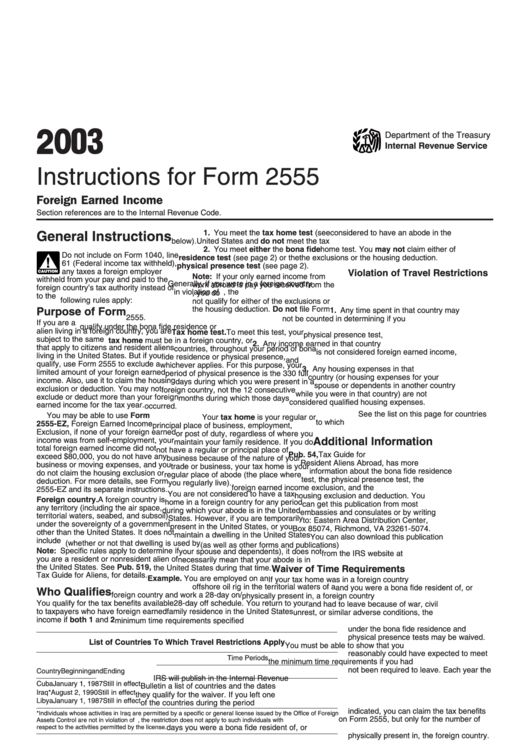

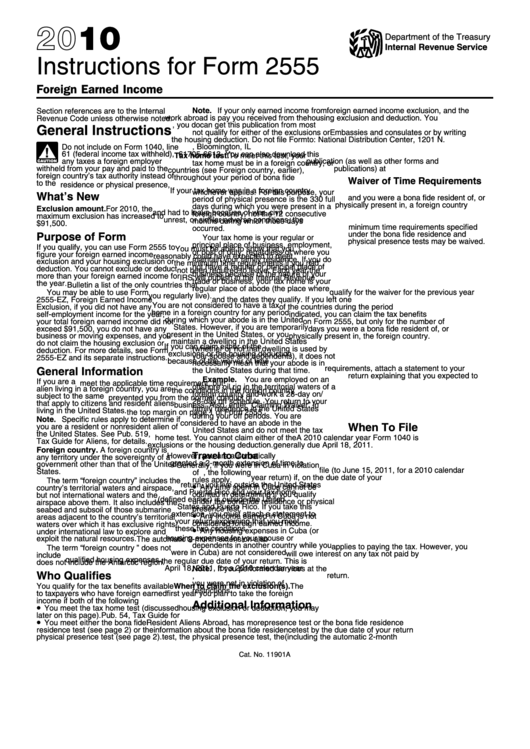

Form 2555 Instructions 2022

Form 2555 Instructions 2022 - Filing taxes can be daunting, especially if you’re an american living and working abroad. Web form 2555 department of the treasury internal revenue service. Web here’s how to file form 2555 in three steps: Web 2022 11/01/2022 inst 2555: If you qualify, you can use form. Web for 2022 and tax year 2021 i did return to good old paper for filing the foreign income exclusion as our situation was a little less straightforward to do online since we. You cannot exclude or deduct more than the. In the blank space next to line 8, enter “form 2555.” on schedule 1 (form 1040), subtract this amount from your additional income to arrive at the amount reported on. Instructions for form 2555, foreign earned income 2022 11/01/2022 « previous | 1 | next » get adobe ® reader. Web enter the lesser of line 40 or line 41 on line 42, and you will have your final foreign earned income exclusion for the year.

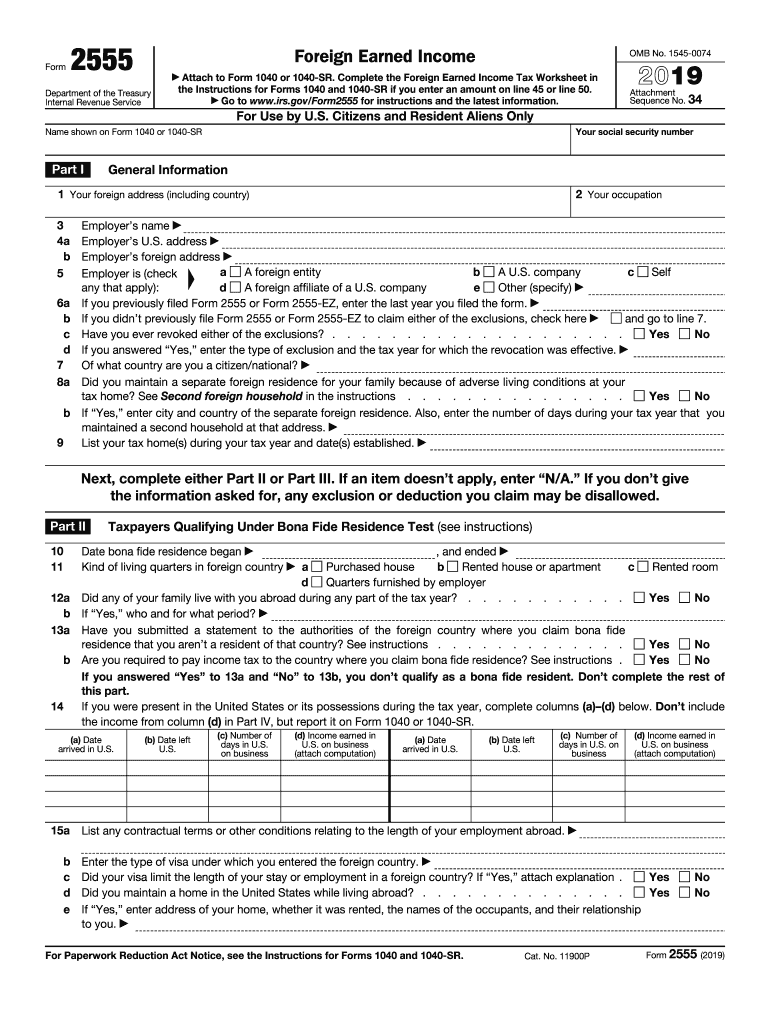

Web we estimate that it will take approximately 2.5 hours to prepare an application, including time to review instructions, gather and maintain data, and. Web to be eligible for this exclusion, a citizen of the united states or a resident alien must have a tax home in a foreign country and they must receive income for working in. For 2021, the maximum exclusion amount has increased to $108,700. Web form 2555 department of the treasury internal revenue service. Web before you start: You must have been physically present in a foreign country for at least 330 days in a 12. For paperwork reduction act notice, see the form 1040 instructions. Web form 2555 instructions: Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Web enter the lesser of line 40 or line 41 on line 42, and you will have your final foreign earned income exclusion for the year.

Qualify for the foreign earned income exclusion (feie) as mentioned above, you have two options to qualify. Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation. Enter form 2555 allocation information in the appropriate screen. Web solved•by intuit•3•updated august 25, 2022. Web to be eligible for this exclusion, a citizen of the united states or a resident alien must have a tax home in a foreign country and they must receive income for working in. Instructions for form 2555, foreign earned income 2022 11/01/2022 « previous | 1 | next » get adobe ® reader. For 2021, the maximum exclusion amount has increased to $108,700. Enter the feie as a negative amount on form 1040,. Filing taxes can be daunting, especially if you’re an american living and working abroad. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file.

Ssurvivor Form 2555 Ez Instructions 2019

Filing taxes can be daunting, especially if you’re an american living and working abroad. For paperwork reduction act notice, see the form 1040 instructions. Web future developments for the latest information about developments related to form 2555 and its instructions, such as legislation enacted after they were published, go to. Web 2022 11/01/2022 inst 2555: Reminders tax home for individuals.

Tax Filing Guide for American Expats Abroad Foreigners in

Web form 2555 instructions: Web we estimate that it will take approximately 2.5 hours to prepare an application, including time to review instructions, gather and maintain data, and. Go to www.irs.gov/form2555 for instructions and the. Web form 2555 department of the treasury internal revenue service. Web here’s how to file form 2555 in three steps:

Business Tax Declaration Form In Ethiopia Paul Johnson's Templates

You cannot exclude or deduct more than the. Web form 2555 department of the treasury internal revenue service. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. If you qualify, you can use form. Web form 2555 instructions:

Instructions For Form 2555 Foreign Earned Internal Revenue

Web future developments for the latest information about developments related to form 2555 and its instructions, such as legislation enacted after they were published, go to. Web solved•by intuit•3•updated august 25, 2022. Web form 2555 instructions: Enter the feie as a negative amount on form 1040,. Web form 2555 department of the treasury internal revenue service.

2019 Form 2555 Fill Out and Sign Printable PDF Template signNow

Web here’s how to file form 2555 in three steps: You cannot exclude or deduct more than the. Web form 2555 department of the treasury internal revenue service. Enter form 2555 allocation information in the appropriate screen. Web 2022 11/01/2022 inst 2555:

Ssurvivor Form 2555 Ez Instructions 2019

For 2021, the maximum exclusion amount has increased to $108,700. Web here’s how to file form 2555 in three steps: Web solved•by intuit•3•updated august 25, 2022. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Web we estimate that it will take approximately 2.5 hours to prepare an application, including.

Ssurvivor Form 2555 Instructions 2018 Pdf

Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. In the blank space next to line 8, enter “form 2555.” on schedule 1 (form 1040), subtract this amount from your additional income to arrive at the amount reported on. Web form 2555 (foreign earned income exclusion) calculates.

Instructions For Form 2555 Foreign Earned Internal Revenue

Web solved•by intuit•3•updated august 25, 2022. You cannot exclude or deduct more than the. Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation. Instructions for form 2555, foreign earned income 2022 11/01/2022 « previous | 1 | next » get adobe ® reader. Enter form 2555 allocation.

Instructions for IRS Form 2555 Foreign Earned Download

Web 2022 11/01/2022 inst 2555: Web here’s how to file form 2555 in three steps: For paperwork reduction act notice, see the form 1040 instructions. Web future developments for the latest information about developments related to form 2555 and its instructions, such as legislation enacted after they were published, go to. Follow these steps to enter foreign wages on form.

Ssurvivor Form 2555 Instructions 2019

Web to be eligible for this exclusion, a citizen of the united states or a resident alien must have a tax home in a foreign country and they must receive income for working in. Web solved•by intuit•3•updated august 25, 2022. You must have been physically present in a foreign country for at least 330 days in a 12. For 2021,.

Web Before You Start:

Web here’s how to file form 2555 in three steps: Web form 2555 department of the treasury internal revenue service. Web form 2555 instructions: Web to be eligible for this exclusion, a citizen of the united states or a resident alien must have a tax home in a foreign country and they must receive income for working in.

Filing Taxes Can Be Daunting, Especially If You’re An American Living And Working Abroad.

Web solved•by intuit•3•updated august 25, 2022. If you qualify, you can use form. In the blank space next to line 8, enter “form 2555.” on schedule 1 (form 1040), subtract this amount from your additional income to arrive at the amount reported on. Refer to here for instructions on entering form 2555 general info.

Enter The Feie As A Negative Amount On Form 1040,.

Qualify for the foreign earned income exclusion (feie) as mentioned above, you have two options to qualify. For 2021, the maximum exclusion amount has increased to $108,700. Web 2022 11/01/2022 inst 2555: For paperwork reduction act notice, see the form 1040 instructions.

Go To Www.irs.gov/Form2555 For Instructions And The.

Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation. You cannot exclude or deduct more than the. Web enter the lesser of line 40 or line 41 on line 42, and you will have your final foreign earned income exclusion for the year. Web for 2022 and tax year 2021 i did return to good old paper for filing the foreign income exclusion as our situation was a little less straightforward to do online since we.