Form 3115 Cash To Accrual Example

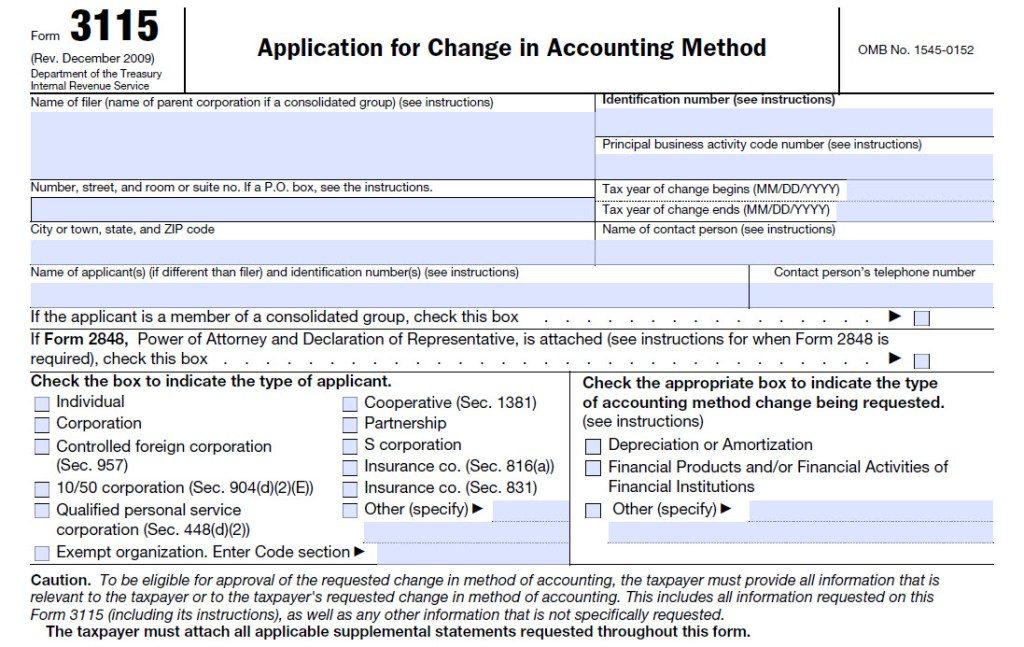

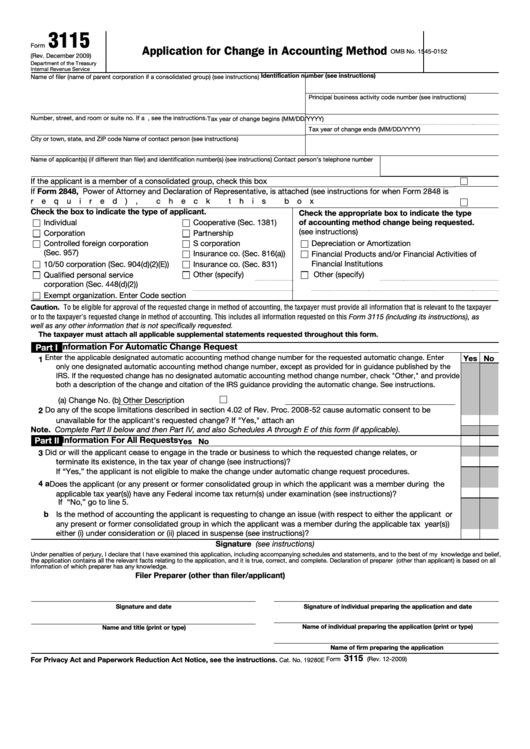

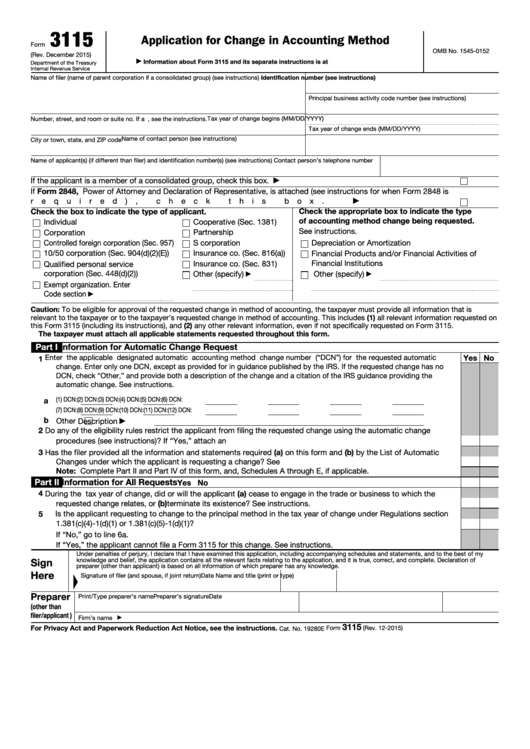

Form 3115 Cash To Accrual Example - Web to obtain the irs's consent, taxpayers file form 3115, application for change in accounting method. Web since the section 481 (a) adjustment is the heart of form 3115 for a change to the cash method of accounting, it is essential that all computations be correctly presented since. This change applies to a taxpayer that wants to change its overall method of accounting from the cash receipts and disbursements method (cash. Web our opening hours mon. Several transition rules are provided for changes that can no longer be made under an. See the instructions for part iv. Web to convert your books from cash basis to accrual, you will need to complete several tasks. General instructions purpose of form file form 3115 to request a change in either an. Web preparing 3115 to report change from cash to accrual if you have been using cash basis accounting or hybrid accounting and need to change to full accrual accounting, you. You will have to make a sec.

Web change their method of accounting from cash to accrual. Web our opening hours mon. File this form to request a change in either: Web for cash to accrual conversion, you need to file form 3115 with your tax return. Web to convert your books from cash basis to accrual, you will need to complete several tasks. The returns for all four tax years reflected. Web requires one form 3115 for an automatic change to, from or within an nae method of accounting under section 15.04 and a required change to an overall accrual. The 911 provider shall not impose, or fail to impose, on company any requirement, service, feature, standard. Web 1 part i information for automatic change request other (specify) enter the requested designated accounting method change number from the list of automatic accounting. Web about form 3115, application for change in accounting method.

Web our opening hours mon. Several transition rules are provided for changes that can no longer be made under an. This change applies to a taxpayer that wants to change its overall method of accounting from the cash receipts and disbursements method (cash. Web about form 3115, application for change in accounting method. Web strong local capabilities and experience. Web since the section 481 (a) adjustment is the heart of form 3115 for a change to the cash method of accounting, it is essential that all computations be correctly presented since. Do this sooner, rather than later, the irs needs time to work through any kinks. Even when the irs's consent is not required, taxpayers. See the instructions for part iv. First, you must adjust your books to reflect the accrual method.

Form 3115 Application for Change in Accounting Method(2015) Free Download

See the instructions for part iv. Even when the irs's consent is not required, taxpayers. Web 1 part i information for automatic change request other (specify) enter the requested designated accounting method change number from the list of automatic accounting. Web to convert your books from cash basis to accrual, you will need to complete several tasks. The 911 provider.

Form 3115 App for change in acctg method Capstan Tax Strategies

File this form to request a change in either: Do this sooner, rather than later, the irs needs time to work through any kinks. Web change their method of accounting from cash to accrual. See the instructions for part iv. The returns for all four tax years reflected.

Tax Accounting Methods

General instructions purpose of form file form 3115 to request a change in either an. Web our opening hours mon. Web since the section 481 (a) adjustment is the heart of form 3115 for a change to the cash method of accounting, it is essential that all computations be correctly presented since. Web strong local capabilities and experience. First, you.

Form 3115 for a Cash to Accrual Method Accounting Change

You will have to make a sec. Web to convert your books from cash basis to accrual, you will need to complete several tasks. File this form to request a change in either: First, you must adjust your books to reflect the accrual method. Web since the section 481 (a) adjustment is the heart of form 3115 for a change.

Form 3115 Definition, Who Must File, & More

General instructions purpose of form file form 3115 to request a change in either an. Web strong local capabilities and experience. Call us for free consultation Web to obtain the irs's consent, taxpayers file form 3115, application for change in accounting method. Web requires one form 3115 for an automatic change to, from or within an nae method of accounting.

Form 3115 Application for Change in Accounting Method(2015) Free Download

File this form to request a change in either: Web department of the treasury internal revenue service application for change in accounting method go to www.irs.gov/form3115 for instructions and the latest information. Call us for free consultation First, you must adjust your books to reflect the accrual method. See the instructions for part iv.

Automatic Change to Cash Method of Accounting for Tax

Web preparing 3115 to report change from cash to accrual if you have been using cash basis accounting or hybrid accounting and need to change to full accrual accounting, you. Call us for free consultation Even when the irs's consent is not required, taxpayers. Web change their method of accounting from cash to accrual. Web department of the treasury internal.

Form 3115 for a Cash to Accrual Method for Small Businesses HCA LAW FIRM

Web our opening hours mon. The 911 provider shall not impose, or fail to impose, on company any requirement, service, feature, standard. Web about form 3115, application for change in accounting method. First, you must adjust your books to reflect the accrual method. Web department of the treasury internal revenue service application for change in accounting method go to www.irs.gov/form3115.

Fillable Form 3115 Application For Change In Accounting Method

Do this sooner, rather than later, the irs needs time to work through any kinks. Several transition rules are provided for changes that can no longer be made under an. Web to convert your books from cash basis to accrual, you will need to complete several tasks. General instructions purpose of form file form 3115 to request a change in.

Fillable Form 3115 Application For Change In Accounting Method

First, you must adjust your books to reflect the accrual method. The returns for all four tax years reflected. General instructions purpose of form file form 3115 to request a change in either an. Web 1 part i information for automatic change request other (specify) enter the requested designated accounting method change number from the list of automatic accounting. Web.

General Instructions Purpose Of Form File Form 3115 To Request A Change In Either An.

Web to obtain the irs's consent, taxpayers file form 3115, application for change in accounting method. Web change their method of accounting from cash to accrual. The returns for all four tax years reflected. An overall method of accounting or.

Web About Form 3115, Application For Change In Accounting Method.

Web our opening hours mon. Do this sooner, rather than later, the irs needs time to work through any kinks. Web for example, you can determine your business income and expenses under an accrual method, even if you use the cash method to figure personal items. Web preparing 3115 to report change from cash to accrual if you have been using cash basis accounting or hybrid accounting and need to change to full accrual accounting, you.

File This Form To Request A Change In Either:

Even when the irs's consent is not required, taxpayers. Call us for free consultation First, you must adjust your books to reflect the accrual method. Web requires one form 3115 for an automatic change to, from or within an nae method of accounting under section 15.04 and a required change to an overall accrual.

See The Instructions For Part Iv.

The 911 provider shall not impose, or fail to impose, on company any requirement, service, feature, standard. Web since the section 481 (a) adjustment is the heart of form 3115 for a change to the cash method of accounting, it is essential that all computations be correctly presented since. Web to convert your books from cash basis to accrual, you will need to complete several tasks. Web department of the treasury internal revenue service application for change in accounting method go to www.irs.gov/form3115 for instructions and the latest information.