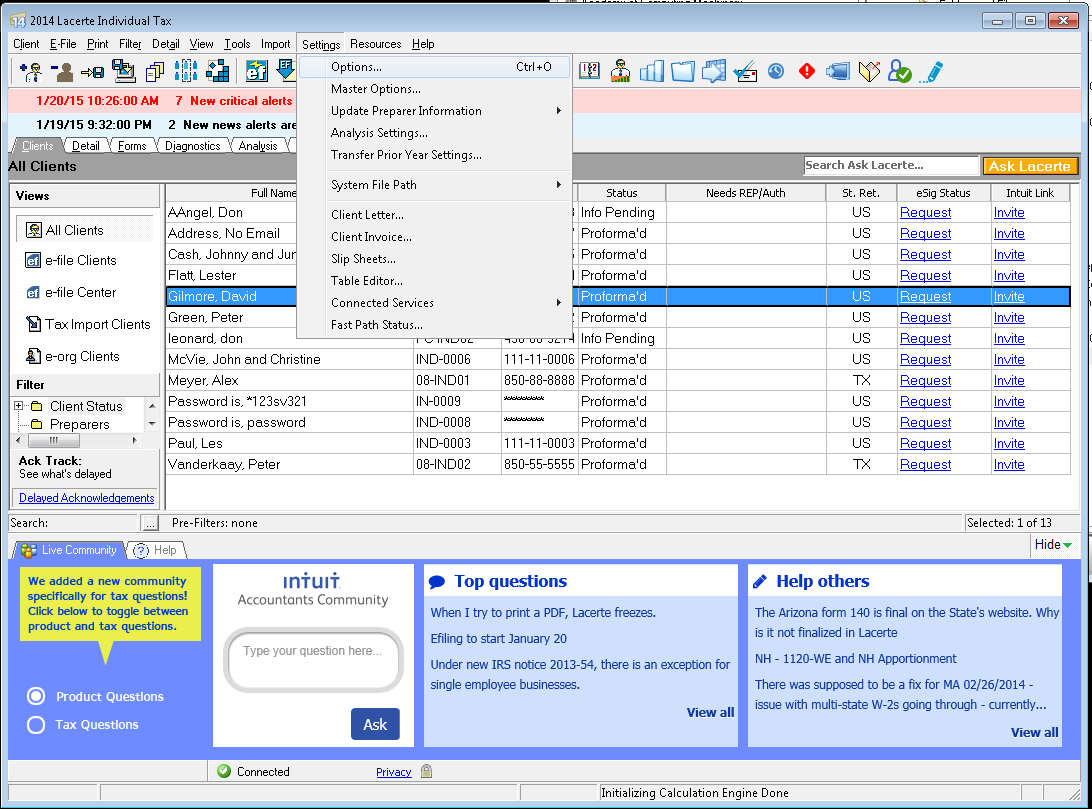

Form 3922 Lacerte

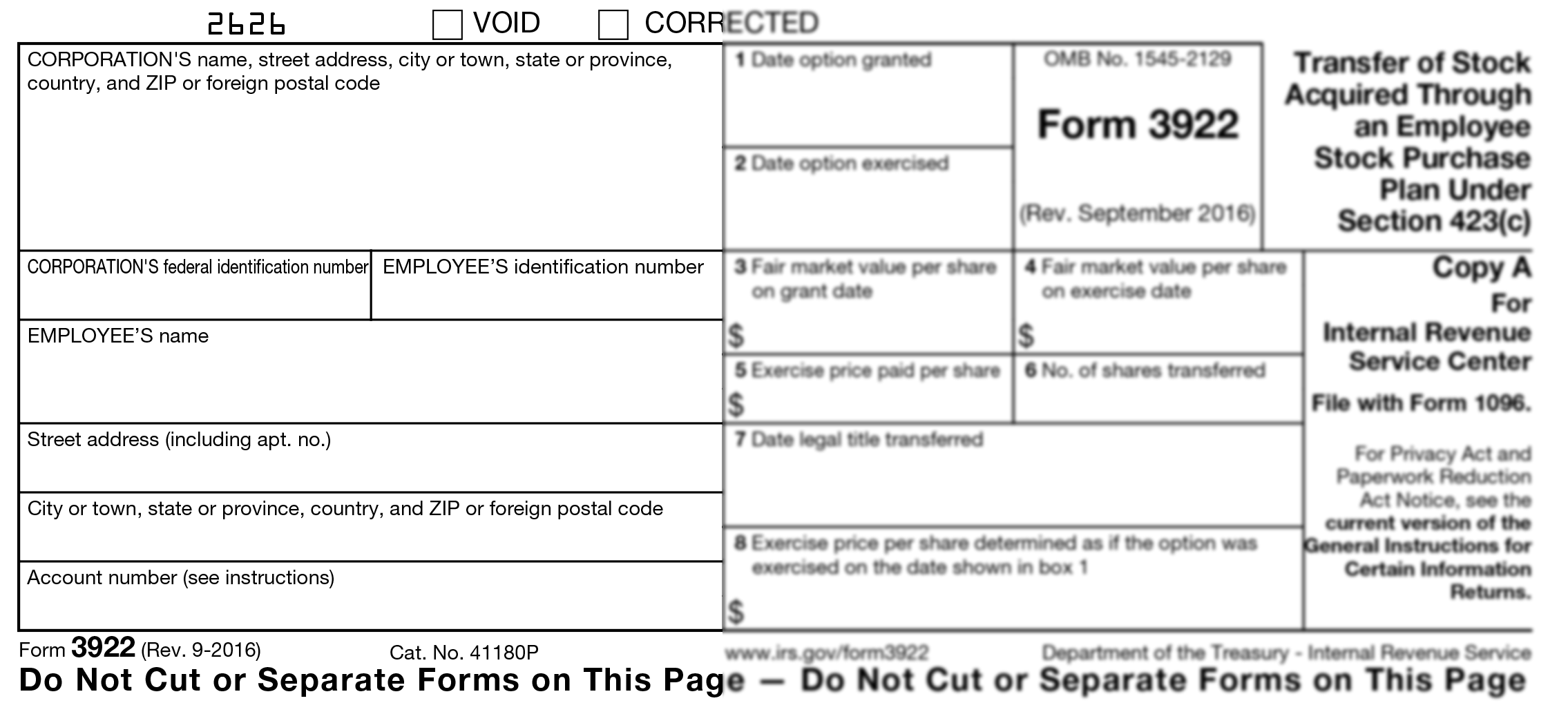

Form 3922 Lacerte - This is an approximation of the release dates for tax year 2022. This needs to be reported on your tax return. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. Additional release dates will be. Web instructions for forms 3921 and 3922 (10/2017) exercise of an incentive stock option under section 422 (b) and transfer of stock acquired through an employee. This article will help you enter. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web only if you sold stock that was purchased through an espp (employee stock purchase plan). Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. Web your employer (or its transfer agent) has recorded a first transfer of legal title of stock you acquired pursuant to your exercise of an option granted under an employee stock.

Web instructions for forms 3921 and 3922 (10/2017) exercise of an incentive stock option under section 422 (b) and transfer of stock acquired through an employee. Lacerte tax is #1 in tax document automation according to cpa practice advisor. Web lacerte 2022 release dates. Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800. Web most current instructions for forms 3921 and 3922. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. Web only if you sold stock that was purchased through an espp (employee stock purchase plan). Web electronic filing beginning 2024, you are required to file forms 3921 and 3922 electronically if you have 10 or more returns to file with the irs. All llcs in the state are required to pay this annual tax to stay compliant and in. Can you store the information on form 3922 ( basis information) in lacerte?

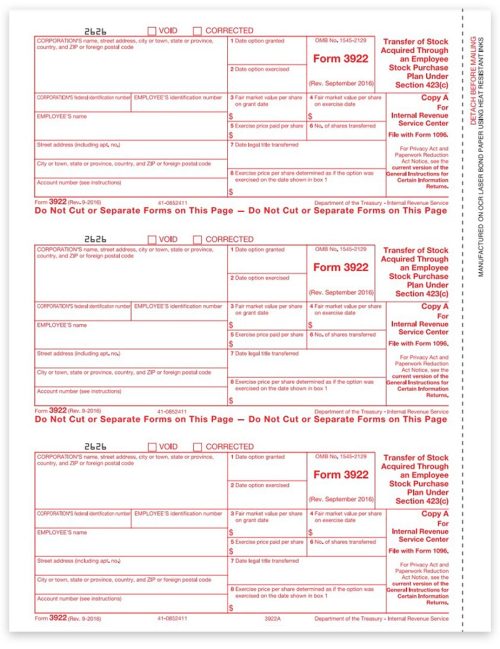

Solved • by intuit • 283 • updated july 19, 2022. Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800. Web lacerte business federal unlimited $ 3,197 lacerte business state unlimited $ 1,110 unlimited federal tax exempt (990) $ 1,784 unlimited federal estate allocation (706) $. Penalties for late filings $15 per form. Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. Web most current instructions for forms 3921 and 3922. Web only if you sold stock that was purchased through an espp (employee stock purchase plan). All dates posted are subject to change without notice. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates, related. Web instructions for forms 3921 and 3922 (10/2017) exercise of an incentive stock option under section 422 (b) and transfer of stock acquired through an employee.

What Is IRS Form 3922?

Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. This needs to be reported on your tax return. Web entering amounts from form 3921 in the individual module of lacerte. A chart in the general instructions gives a quick guide.

Lacerte keyboard shortcuts ‒ defkey

Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), is a form a taxpayer receives if they have. Can you store the information on form 3922 ( basis information) in lacerte? • lacerte • 362 • updated january 17, 2023. Penalties for late filings $15 per form. Web lacerte 2022 release dates.

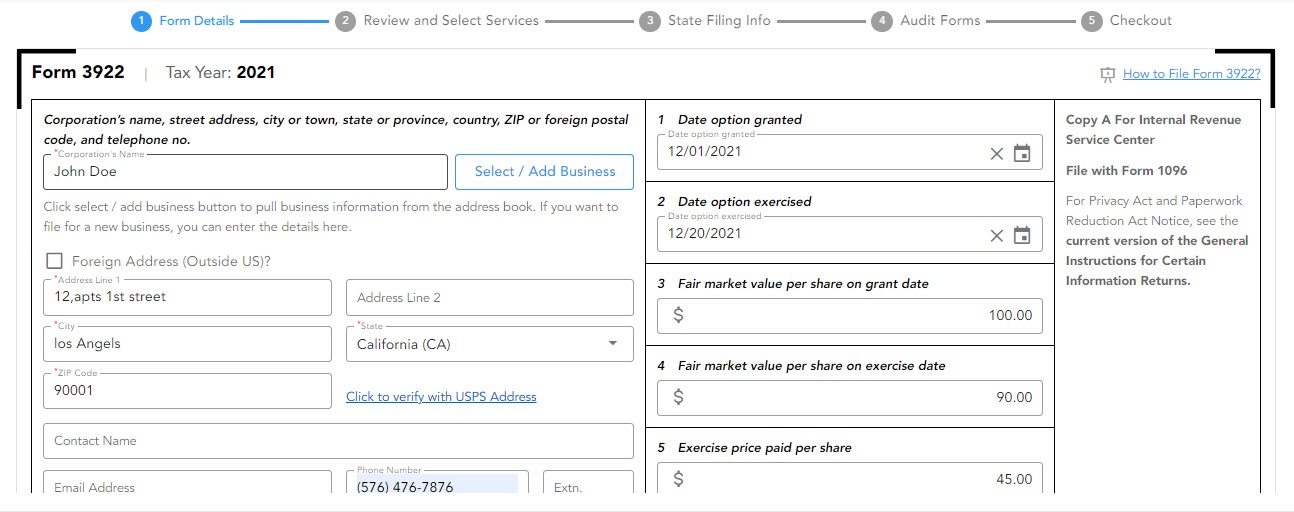

IRS Form 3922 Instructions 2022 How to Fill out Form 3922

Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates, related. Lacerte tax is #1 in tax document automation according.

IRS Form 3922

Penalties for late filings $15 per form. This needs to be reported on your tax return. Web lacerte 2022 release dates. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. Web electronic filing beginning 2024, you are required to file.

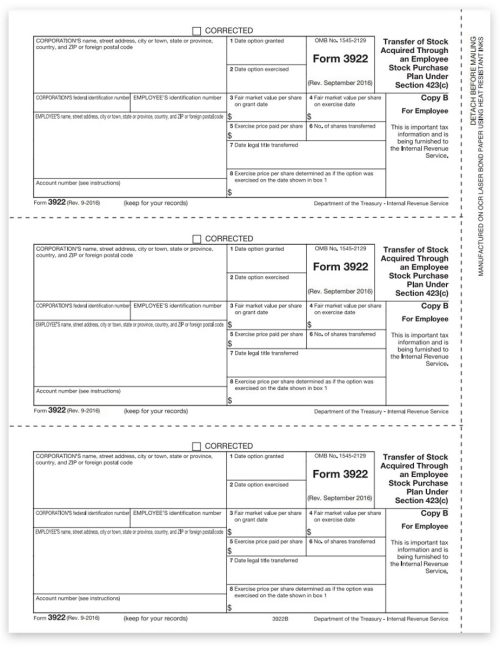

3922 Forms, Employee Stock Purchase, Employee Copy B DiscountTaxForms

Lacerte tax is #1 in tax document automation according to cpa practice advisor. Web lacerte 2022 release dates. Can you store the information on form 3922 ( basis information) in lacerte? Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section..

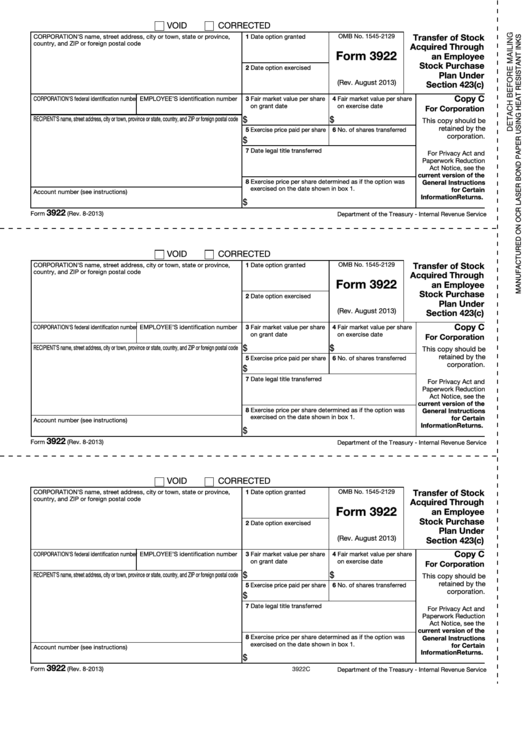

3922 2020 Public Documents 1099 Pro Wiki

This needs to be reported on your tax return. This is an approximation of the release dates for tax year 2022. All dates posted are subject to change without notice. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web irs form.

Form 3922 Transfer Of Stock Acquired Through An Employee Stock

Web entering amounts from form 3921 in the individual module of lacerte. This needs to be reported on your tax return. Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800. A chart in the general instructions gives a quick guide to which form must be filed to report a particular.

File IRS Form 3922 Online EFile Form 3922 for 2022

Web instructions for forms 3921 and 3922 (10/2017) exercise of an incentive stock option under section 422 (b) and transfer of stock acquired through an employee. All llcs in the state are required to pay this annual tax to stay compliant and in. Lacerte tax is #1 in tax document automation according to cpa practice advisor. All dates posted are.

IRS Form 3922 Software 289 eFile 3922 Software

Web electronic filing beginning 2024, you are required to file forms 3921 and 3922 electronically if you have 10 or more returns to file with the irs. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. This needs to be.

3922 Forms, Employee Stock Purchase, IRS Copy A DiscountTaxForms

Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates, related. Ad lacerte tax is your trusted leader in innovative solutions to taxpayer problems since 1978. Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. Web only if you sold stock that was.

This Needs To Be Reported On Your Tax Return.

Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), is a form a taxpayer receives if they have. Web instructions for forms 3921 and 3922 (10/2017) exercise of an incentive stock option under section 422 (b) and transfer of stock acquired through an employee. Penalties for late filings $15 per form. Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a.

Web Only If You Sold Stock That Was Purchased Through An Espp (Employee Stock Purchase Plan).

Web entering amounts from form 3921 in the individual module of lacerte. All llcs in the state are required to pay this annual tax to stay compliant and in. Web lacerte business federal unlimited $ 3,197 lacerte business state unlimited $ 1,110 unlimited federal tax exempt (990) $ 1,784 unlimited federal estate allocation (706) $. Can you store the information on form 3922 ( basis information) in lacerte?

Lacerte Tax Is #1 In Tax Document Automation According To Cpa Practice Advisor.

Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800. Web most current instructions for forms 3921 and 3922. This is an approximation of the release dates for tax year 2022. • lacerte • 362 • updated january 17, 2023.

Ad Lacerte Tax Is Your Trusted Leader In Innovative Solutions To Taxpayer Problems Since 1978.

This article will help you enter. Basis would carry forward in the software. All dates posted are subject to change without notice. Web your employer (or its transfer agent) has recorded a first transfer of legal title of stock you acquired pursuant to your exercise of an option granted under an employee stock.