Form 1310 Is Not Needed If

Form 1310 Is Not Needed If - The return includes a surviving spouse filing an original or amended joint return with the decedent, or a. You just need to attach a copy of the. However, you must attach to his return a copy of the court certificate showing your appointment. Then you have to provide all other required information in the. Web new member filing return for deceased parent. Web 4,086 reply bookmark icon 3 best answer leonards expert alumni yes, you are correct you cannot efile the return due to form 1310 this is an irs requirement. Web form 1310 isn't needed in a return if either of the following applies: Web however, you do not need to attach irs form 1310 to a previously filed tax return or a future tax return. Web actually, if you are the court appointed executor or personal representative, you do not have to file form 1310. First, there are encouraging reports from the team’s training staff on the injured fried,.

Web fortunately, the form is very simple to complete. The return includes a surviving spouse filing an original or amended joint return with the decedent, or a. Web form 1310 isn't needed in a return if either of the following applies: You are a surviving spouse filing an original or. Web you are not required to claim the refund due the decedent, but if you do so, you must provide the information requested on this form. Then you have to provide all other required information in the. Web actually, if you are the court appointed executor or personal representative, you do not have to file form 1310. Failure to provide this information may. Green’s for privacy act and paperwork reduction act notice, see page 2. However, you must attach to.

Web you are not required to claim the refund due the decedent, but if you do so, you must provide the information requested on this form. Can i file form 1310 electronically? Web 4,086 reply bookmark icon 3 best answer leonards expert alumni yes, you are correct you cannot efile the return due to form 1310 this is an irs requirement. At the top of the form, you’ll provide identifying information such as the tax year, the decedent’s social security. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual. Green’s for privacy act and paperwork reduction act notice, see page 2. However, you must attach to. You are a surviving spouse filing an original or. Web actually, if you are the court appointed executor or personal representative, you do not have to file form 1310. Web you do not need to file form 1310 to claim the refund on mr.

Irs Form 1310 Printable Master of Documents

Web you do not need to file form 1310 to claim the refund on mr. Web if you are claiming a refund for a deceased person that is not your spouse, you will need to include form 1310. You just need to attach a copy of the. Web you are not required to claim the refund due the decedent, but.

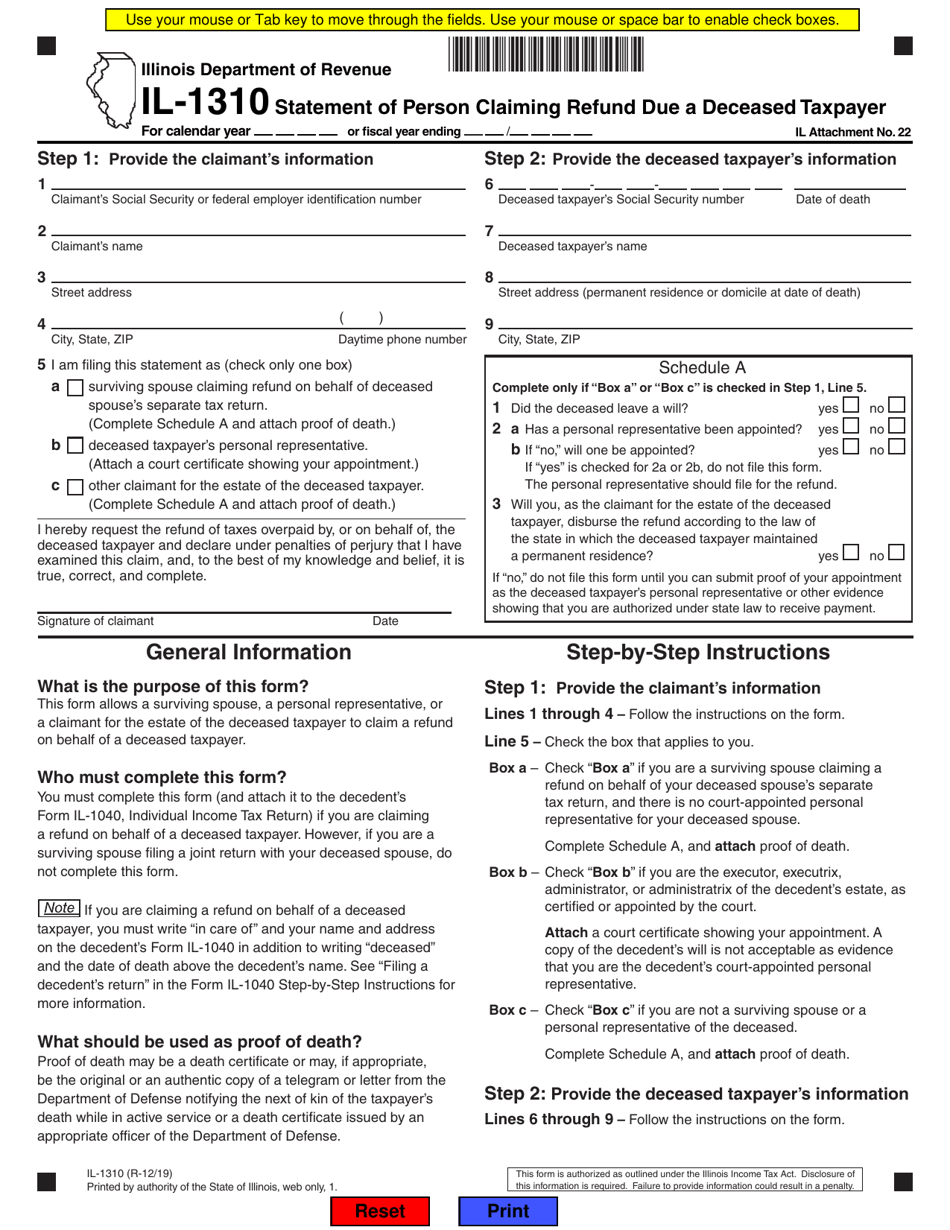

Form IL1310 Download Fillable PDF or Fill Online Statement of Person

Web you do not need to file form 1310 to claim the refund on mr. Then you have to provide all other required information in the. First, there are encouraging reports from the team’s training staff on the injured fried,. However, you must attach to his return a copy of the court certificate showing your appointment. Web anthopoulos’s decision to.

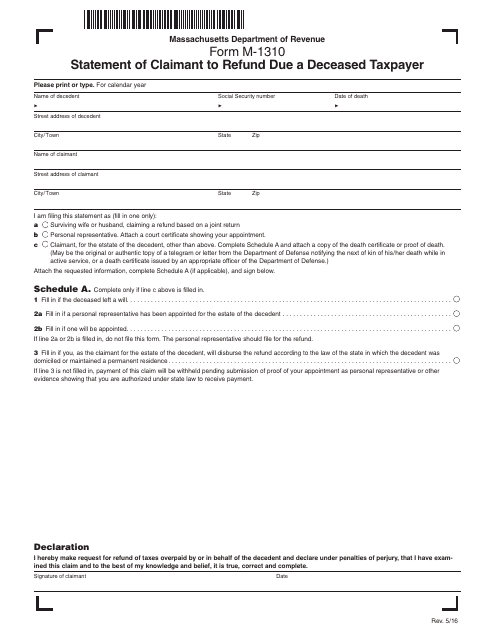

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased

Web this information includes name, address, and the social security number of the person who is filing the tax return. Web new member filing return for deceased parent. You just need to attach a copy of the. First, there are encouraging reports from the team’s training staff on the injured fried,. Green’s for privacy act and paperwork reduction act notice,.

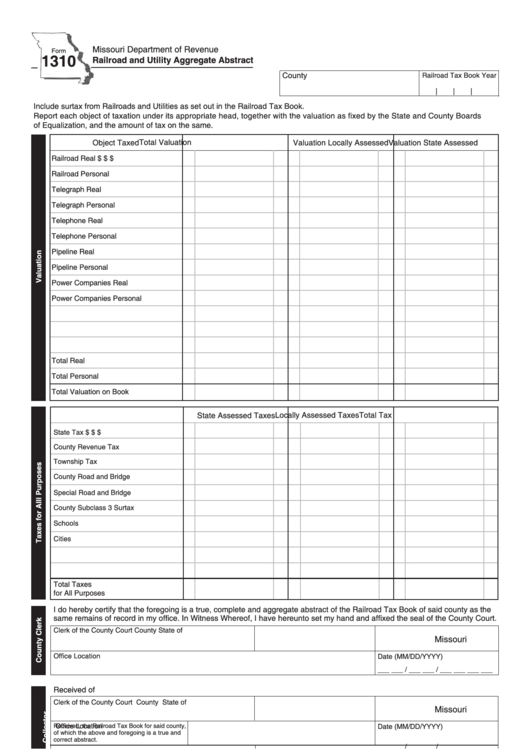

Fillable Form 1310 Railroad And Utility Aggregate Abstract printable

Web if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual. Web new member filing return for deceased.

Irs Form 1310 Printable Master of Documents

The irs requires the form to show who is claiming the refund on. First, there are encouraging reports from the team’s training staff on the injured fried,. Turbotax free edition online posted june 7, 2019 3:50. At the top of the form, you’ll provide identifying information such as the tax year, the decedent’s social security. You just need to attach.

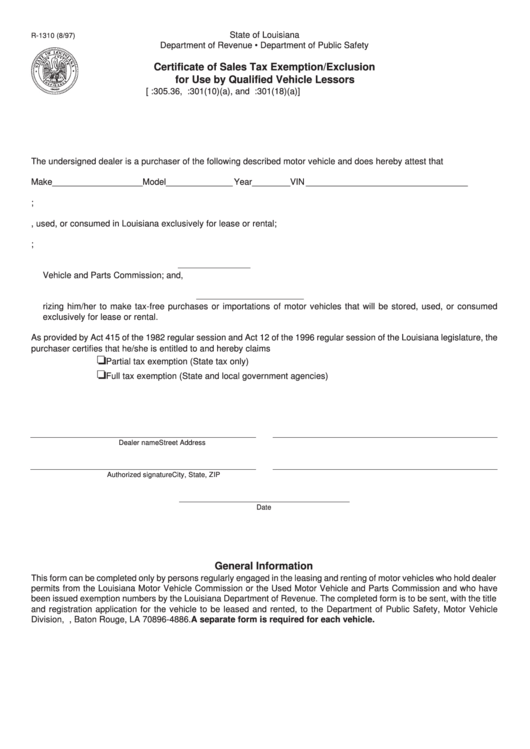

Fillable Form R1310 Certificate Of Sales Tax Exemption/exclusion For

Web if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: However, you must attach to his return a copy of the court certificate showing your appointment. You are a surviving spouse filing an original or. However, you must attach to. Web however, you do not need.

Form 1310 Instructions 2021 2022 IRS Forms Zrivo

Can i file form 1310 electronically? At the top of the form, you’ll provide identifying information such as the tax year, the decedent’s social security. However, you must attach to. The return includes a surviving spouse filing an original or amended joint return with the decedent, or a. Web 4,086 reply bookmark icon 3 best answer leonards expert alumni yes,.

Mi 1310 Instructions Pdf Fill Out and Sign Printable PDF Template

Web actually, if you are the court appointed executor or personal representative, you do not have to file form 1310. However, you must attach to his return a copy of the court certificate showing your appointment. Web if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies:.

Form 1310 2014 2019 Blank Sample to Fill out Online in PDF

At the top of the form, you’ll provide identifying information such as the tax year, the decedent’s social security. Web you do not need to file form 1310 to claim the refund on mr. First, there are encouraging reports from the team’s training staff on the injured fried,. Web you are not required to claim the refund due the decedent,.

Irs Form 1310 Printable Master of Documents

Web 4,086 reply bookmark icon 3 best answer leonards expert alumni yes, you are correct you cannot efile the return due to form 1310 this is an irs requirement. Web if you are claiming a refund for a deceased person that is not your spouse, you will need to include form 1310. You are a surviving spouse filing an original.

The Irs Requires The Form To Show Who Is Claiming The Refund On.

However, you must attach to his return a copy of the court certificate showing your appointment. Web if you are claiming a refund for a deceased person that is not your spouse, you will need to include form 1310. Web fortunately, the form is very simple to complete. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual.

Web New Member Filing Return For Deceased Parent.

Failure to provide this information may. Web you do not need to file form 1310 to claim the refund on mr. Turbotax free edition online posted june 7, 2019 3:50. Then you have to provide all other required information in the.

At The Top Of The Form, You’ll Provide Identifying Information Such As The Tax Year, The Decedent’s Social Security.

You are a surviving spouse filing an original or. The return includes a surviving spouse filing an original or amended joint return with the decedent, or a. Web you are not required to claim the refund due the decedent, but if you do so, you must provide the information requested on this form. Can i file form 1310 electronically?

Web Actually, If You Are The Court Appointed Executor Or Personal Representative, You Do Not Have To File Form 1310.

You just need to attach a copy of the. Web form 1310 isn't needed in a return if either of the following applies: Green’s for privacy act and paperwork reduction act notice, see page 2. First, there are encouraging reports from the team’s training staff on the injured fried,.