Form 5471 Schedule Q Instructions

Form 5471 Schedule Q Instructions - Web schedule q(form 5471) (december 2020) cfc income by cfc income groups department of the treasuryinternal revenue service attach to form 5471. Taxpayer who is a shareholder in any section 965 specified foreign corporation. Shareholders of the cfc so. The december 2021 revision of separate. Web on this new schedule q, the cfc income in each cfc income group of the cfc is reported to the u.s. Web and today, we're going to give you an overview of the form 5471. On schedule q, should column (xi) net income tie to schedule h line 5 current earnings and profits? Web complete a separate schedule q with respect to each applicable category of income (see instructions). Anyone preparing a form 5471 knows. Web on its webpage, the irs has clarified its instructions for 2020 schedule q (cfc income by cfc income groups) of form 5471 (information return of u.s.

And as julie mentioned, there. Web on its webpage, the irs has clarified its instructions for 2020 schedule q (cfc income by cfc income groups) of form 5471 (information return of u.s. An sfc includes any foreign corporation with one or more. On schedule q, should column (xi) net income tie to schedule h line 5 current earnings and profits? Web complete a separate schedule q with respect to each applicable category of income (see instructions). Web starting in tax year 2020, the new separate schedule q (form 5471), cfc income by cfc income groups, is used to report the cfc's income in each cfc income. Web introduction to schedule q of form 5471 schedule q will be used to report a cfc’s income, deductions, taxes, and assets by cfc income groups. Enter separate category code with respect to which this schedule q is. Shareholders of the cfc so that the u.s. Schedule q (form 5471) (rev.

Web at this time, the irs has yet to release draft instructions for forms 5471 and 5471 (schedule q) so it is difficult to comment further on the forthcoming impact. Shareholders of the cfc so. And as julie mentioned, there. Check the box if this form 5471 has been completed using “alternative. Web schedule q(form 5471) (december 2020) cfc income by cfc income groups department of the treasuryinternal revenue service attach to form 5471. Web the article is based on the instructions promulgated by the internal revenue service (“irs”). Schedule q (form 5471) (rev. On schedule q, should column (xi) net income tie to schedule h line 5 current earnings and profits? Web on this new schedule q, the cfc income in each cfc income group of the cfc is reported to the u.s. Web introduction to schedule q of form 5471 schedule q will be used to report a cfc’s income, deductions, taxes, and assets by cfc income groups.

IRS Issues Updated New Form 5471 What's New?

Who must complete the form 5471 schedule q. Web on its webpage, the irs has clarified its instructions for 2020 schedule q (cfc income by cfc income groups) of form 5471 (information return of u.s. Web complete a separate schedule q with respect to each applicable category of income (see instructions). On schedule q, should column (xi) net income tie.

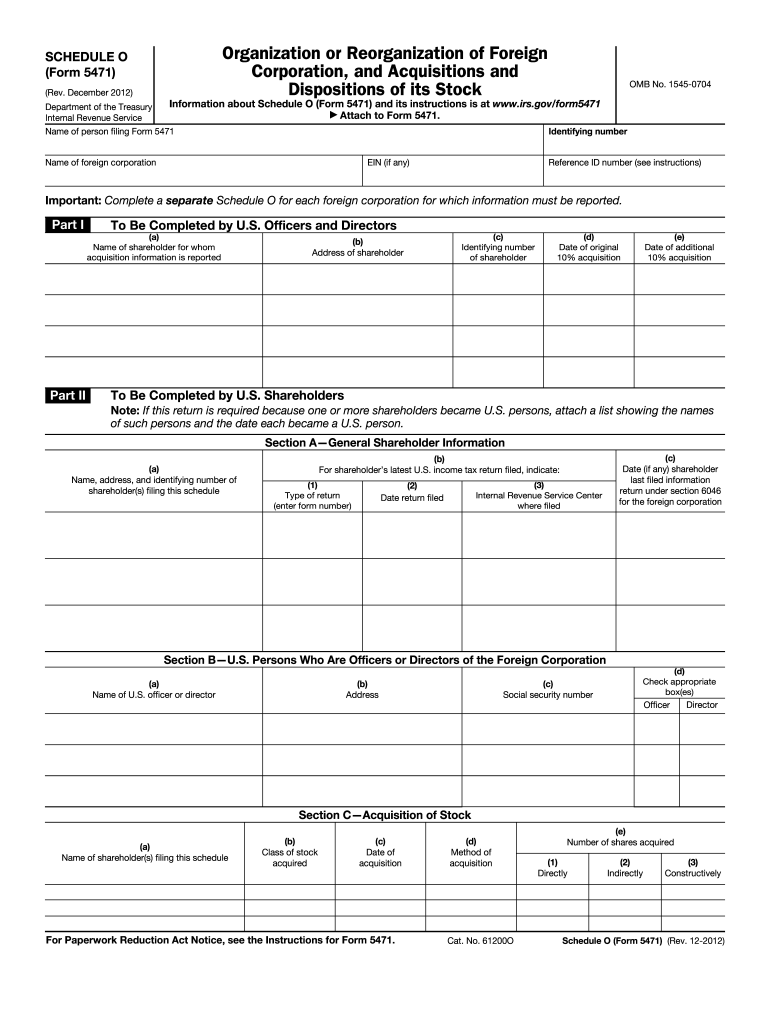

20122021 Form IRS 5471 Schedule O Fill Online, Printable, Fillable

Web introduction to schedule q of form 5471 schedule q will be used to report a cfc’s income, deductions, taxes, and assets by cfc income groups. Taxpayer who is a shareholder in any section 965 specified foreign corporation. Web starting in tax year 2020, the new separate schedule q (form 5471), cfc income by cfc income groups, is used to.

form 5471 schedule i1 instructions Fill Online, Printable, Fillable

The december 2021 revision of separate. Schedule q (form 5471) (rev. Web on its webpage, the irs has clarified its instructions for 2020 schedule q (cfc income by cfc income groups) of form 5471 (information return of u.s. So let's jump right into it. And as julie mentioned, there.

form 5471 schedule j instructions 2022 Fill Online, Printable

The december 2021 revision of separate. Web on this new schedule q, the cfc income in each cfc income group of the cfc is reported to the u.s. Shareholders of the cfc so. Web on its webpage, the irs has clarified its instructions for 2020 schedule q (cfc income by cfc income groups) of form 5471 (information return of u.s..

form 5471 schedule e1 Fill Online, Printable, Fillable Blank form

Web starting in tax year 2020 a new schedule q (form 5471) is used to report the cfc’s income in each cfc income group to the u.s. Web form 5471 (schedule r) distributions from a foreign corporation 1220 12/28/2020 form 5471 (schedule q) cfc income by cfc income groups 1222 12/01/2022 form 5471. On schedule q, should column (xi) net.

The Tax Times New Form 5471, Sch Q You Really Need to Understand

Schedule q (form 5471) (rev. Web on its webpage, the irs has clarified its instructions for 2020 schedule q (cfc income by cfc income groups) of form 5471 (information return of u.s. An sfc includes any foreign corporation with one or more. Web schedule q(form 5471) (december 2020) cfc income by cfc income groups department of the treasuryinternal revenue service.

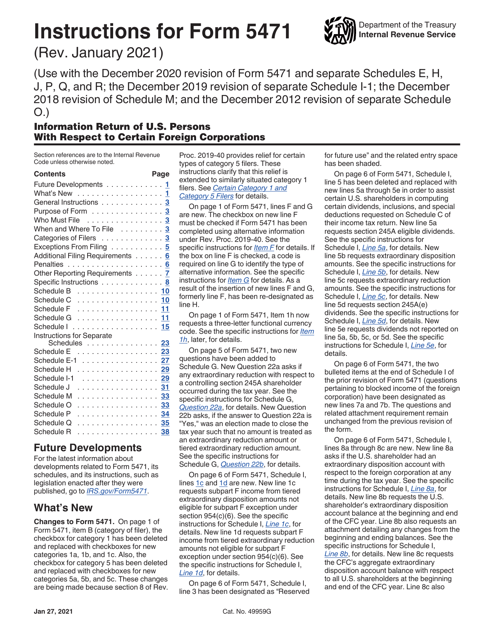

Download Instructions for IRS Form 5471 Information Return of U.S

Web and today, we're going to give you an overview of the form 5471. Anyone preparing a form 5471 knows. An sfc includes any foreign corporation with one or more. Taxpayer who is a shareholder in any section 965 specified foreign corporation. The december 2021 revision of separate.

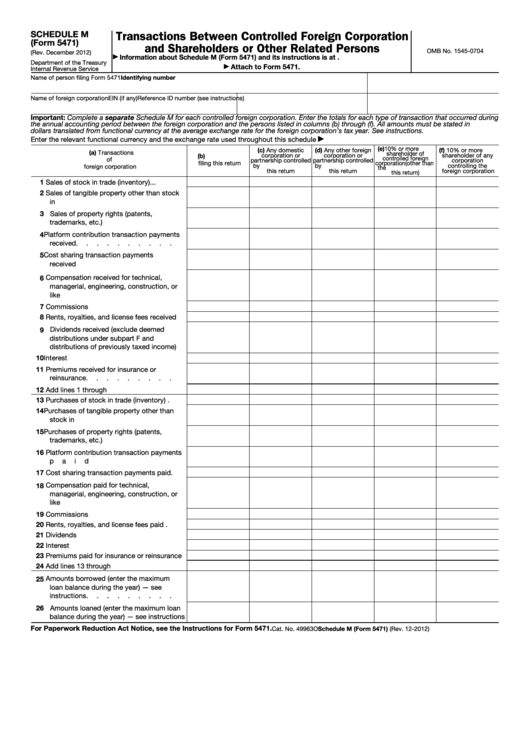

Fillable Form 5471 Schedule M Transactions Between Controlled

Who must complete the form 5471 schedule q. Web the article is based on the instructions promulgated by the internal revenue service (“irs”). Web and today, we're going to give you an overview of the form 5471. Web instructions for form 5471(rev. Taxpayer who is a shareholder in any section 965 specified foreign corporation.

A Brief Introduction to the Brand New Schedule Q and Schedule R for IRS

Web and today, we're going to give you an overview of the form 5471. Schedule q & schedule r question: Who must complete the form 5471 schedule q. Shareholders of the cfc so that the u.s. Web starting in tax year 2020 a new schedule q (form 5471) is used to report the cfc’s income in each cfc income group.

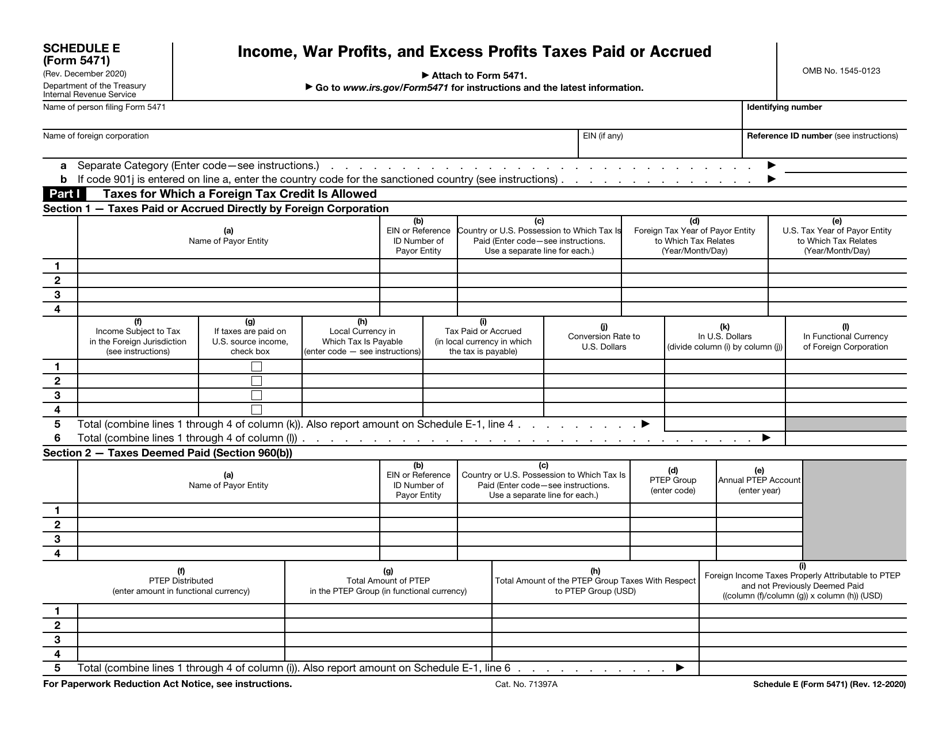

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

For this portion of the discussion, we're going to be discussing the purpose of form. Web category 1 filer any u.s. Who must complete the form 5471 schedule q. Shareholders can use it to. Web on its webpage, the irs has clarified its instructions for 2020 schedule q (cfc income by cfc income groups) of form 5471 (information return of.

Web On This New Schedule Q, The Cfc Income In Each Cfc Income Group Of The Cfc Is Reported To The U.s.

Web and today, we're going to give you an overview of the form 5471. Schedule q (form 5471) (rev. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web starting in tax year 2020 a new schedule q (form 5471) is used to report the cfc’s income in each cfc income group to the u.s.

Shareholders Can Use It To.

Web instructions for form 5471(rev. And as julie mentioned, there. Anyone preparing a form 5471 knows. An sfc includes any foreign corporation with one or more.

Web On Its Webpage, The Irs Has Clarified Its Instructions For 2020 Schedule Q (Cfc Income By Cfc Income Groups) Of Form 5471 (Information Return Of U.s.

Web starting in tax year 2020, the new separate schedule q (form 5471), cfc income by cfc income groups, is used to report the cfc's income in each cfc income. Taxpayer who is a shareholder in any section 965 specified foreign corporation. Check the box if this form 5471 has been completed using “alternative. On schedule q, should column (xi) net income tie to schedule h line 5 current earnings and profits?

So Let's Jump Right Into It.

Web introduction to schedule q of form 5471 schedule q will be used to report a cfc’s income, deductions, taxes, and assets by cfc income groups. Web instructions for form 5471(rev. Web on its webpage, the irs has clarified its instructions for 2020 schedule q (cfc income by cfc income groups) of form 5471 (information return of u.s. Web complete a separate schedule q with respect to each applicable category of income (see instructions).