Form 571 L

Form 571 L - Equipment (do not include property reported in part iii.) include expensed equipment and fully depreciated. You are required to report the total cost of all your business property unless it is not assessable. Please call our office at. Web select the business personal property form you need from the following list. Businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business personal. What is the “lien date” for property tax purposes? Buildings, building improvements, and/or leasehold improvements, land improvements,. Web filing form 571l business property statement. May 7 is the last day to file a. Web what is a form 571l business property statement (bps)?

What is the “lien date” for property tax purposes? Who must file a bps? Web select the business personal property form you need from the following list. Equipment (do not include property reported in part iii.) include expensed equipment and fully depreciated. May 7 is the last day to file a. You are required to report the total cost of all your business property unless it is not assessable. What is business personal property? For more information , read the assessor's business personal property information page. Businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business personal. Please call our office at.

Who must file a bps? Please call our office at. You are required to report the total cost of all your business property unless it is not assessable. Web select the business personal property form you need from the following list. Web what is a form 571l business property statement (bps)? What is the “lien date” for property tax purposes? Web filing form 571l business property statement. For more information , read the assessor's business personal property information page. Businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business personal. Equipment (do not include property reported in part iii.) include expensed equipment and fully depreciated.

CA BOE571L (P1) 2012 Fill and Sign Printable Template Online US

Web what is a form 571l business property statement (bps)? Web filing form 571l business property statement. Businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business personal. What is business personal property? For more information , read the assessor's business personal property information page.

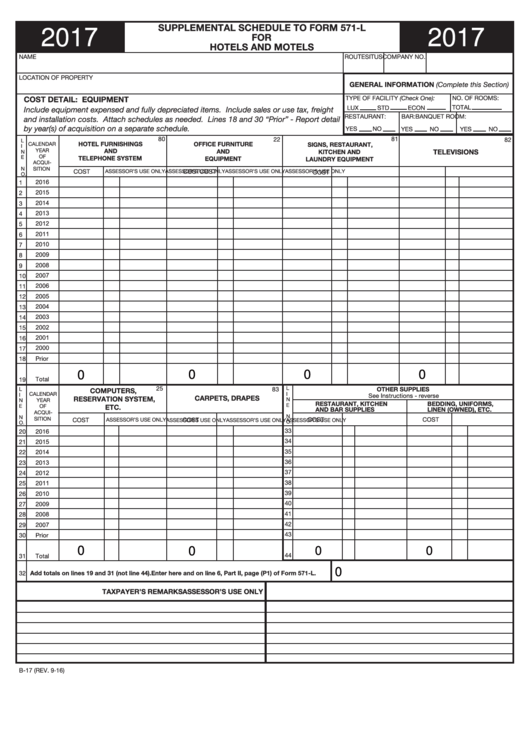

Fillable Supplemental Schedule To Form 571L For Hotels And Motels

Equipment (do not include property reported in part iii.) include expensed equipment and fully depreciated. Web filing form 571l business property statement. What is business personal property? Who must file a bps? Please call our office at.

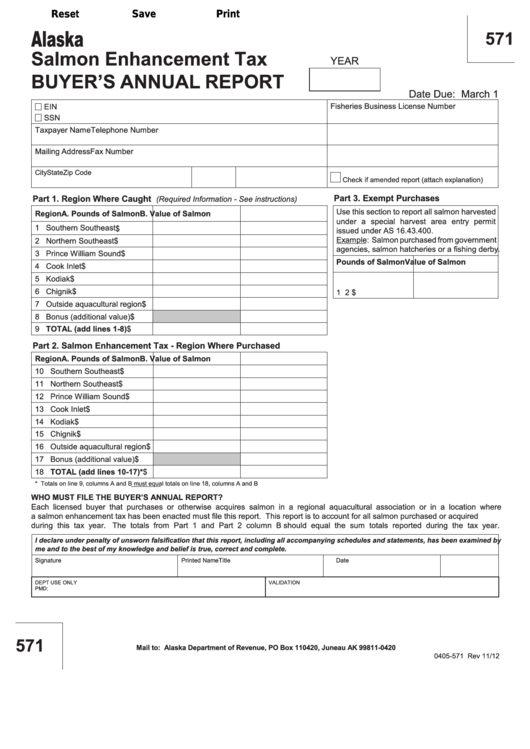

Fillable Form 571 Salmon Enhancement Tax Buyer'S Annual Report

What is the “lien date” for property tax purposes? Buildings, building improvements, and/or leasehold improvements, land improvements,. For more information , read the assessor's business personal property information page. May 7 is the last day to file a. Who must file a bps?

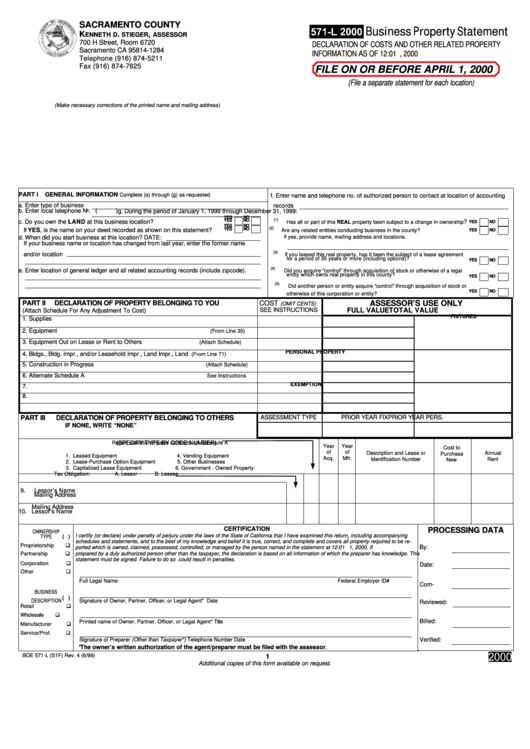

Form 571L Business Property Statement 2000 printable pdf download

Please call our office at. You are required to report the total cost of all your business property unless it is not assessable. Buildings, building improvements, and/or leasehold improvements, land improvements,. For more information , read the assessor's business personal property information page. May 7 is the last day to file a.

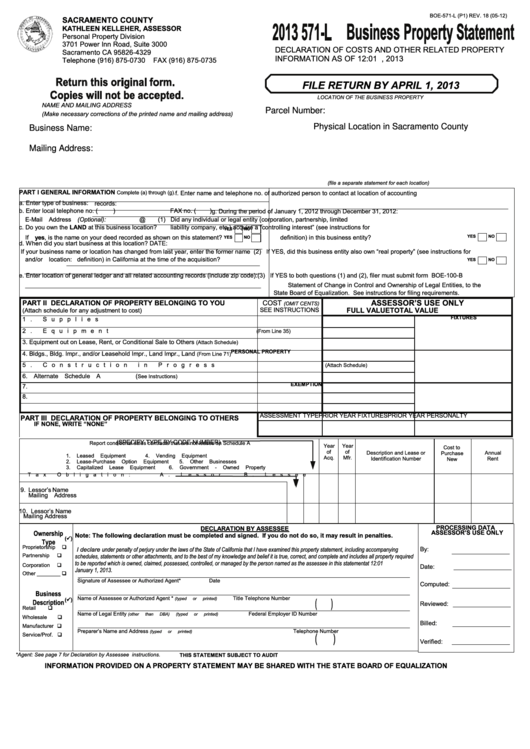

Fillable Form 571L Business Property Statement 2013 printable pdf

You are required to report the total cost of all your business property unless it is not assessable. Who must file a bps? What is the “lien date” for property tax purposes? Equipment (do not include property reported in part iii.) include expensed equipment and fully depreciated. What is business personal property?

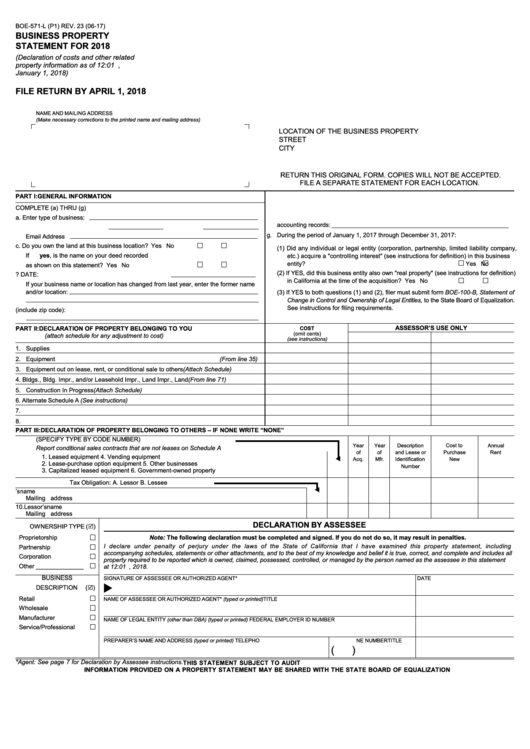

Fillable Form Boe571L Business Property Statement 2018 printable

Businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business personal. What is the “lien date” for property tax purposes? Web select the business personal property form you need from the following list. Please call our office at. Who must file a bps?

Form Boe 571 L Fill Out and Sign Printable PDF Template signNow

Web select the business personal property form you need from the following list. Web filing form 571l business property statement. What is business personal property? Businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business personal. Buildings, building improvements, and/or leasehold improvements, land improvements,.

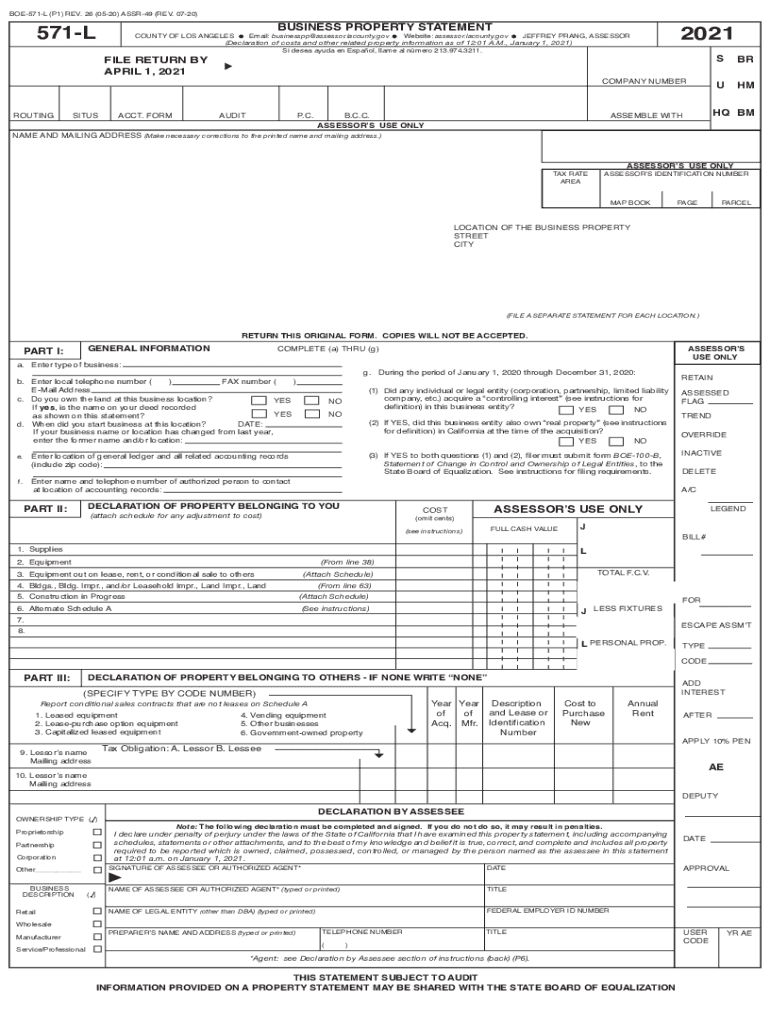

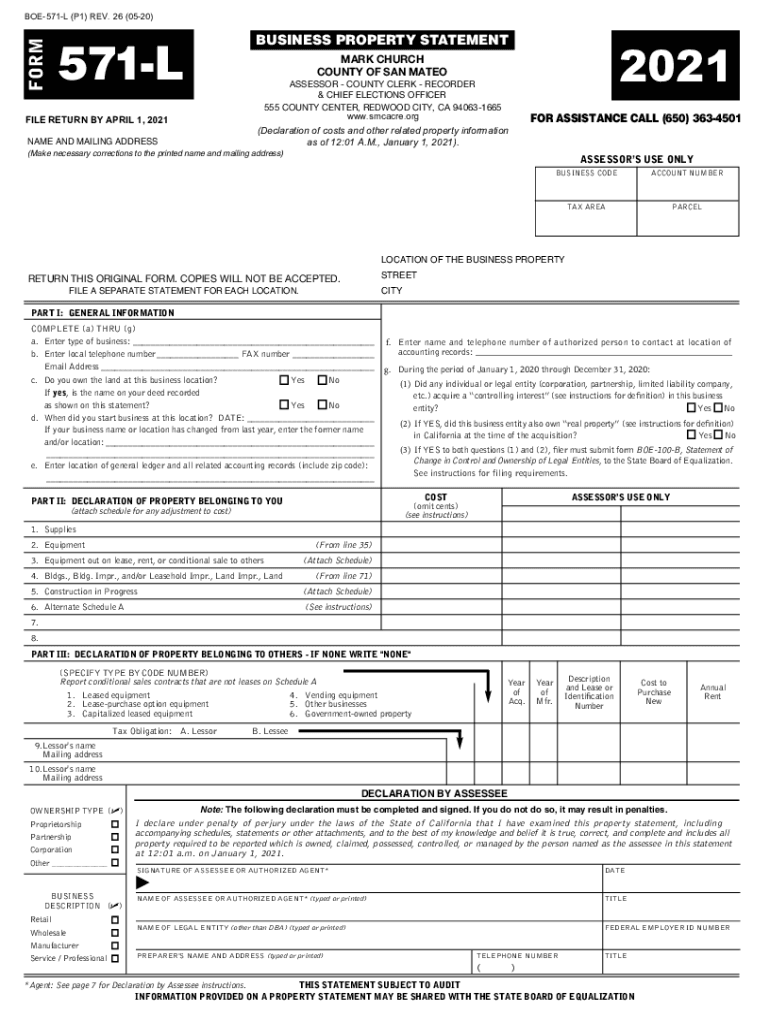

20212023 Form CA BOE571L Fill Online, Printable, Fillable, Blank

Please call our office at. Web filing form 571l business property statement. You are required to report the total cost of all your business property unless it is not assessable. For more information , read the assessor's business personal property information page. Equipment (do not include property reported in part iii.) include expensed equipment and fully depreciated.

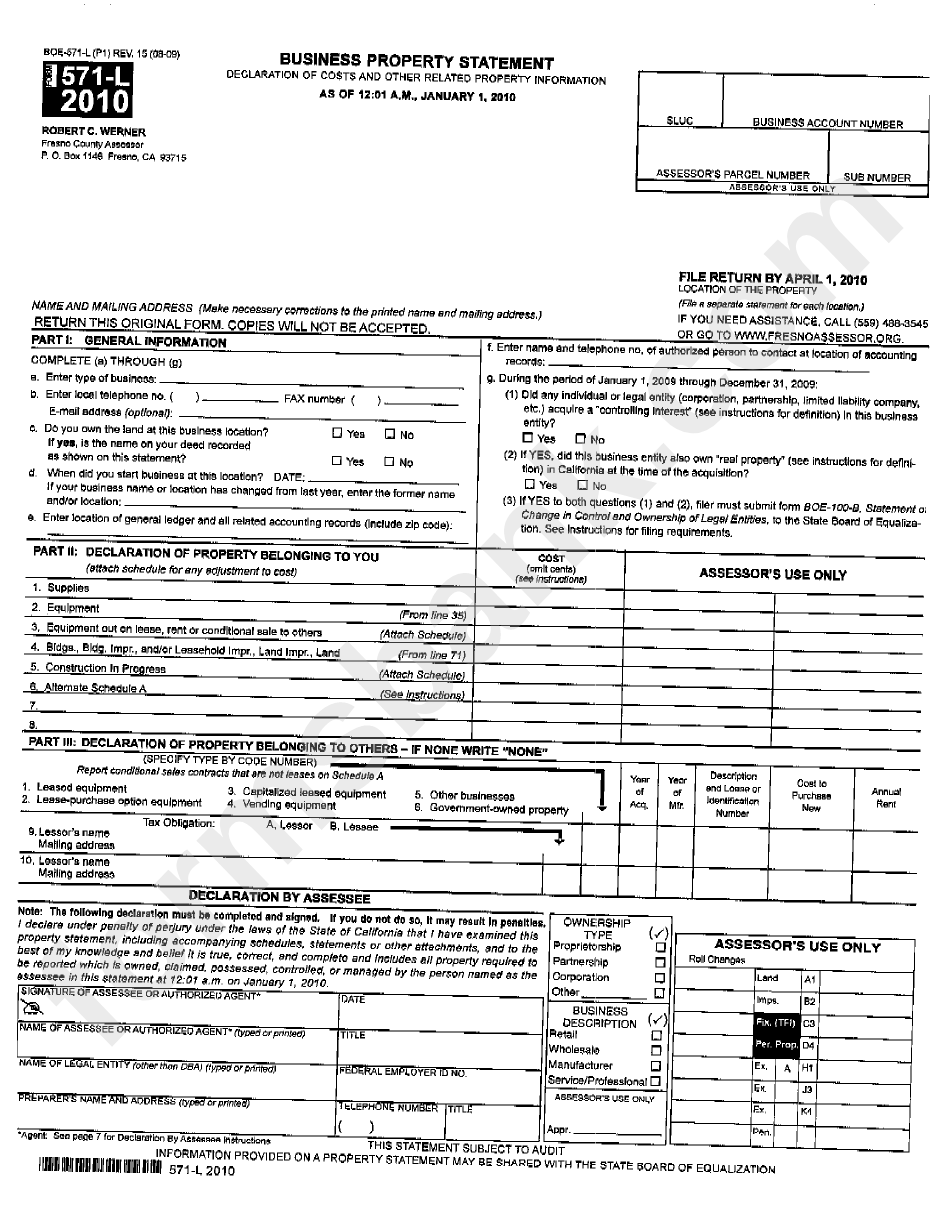

Form Boe571L Business Property Statement Montana 2010 printable

Buildings, building improvements, and/or leasehold improvements, land improvements,. What is business personal property? Businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business personal. Web filing form 571l business property statement. For more information , read the assessor's business personal property information page.

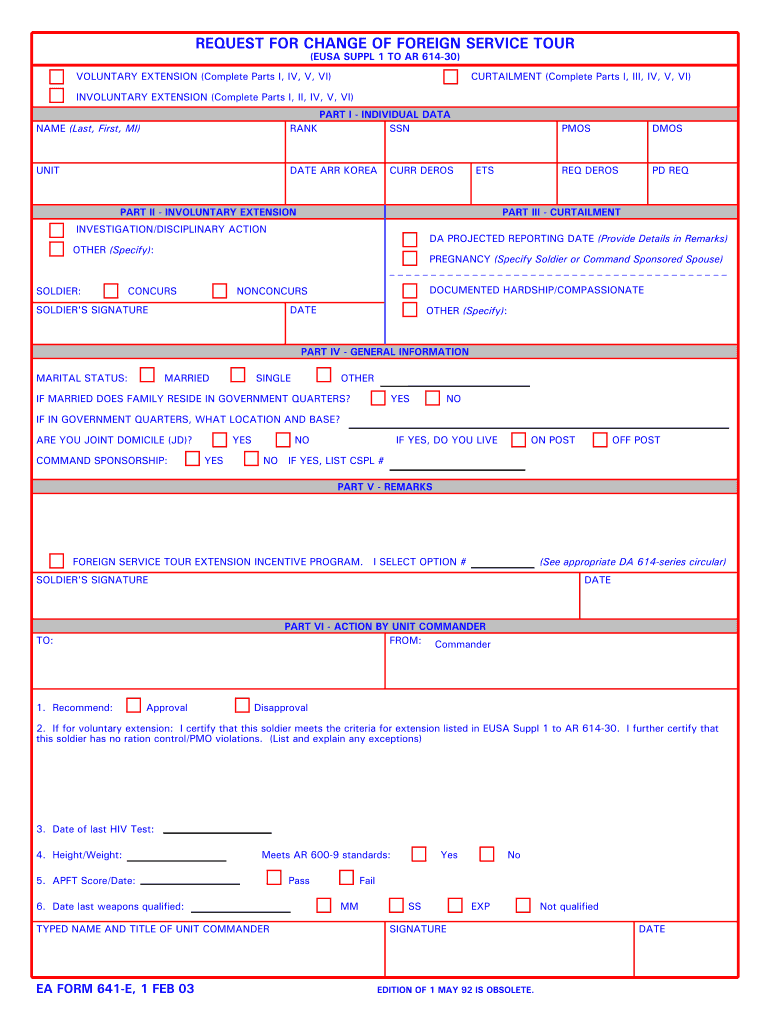

Ea Form 571 E 20202022 Fill and Sign Printable Template Online US

You are required to report the total cost of all your business property unless it is not assessable. What is the “lien date” for property tax purposes? May 7 is the last day to file a. What is business personal property? For more information , read the assessor's business personal property information page.

Please Call Our Office At.

You are required to report the total cost of all your business property unless it is not assessable. What is the “lien date” for property tax purposes? Who must file a bps? May 7 is the last day to file a.

For More Information , Read The Assessor's Business Personal Property Information Page.

What is business personal property? Buildings, building improvements, and/or leasehold improvements, land improvements,. Web what is a form 571l business property statement (bps)? Businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business personal.

Equipment (Do Not Include Property Reported In Part Iii.) Include Expensed Equipment And Fully Depreciated.

Web select the business personal property form you need from the following list. Web filing form 571l business property statement.