Form 3514 Business Code

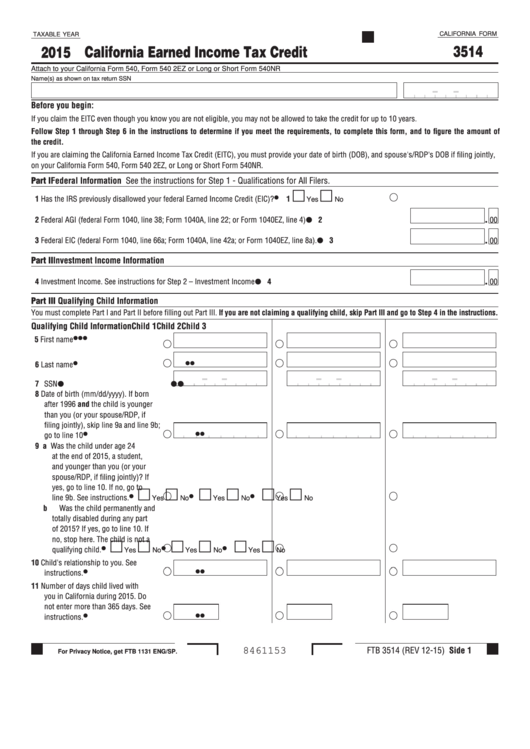

Form 3514 Business Code - Web 2021 instructions for form ftb 3514 california earned income tax credit revised: Please provide your email address and it will be emailed to you. This return has business income on ca3514 line 18 but is missing the business name/address. Enter all necessary information in the required fillable fields. California has some differences from the federal earned income credit, so if. Pick the template from the library. Web we last updated the california earned income tax credit in january 2023, so this is the latest version of form 3514, fully updated for tax year 2022. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the california revenue and. That will remove the business. Current as of july 10, 2023 | updated by findlaw staff.

This return has business income on ca3514 line 18 but is missing the business name/address. That will remove the business. Web we last updated the california earned income tax credit in january 2023, so this is the latest version of form 3514, fully updated for tax year 2022. Web california form 3514 want business code, etc. Web business and professions code /. Web ca3514 missing business demographic information. References in these instructions are to the internal revenue code (irc) as of january. Web this business code can be found on any of your business activities not only on a schedule c. Draw your signature, type it,. Web 2021 instructions for form ftb 3514 california earned income tax credit revised:

California has some differences from the federal earned income credit, so if. Web we last updated the california earned income tax credit in january 2023, so this is the latest version of form 3514, fully updated for tax year 2022. If you claim the california eitc even though you know you are not eligible, you may not be allowed to take the credit for up to 10 years. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the california revenue and. Web this business code can be found on any of your business activities not only on a schedule c. How do we get rid of that form? This return has business income on ca3514 line 18 but is missing the business name/address. That will remove the business. Sign it in a few clicks. Web download or print the 2022 california form 3514 ins (form 3514 instructions) for free from the california franchise tax board.

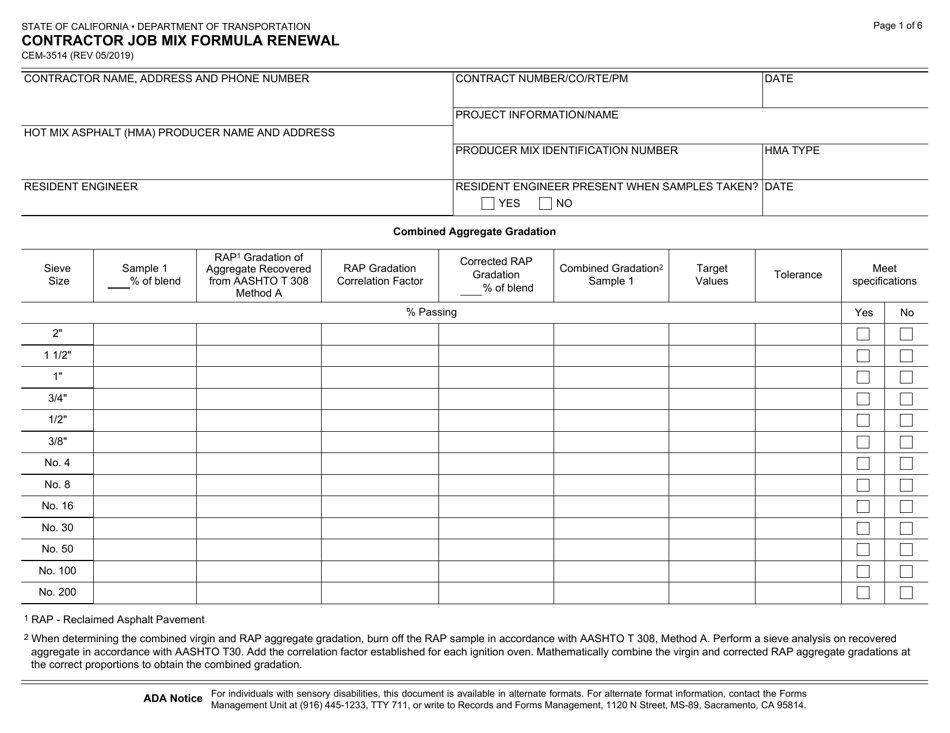

Form CEM3514 Download Fillable PDF or Fill Online Contractor Job Mix

Enter all necessary information in the required fillable fields. 2022 earned income tax credit table. Sign it in a few clicks. Web business and professions code /. Web business activity codes the codes listed in this section are a selection from the north code for the activity you are trying to categorize, select the (beginning with 90) are not.

Form 3514 California Earned Tax Credit 2015 printable pdf

If you claim the california eitc even though you know you are not eligible, you may not be allowed to take the credit for up to 10 years. Type text, add images, blackout confidential details, add comments, highlights and more. Web 2021, 3514, instructions for 3514 form, california earned income tax credit this is only available by request. California earned.

Form FDA 3511c Processing in Steam in Continuous Agitating Retorts

California has some differences from the federal earned income credit, so if. Draw your signature, type it,. General instructions other schedules and forms you may have to. Web 2021 instructions for form ftb 3514 california earned income tax credit revised: Welcome to findlaw's cases & codes, a free source of state.

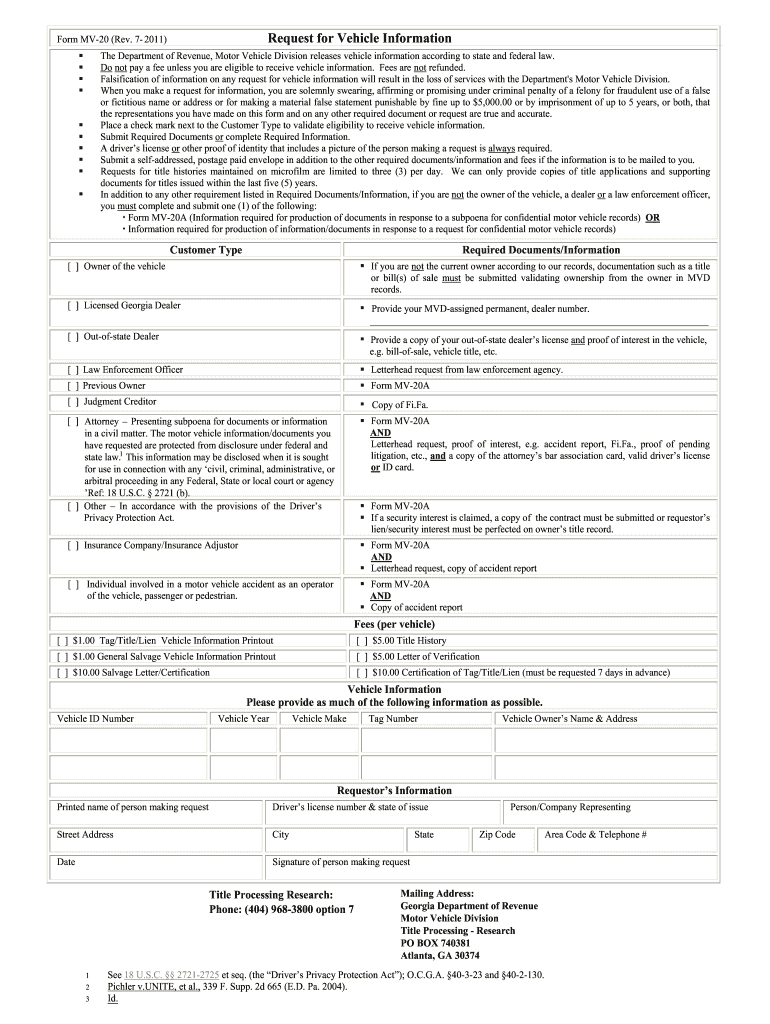

Mv20 Form Fill Out and Sign Printable PDF Template signNow

You can download or print. Web this business code can be found on any of your business activities not only on a schedule c. Web download or print the 2022 california form 3514 ins (form 3514 instructions) for free from the california franchise tax board. Web 603 rows use form ftb 3514 to determine whether you qualify to claim the.

78th field artillery hires stock photography and images Alamy

Web 603 rows use form ftb 3514 to determine whether you qualify to claim the credit, provide information about your qualifying children, if applicable, and to figure the amount of your. Type text, add images, blackout confidential details, add comments, highlights and more. Welcome to findlaw's cases & codes, a free source of state. It could refer to a small.

Form FDA 1572 (PDF 208KB) [PDF Document]

2022 earned income tax credit table. General instructions other schedules and forms you may have to. Web ca3514 missing business demographic information. This return has business income on ca3514 line 18 but is missing the business name/address. Web we last updated the california earned income tax credit in january 2023, so this is the latest version of form 3514, fully.

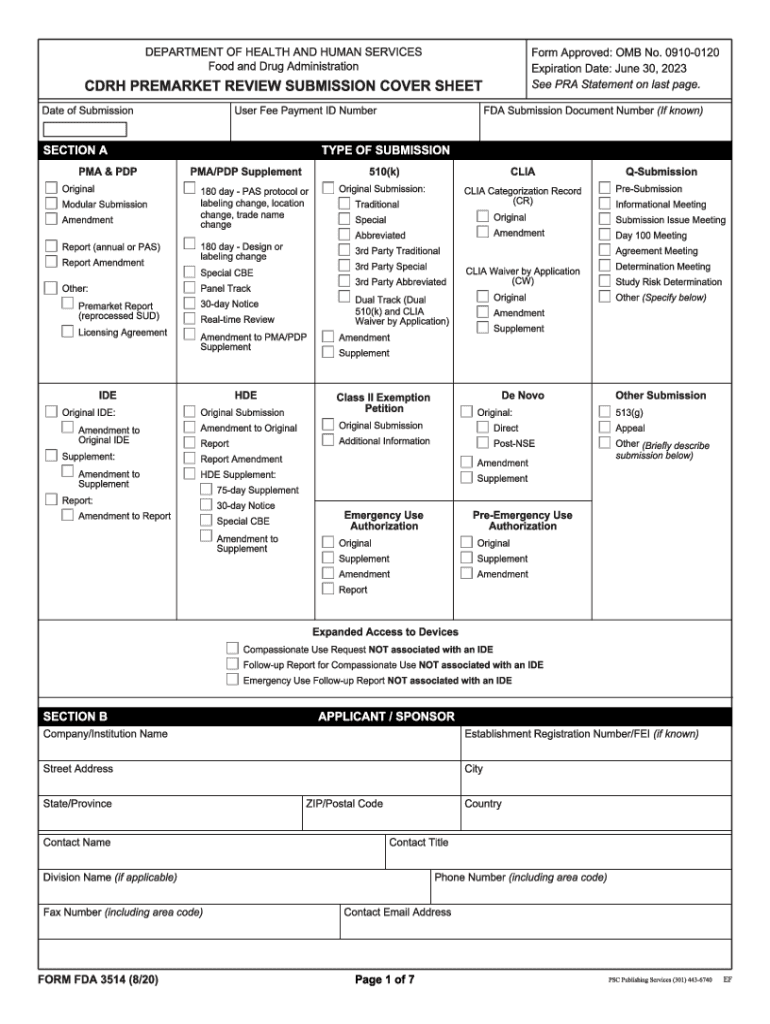

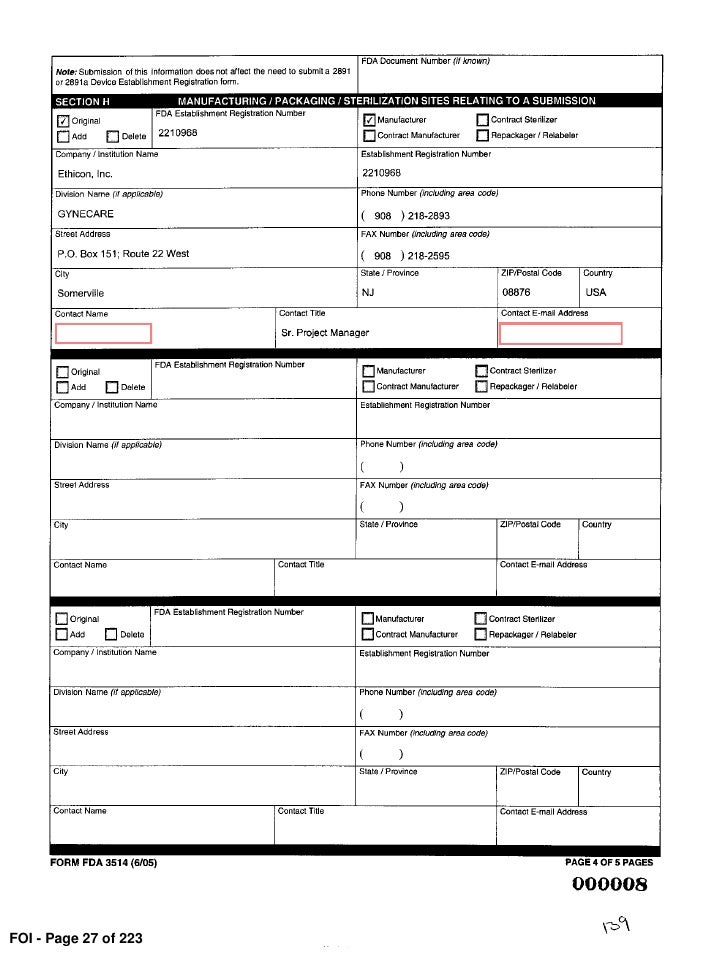

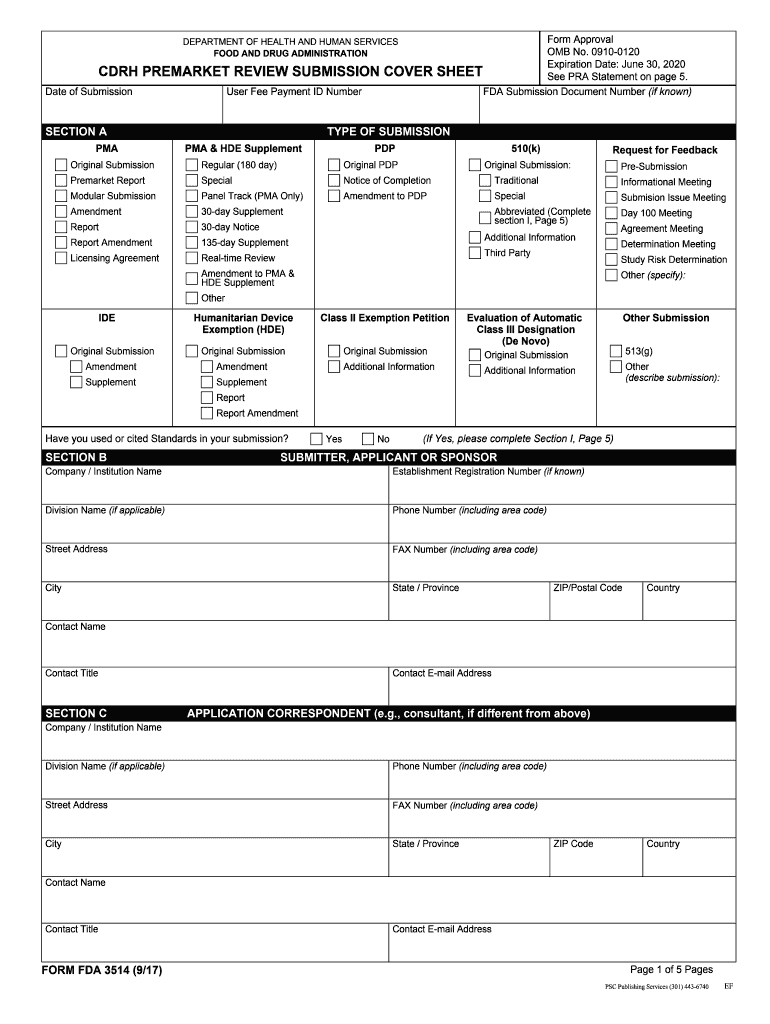

Fda form 3514 Fill out & sign online DocHub

Draw your signature, type it,. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the california revenue and. Make sure you told turbotax the money came from a legal settlement. Web 2021 instructions for form ftb 3514 california earned income tax credit revised: How do we get rid of that form?

FDA FORM 3514 PDF

If you claim the california eitc even though you know you are not eligible, you may not be allowed to take the credit for up to 10 years. California has some differences from the federal earned income credit, so if. How do we get rid of that form? Web business activity codes the codes listed in this section are a.

Fill Free fillable 2016 Instructions for Form FTB 3514 (California

California earned income tax credit. Welcome to findlaw's cases & codes, a free source of state. Web 2021 instructions for form ftb 3514 california earned income tax credit revised: Web california form 3514 want business code, etc. Web this code categorizes sole proprietorships and independent contractor jobs by an activity they’re heavily involved in, to help the irs process tax.

Fda form 3514 Fill out & sign online DocHub

Web this code categorizes sole proprietorships and independent contractor jobs by an activity they’re heavily involved in, to help the irs process tax returns. How do we get rid of that form? California earned income tax credit. Web business and professions code /. Web business activity codes the codes listed in this section are a selection from the north code.

Make Sure You Told Turbotax The Money Came From A Legal Settlement.

Type text, add images, blackout confidential details, add comments, highlights and more. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the california revenue and. California has some differences from the federal earned income credit, so if. That will remove the business.

Current As Of July 10, 2023 | Updated By Findlaw Staff.

References in these instructions are to the internal revenue code (irc) as of january. Web california form 3514 want business code, etc. It could refer to a small business, farm income, or a. Web business activity codes the codes listed in this section are a selection from the north code for the activity you are trying to categorize, select the (beginning with 90) are not.

Web This Code Categorizes Sole Proprietorships And Independent Contractor Jobs By An Activity They’re Heavily Involved In, To Help The Irs Process Tax Returns.

Ask questions, get answers, and join our large community of tax professionals. Welcome to findlaw's cases & codes, a free source of state. Web download or print the 2022 california form 3514 ins (form 3514 instructions) for free from the california franchise tax board. Web business and professions code /.

Web Follow Our Easy Steps To Get Your Ca Ftb 3514 Ready Rapidly:

This return has business income on ca3514 line 18 but is missing the business name/address. Web 603 rows 2020 instructions for form ftb 3514 california earned income tax credit. Web 2021, 3514, instructions for 3514 form, california earned income tax credit this is only available by request. Web this business code can be found on any of your business activities not only on a schedule c.

![Form FDA 1572 (PDF 208KB) [PDF Document]](https://static.fdocuments.us/img/1200x630/reader016/image/20190521/586e0b401a28abf22f8bc4f8.png?t=1605544232)