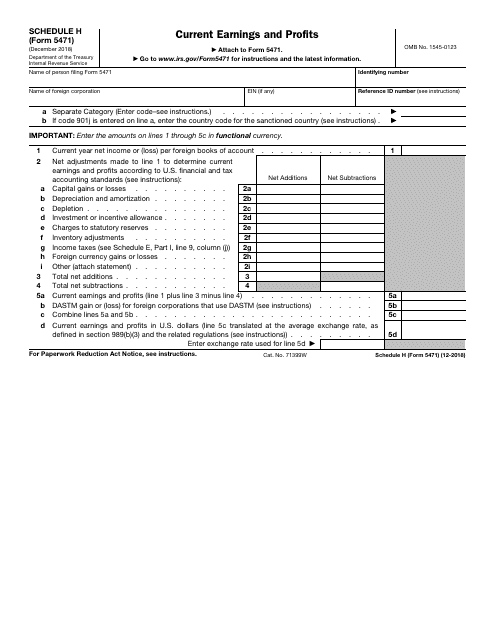

Form 5471 Schedule H

Form 5471 Schedule H - Gaap income reported on schedule c includes any expenses or income related to ptep that should not be included in current year e&p. Anyone preparing a form 5471 knows that the. For instructions and the latest information. On lines 1 and 2, the Department of the treasury internal revenue service. Web schedule h (form 5471), current earnings and profits foreign corporation’s that file form 5471 use this schedule to report the current e&p for u.s. The instructions for schedule h, line 2i, have been revised to clarify that taxpayers must report an adjustment if u.s. A foreign corporation's e&p is completed in a similar fashion to an e&p calculation for. Web form 5471, officially called the information return of u.s. Web schedule h is completed with a form 5471 to disclose the current earnings & profits (e&p) of the cfc.

On lines 1 and 2, the Web schedule h is used to report a foreign corporation’s current earnings and profits (“e&p”) for us tax purposes to the internal revenue service (“irs”). Persons with respect to certain foreign corporations, is an information statement (information return) (as opposed to a tax return) for certain u.s. Department of the treasury internal revenue service. A foreign corporation's e&p is completed in a similar fashion to an e&p calculation for. Gaap income reported on schedule c includes any expenses or income related to ptep that should not be included in current year e&p. Anyone preparing a form 5471 knows that the. The instructions for schedule h, line 2i, have been revised to clarify that taxpayers must report an adjustment if u.s. Web all persons identified in item h must complete a separate schedule p (form 5471) if the person is a u.s. Recently, schedule h was revised.

December 2021) current earnings and profits. Shareholder described in category 1a, 1b, 4, 5a, or 5b. For instructions and the latest information. Gaap income reported on schedule c includes any expenses or income related to ptep that should not be included in current year e&p. Persons with respect to certain foreign corporations, is an information statement (information return) (as opposed to a tax return) for certain u.s. The instructions for schedule h, line 2i, have been revised to clarify that taxpayers must report an adjustment if u.s. Web schedule h (form 5471) (rev. Web schedule h (form 5471), current earnings and profits foreign corporation’s that file form 5471 use this schedule to report the current e&p for u.s. Web form 5471, officially called the information return of u.s. Web schedule h (form 5471) (december 2018) schedule h (form 5471) department of the treasury internal revenue service current earnings and profits attach to form 5471.

Demystifying the Form 5471 Part 9. Schedule G SF Tax Counsel

All schedule h (form 5471) revisions Recently, schedule h was revised. Persons with respect to certain foreign corporations, is an information statement (information return) (as opposed to a tax return) for certain u.s. Web an overview of schedule h of form 5471 schedule h is used to report a cfc’s current e&p. This article is designed to supplement the irs.

IRS Form 5471 Schedule H SF Tax Counsel

A foreign corporation's e&p is completed in a similar fashion to an e&p calculation for. Department of the treasury internal revenue service. Category 4 and category 5 filers complete schedule h. Persons with respect to certain foreign corporations, is an information statement (information return) (as opposed to a tax return) for certain u.s. Go to www.irs.gov/form5471 for instructions and the.

The Tax Times New Form 5471, Sch Q You Really Need to Understand

For instructions and the latest information. The instructions for schedule h, line 2i, have been revised to clarify that taxpayers must report an adjustment if u.s. Web schedule h (form 5471), current earnings and profits foreign corporation’s that file form 5471 use this schedule to report the current e&p for u.s. Anyone preparing a form 5471 knows that the. Who.

2018 Form IRS 5471 Fill Online, Printable, Fillable, Blank PDFfiller

Go to www.irs.gov/form5471 for instructions and the latest information. Web schedule h (form 5471) (rev. All schedule h (form 5471) revisions The instructions for schedule h, line 2i, have been revised to clarify that taxpayers must report an adjustment if u.s. Gaap income reported on schedule c includes any expenses or income related to ptep that should not be included.

The IRS Makes Significant Changes to Schedule H of Form 5471 SF Tax

Anyone preparing a form 5471 knows that the. Web all persons identified in item h must complete a separate schedule p (form 5471) if the person is a u.s. On lines 1 and 2, the The instructions for schedule h, line 2i, have been revised to clarify that taxpayers must report an adjustment if u.s. Web schedule h is completed.

A Dive into the New Form 5471 Categories of Filers and the Schedule R

The instructions for schedule h, line 2i, have been revised to clarify that taxpayers must report an adjustment if u.s. Web schedule h is used to report a foreign corporation’s current earnings and profits (“e&p”) for us tax purposes to the internal revenue service (“irs”). December 2021) current earnings and profits. Web schedule h (form 5471) (rev. Recently, schedule h.

IRS Form 5471 Schedule E and Schedule H SF Tax Counsel

Web an overview of schedule h of form 5471 schedule h is used to report a cfc’s current e&p. Web schedule h (form 5471) (december 2018) schedule h (form 5471) department of the treasury internal revenue service current earnings and profits attach to form 5471. Web schedule h (form 5471), current earnings and profits foreign corporation’s that file form 5471.

Guide to Form 5471 Schedule E and Schedule H SF Tax Counsel

December 2021) current earnings and profits. Category 4 and category 5 filers complete schedule h. The instructions for schedule h, line 2i, have been revised to clarify that taxpayers must report an adjustment if u.s. Web schedule h (form 5471), current earnings and profits foreign corporation’s that file form 5471 use this schedule to report the current e&p for u.s..

Form 5471, Pages 24 YouTube

Web all persons identified in item h must complete a separate schedule p (form 5471) if the person is a u.s. Web an overview of schedule h of form 5471 schedule h is used to report a cfc’s current e&p. In such a case, the schedule p must be attached to the statement described above. Web schedule h (form 5471).

IRS Form 5471 Schedule H Download Fillable PDF or Fill Online Current

The instructions for schedule h, line 2i, have been revised to clarify that taxpayers must report an adjustment if u.s. Web schedule h is completed with a form 5471 to disclose the current earnings & profits (e&p) of the cfc. December 2021) current earnings and profits. Recently, schedule h was revised. For instructions and the latest information.

Web Form 5471, Officially Called The Information Return Of U.s.

Who must complete schedule h. The instructions for schedule h, line 2i, have been revised to clarify that taxpayers must report an adjustment if u.s. Recently, schedule h was revised. Web schedule h (form 5471) (december 2018) schedule h (form 5471) department of the treasury internal revenue service current earnings and profits attach to form 5471.

Web All Persons Identified In Item H Must Complete A Separate Schedule P (Form 5471) If The Person Is A U.s.

Gaap income reported on schedule c includes any expenses or income related to ptep that should not be included in current year e&p. This article is designed to supplement the irs instructions to the form 5471. Anyone preparing a form 5471 knows that the. Web schedule h (form 5471) (rev.

A Foreign Corporation's E&P Is Completed In A Similar Fashion To An E&P Calculation For.

On lines 1 and 2, the All schedule h (form 5471) revisions December 2021) current earnings and profits. Department of the treasury internal revenue service.

Persons With Respect To Certain Foreign Corporations, Is An Information Statement (Information Return) (As Opposed To A Tax Return) For Certain U.s.

Web schedule h is completed with a form 5471 to disclose the current earnings & profits (e&p) of the cfc. Web schedule h is used to report a foreign corporation’s current earnings and profits (“e&p”) for us tax purposes to the internal revenue service (“irs”). Category 4 and category 5 filers complete schedule h. In such a case, the schedule p must be attached to the statement described above.