Form 2210 Line D Withholding

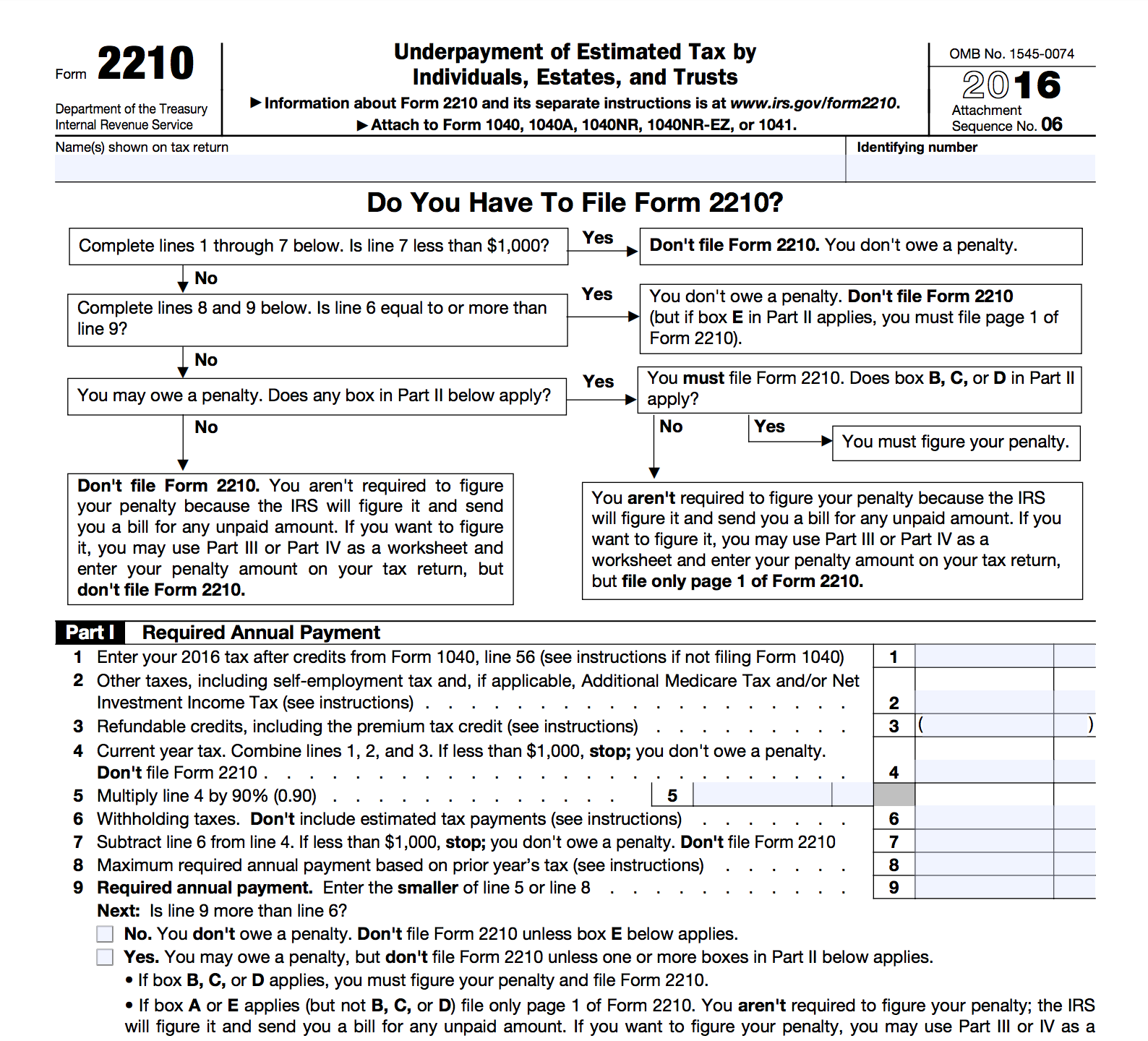

Form 2210 Line D Withholding - Purpose of form use form 2210 to see. Web 06 name(s) shown on tax return identifying number do you have to file form 2210? Complete lines 1 through 7 below. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web if you treat withholding as paid for estimated tax purposes when it was actually withheld, you must check box d in part ii and complete and attach form 2210 to your return. How do i fix this? Form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of. To determine adjustments to your withholdings, go to the tax withholding estimator at irs.gov/w4app. The sum of the four columns is not equal to your total withholding of $xxxx for the year. What am i required to do?

File form 2210 unless one or more boxes in part ii below applies. Complete lines 1 through 7 below. Web for form 2210, turbotax asks me to enter line d withholding. To determine adjustments to your withholdings, go to the tax withholding estimator at irs.gov/w4app. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of. Not sure what this means/ what to. Is line 4 or line 7 less than $1,000? Web department of the treasury internal revenue service underpayment of estimated tax by individuals, estates, and trusts go to www.irs.gov/form2210 for instructions and the. The irs will generally figure your penalty for you and you should not file.

Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty. Complete lines 1 through 7 below. I looked at the error report which. Web if you treat withholding as paid for estimated tax purposes when it was actually withheld, you must check box d in part ii and complete and attach form 2210 to your return. Purpose of form use form 2210 to see. Form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of. You may owe a penalty, but. Not sure what this means/ what to. Web 17 2,413 reply bookmark icon andy77 level 3 it looks like a programming error on the part of turbotax. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due.

Estimated vs Withholding Tax Penalty rules Saverocity Finance

You may owe a penalty, but. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty. To determine adjustments to your withholdings, go to the tax withholding estimator at irs.gov/w4app. What am i required to do? Web for form.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

How do i fix this? Web 06 name(s) shown on tax return identifying number do you have to file form 2210? You may owe a penalty, but. Is line 4 or line 7 less than $1,000? What am i required to do?

Ssurvivor Form 2210 Line 8 2018

Web for form 2210, turbotax asks me to enter line d withholding. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty. You may owe a penalty, but. Your tax liability on taxable income after deducting your district of.

Instructions For Form 2210 Underpayment Of Estimated Tax By

Web if you treat withholding as paid for estimated tax purposes when it was actually withheld, you must check box d in part ii and complete and attach form 2210 to your return. Web file form 2210 unless box. To determine adjustments to your withholdings, go to the tax withholding estimator at irs.gov/w4app. Web irs form 2210, underpayment of estimated.

Publication 505 Tax Withholding and Estimated Tax; Tax Withholding

File form 2210 unless one or more boxes in part ii below applies. Web file form 2210 unless box. To determine adjustments to your withholdings, go to the tax withholding estimator at irs.gov/w4app. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. United states (english) united states (spanish) canada (english).

Form 2210 Edit, Fill, Sign Online Handypdf

To determine adjustments to your withholdings, go to the tax withholding estimator at irs.gov/w4app. The irs will generally figure your penalty for you and you should not file. Web file form 2210 unless box. Not sure what this means/ what to. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax.

Fillable Form 2210 Fill Online, Printable, Fillable, Blank pdfFiller

To determine adjustments to your withholdings, go to the tax withholding estimator at irs.gov/w4app. You may owe a penalty, but. United states (english) united states (spanish) canada (english). Is line 4 or line 7 less than $1,000? Your tax liability on taxable income after deducting your district of columbia (dc) withholding tax and applicable credits is less than $100, or.

IRS Form 2210Fill it with the Best Form Filler

Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Web 17 2,413 reply bookmark icon andy77 level 3 it looks like a programming error on the part of turbotax. What am i required to do? To determine adjustments to your withholdings, go to the tax withholding estimator at irs.gov/w4app. Web 2021.

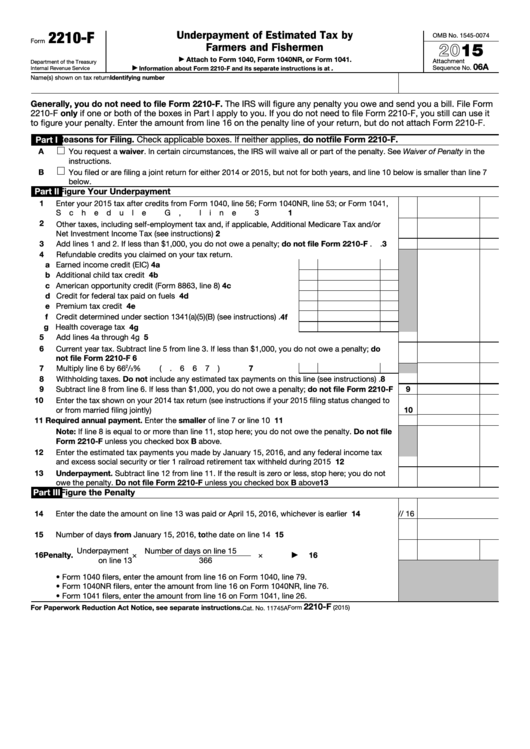

Fillable Form 2210F Underpayment Of Estimated Tax By Farmers And

To determine adjustments to your withholdings, go to the tax withholding estimator at irs.gov/w4app. When you are annualizing, you can. You may owe a penalty, but. Not sure what this means/ what to. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax.

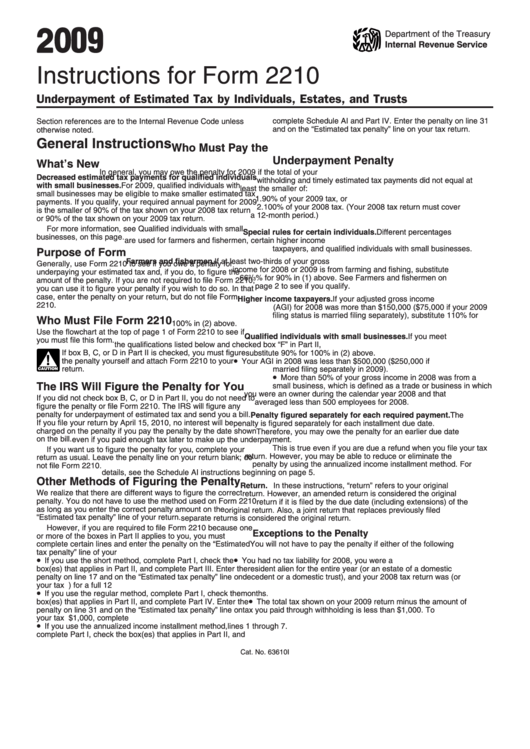

Instructions For Form 2210 Underpayment Of Estimated Tax By

You may owe a penalty, but. Web 2021 form 2210 calculation error subscribe to rss feed report inappropriate content 2021 form 2210 calculation error submitting via paper is an. Web if you treat withholding as paid for estimated tax purposes when it was actually withheld, you must check box d in part ii and complete and attach form 2210 to.

Web File Form 2210 Unless Box.

(see instructions.) c enter delaware withholding, s corp payments, or. Web 2021 form 2210 calculation error subscribe to rss feed report inappropriate content 2021 form 2210 calculation error submitting via paper is an. Web department of the treasury internal revenue service underpayment of estimated tax by individuals, estates, and trusts go to www.irs.gov/form2210 for instructions and the. Form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of.

Not Sure What This Means/ What To.

Web if you treat withholding as paid for estimated tax purposes when it was actually withheld, you must check box d in part ii and complete and attach form 2210 to your return. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Purpose of form use form 2210 to see. The sum of the four columns is not equal to your total withholding of $xxxx for the year.

To Determine Adjustments To Your Withholdings, Go To The Tax Withholding Estimator At Irs.gov/W4App.

Web form 2210 department of the treasury internal revenue service underpayment of estimated tax by individuals, estates, and trusts see separate instructions. Your tax liability on taxable income after deducting your district of columbia (dc) withholding tax and applicable credits is less than $100, or b. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty. How do i fix this?

You May Owe A Penalty, But.

Web 06 name(s) shown on tax return identifying number do you have to file form 2210? Web 17 2,413 reply bookmark icon andy77 level 3 it looks like a programming error on the part of turbotax. I looked at the error report which. File form 2210 unless one or more boxes in part ii below applies.