Form 5500 For 401K

Form 5500 For 401K - Web form 5500 will vary according to the type of plan or arrangement. Less fees so employees can keep more money where it matters—in their retirement accounts. You can set up a guideline 401(k) in 20 min. Ad easy setup, a breeze to manage. Web most 401(k) plan sponsors are required to file an annual form 5500, annual return/report of employee benefit plan. Web 22 hours agoa federal judge i dismissed a lawsuit against denso international america inc. Web 13 hours agogwa llc 401(k) profit sharing plan, rocky hill, conn., had $91 million in assets as of dec. For an explanation of how to file your form 5500 return, in. Southfield, mich., had $2 billion in assets, according to the. Web elements of a plan that need to be handled include:

Yes, form 5500 is due on july 31st for the previous year. Ad easy setup, a breeze to manage. The irs has an online fillable form on its website you can complete and print out. So, if you didn't open your 401k until sometime in 2023, you won't need to file form 5500 until 2024. Web form 5500 will vary according to the type of plan or arrangement. Web vynm2 • 1 min. Large plans, including new plans with 100 or. Southfield, mich., had $2 billion in assets, according to the. Department of labor, internal revenue service, and pension benefit guaranty corporation to simplify and expedite the. 31, 2022, according to the latest form 5500.

Southfield, mich., had $2 billion in assets, according to the. Web most 401(k) plan sponsors are required to file an annual form 5500, annual return/report of employee benefit plan. Posting on the web does not constitute acceptance of the filing by the. So, if you didn't open your 401k until sometime in 2023, you won't need to file form 5500 until 2024. You can set up a guideline 401(k) in 20 min. Web the form 5500 annual return/reports are a critical enforcement, compliance, and research tool for the dol, the irs, and pbgc. Ad easy setup, a breeze to manage. The irs has an online fillable form on its website you can complete and print out. 31, 2021, according to the latest form 5500. Web 15 hours agocobham united states 401k plan, san jose, calif., had $970 million in assets as of dec.

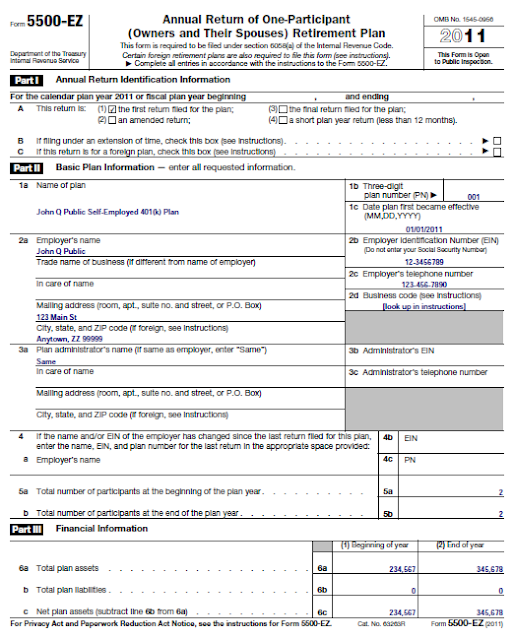

How To File The Form 5500EZ For Your Solo 401k in 2022 Good Money Sense

Less fees so employees can keep more money where it matters—in their retirement accounts. Web 22 hours agoa federal judge i dismissed a lawsuit against denso international america inc. Yes, form 5500 is due on july 31st for the previous year. Web the form 5500 annual return/reports are a critical enforcement, compliance, and research tool for the dol, the irs,.

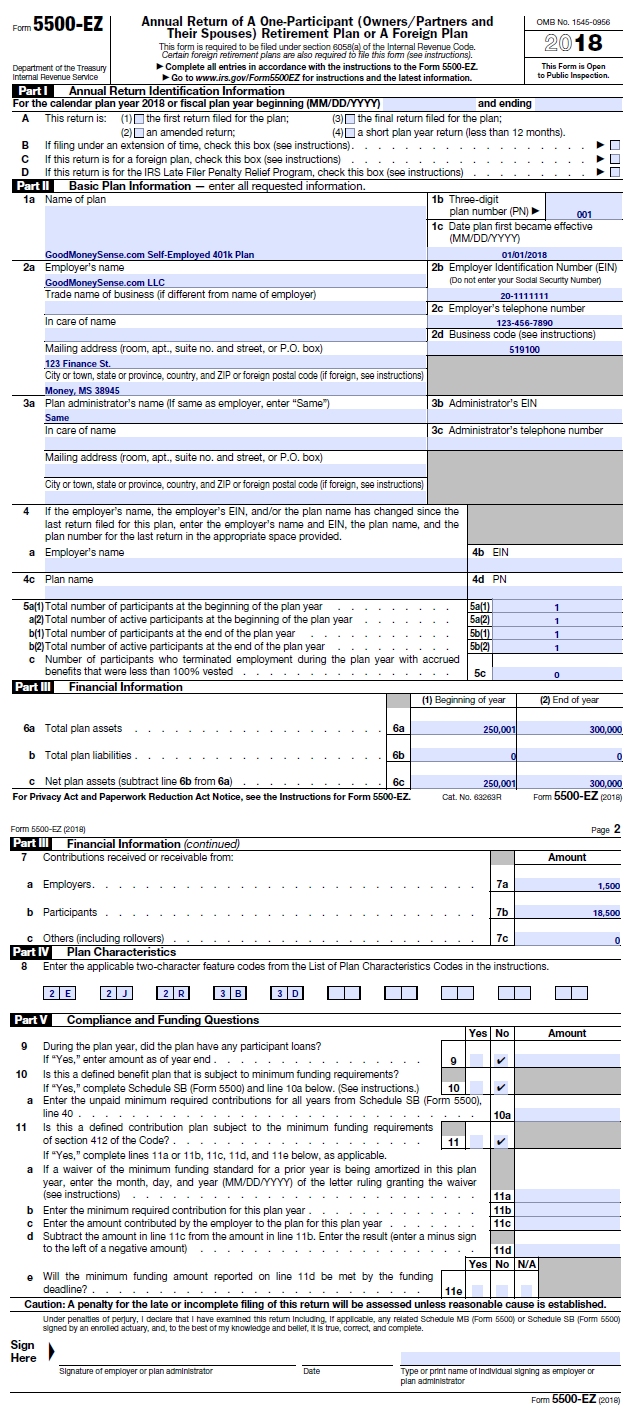

2018 Updated Form 5500EZ Guide Solo 401k

Southfield, mich., had $2 billion in assets, according to the. Web this search tool allows you to search for form 5500 series returns/reports filed since january 1, 2010. 31, 2021, according to the latest form 5500. So, if you didn't open your 401k until sometime in 2023, you won't need to file form 5500 until 2024. The type of plan,.

The 401(k) Form 5500 Frequently Asked Questions (FAQ)

The irs has an online fillable form on its website you can complete and print out. Web elements of a plan that need to be handled include: Posting on the web does not constitute acceptance of the filing by the. Large plans, including new plans with 100 or. Web schedule a (form 5500) 2022 page 4 part iii welfare benefit.

Form 5500 Instructions 5 Steps to Filing Correctly (2023)

Posting on the web does not constitute acceptance of the filing by the. Web most 401(k) plan sponsors are required to file an annual form 5500, annual return/report of employee benefit plan. Web the form 5500 annual return/reports are a critical enforcement, compliance, and research tool for the dol, the irs, and pbgc. Ad easy setup, a breeze to manage..

Form 5500EZ For Your Solo 401k

The section what to file summarizes what information must be reported for different types of plans and. Less fees so employees can keep more money where it matters—in their retirement accounts. Participation contributions vesting nondiscrimination investing 401 (k) monies fiduciary responsibilities disclosing. The type of plan, or entity submitting the filing, determines who is required to sign the form. Large.

How To File The Form 5500EZ For Your Solo 401k for 2018 Good Money Sense

Web vynm2 • 1 min. Less fees so employees can keep more money where it matters—in their retirement accounts. The irs has an online fillable form on its website you can complete and print out. Use the rate table or worksheets in chapter 5 of irs publication 560, retirement plans for small. Department of labor, internal revenue service, and pension.

How to File Form 5500EZ Solo 401k

Web the form 5500 annual return/reports are a critical enforcement, compliance, and research tool for the dol, the irs, and pbgc. For an explanation of how to file your form 5500 return, in. Web form 5500 will vary according to the type of plan or arrangement. Ad easy setup, a breeze to manage. Web most 401(k) plan sponsors are required.

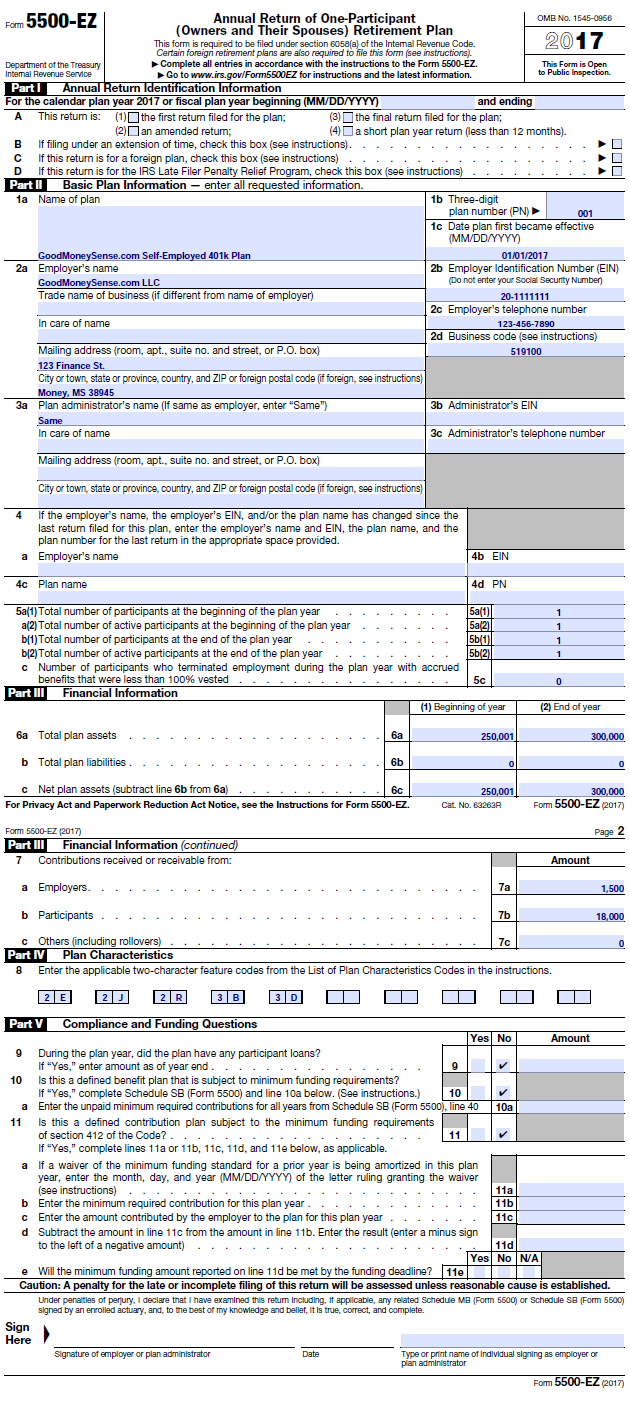

How To File The Form 5500EZ For Your Solo 401k for 2017 Good Money Sense

Southfield, mich., had $2 billion in assets, according to the. Web the form 5500 is filed with the dol and contains information about a 401(k) plan's financial condition, plan qualifications, and operation. So, if you didn't open your 401k until sometime in 2023, you won't need to file form 5500 until 2024. Web schedule a (form 5500) 2022 page 4.

Form 5500EZ How To Fill It Out For Your Solo 401k

For an explanation of how to file your form 5500 return, in. Large plans, including new plans with 100 or. The purpose of the form is. Web 22 hours agoa federal judge i dismissed a lawsuit against denso international america inc. You can set up a guideline 401(k) in 20 min.

How to File Form 5500EZ Solo 401k

31, 2021, according to the latest form 5500. Ad easy setup, a breeze to manage. 31, 2022, according to the latest form 5500. The purpose of the form is. Department of labor, internal revenue service, and pension benefit guaranty corporation to simplify and expedite the.

Web 22 Hours Agoa Federal Judge I Dismissed A Lawsuit Against Denso International America Inc.

Posting on the web does not constitute acceptance of the filing by the. The section what to file summarizes what information must be reported for different types of plans and. Department of labor, internal revenue service, and pension benefit guaranty corporation to simplify and expedite the. Web most 401(k) plan sponsors are required to file an annual form 5500, annual return/report of employee benefit plan.

Web Form 5500 Will Vary According To The Type Of Plan Or Arrangement.

Less fees so employees can keep more money where it matters—in their retirement accounts. Web schedule a (form 5500) 2022 page 4 part iii welfare benefit contract information if more than one contract covers the same group of employees of the same. Web the form 5500 is filed with the dol and contains information about a 401(k) plan's financial condition, plan qualifications, and operation. So, if you didn't open your 401k until sometime in 2023, you won't need to file form 5500 until 2024.

Yes, Form 5500 Is Due On July 31St For The Previous Year.

Large plans, including new plans with 100 or. The type of plan, or entity submitting the filing, determines who is required to sign the form. The irs has an online fillable form on its website you can complete and print out. Web this search tool allows you to search for form 5500 series returns/reports filed since january 1, 2010.

You Can Set Up A Guideline 401(K) In 20 Min.

Web item explanation due to: For an explanation of how to file your form 5500 return, in. Web 13 hours agogwa llc 401(k) profit sharing plan, rocky hill, conn., had $91 million in assets as of dec. The purpose of the form is.