Form 3115 Depreciation Example

Form 3115 Depreciation Example - Web how do i file an irs extension (form 4868) in turbotax online? Web have you ever had a client who was not depreciating their rental property? Web for example, an applicant requesting both a change to deduct repair and maintenance costs for tangible property (dcn 184) and a change to capitalize acquisition or. Or one who was depreciating the land as well as the building? Furthermore, this webinar will deliver a comprehensive. Web form 3115 is used for a change in accounting method, and the 'catching up' on depreciation is usually allowed because you go from an impermissible method. Web i am filing form 3115 to catch up on missed depreciations, is form 4562 also needed to be filed in this same year along with form 3115 or that will go next year. This template is free and. How do i clear and. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file.

If irs demands the 3115 form be filed in a. Attach the original form 3115 to the filer’s timely filed federal income tax return for the year of change. Furthermore, this webinar will deliver a comprehensive. How do i clear and. Web the form 3115 instructions provide that the automatic change number is “7” for changes from an impermissible method to a permissible method of depreciation for depreciable. Web there are procedures, which will be explained, that will allow us to fix these depreciation omission and or oversights. Web for automatic change requests: File an extension in turbotax online before the deadline to avoid a late filing penalty. Web to qualify for the blanket consent to changing methods of depreciation, a taxpayer must change to a permissible method and complete and file a form 3115 in accordance with. This template is free and.

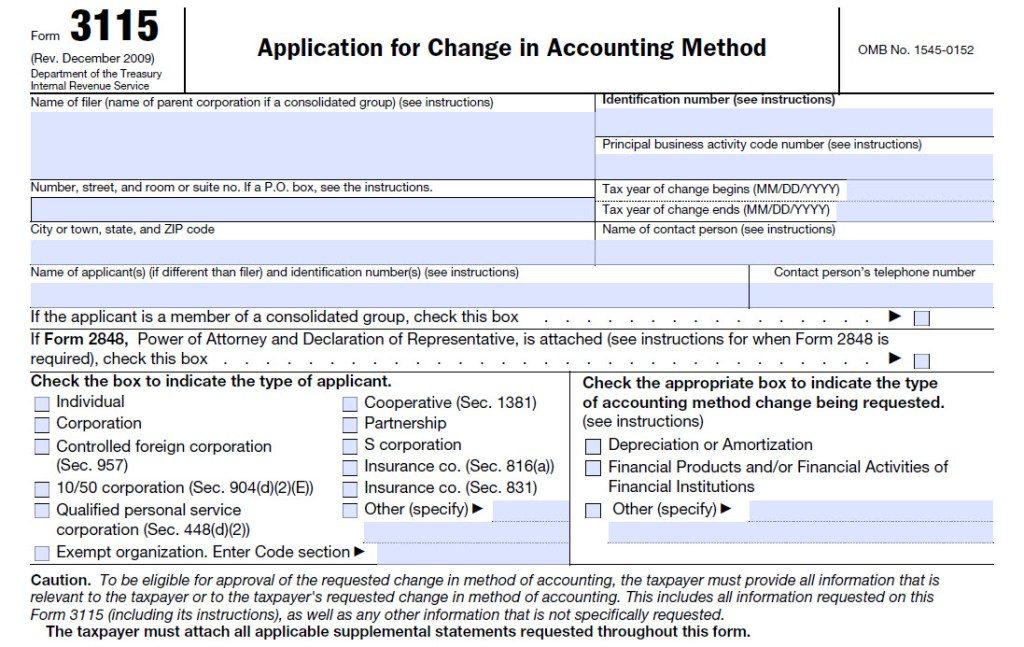

Web for automatic change requests: Attach the original form 3115 to the filer’s timely filed federal income tax return for the year of change. The form 3115 is the way you must make. Web for example, an applicant requesting both a change to deduct repair and maintenance costs for tangible property (dcn 184) and a change to capitalize acquisition or. Web to qualify for the blanket consent to changing methods of depreciation, a taxpayer must change to a permissible method and complete and file a form 3115 in accordance with. Web form 3115, application for change in accounting method, is an application to the irs to change either an entity’s overall accounting method or the accounting treatment of any. Web the form 3115 allows building owners to implement cost segregation studies through an “automatic change” with no additional payment due to the irs. Web how do i file an irs extension (form 4868) in turbotax online? Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. How do i clear and.

Correcting Depreciation Form 3115 LinebyLine

Attach the original form 3115 to the filer’s timely filed federal income tax return for the year of change. Web kbkg has put together a sample form 3115 template with attachments for the concurrent designated change numbers (dcn) 244 and 7. Or one who was depreciating the land as well as the building? Web for automatic change requests: File an.

Form 3115 App for change in acctg method Capstan Tax Strategies

Web i am filing form 3115 to catch up on missed depreciations, is form 4562 also needed to be filed in this same year along with form 3115 or that will go next year. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. Web for automatic change.

How to catch up missed depreciation on rental property (part I) filing

Web how do i file an irs extension (form 4868) in turbotax online? Web for automatic change requests: Web department of the treasury internal revenue service application for change in accounting method go to www.irs.gov/form3115 for instructions and the latest information. Web for example, an applicant requesting both a change to deduct repair and maintenance costs for tangible property (dcn.

Tax Accounting Methods

Web the form 3115 instructions provide that the automatic change number is “7” for changes from an impermissible method to a permissible method of depreciation for depreciable. Attach the original form 3115 to the filer’s timely filed federal income tax return for the year of change. Web form 3115 will have to be filed, with the entire amount of incorrect.

Form 3115 Application for Change in Accounting Method

Web for example, an applicant requesting both a change to deduct repair and maintenance costs for tangible property (dcn 184) and a change to capitalize acquisition or. Web for automatic change requests: This template is free and. Web form 3115 is used for a change in accounting method, and the 'catching up' on depreciation is usually allowed because you go.

Automatic Change to Cash Method of Accounting for Tax

Web i am filing form 3115 to catch up on missed depreciations, is form 4562 also needed to be filed in this same year along with form 3115 or that will go next year. Web form 3115 is used for a change in accounting method, and the 'catching up' on depreciation is usually allowed because you go from an impermissible.

Form 3115 Edit, Fill, Sign Online Handypdf

Web have you ever had a client who was not depreciating their rental property? Web kbkg has put together a sample form 3115 template with attachments for the concurrent designated change numbers (dcn) 244 and 7. Web there are procedures, which will be explained, that will allow us to fix these depreciation omission and or oversights. This template is free.

Form 3115 Definition, Who Must File, & More

Or one who was depreciating the land as well as the building? This template is free and. Web for automatic change requests: Web form 3115, application for change in accounting method, is an application to the irs to change either an entity’s overall accounting method or the accounting treatment of any. Furthermore, this webinar will deliver a comprehensive.

Form 3115 Application for Change in Accounting Method(2015) Free Download

Attach the original form 3115 to the filer’s timely filed federal income tax return for the year of change. Web the form 3115 instructions provide that the automatic change number is “7” for changes from an impermissible method to a permissible method of depreciation for depreciable. If irs demands the 3115 form be filed in a. The form 3115 is.

Form 3115 Application for Change in Accounting Method(2015) Free Download

Web to qualify for the blanket consent to changing methods of depreciation, a taxpayer must change to a permissible method and complete and file a form 3115 in accordance with. Web form 3115 is used for a change in accounting method, and the 'catching up' on depreciation is usually allowed because you go from an impermissible method. Web i am.

Web The Form 3115 Instructions Provide That The Automatic Change Number Is “7” For Changes From An Impermissible Method To A Permissible Method Of Depreciation For Depreciable.

Web have you ever had a client who was not depreciating their rental property? The form 3115 is the way you must make. Web department of the treasury internal revenue service application for change in accounting method go to www.irs.gov/form3115 for instructions and the latest information. This template is free and.

Or One Who Was Depreciating The Land As Well As The Building?

Web for automatic change requests: If irs demands the 3115 form be filed in a. Web form 3115 is used for a change in accounting method, and the 'catching up' on depreciation is usually allowed because you go from an impermissible method. File an extension in turbotax online before the deadline to avoid a late filing penalty.

Furthermore, This Webinar Will Deliver A Comprehensive.

How do i clear and. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. Web a form 3115 is filed to change either an entity’s overall accounting method or the accounting treatment of any item, such as switching to the accrual method,. Web i am filing form 3115 to catch up on missed depreciations, is form 4562 also needed to be filed in this same year along with form 3115 or that will go next year.

Web Kbkg Has Put Together A Sample Form 3115 Template With Attachments For The Concurrent Designated Change Numbers (Dcn) 244 And 7.

Web for example, an applicant requesting both a change to deduct repair and maintenance costs for tangible property (dcn 184) and a change to capitalize acquisition or. Attach the original form 3115 to the filer’s timely filed federal income tax return for the year of change. Web how do i file an irs extension (form 4868) in turbotax online? Web there are procedures, which will be explained, that will allow us to fix these depreciation omission and or oversights.