Form 433 A

Form 433 A - Download past year versions of this tax form as pdfs here: You may deal with a revenue officer if you have more $250,000 in tax debt owed, you’ve mixed business and personal expenses, or you have. This form is also about eight pages long. Individual income tax return an individual with a personal liability for excise tax If you are an individual who owes income tax on form 1040, The irs uses this form to determine whether you're able to satisfy an outstanding tax liability. Individual income tax return an individual with a personal liability for excise tax

Individual income tax return an individual with a personal liability for excise tax You may deal with a revenue officer if you have more $250,000 in tax debt owed, you’ve mixed business and personal expenses, or you have. This form is also about eight pages long. If you are an individual who owes income tax on form 1040, Individual income tax return an individual with a personal liability for excise tax Download past year versions of this tax form as pdfs here: The irs uses this form to determine whether you're able to satisfy an outstanding tax liability.

Individual income tax return an individual with a personal liability for excise tax If you are an individual who owes income tax on form 1040, The irs uses this form to determine whether you're able to satisfy an outstanding tax liability. This form is also about eight pages long. Download past year versions of this tax form as pdfs here: You may deal with a revenue officer if you have more $250,000 in tax debt owed, you’ve mixed business and personal expenses, or you have. Individual income tax return an individual with a personal liability for excise tax

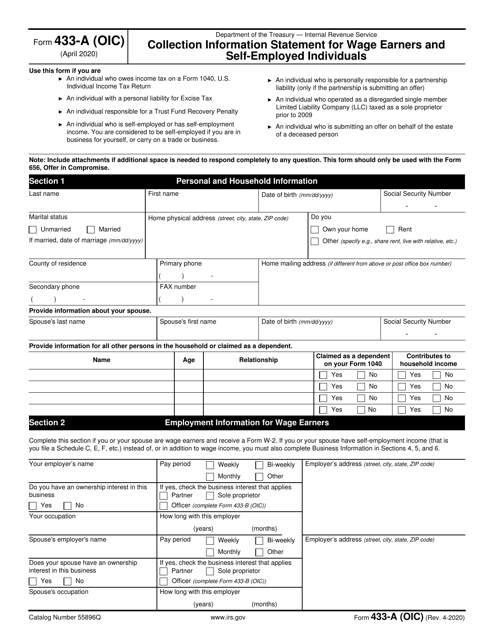

Form 433A (OIC) Collection Information Statement for Wage Earners

This form is also about eight pages long. You may deal with a revenue officer if you have more $250,000 in tax debt owed, you’ve mixed business and personal expenses, or you have. Download past year versions of this tax form as pdfs here: Individual income tax return an individual with a personal liability for excise tax The irs uses.

Irs Form 433 A Instructions Form Resume Examples 05KA6wD3wP

Individual income tax return an individual with a personal liability for excise tax You may deal with a revenue officer if you have more $250,000 in tax debt owed, you’ve mixed business and personal expenses, or you have. If you are an individual who owes income tax on form 1040, This form is also about eight pages long. Individual income.

Form 433A (OIC) Download Fillable PDF or Fill Online Collection

Download past year versions of this tax form as pdfs here: If you are an individual who owes income tax on form 1040, You may deal with a revenue officer if you have more $250,000 in tax debt owed, you’ve mixed business and personal expenses, or you have. The irs uses this form to determine whether you're able to satisfy.

Form 433A (OIC) Collection Information Statement for Wage Earners

If you are an individual who owes income tax on form 1040, You may deal with a revenue officer if you have more $250,000 in tax debt owed, you’ve mixed business and personal expenses, or you have. Individual income tax return an individual with a personal liability for excise tax Download past year versions of this tax form as pdfs.

IRS Form 433A 2019 Fillable and Editable PDF Template

This form is also about eight pages long. Individual income tax return an individual with a personal liability for excise tax The irs uses this form to determine whether you're able to satisfy an outstanding tax liability. If you are an individual who owes income tax on form 1040, Download past year versions of this tax form as pdfs here:

IRS Form 433A (OIC) 2018 2019 Fill out and Edit Online PDF Template

The irs uses this form to determine whether you're able to satisfy an outstanding tax liability. You may deal with a revenue officer if you have more $250,000 in tax debt owed, you’ve mixed business and personal expenses, or you have. Individual income tax return an individual with a personal liability for excise tax This form is also about eight.

Form 433A (OIC) Collection Information Statement for Wage Earners

This form is also about eight pages long. Download past year versions of this tax form as pdfs here: The irs uses this form to determine whether you're able to satisfy an outstanding tax liability. Individual income tax return an individual with a personal liability for excise tax If you are an individual who owes income tax on form 1040,

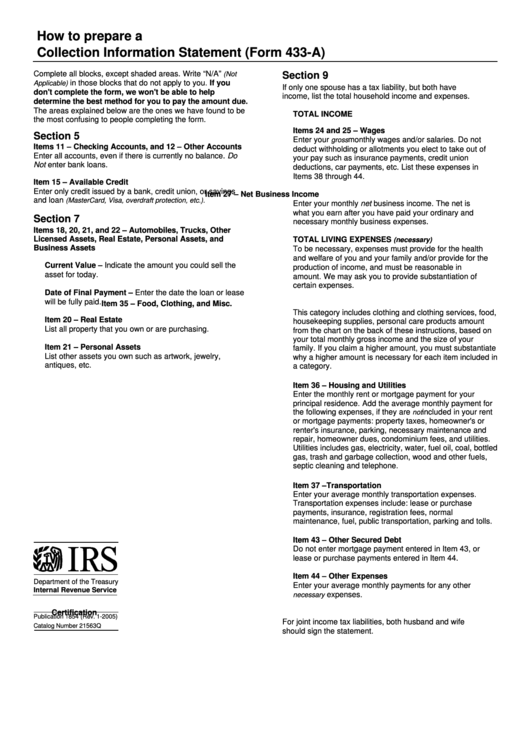

Instructions For Form 433A 2005 printable pdf download

Individual income tax return an individual with a personal liability for excise tax You may deal with a revenue officer if you have more $250,000 in tax debt owed, you’ve mixed business and personal expenses, or you have. If you are an individual who owes income tax on form 1040, Download past year versions of this tax form as pdfs.

Download Form 433A for Free Page 5 FormTemplate

This form is also about eight pages long. You may deal with a revenue officer if you have more $250,000 in tax debt owed, you’ve mixed business and personal expenses, or you have. Individual income tax return an individual with a personal liability for excise tax If you are an individual who owes income tax on form 1040, The irs.

Stephen B Jordan, EA Form 433A / Form 433F

If you are an individual who owes income tax on form 1040, This form is also about eight pages long. Individual income tax return an individual with a personal liability for excise tax You may deal with a revenue officer if you have more $250,000 in tax debt owed, you’ve mixed business and personal expenses, or you have. Download past.

If You Are An Individual Who Owes Income Tax On Form 1040,

Individual income tax return an individual with a personal liability for excise tax Download past year versions of this tax form as pdfs here: You may deal with a revenue officer if you have more $250,000 in tax debt owed, you’ve mixed business and personal expenses, or you have. This form is also about eight pages long.

Individual Income Tax Return An Individual With A Personal Liability For Excise Tax

The irs uses this form to determine whether you're able to satisfy an outstanding tax liability.