Form 4136 Instructions 2022

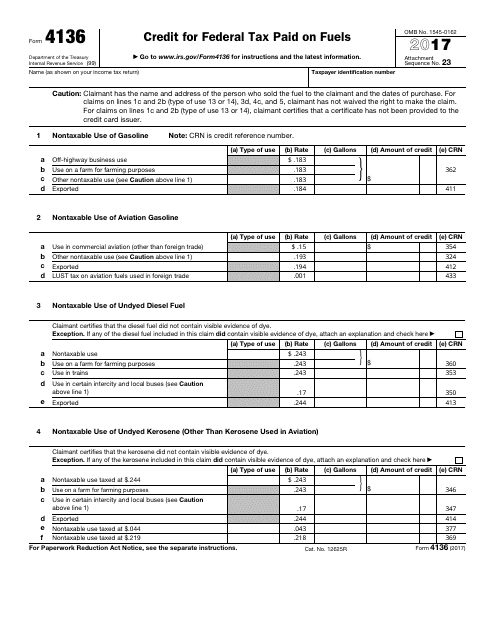

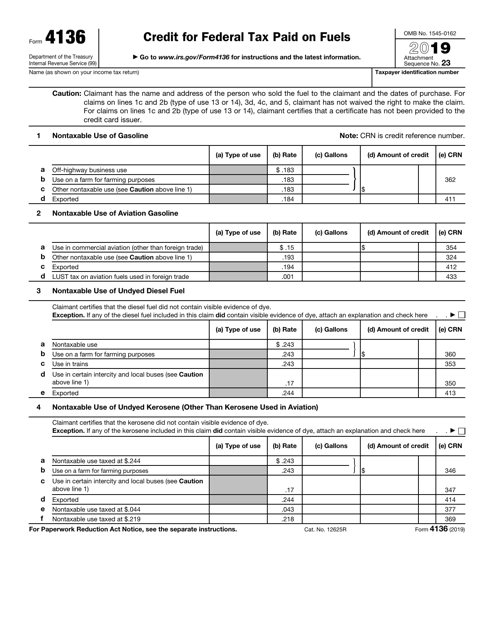

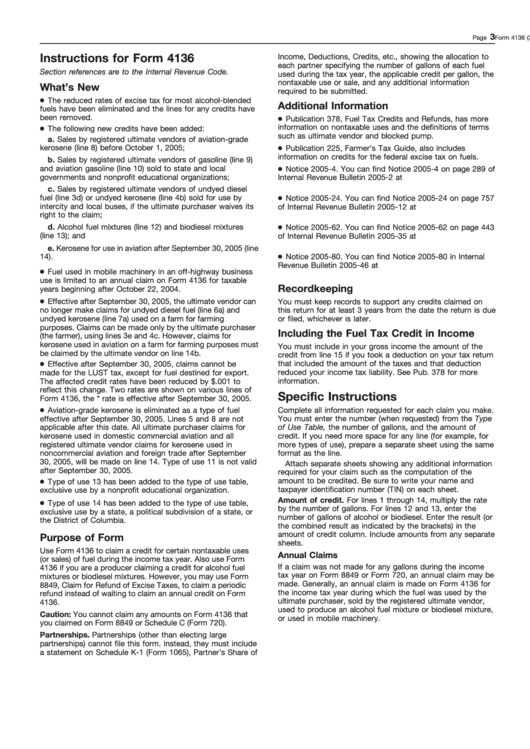

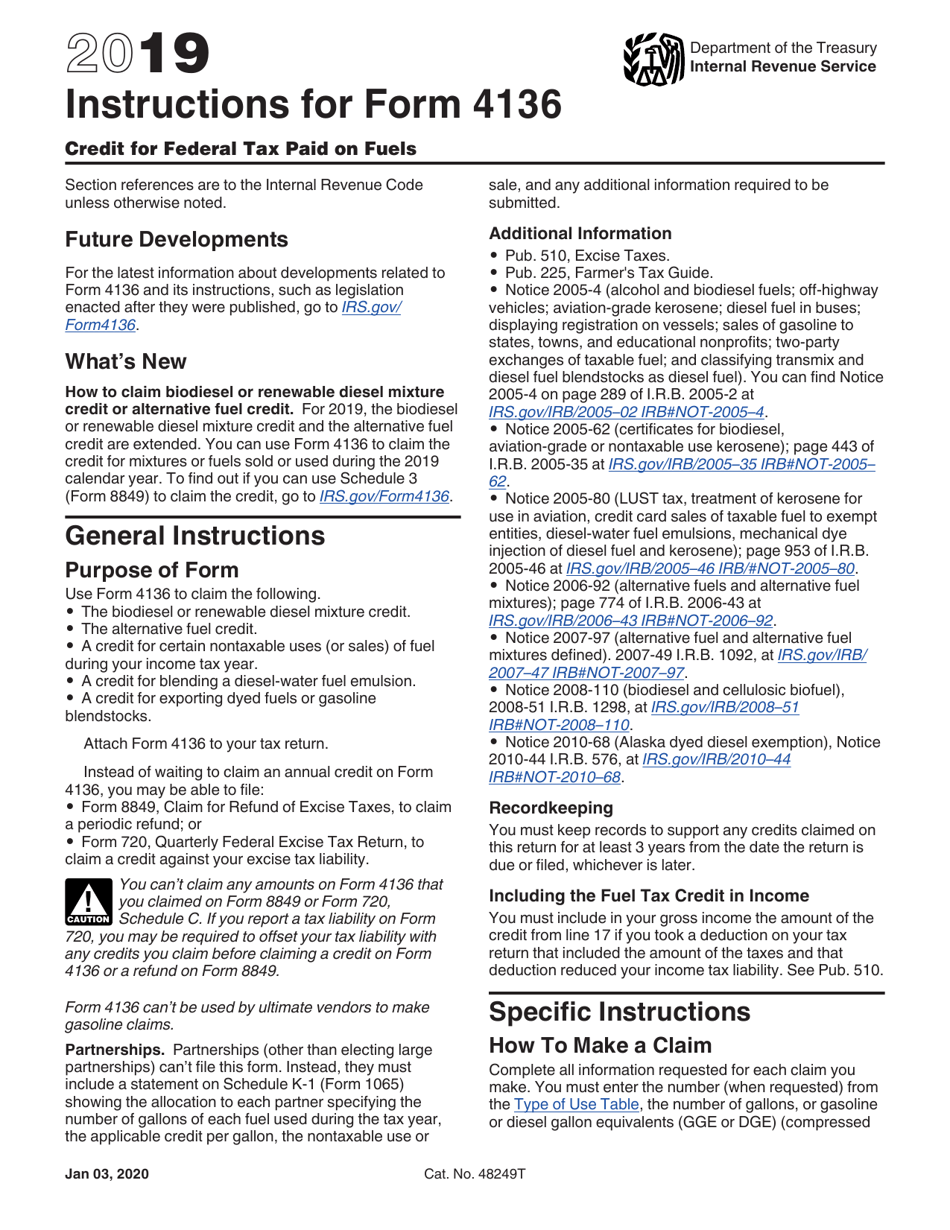

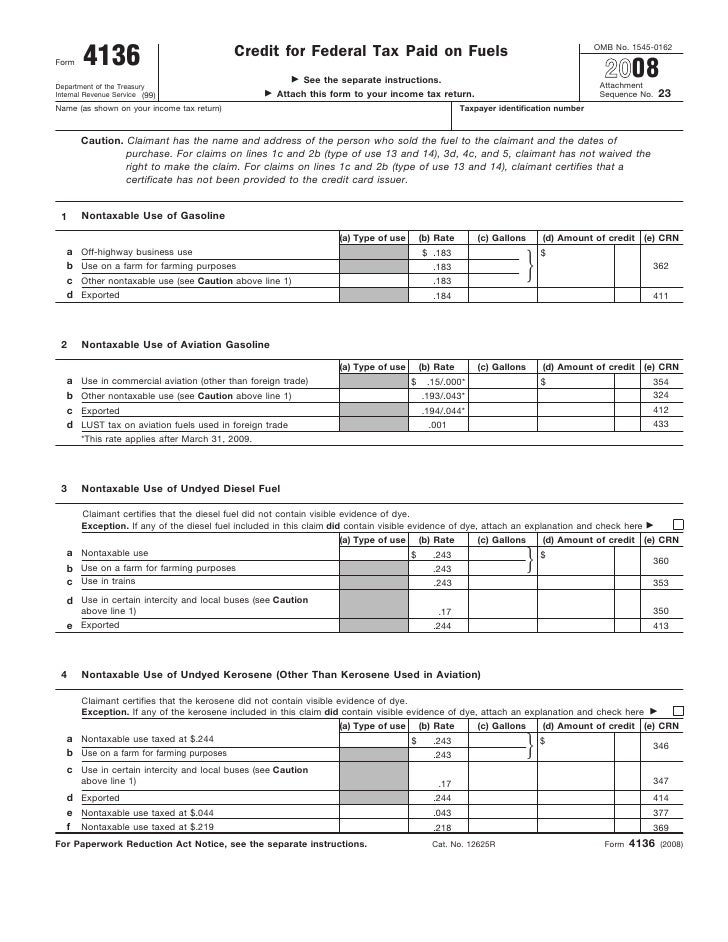

Form 4136 Instructions 2022 - Web claimant certifies that the diesel fuel did not contain visible evidence of dye. Use form 4136 to claim a credit. Instructions for form 4136, credit for federal tax paid on fuels 2022 01/31/2023 Ad access irs tax forms. Department of the treasury internal revenue service. If you downloaded or printed the 2022 form 4136 between january 12, 2023, and january 13, 2023, please note that line. Get ready for tax season deadlines by completing any required tax forms today. Web general instructions purpose of form use form 4136 to claim the following. 23 name (as shown on your income tax return). Credit for certain nontaxable uses (or sales) of fuel during your income tax year.

Credit for federal tax paid on fuels 2022 01/13/2023 inst 4136: Web taxslayer support what do i report on form 4136? You can make this adjustment on screen. Credit for certain nontaxable uses (or sales) of fuel during your income tax year. Web follow the simple instructions below: Web general instructions purpose of form use form 4136 to claim the following. Instructions for form 4136, credit for federal tax paid on fuels 2022 01/31/2023 For paperwork reduction act notice, see the separate instructions. Web or solely because a form id code changes without major formatting changes. Web to claim this credit, complete form 4136:

Instead, employers in the u.s. Web general instructions purpose of form use form 4136 to claim the following. (a) type of use (b) rate (c) gallons, or gasoline or diesel gallon equivalents (d) amount of credit (e) crn a liquefied petroleum gas (lpg) (see. Ad access irs tax forms. Credit for certain nontaxable uses (or sales) of fuel during your income tax year. Credit for federal tax paid on fuels 2022 01/13/2023 inst 4136: Complete, edit or print tax forms instantly. Web go to www.irs.gov/form4136 for instructions and the latest information. Complete, edit or print tax forms instantly. Web information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file.

IRS Form 4136 Download Fillable PDF or Fill Online Credit for Federal

Use form 4136 to claim a credit. Credit for federal tax paid on fuels. When individuals aren?t associated with document management and lawful processes, submitting irs forms can be extremely stressful. Credit for federal tax paid on fuels 2022 01/13/2023 inst 4136: Web general instructions purpose of form use form 4136 to claim the following.

Form 4136Credit for Federal Tax Paid on Fuel

Use form 4136 to claim a credit for federal taxes paid on certain fuels. Web taxslayer support what do i report on form 4136? Credit for federal tax paid on fuels 2022 01/13/2023 inst 4136: Web follow the simple instructions below: Use form 4136 to claim a credit.

IRS Form 4136 Download Fillable PDF or Fill Online Credit for Federal

Get ready for tax season deadlines by completing any required tax forms today. The credits available on form 4136 are: You can make this adjustment on screen. Nontaxable use of gasoline who can claim this credit generally, the ultimate purchaser is the only entity who can claim a tax credit on business. 23 name (as shown on your income tax.

Fill Free fillable Form 4136 Credit for Federal Tax Paid on Fuels

Web correction to form 4136 for tax year 2022. If you downloaded or printed the 2022 form 4136 between january 12, 2023, and january 13, 2023, please note that line. The credits available on form 4136 are: Get ready for tax season deadlines by completing any required tax forms today. Web follow the simple instructions below:

Instructions For Form 4136 2005 printable pdf download

Web or solely because a form id code changes without major formatting changes. The biodiesel or renewable diesel mixture credit. Territories will file form 941, or, if you prefer your. 23 name (as shown on your income tax return). Get ready for tax season deadlines by completing any required tax forms today.

Download Instructions for IRS Form 4136 Credit for Federal Tax Paid on

The biodiesel or renewable diesel mixture credit. Web for form 1120 filers: Web correction to form 4136 for tax year 2022. For paperwork reduction act notice, see the separate instructions. Credit for certain nontaxable uses (or sales) of fuel during your income tax year.

Form 4136 Credit For Federal Tax Paid on Fuels (2015) Free Download

Web to claim this credit, complete form 4136: Web claimant certifies that the diesel fuel did not contain visible evidence of dye. Web general instructions purpose of form use form 4136 to claim the following. Credit for certain nontaxable uses (or sales) of fuel during your income tax year. For paperwork reduction act notice, see the separate instructions.

Form 4136 Credit For Federal Tax Paid on Fuels (2015) Free Download

Get ready for tax season deadlines by completing any required tax forms today. For paperwork reduction act notice, see the separate instructions. Web to claim this credit, complete form 4136: Web follow the simple instructions below: Web or solely because a form id code changes without major formatting changes.

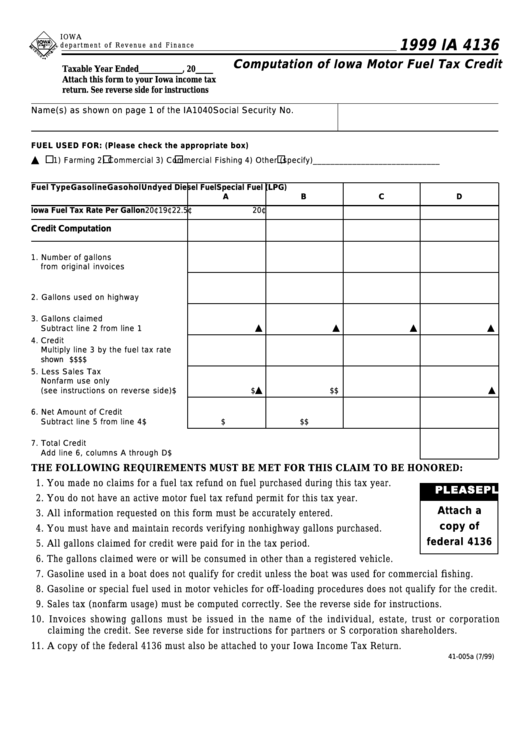

Form Ia 4136 Computation Of Iowa Motor Fuel Tax Credit 1999

Web taxslayer support what do i report on form 4136? Instead, employers in the u.s. Credit for federal tax paid on fuels. Web to claim this credit, complete form 4136: Web general instructions purpose of form use form 4136 to claim the following.

Form 4136Credit for Federal Tax Paid on Fuel

Credit for federal tax paid on fuels. Nontaxable use of gasoline who can claim this credit generally, the ultimate purchaser is the only entity who can claim a tax credit on business. Web general instructions purpose of form use form 4136 to claim the following. Use form 4136 to claim a credit for federal taxes paid on certain fuels. Form.

For Paperwork Reduction Act Notice, See The Separate Instructions.

Ad access irs tax forms. If you downloaded or printed the 2022 form 4136 between january 12, 2023, and january 13, 2023, please note that line. Web taxslayer support what do i report on form 4136? Credit for federal tax paid on fuels.

Web Correction To Form 4136 For Tax Year 2022.

You can make this adjustment on screen. Nontaxable use of gasoline who can claim this credit generally, the ultimate purchaser is the only entity who can claim a tax credit on business. Web claimant certifies that the diesel fuel did not contain visible evidence of dye. Web credit for federal tax paid on fuels (form 4136) the government taxes gasoline, diesel fuel, kerosene, alternative fuels and some other types of fuel.

(A) Type Of Use (B) Rate (C) Gallons, Or Gasoline Or Diesel Gallon Equivalents (D) Amount Of Credit (E) Crn A Liquefied Petroleum Gas (Lpg) (See.

Complete, edit or print tax forms instantly. Use form 4136 to claim a credit. Complete, edit or print tax forms instantly. Web go to www.irs.gov/form4136 for instructions and the latest information.

Web Follow The Simple Instructions Below:

Web or solely because a form id code changes without major formatting changes. Web to claim this credit, complete form 4136: Web for form 1120 filers: The biodiesel or renewable diesel mixture credit.