Form 5471 Filing Instructions

Form 5471 Filing Instructions - Shareholder who doesn't qualify as either a category 5b or 5c filer. Follow the instructions below for an individual (1040) return, or. So, a 5a filer is an unrelated section 958(a) u.s. Web the form 5471 instructions as laid out by the irs defines the criteria for each category of filer (5 in total) and the requirements for each. Web form 5471 is used by certain u.s. Draft version of the instructions[pdf 511 kb] for form 5471 for 2018. Web information about form 5471, information return of u.s. When and where to file. File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file.

The draft instructions reflect a “watermark” date of december 12. Web changes to form 5471. Web solved • by intuit • proconnect tax • 2 • updated december 14, 2022. Follow the instructions below for an individual (1040) return, or. Web information about form 5471, information return of u.s. Draft version of the instructions[pdf 511 kb] for form 5471 for 2018. Shareholder, while a 5c filer is a related constructive u.s. Also, the checkbox for category 5 has been deleted and replaced with checkboxes for new categories 5a, 5b, and 5c. Web the person that files form 5471 must complete form 5471 in the manner described in the instructions for item h. Persons who are officers, directors, or shareholders in certain foreign corporations.

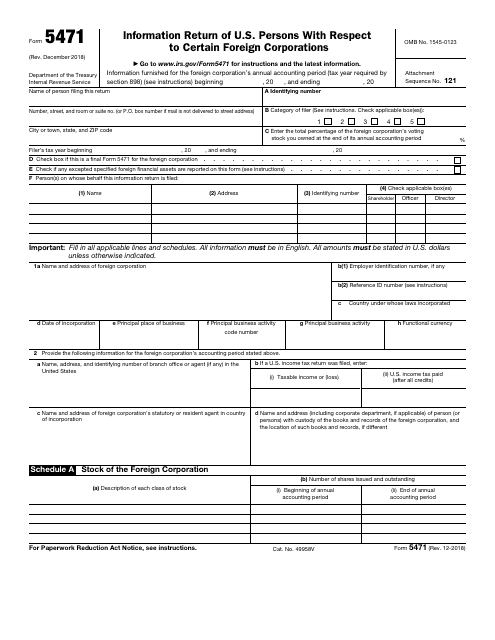

Web form 5471 is used by certain u.s. Web information about form 5471, information return of u.s. Shareholder who doesn't qualify as either a category 5b or 5c filer. On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and replaced with checkboxes for new categories 1a, 1b, and 1c. When and where to file. The form and schedules are used to satisfy the filing requirements of sections 6038 and 6046, and the related regulations, as well as to report amounts related to section 965. So, a 5a filer is an unrelated section 958(a) u.s. Also, the checkbox for category 5 has been deleted and replaced with checkboxes for new categories 5a, 5b, and 5c. Web the instructions to form 5471 describes a category 5a filer as a u.s. All persons identified in item h must attach a statement to their income tax return that includes the information described in the instructions for item h.

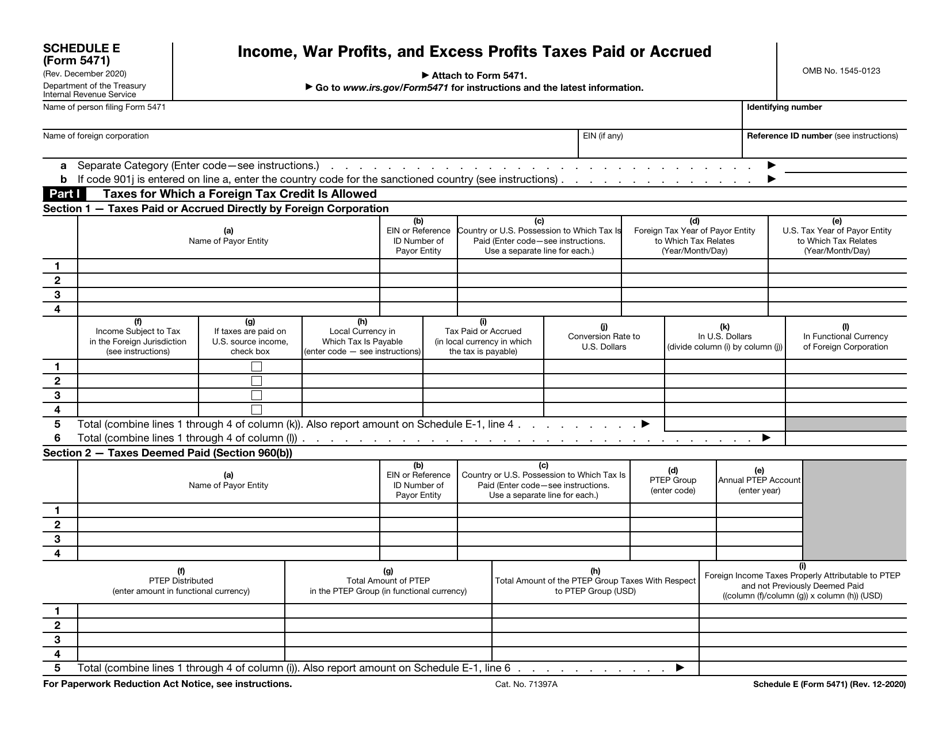

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Web the person that files form 5471 must complete form 5471 in the manner described in the instructions for item h. Web the form 5471 instructions as laid out by the irs defines the criteria for each category of filer (5 in total) and the requirements for each. Draft version of the instructions[pdf 511 kb] for form 5471 for 2018..

2012 form 5471 instructions Fill out & sign online DocHub

Web the form 5471 instructions as laid out by the irs defines the criteria for each category of filer (5 in total) and the requirements for each. Also, the checkbox for category 5 has been deleted and replaced with checkboxes for new categories 5a, 5b, and 5c. Web information about form 5471, information return of u.s. Persons with respect to.

IRS Issues Updated New Form 5471 What's New?

The draft instructions reflect a “watermark” date of december 12. Web changes to form 5471. Web the irs has provided a draft version of instructions for form 5471 for 2018. Web solved • by intuit • proconnect tax • 2 • updated december 14, 2022. Shareholder who doesn't qualify as either a category 5b or 5c filer.

IRS Form 5471 Carries Heavy Penalties and Consequences

When and where to file. This article will help you generate form 5471 and any required schedules. Web the irs has provided a draft version of instructions for form 5471 for 2018. Web the person that files form 5471 must complete form 5471 in the manner described in the instructions for item h. Persons who are officers, directors, or shareholders.

IRS Form 5471 Filing Instructions for Green Card Holders and US

On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and replaced with checkboxes for new categories 1a, 1b, and 1c. Shareholder, while a 5c filer is a related constructive u.s. Follow the instructions below for an individual (1040) return, or. Web the form 5471 instructions as laid out by the.

Download Instructions for IRS Form 5471 Information Return of U.S

Persons who are officers, directors, or shareholders in certain foreign corporations. Web form 5471 is used by certain u.s. Web information about form 5471, information return of u.s. Web changes to form 5471. Also, the checkbox for category 5 has been deleted and replaced with checkboxes for new categories 5a, 5b, and 5c.

form 5471 schedule e1 Fill Online, Printable, Fillable Blank form

The form and schedules are used to satisfy the filing requirements of sections 6038 and 6046, and the related regulations, as well as to report amounts related to section 965. Also, the checkbox for category 5 has been deleted and replaced with checkboxes for new categories 5a, 5b, and 5c. Persons with respect to certain foreign corporations • read the..

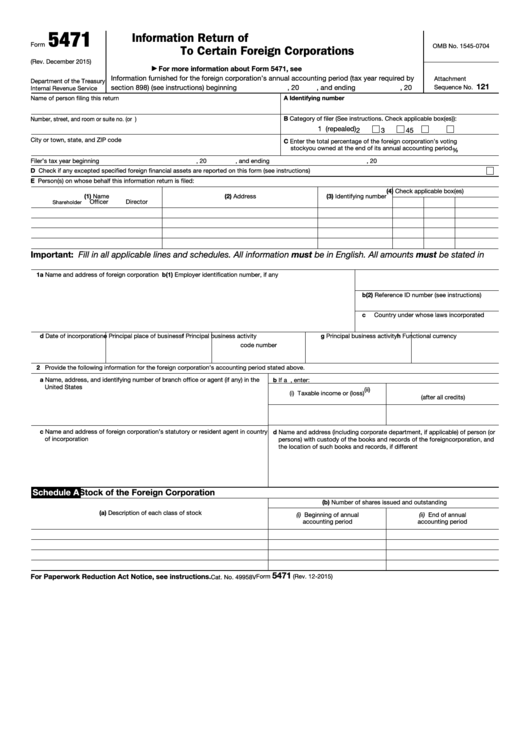

Fillable Form 5471 Information Return Of U.s. Persons With Respect To

Web changes to form 5471. The draft instructions reflect a “watermark” date of december 12. Shareholder, while a 5c filer is a related constructive u.s. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. Form 5471[pdf 218 kb], information return of u.s.

IRS Form 5471 Download Fillable PDF or Fill Online Information Return

Web the form 5471 instructions as laid out by the irs defines the criteria for each category of filer (5 in total) and the requirements for each. Shareholder, while a 5c filer is a related constructive u.s. File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. The form and schedules are used.

Filing Form 5471 Everything You Need to Know

Persons with respect to certain foreign corporations • read the. When and where to file. Persons who are officers, directors, or shareholders in certain foreign corporations. Form 5471[pdf 218 kb], information return of u.s. Web information about form 5471, information return of u.s.

Web The Person That Files Form 5471 Must Complete Form 5471 In The Manner Described In The Instructions For Item H.

Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. Web changes to form 5471. The form and schedules are used to satisfy the filing requirements of sections 6038 and 6046, and the related regulations, as well as to report amounts related to section 965. Form 5471[pdf 218 kb], information return of u.s.

Shareholder Who Doesn't Qualify As Either A Category 5B Or 5C Filer.

File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Draft version of the instructions[pdf 511 kb] for form 5471 for 2018. This article will help you generate form 5471 and any required schedules. Also, the checkbox for category 5 has been deleted and replaced with checkboxes for new categories 5a, 5b, and 5c.

Web The Instructions To Form 5471 Describes A Category 5A Filer As A U.s.

Persons who are officers, directors, or shareholders in certain foreign corporations. So, a 5a filer is an unrelated section 958(a) u.s. Follow the instructions below for an individual (1040) return, or. Web solved • by intuit • proconnect tax • 2 • updated december 14, 2022.

When And Where To File.

Shareholder, while a 5c filer is a related constructive u.s. On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and replaced with checkboxes for new categories 1a, 1b, and 1c. Web the irs has provided a draft version of instructions for form 5471 for 2018. All persons identified in item h must attach a statement to their income tax return that includes the information described in the instructions for item h.