Form 588 Instructions

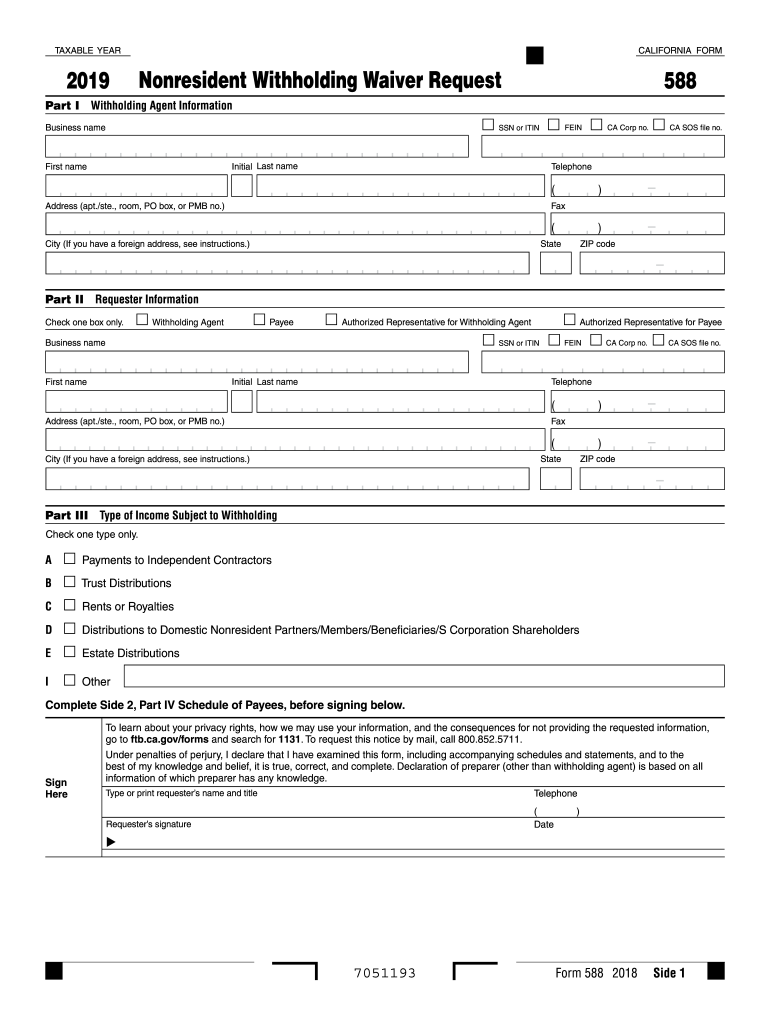

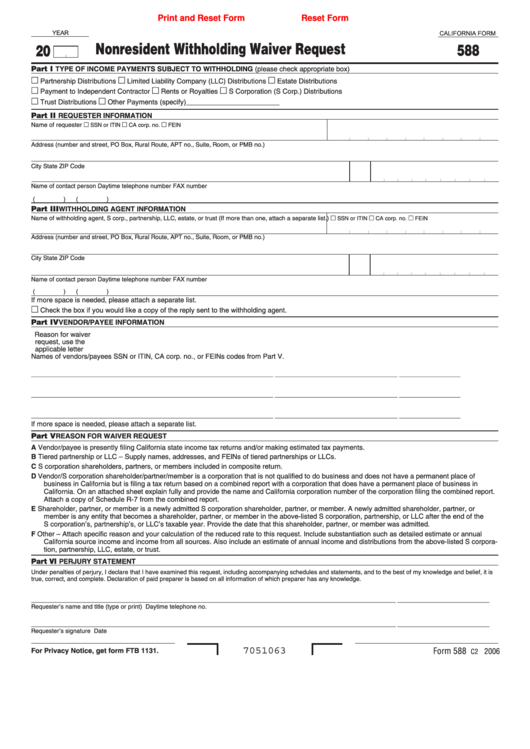

Form 588 Instructions - This is only available by request. The advanced tools of the. Web form 588, nonresident withholding waiver request, can be filed to request a waiver from withholding on payments of california source income to nonresident domestic owners. Web cms 588 dynamic list information. Purpose use form 587, nonresident. Web authorized representative for withholding agent authorized representative for payee ssn or itin fein ca corp no. File your california and federal tax returns online with turbotax in minutes. Web how you can fill out the form 588 2019 online: Part iv schedule of payees. Web 2022 nonresident withholding waiver request taxable year 2022nonresident withholding waiver request california form 588 part ii requester information.

Web cms 588 dynamic list information. Please provide your email address and it will be emailed. Purpose use form 587, nonresident. Web how you can fill out the form 588 2019 online: Web we last updated california form 588 in january 2022 from the california franchise tax board. This form is for income earned in tax year 2022, with tax returns due in april 2023. Sign online button or tick the preview image of the blank. Part iv schedule of payees. Pdffiller allows users to edit, sign, fill & share all type of documents online. Use form 588, nonresident withholding waiver request, to request a waiver from withholding on payments of california source income to nonresident payees.

Do not enter data in boxes filled with xs. This form is for income earned in tax year 2022, with tax returns due in april 2023. Nonresident withholding waiver request (form 588) submit. Web use form 587 to allocate california source payments and determine if withholding is required. The advanced tools of the. Web use form 588, nonresident withholding waiver request, to request a waiver or a reduced withholding rate on payments of california source income to nonresident. Part iv schedule of payees. File your california and federal tax returns online with turbotax in minutes. This is only available by request. Please provide your email address and it will be emailed.

Form 588 Fill Out and Sign Printable PDF Template signNow

Web use form 587 to allocate california source payments and determine if withholding is required. Web how you can fill out the form 588 2019 online: Web 2023, 588, instructions for form 588 nonresident withholding waiver request. Authorization by your signature on this form you are certifying that the account is drawn in the name of. Use your own version.

Fillable Form 1023 in 2021 Form, Fillable forms, Recognition

Authorization by your signature on this form you are certifying that the account is drawn in the name of. Nonresident withholding waiver request (form 588) submit. Web specific instructions references in these instructions are to the california revenue and taxation code (r&tc). Web we last updated california form 588 in january 2022 from the california franchise tax board. Web 2022.

Instructions for Form 588 Nonresident Withholding Waiver Request

Pdffiller allows users to edit, sign, fill & share all type of documents online. Authorization by your signature on this form you are certifying that the account is drawn in the name of. To amend a current or prior year annual return,. To begin the document, use the fill camp; Web we last updated california form 588 in january 2022.

Notice of Temporary Displacement — RPI Form 588

Web how you can fill out the form 588 2019 online: Use form 588, nonresident withholding waiver request, to request a waiver from withholding on payments of california source income to nonresident payees. Please provide your email address and it will be emailed. Nonresident withholding waiver request (form 588) submit. Purpose use form 587, nonresident.

Fillable California Form 588 Nonresident Withholding Waiver Request

Web specific instructions references in these instructions are to the california revenue and taxation code (r&tc). Pdffiller allows users to edit, sign, fill & share all type of documents online. Web cms 588 dynamic list information. The advanced tools of the. To amend a current or prior year annual return,.

Fill Free fillable forms Comptroller of Maryland

Web specific instructions references in these instructions are to the california revenue and taxation code (r&tc). Use form 588, nonresident withholding waiver request, to request a waiver from withholding on payments of california source income to nonresident payees. Do not enter data in boxes filled with xs. Web efile your california tax return now efiling is easier, faster, and safer.

2017 Form 588 Nonresident Withholding Waiver Request Edit, Fill, Sign

Web form 588, nonresident withholding waiver request, can be filed to request a waiver from withholding on payments of california source income to nonresident domestic owners. Nonresident withholding waiver request (form 588) submit. Use your own version of the schedule of payees to report additional payees. Web describe methods that will be applied during importation to maintain control of plant.

Company Return Instructions 2017

Web 2023, 588, instructions for form 588 nonresident withholding waiver request. Web cms 588 dynamic list information. File your california and federal tax returns online with turbotax in minutes. Purpose use form 587, nonresident. To amend a current or prior year annual return,.

Form E588 Download Fillable PDF or Fill Online Business Claim for

Web cms 588 dynamic list information. Web 2022 nonresident withholding waiver request taxable year 2022nonresident withholding waiver request california form 588 part ii requester information. Nonresident withholding waiver request (form 588) submit. Purpose use form 587, nonresident. Pdffiller allows users to edit, sign, fill & share all type of documents online.

cms 588 Fill out & sign online DocHub

The advanced tools of the. This form is for income earned in tax year 2022, with tax returns due in april 2023. Use your own version of the schedule of payees to report additional payees. To begin the document, use the fill camp; Electronic funds transfer (eft) authorization agreement.

Web We Last Updated California Form 588 In January 2022 From The California Franchise Tax Board.

Purpose use form 587, nonresident. Electronic funds transfer (eft) authorization agreement. Do not enter data in boxes filled with xs. The advanced tools of the.

Use Your Own Version Of The Schedule Of Payees To Report Additional Payees.

Nonresident withholding waiver request (form 588) submit. Web 2022 nonresident withholding waiver request taxable year 2022nonresident withholding waiver request california form 588 part ii requester information. Part iv schedule of payees. Please provide your email address and it will be emailed.

Web Describe Methods That Will Be Applied During Importation To Maintain Control Of Plant Material And Prevent Exposure Or Transmission Of Any Associated Plant Pests And Pathogens To.

Pdffiller allows users to edit, sign, fill & share all type of documents online. Web 2023, 588, instructions for form 588 nonresident withholding waiver request. Web authorized representative for withholding agent authorized representative for payee ssn or itin fein ca corp no. Use form 588, nonresident withholding waiver request, to request a waiver from withholding on payments of california source income to nonresident payees.

File Your California And Federal Tax Returns Online With Turbotax In Minutes.

To amend a current or prior year annual return,. Web efile your california tax return now efiling is easier, faster, and safer than filling out paper tax forms. This form is for income earned in tax year 2022, with tax returns due in april 2023. Use your own version of the schedule of payees to report additional payees.