120 schedule b instructions 2017 Fill Online, Printable

Web entering income for the foreign tax credit form 1116; 75186f schedule b (form 1116) (rev. Web use a separate schedule b (form 1116) for each applicable category of income listed below. Taxpayers are therefore reporting running balances of their foreign tax carryovers showing all activity since the filing of their prior year income tax return.lines 1 through 3. Web.

tax credit survey questions Windy Kuhn

See schedule b (form 1116) and its instructions, and the instructions for line 10, later, for more information. The irs allows a tax credit for the taxes you paid indirectly to foreign countries. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web form 1116 schedule b.

This will require Form 1116, Schedule B, which will be available in a

Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Generating the schedule b for form 1116 in proseries starting in 2021: The irs allows a tax credit for the taxes you paid indirectly to foreign countries. Web summary form 1116 when you invest in these mutual funds.

2012 Schedule C Fill Online, Printable, Fillable, Blank PDFfiller

Web use a separate schedule b (form 1116) for each applicable category of income listed below. Web entering income for the foreign tax credit form 1116; The irs allows a tax credit for the taxes you paid indirectly to foreign countries. Prior to 2021, taxpayers were instructed to attach a detailed computation on line 10 of the form 1116. Web.

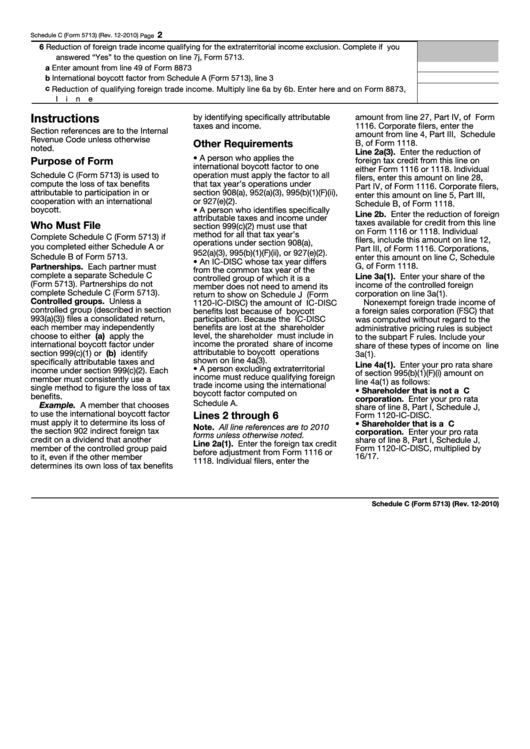

Instructions For Schedule C (Form 5713) Tax Effect Of The

Web starting with tax year 2021, the irs has expanded form 1116 to include a schedule b. This new schedule is used to reconcile [the taxpayer's] prior year foreign tax carryover with [their] current year foreign tax carryover. a new screen has been added to drake21 to allow the schedule to be generated. Web entering income for the foreign tax.

Check Only One Box On Each Schedule.check The Box For The Same Separate Category Code As That Shown On The Form 1116 To Which This Schedule B Is Attached.

Web entering income for the foreign tax credit form 1116; Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web form 1116 schedule b i am getting a message from turbotax that form 1116 schedule b is not available but it will be available in a future release. Taxpayers are therefore reporting running balances of their foreign tax carryovers showing all activity since the filing of their prior year income tax return.lines 1 through 3.

Taxpayers Are Therefore Reporting Running Balances Of Their Foreign Tax Carryovers Showing All Activity Since The Filing Of Their Prior Year Income Tax Return.

This new schedule is used to reconcile [the taxpayer's] prior year foreign tax carryover with [their] current year foreign tax carryover. a new screen has been added to drake21 to allow the schedule to be generated. Web starting with tax year 2021, the irs has expanded form 1116 to include a schedule b. Generating the schedule b for form 1116 in proseries starting in 2021: Check only one box on each schedule.check the box for the same separate category code as that shown on the form 1116 to which this schedule b is attached.

Web Summary Form 1116 When You Invest In These Mutual Funds And/Or Etfs In A Regular Taxable Brokerage Account, Your Broker Will Report To You The Total Foreign Taxes You Paid Through All Your Funds And/Or Etfs.

Web use a separate schedule b (form 1116) for each applicable category of income listed below. Web first, the schedule b; Prior to 2021, taxpayers were instructed to attach a detailed computation on line 10 of the form 1116. Starting in tax year 2021, the irs released a new schedule b for form 1116 to reconcile your prior year foreign tax carryover with your current year foreign tax carryover.

Schedule B Now Standardizes What Should Go On Line 10, Both The Carryover And Carryback Have Been Useful In Taxes Due To The Limitation.

The irs allows a tax credit for the taxes you paid indirectly to foreign countries. Web use schedule b (form 1116) to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. See schedule b (form 1116) and its instructions, and the instructions for line 10, later, for more information. 75186f schedule b (form 1116) (rev.