Form 1122 Instructions

Form 1122 Instructions - Inventory of estate of estate no. Inventory supporting schedule (268kb) 11/09: Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for. Select the sample you need in our collection of templates. If the applicant identifies as being a new producer or has increased their operation size between the benchmark year and. Web follow these simple instructions to get form 1122 instructions prepared for submitting: Web instructions for the subsidiary corporation. This form is submitted to fsa by lenders after the lender has. Form 8822 is a change of address form. Web lenders use this form to apply for an fsa loan guarantee.

Web lenders use this form to apply for an fsa loan guarantee. Complete and submit an original, signed form 1122 to the common parent corporation of the consolidated group for the first tax. To be eligible for payments,. Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for. Form 8822 is a change of address form. Loan applicants should not submit this form to fsa. Web instructions for the subsidiary corporation. If the applicant identifies as being a new producer or has increased their operation size between the benchmark year and. If this message is not eventually replaced by the proper contents of the document, your pdf viewer may not be able to display this type of document. A form that one files with the irs to include a subsidiary on its parent company's tax return.

Select the sample you need in our collection of templates. Web what is form 8822? Complete and submit an original, signed form 1122 to the common parent corporation of the consolidated group for the first tax. For level 2 eauthenicated users. Open the template in our. Inventory of estate of estate no. Web lenders use this form to apply for an fsa loan guarantee. After moving into a new residence, you can use form 8822 to inform the internal revenue service (irs) of your. This form is submitted to fsa by lenders after the lender has. A form that one files with the irs to include a subsidiary on its parent company's tax return.

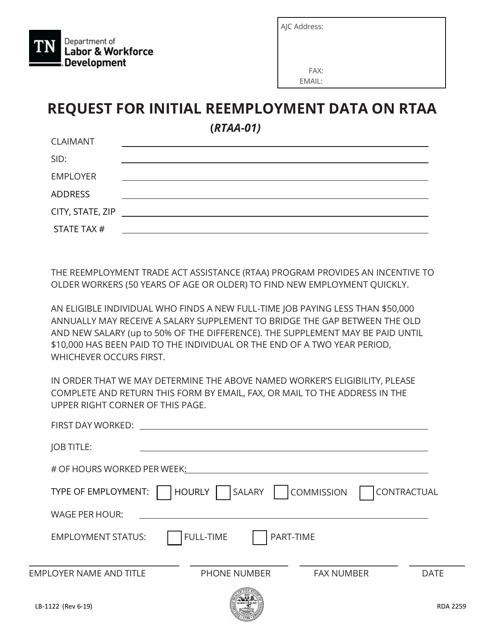

Form LB1122 Download Fillable PDF or Fill Online Request for Initial

Web what is form 8822? After moving into a new residence, you can use form 8822 to inform the internal revenue service (irs) of your. Form 8822 is a change of address form. Web follow these simple instructions to get form 1122 instructions prepared for submitting: Web a corporation that held a qualified investment in an advanced manufacturing facility that.

NTS Rescue 1122 Jobs 2016 Application Form Apply Last Date

This form is submitted to fsa by lenders after the lender has. Inventory of estate of estate no. Select the sample you need in our collection of templates. Total verification of appraiser other than personal. Loan applicants should not submit this form to fsa.

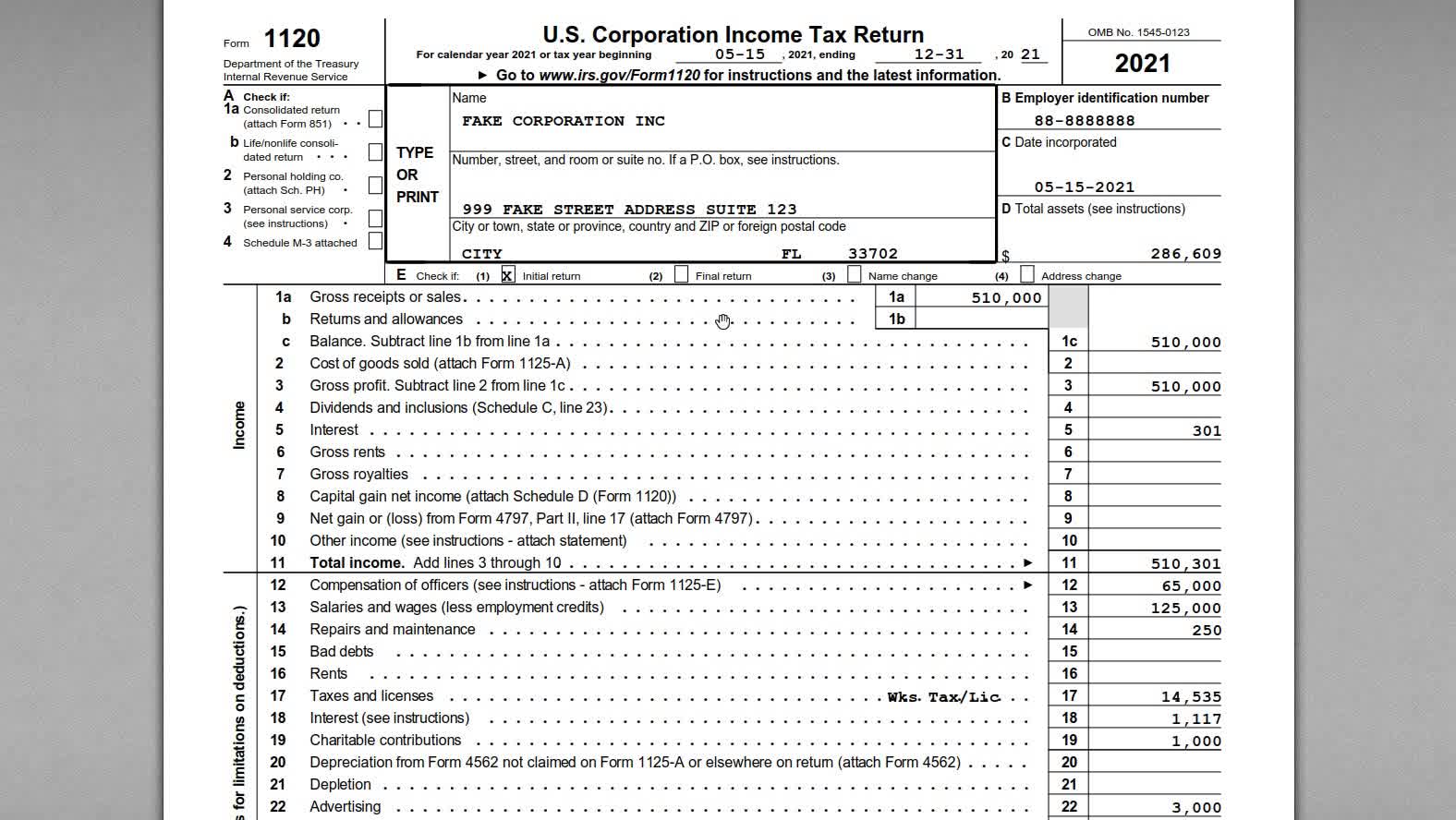

How to Fill Out Form 1120 for 2021. StepbyStep Instructions

Web instructions for the subsidiary corporation. Select the sample you need in our collection of templates. Total verification of appraiser other than personal. After moving into a new residence, you can use form 8822 to inform the internal revenue service (irs) of your. Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in.

form 1122 instructions Fill Online, Printable, Fillable Blank form

Inventory summary and supporting schedule (328kb) 01/16: Open the template in our. Complete and submit an original, signed form 1122 to the common parent corporation of the consolidated group for the first tax. Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the.

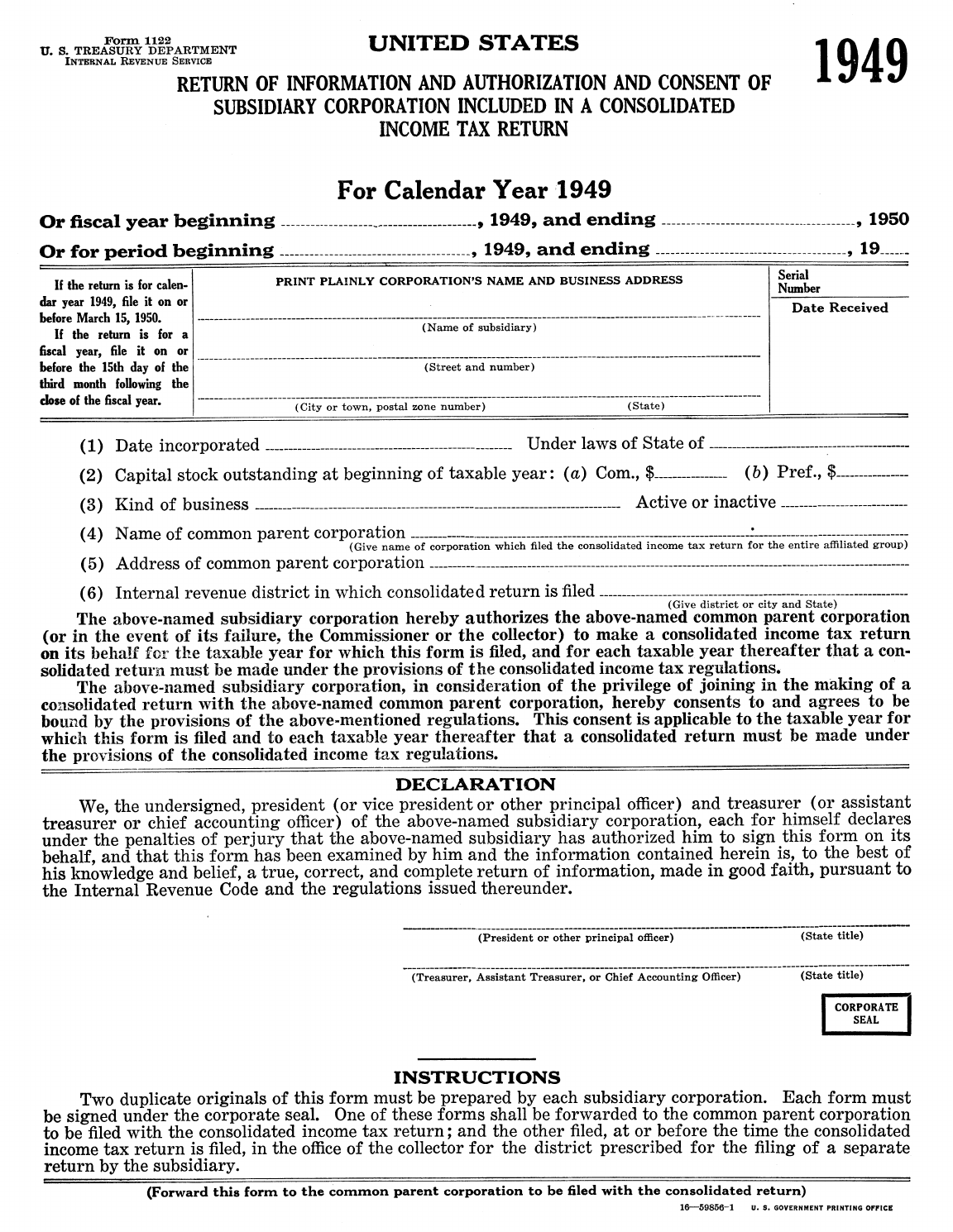

1949 Form 1122 Edit, Fill, Sign Online Handypdf

Select the sample you need in our collection of templates. Total verification of appraiser other than personal. Web lenders use this form to apply for an fsa loan guarantee. This form is submitted to fsa by lenders after the lender has. If this message is not eventually replaced by the proper contents of the document, your pdf viewer may not.

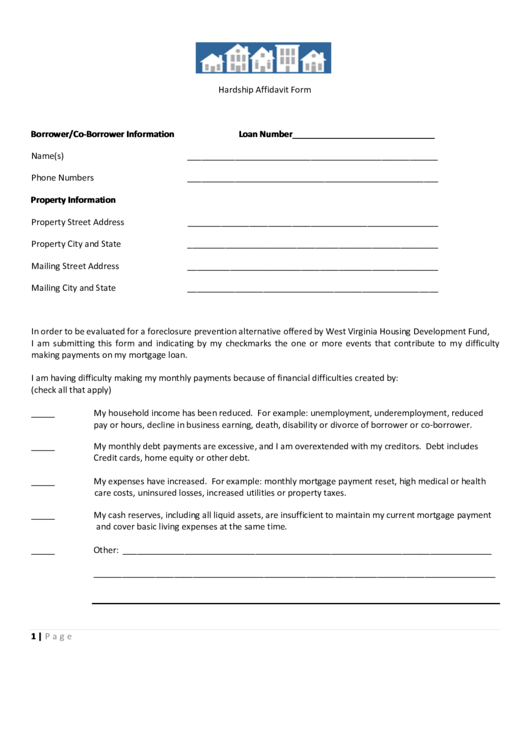

Hardship Affidavit Form 1122

Complete and submit an original, signed form 1122 to the common parent corporation of the consolidated group for the first tax. Web what is form 8822? Web lenders use this form to apply for an fsa loan guarantee. After moving into a new residence, you can use form 8822 to inform the internal revenue service (irs) of your. Web we.

How to Complete IRS Form 1122 Filing Consolidated Form 1120 Tax

After moving into a new residence, you can use form 8822 to inform the internal revenue service (irs) of your. This form is submitted to fsa by lenders after the lender has. Open the template in our. Form 8822 is a change of address form. If the applicant identifies as being a new producer or has increased their operation size.

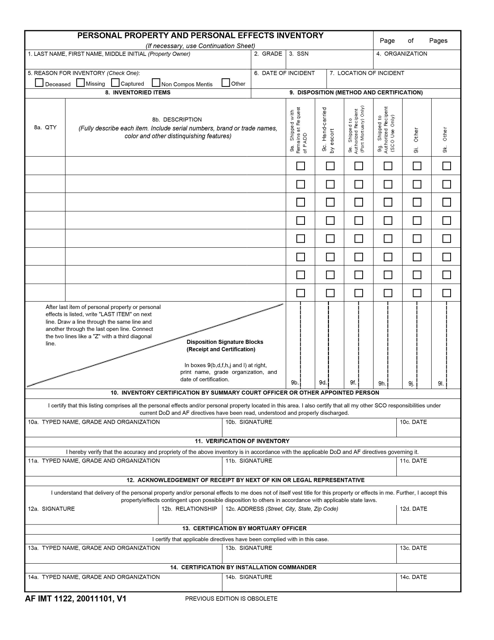

AF IMT Form 1122 Download Fillable PDF or Fill Online Personal Property

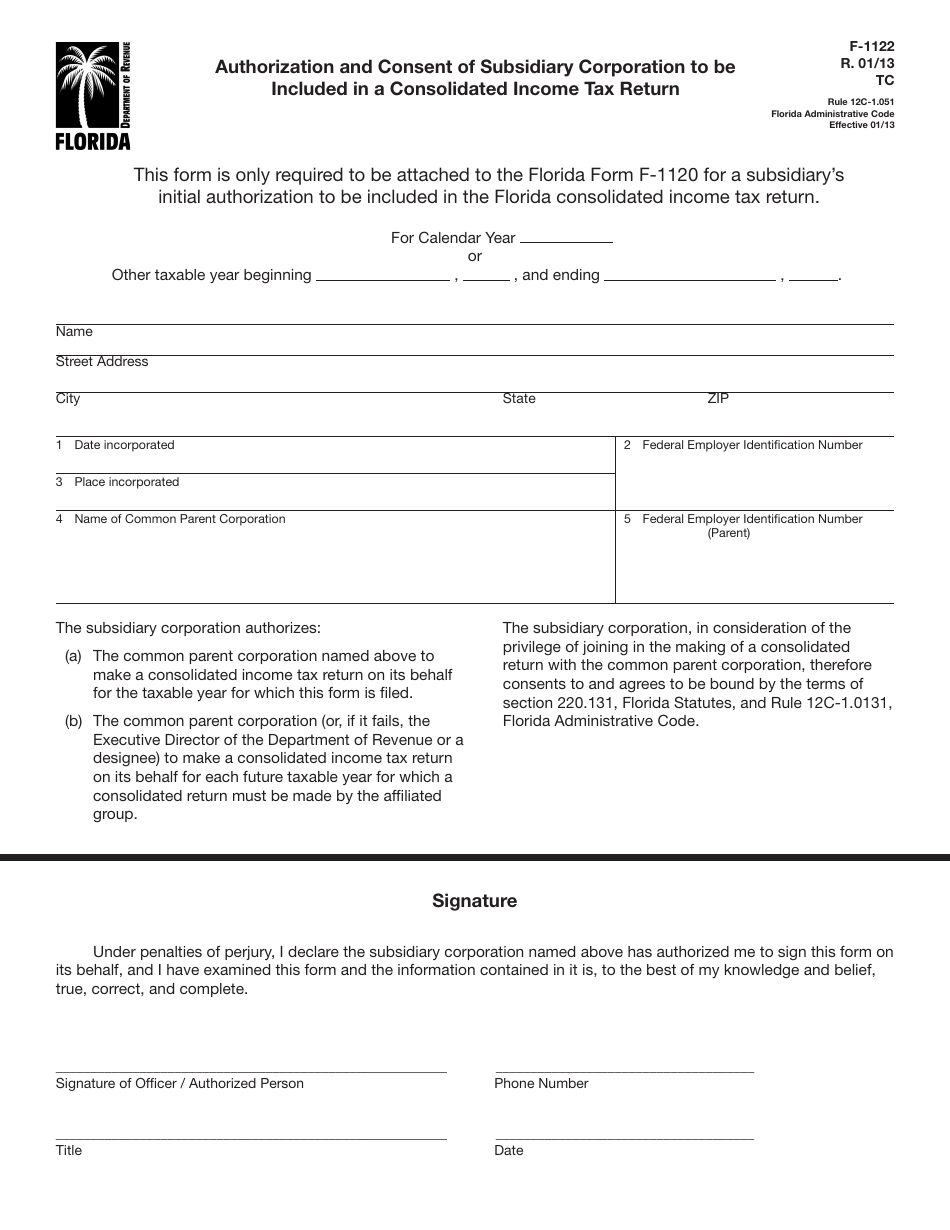

Web we last updated the authorization and consent of subsidiary corporation to be included in a consolidated income tax return in february 2023, so this is the latest version of form. Web follow these simple instructions to get form 1122 instructions prepared for submitting: Inventory of estate of estate no. Inventory summary and supporting schedule (328kb) 01/16: Select the sample.

Rescue 1122 Jobs 2021 Punjab (Application Form) Sept 2021

To be eligible for payments,. A form that one files with the irs to include a subsidiary on its parent company's tax return. Web what is form 8822? Complete and submit an original, signed form 1122 to the common parent corporation of the consolidated group for the first tax. Inventory supporting schedule (268kb) 11/09:

Form F1122 Download Printable PDF or Fill Online Authorization and

Web follow these simple instructions to get form 1122 instructions prepared for submitting: Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for. Web we last updated the authorization and consent of subsidiary corporation to be included in a consolidated income.

Web We Last Updated The Authorization And Consent Of Subsidiary Corporation To Be Included In A Consolidated Income Tax Return In February 2023, So This Is The Latest Version Of Form.

Inventory supporting schedule (268kb) 11/09: Web what is form 8822? This form is submitted to fsa by lenders after the lender has. Loan applicants should not submit this form to fsa.

If The Applicant Identifies As Being A New Producer Or Has Increased Their Operation Size Between The Benchmark Year And.

To be eligible for payments,. Select the sample you need in our collection of templates. Inventory of estate of estate no. For level 2 eauthenicated users.

Open The Template In Our.

Inventory summary and supporting schedule (328kb) 01/16: Web instructions for the subsidiary corporation. Total verification of appraiser other than personal. Web lenders use this form to apply for an fsa loan guarantee.

If This Message Is Not Eventually Replaced By The Proper Contents Of The Document, Your Pdf Viewer May Not Be Able To Display This Type Of Document.

Form 8822 is a change of address form. After moving into a new residence, you can use form 8822 to inform the internal revenue service (irs) of your. Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for. Complete and submit an original, signed form 1122 to the common parent corporation of the consolidated group for the first tax.