Form 5329 Instructions

Form 5329 Instructions - Go to www.irs.gov/form5329 for instructions and the latest information. Web what is irs form 5329? Form 5329 applies to each individual that might owe a penalty, so for married couples filing jointly, each spouse must complete their own form. Web form 5329 instructions get tax form 5329 from a government agency, a tax preparation service, or you can download it from the irs website. Web form 5329 is the tax form used to calculate possibly irs penalties from the situations listed above and possibly request a penalty waiver. Want more help with form 5329? Form 5329 must accompany a taxpayer's annual tax return. Individual retirement accounts (iras) roth iras Web 12 — other — see form 5329 instructions. Once you have the proper form, fill in your personal details including your name, address, and social security number.

Web form 5329 is the tax form used to calculate possibly irs penalties from the situations listed above and possibly request a penalty waiver. Web note that the form should be the version for that year (i.e., reporting a missed rmd for the tax year 2022 should be done on a 2022 form 5329). Web form 5329 instructions get tax form 5329 from a government agency, a tax preparation service, or you can download it from the irs website. Web common triggers for form 5329 include receiving early distributions and making excess contributions to qualified retirement accounts. Individual retirement accounts (iras) roth iras Web form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Form 5329 applies to each individual that might owe a penalty, so for married couples filing jointly, each spouse must complete their own form. Go to www.irs.gov/form5329 for instructions and the latest information. Use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or. To view form 5329 instructions, visit irs.gov.

Web 12 — other — see form 5329 instructions. Web what is irs form 5329? The following steps are from the 2022 form 5329: Go to www.irs.gov/form5329 for instructions and the latest information. Use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or. Want more help with form 5329? Web form 5329 instructions get tax form 5329 from a government agency, a tax preparation service, or you can download it from the irs website. Form 5329 must accompany a taxpayer's annual tax return. Web form 5329 is the tax form used to calculate possibly irs penalties from the situations listed above and possibly request a penalty waiver. The irs website contains downloadable versions of form 5329 going back to 1975.

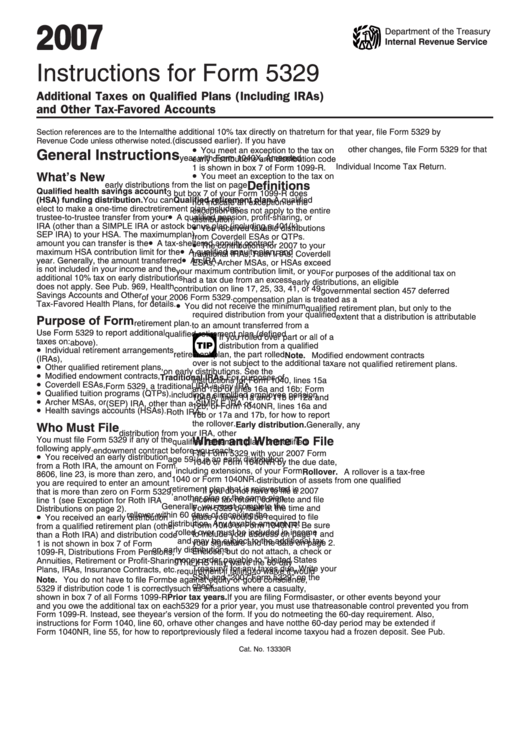

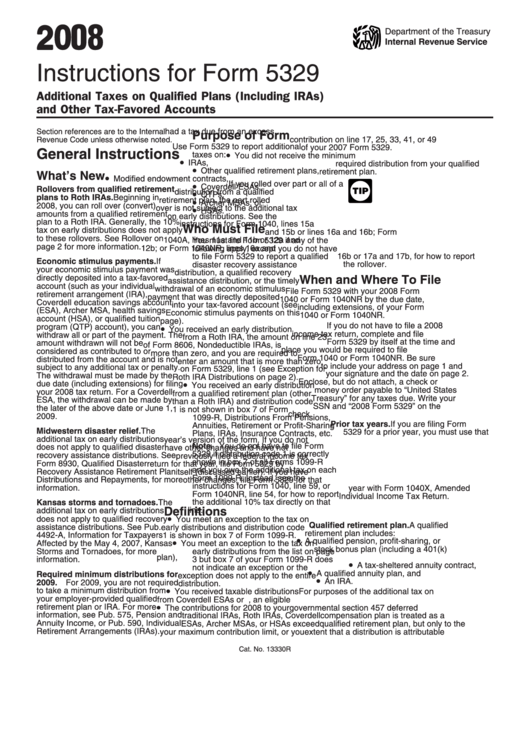

Instructions For Form 5329 Additional Taxes On Qualified Plans And

Web form 5329 is the tax form used to calculate possibly irs penalties from the situations listed above and possibly request a penalty waiver. Web 12 — other — see form 5329 instructions. Web note that the form should be the version for that year (i.e., reporting a missed rmd for the tax year 2022 should be done on a.

IRS Form 5329 Instructions How To File Retirement Plan Tax Form IRS

Web common triggers for form 5329 include receiving early distributions and making excess contributions to qualified retirement accounts. Web what is irs form 5329? Form 5329 applies to each individual that might owe a penalty, so for married couples filing jointly, each spouse must complete their own form. Use form 5329 to report additional taxes on iras, other qualified retirement.

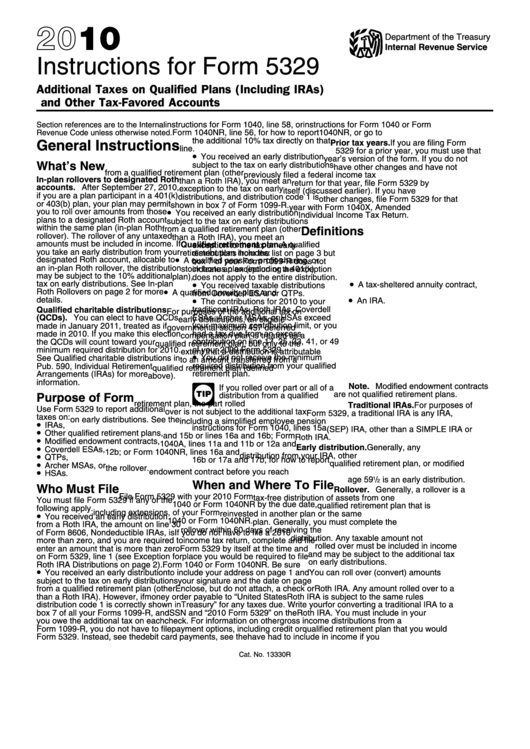

Instructions For Form 5329 2010 printable pdf download

The following steps are from the 2022 form 5329: Web 12 — other — see form 5329 instructions. Form 5329 applies to each individual that might owe a penalty, so for married couples filing jointly, each spouse must complete their own form. Web form 5329 is used by any individual who has established a retirement account, annuity or retirement bond..

Form 5329 Instructions & Exception Information for IRS Form 5329

Web common triggers for form 5329 include receiving early distributions and making excess contributions to qualified retirement accounts. Web note that the form should be the version for that year (i.e., reporting a missed rmd for the tax year 2022 should be done on a 2022 form 5329). Also, use this code if more than one exception applies. Go to.

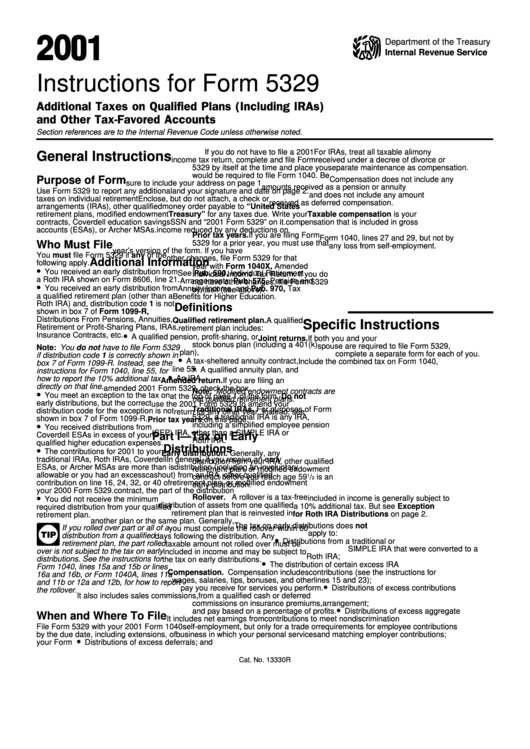

Instructions For Form 5329 Additional Taxes Attributable To Iras

Web common triggers for form 5329 include receiving early distributions and making excess contributions to qualified retirement accounts. The following steps are from the 2022 form 5329: The irs website contains downloadable versions of form 5329 going back to 1975. If you’re looking for more help with tax reporting using form 5329, get the help of h&r block. Web what.

Instructions For Form 5329 Additional Taxes On Qualified Plans And

The following steps are from the 2022 form 5329: If you’re looking for more help with tax reporting using form 5329, get the help of h&r block. Go to www.irs.gov/form5329 for instructions and the latest information. Want more help with form 5329? Web note that the form should be the version for that year (i.e., reporting a missed rmd for.

Instructions For Form 5329 Additional Taxes On Qualified Plans

The irs website contains downloadable versions of form 5329 going back to 1975. Form 5329 applies to each individual that might owe a penalty, so for married couples filing jointly, each spouse must complete their own form. Go to www.irs.gov/form5329 for instructions and the latest information. Web note that the form should be the version for that year (i.e., reporting.

Form 5329 Instructions & Exception Information for IRS Form 5329

Form 5329 must accompany a taxpayer's annual tax return. Go to www.irs.gov/form5329 for instructions and the latest information. The following steps are from the 2022 form 5329: Also, use this code if more than one exception applies. Once you have the proper form, fill in your personal details including your name, address, and social security number.

Instructions for How to Fill in IRS Form 5329

Form 5329 applies to each individual that might owe a penalty, so for married couples filing jointly, each spouse must complete their own form. Form 5329 must accompany a taxpayer's annual tax return. Once you have the proper form, fill in your personal details including your name, address, and social security number. Want more help with form 5329? Web form.

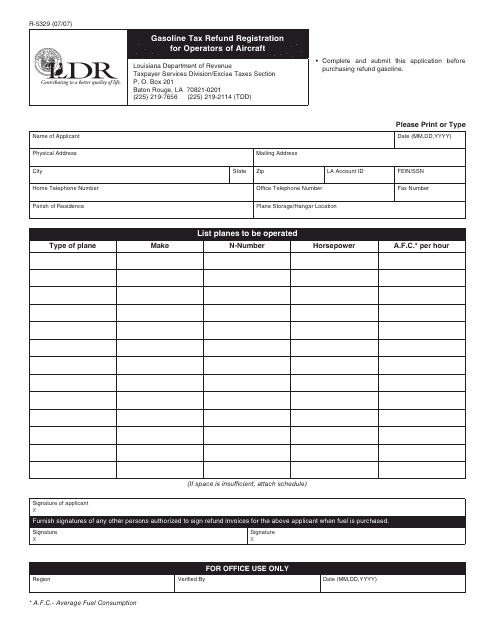

Form R5329 Download Printable PDF or Fill Online Gasoline Tax Refund

Form 5329 must accompany a taxpayer's annual tax return. To view form 5329 instructions, visit irs.gov. The irs website contains downloadable versions of form 5329 going back to 1975. Want more help with form 5329? Web what is irs form 5329?

Form 5329 Must Accompany A Taxpayer's Annual Tax Return.

Web note that the form should be the version for that year (i.e., reporting a missed rmd for the tax year 2022 should be done on a 2022 form 5329). Form 5329 applies to each individual that might owe a penalty, so for married couples filing jointly, each spouse must complete their own form. The following steps are from the 2022 form 5329: Web what is irs form 5329?

Use Form 5329 To Report Additional Taxes On Iras, Other Qualified Retirement Plans, Modified Endowment Contracts, Coverdell Esas, Qtps, Archer Msas, Or.

Web form 5329 instructions get tax form 5329 from a government agency, a tax preparation service, or you can download it from the irs website. To view form 5329 instructions, visit irs.gov. Web common triggers for form 5329 include receiving early distributions and making excess contributions to qualified retirement accounts. Web 12 — other — see form 5329 instructions.

Once You Have The Proper Form, Fill In Your Personal Details Including Your Name, Address, And Social Security Number.

Web form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. If you’re looking for more help with tax reporting using form 5329, get the help of h&r block. Web form 5329 is the tax form used to calculate possibly irs penalties from the situations listed above and possibly request a penalty waiver. Want more help with form 5329?

Also, Use This Code If More Than One Exception Applies.

Go to www.irs.gov/form5329 for instructions and the latest information. Individual retirement accounts (iras) roth iras The irs website contains downloadable versions of form 5329 going back to 1975.