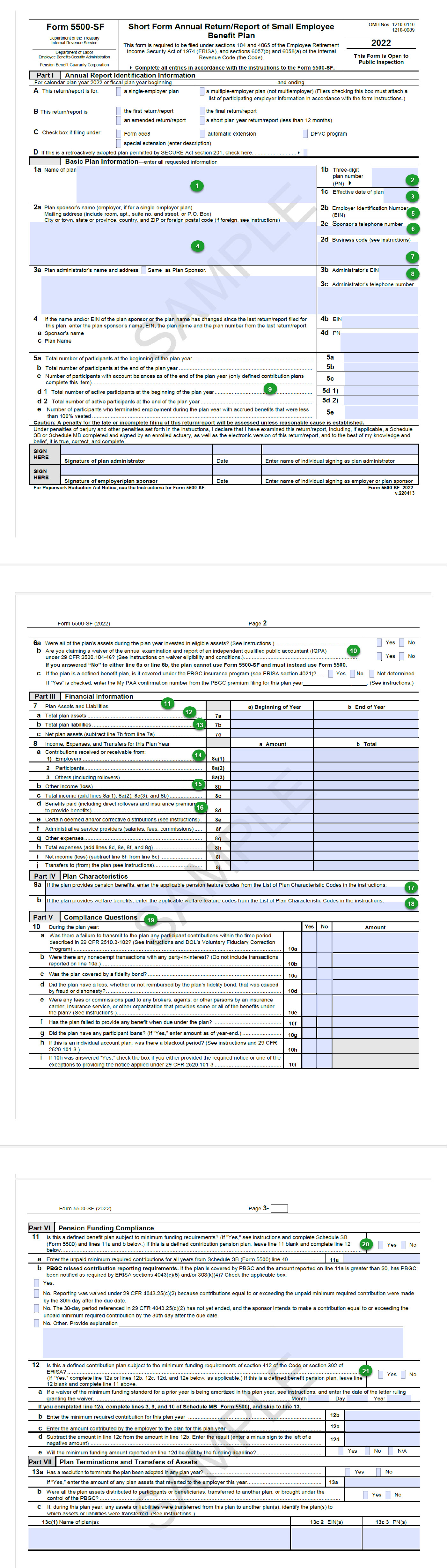

Form 5500 Instructions

Form 5500 Instructions - Web schedule a (form 5500) 17 hr., 28 min. Web generally, any business that sponsors a retirement savings plan must file a form 5500 each year that the plan holds assets. Schedule e (form 5500) (leveraged esop) 1 hr., 56 min.10 hr., 2 min. Form 5500 raw data sets. Schedule b (form 5500) part 2 8 hr., 39 min. For more detailed information on how to file, see the efast2 faqs and other publications. Web form 5500 is a report detailing a company’s employee benefits. Form 5500 version selection tool. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. Schedule e (form 5500) (nonleveraged esop) 13 min.1 hr., 12 min.

Web form 5500 is a report detailing a company’s employee benefits. Web form 5500 annual return/report of employee benefit plan | instructions; Web schedule a (form 5500) 17 hr., 28 min. Schedule e (form 5500) (nonleveraged esop) 13 min.1 hr., 12 min. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. Form 5500 version selection tool. Schedule c (form 5500) 5 hr., 16 min. Form 5500 raw data sets. Schedule e (form 5500) (leveraged esop) 1 hr., 56 min.10 hr., 2 min. We anticipate that similar rules will apply to the retroactive adoption of a plan pursuant to section 201 of the secure act after an employer’s 2021 taxable year.

We anticipate that similar rules will apply to the retroactive adoption of a plan pursuant to section 201 of the secure act after an employer’s 2021 taxable year. Form 5500 version selection tool. Web generally, any business that sponsors a retirement savings plan must file a form 5500 each year that the plan holds assets. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. Other form 5500 data sets. For more detailed information on how to file, see the efast2 faqs and other publications. Pension benefit plan all pension benefit plans covered by erisa must file an annual return/report except as provided in this section. Form 5500 raw data sets. Web schedule a (form 5500) 17 hr., 28 min. Schedule e (form 5500) (nonleveraged esop) 13 min.1 hr., 12 min.

Form 5500 Instructions 5 Steps to Filing Correctly

Pension benefit plan all pension benefit plans covered by erisa must file an annual return/report except as provided in this section. Schedule e (form 5500) (leveraged esop) 1 hr., 56 min.10 hr., 2 min. Web generally, any business that sponsors a retirement savings plan must file a form 5500 each year that the plan holds assets. Other form 5500 data.

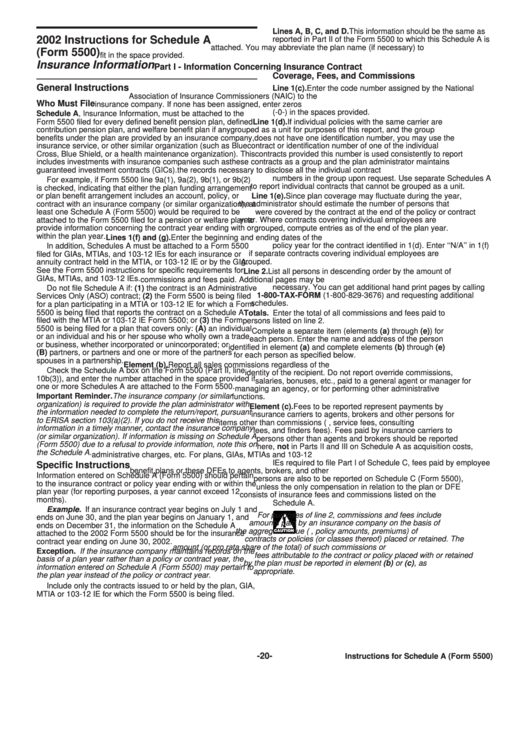

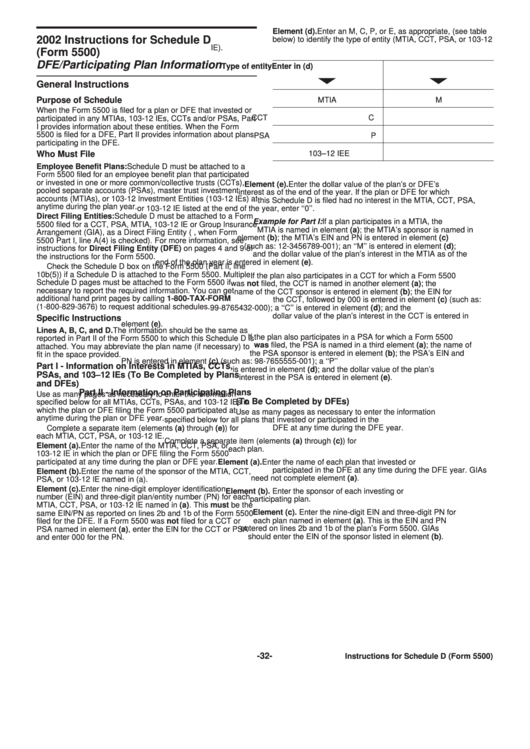

Form 5500 Schedule A Instructions Insurance Information 2002

Other form 5500 data sets. Web form 5500 is a report detailing a company’s employee benefits. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. Schedule b (form 5500) part 2 8 hr., 39 min. Schedule e (form 5500) (nonleveraged esop) 13 min.1 hr., 12 min.

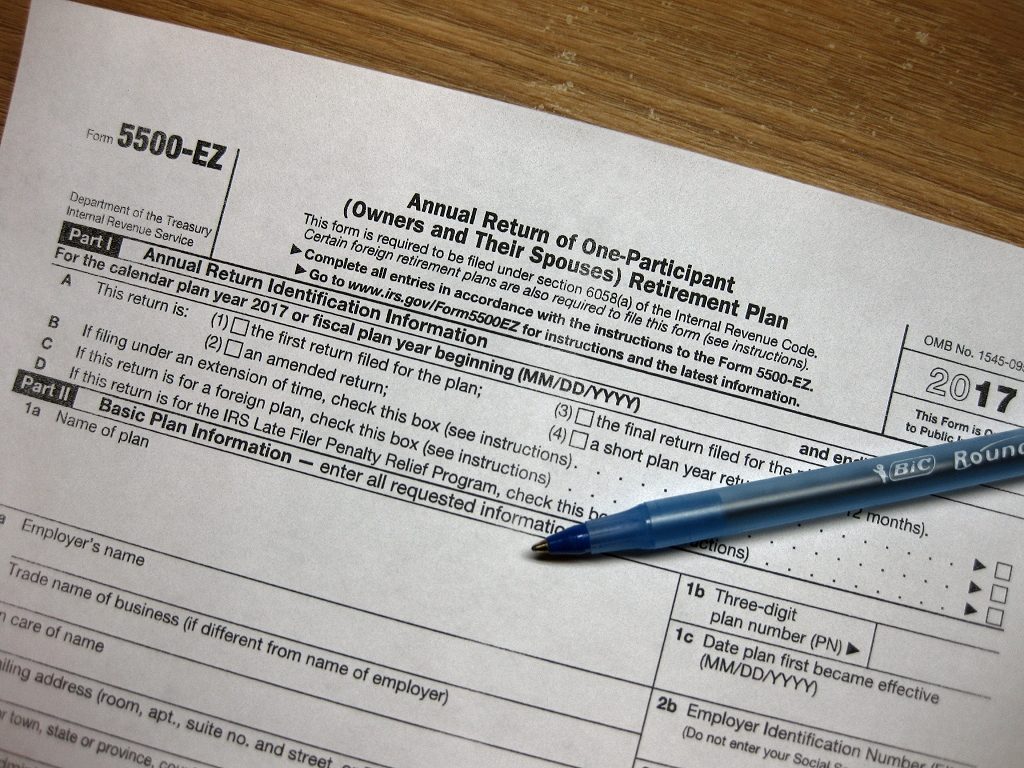

How To File The Form 5500EZ For Your Solo 401k in 2022 Good Money Sense

Form 5500 raw data sets. Web schedule a (form 5500) 17 hr., 28 min. Schedule e (form 5500) (leveraged esop) 1 hr., 56 min.10 hr., 2 min. Web generally, any business that sponsors a retirement savings plan must file a form 5500 each year that the plan holds assets. Form 5500 version selection tool.

form 5500 instructions 2022 Fill Online, Printable, Fillable Blank

Schedule b (form 5500) part 2 8 hr., 39 min. Web generally, any business that sponsors a retirement savings plan must file a form 5500 each year that the plan holds assets. Web form 5500 is a report detailing a company’s employee benefits. We anticipate that similar rules will apply to the retroactive adoption of a plan pursuant to section.

Form 5500 Instructions 5 Steps to Filing Correctly

Schedule c (form 5500) 5 hr., 16 min. Schedule b (form 5500) part 2 8 hr., 39 min. Schedule e (form 5500) (leveraged esop) 1 hr., 56 min.10 hr., 2 min. Schedule e (form 5500) (nonleveraged esop) 13 min.1 hr., 12 min. Web schedule a (form 5500) 17 hr., 28 min.

Form 5500 Instructions 5 Steps to Filing Correctly

Schedule e (form 5500) (leveraged esop) 1 hr., 56 min.10 hr., 2 min. Pension benefit plan all pension benefit plans covered by erisa must file an annual return/report except as provided in this section. Web schedule a (form 5500) 17 hr., 28 min. Form 5500 version selection tool. Web form 5500 is a report detailing a company’s employee benefits.

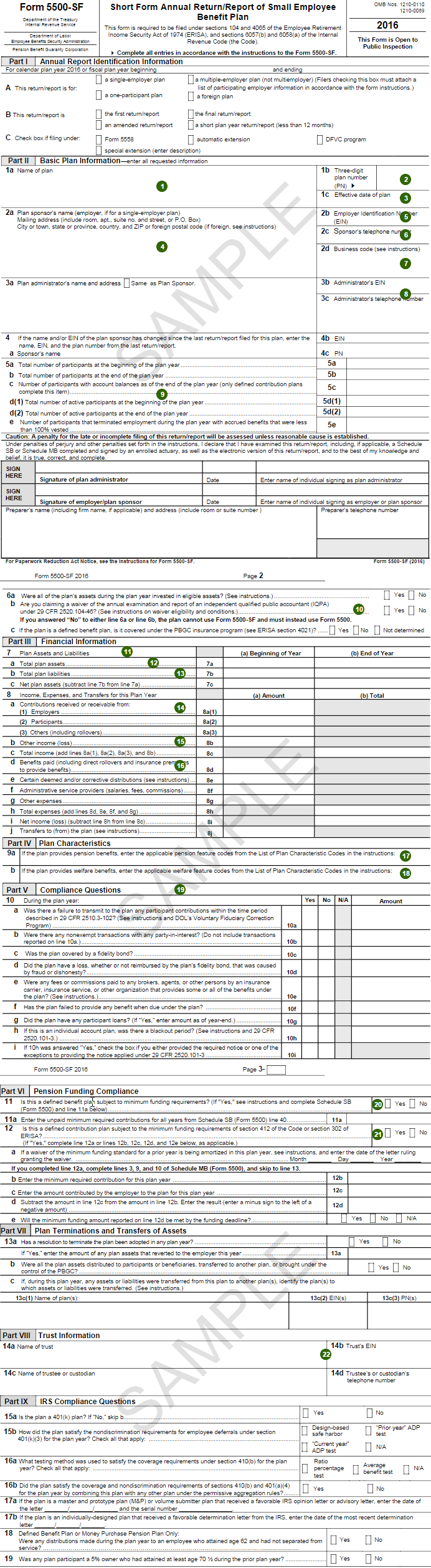

Understanding the Form 5500 for Defined Contribution Plans Fidelity

Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. We anticipate that similar rules will apply to the retroactive adoption of a plan pursuant to section 201 of the secure act after an employer’s 2021 taxable year. Web schedule a (form 5500) 17 hr., 28 min. Form 5500 version selection tool..

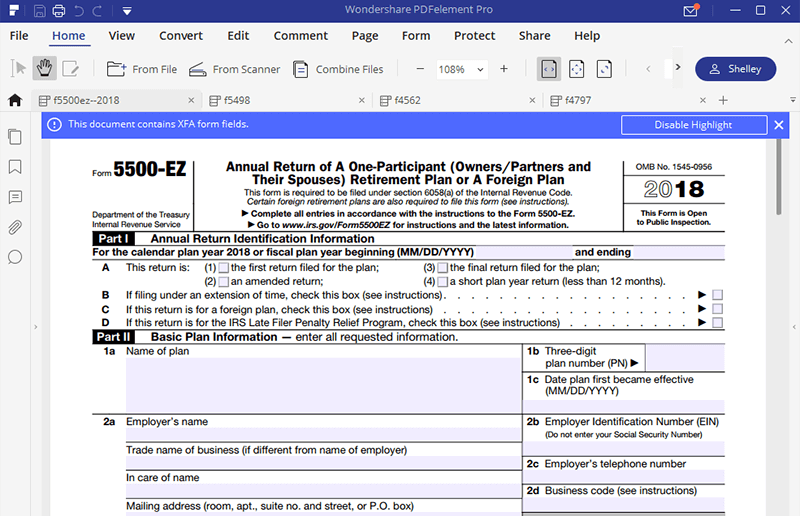

IRS Form 5500EZ Use the Most Efficient Tool to Fill it

Form 5500 version selection tool. Schedule e (form 5500) (leveraged esop) 1 hr., 56 min.10 hr., 2 min. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. Schedule c (form 5500) 5 hr., 16 min. Schedule b (form 5500) part 2 8 hr., 39 min.

Understanding the Form 5500 for Defined Benefit Plans Fidelity

Pension benefit plan all pension benefit plans covered by erisa must file an annual return/report except as provided in this section. Form 5500 raw data sets. Web schedule a (form 5500) 17 hr., 28 min. Other form 5500 data sets. Schedule e (form 5500) (leveraged esop) 1 hr., 56 min.10 hr., 2 min.

Instructions For Schedule D (Form 5500) Dfe/participating Plan

Schedule b (form 5500) part 2 8 hr., 39 min. Web schedule a (form 5500) 17 hr., 28 min. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. Pension benefit plan all pension benefit plans covered by erisa must file an annual return/report except as provided in this section. Web form.

Schedule E (Form 5500) (Nonleveraged Esop) 13 Min.1 Hr., 12 Min.

Schedule c (form 5500) 5 hr., 16 min. Schedule e (form 5500) (leveraged esop) 1 hr., 56 min.10 hr., 2 min. Form 5500 raw data sets. Pension benefit plan all pension benefit plans covered by erisa must file an annual return/report except as provided in this section.

Web Form 5500 Annual Return/Report Of Employee Benefit Plan | Instructions;

Web schedule a (form 5500) 17 hr., 28 min. We anticipate that similar rules will apply to the retroactive adoption of a plan pursuant to section 201 of the secure act after an employer’s 2021 taxable year. Web form 5500 is a report detailing a company’s employee benefits. Web generally, any business that sponsors a retirement savings plan must file a form 5500 each year that the plan holds assets.

For More Detailed Information On How To File, See The Efast2 Faqs And Other Publications.

Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. Form 5500 version selection tool. Schedule b (form 5500) part 2 8 hr., 39 min. Other form 5500 data sets.