Form 3520 Inheritance

Form 3520 Inheritance - Person receives a gift, inheritance (a type of “gift”) from a foreign person, or a foreign trust distribution. Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over. Web irs form 3520 applies to american citizens who have inherited over $100,000 from another country. Web the common common reason for filing this irs form, is to report a foreign person gift. Even expatriates who live abroad must report an inheritance over that sum to. Web the form 3520 is generally required when a u.s. Web the irs form 3520 reports annually information about us persons’ (a) ownership of foreign trusts, (b) contributions to foreign trusts, (c) distributions from foreign trusts and (d) major. The nature of the foreign. Web if you have received a foreign gift or inheritance worth more than $100,000, you must file irs form 3520 or you could land with big penalties. Person who received foreign gifts of money or other property, you may need to report these gifts on form 3520, annual return to report transactions with.

Web the form 3520 is generally required when a u.s. The form provides information about the foreign trust, its u.s. Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over. So, why are foreign inheritances included in the. Ad talk to our skilled attorneys by scheduling a free consultation today. Person receives a bequest (inheritance) from a foreign person in excess of $100,000, the transaction requires a form 3520 filing requirement. Person receives a gift, inheritance (a type of “gift”) from a foreign person, or a foreign trust distribution. Web the common common reason for filing this irs form, is to report a foreign person gift. Web irs form 3520 applies to american citizens who have inherited over $100,000 from another country. Person who received foreign gifts of money or other property, you may need to report these gifts on form 3520, annual return to report transactions with.

Person who received foreign gifts of money or other property, you may need to report these gifts on form 3520, annual return to report transactions with. Web form 3520 is an informational tax form used to report certain foreign assets, inheritances, or certain large gifts from foreign persons. Web irs form 3520 applies to american citizens who have inherited over $100,000 from another country. The penalties for not properly reporting form 3520 can be significantly high — and if more than five months have passed since the reporting was. Register and subscribe now to work on your irs form 3520 & more fillable forms. Ad talk to our skilled attorneys by scheduling a free consultation today. Web the form 3520 is generally required when a u.s. Person receives a bequest (inheritance) from a foreign person in excess of $100,000, the transaction requires a form 3520 filing requirement. Complete, edit or print tax forms instantly. The form provides information about the foreign trust, its u.s.

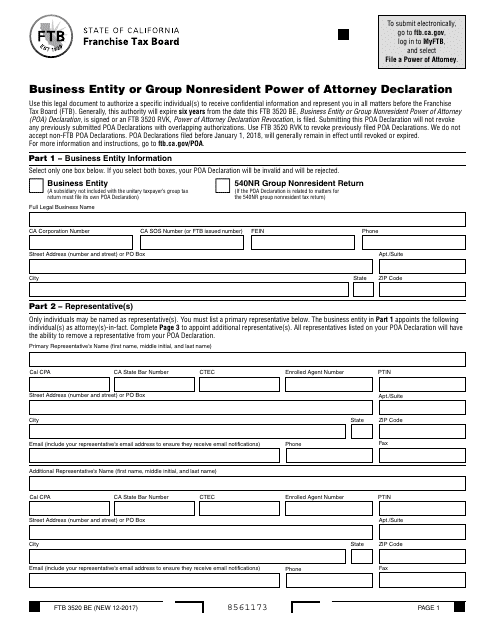

Form FTB 3520 BE Download Fillable PDF, Business Entity or Group

The nature of the foreign. Complete, edit or print tax forms instantly. Person who received foreign gifts of money or other property, you may need to report these gifts on form 3520, annual return to report transactions with. Web if you have received a foreign gift or inheritance worth more than $100,000, you must file irs form 3520 or you.

Steuererklärung dienstreisen Form 3520

Reportable gifts include transactions involving foreign individuals or entities, such as. Web as its title states, form 3520 is an information return by which us persons, as well as executors of the estates of us decedents, report: The penalties for not properly reporting form 3520 can be significantly high — and if more than five months have passed since the.

해외금융계좌 신고 4 Form 3520 (Annual Return of Report Transactions with

Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Reportable gifts include transactions involving foreign individuals or entities, such as. Web foreign inheritance & form 3520: Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over. The nature of the foreign.

Form 3520 What is it and How to Report Foreign Gift, Trust and

The form provides information about the foreign trust, its u.s. Web form 3520 is an informational tax form used to report certain foreign assets, inheritances, or certain large gifts from foreign persons. Person receives a gift, inheritance (a type of “gift”) from a foreign person, or a foreign trust distribution. So, why are foreign inheritances included in the. Complete, edit.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Reportable gifts include transactions involving foreign individuals or entities, such as. Person receives a bequest (inheritance) from a foreign person in excess of $100,000, the transaction requires a form 3520 filing requirement. Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over. Complete, edit or print.

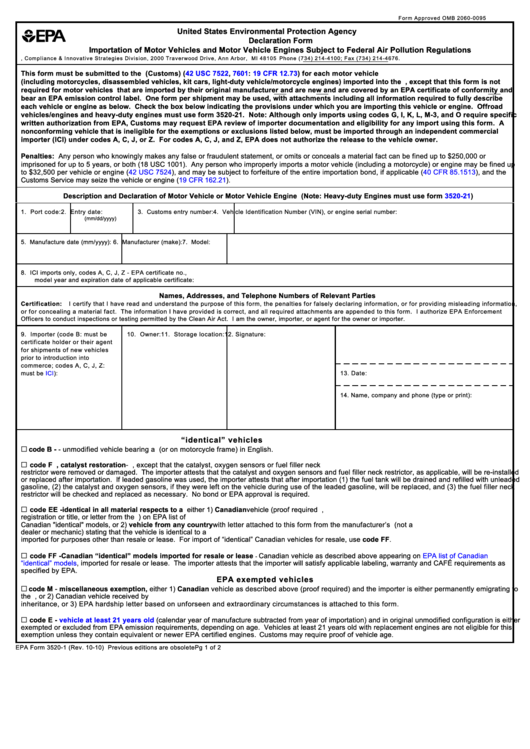

Top Epa Form 35201 Templates free to download in PDF format

Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over. The nature of the foreign. You only need part iv u.s. Web irs form 3520 applies to american citizens who have inherited over $100,000 from another country. Don’t feel alone if you’re dealing with irs form.

Reporting Foreign Inheritance with Form 3520

Complete, edit or print tax forms instantly. So, why are foreign inheritances included in the. Web form 3520 department of the treasury internal revenue service annual return to report transactions with foreign trusts and receipt of certain foreign gifts go to. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Reportable gifts include transactions involving foreign.

Inheritance Tax Illinois ellieldesign

Web the irs form 3520 reports annually information about us persons’ (a) ownership of foreign trusts, (b) contributions to foreign trusts, (c) distributions from foreign trusts and (d) major. Register and subscribe now to work on your irs form 3520 & more fillable forms. Complete, edit or print tax forms instantly. Web the common common reason for filing this irs.

Form 3520 US Taxes on Gifts and Inheritances

Web if you are a u.s. The penalties for not properly reporting form 3520 can be significantly high — and if more than five months have passed since the reporting was. Web foreign inheritance & form 3520: Web as its title states, form 3520 is an information return by which us persons, as well as executors of the estates of.

Form 3520 (2020) Instructions for Foreign Gifts & Inheritance

The irs form 3520 is used to report certain foreign transactions involving gifts and trusts. Register and subscribe now to work on your irs form 3520 & more fillable forms. Web form 3520 is an informational tax form used to report certain foreign assets, inheritances, or certain large gifts from foreign persons. Even expatriates who live abroad must report an.

You Only Need Part Iv U.s.

Register and subscribe now to work on your irs form 3520 & more fillable forms. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Ad talk to our skilled attorneys by scheduling a free consultation today. Complete, edit or print tax forms instantly.

Complete, Edit Or Print Tax Forms Instantly.

Web if you are a u.s. Web the form 3520 is generally required when a u.s. Person who received foreign gifts of money or other property, you may need to report these gifts on form 3520, annual return to report transactions with. Web form 3520 department of the treasury internal revenue service annual return to report transactions with foreign trusts and receipt of certain foreign gifts go to.

Reportable Gifts Include Transactions Involving Foreign Individuals Or Entities, Such As.

Even expatriates who live abroad must report an inheritance over that sum to. Web as its title states, form 3520 is an information return by which us persons, as well as executors of the estates of us decedents, report: The penalties for not properly reporting form 3520 can be significantly high — and if more than five months have passed since the reporting was. Web foreign inheritance & form 3520:

Web The Common Common Reason For Filing This Irs Form, Is To Report A Foreign Person Gift.

The form provides information about the foreign trust, its u.s. Web irs form 3520 applies to american citizens who have inherited over $100,000 from another country. So, why are foreign inheritances included in the. Web if you have received a foreign gift or inheritance worth more than $100,000, you must file irs form 3520 or you could land with big penalties.