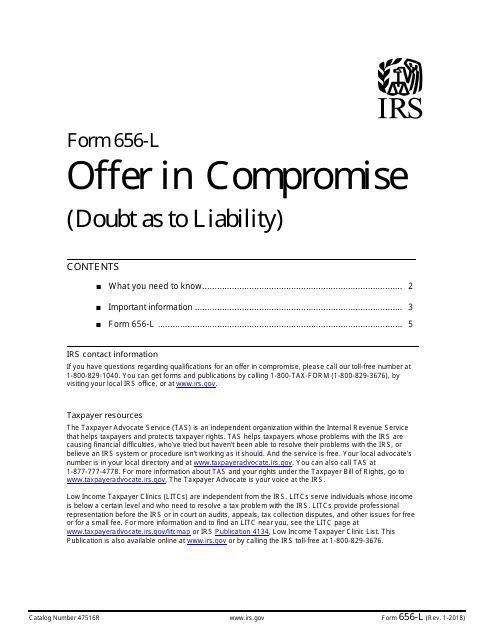

Form 656 L

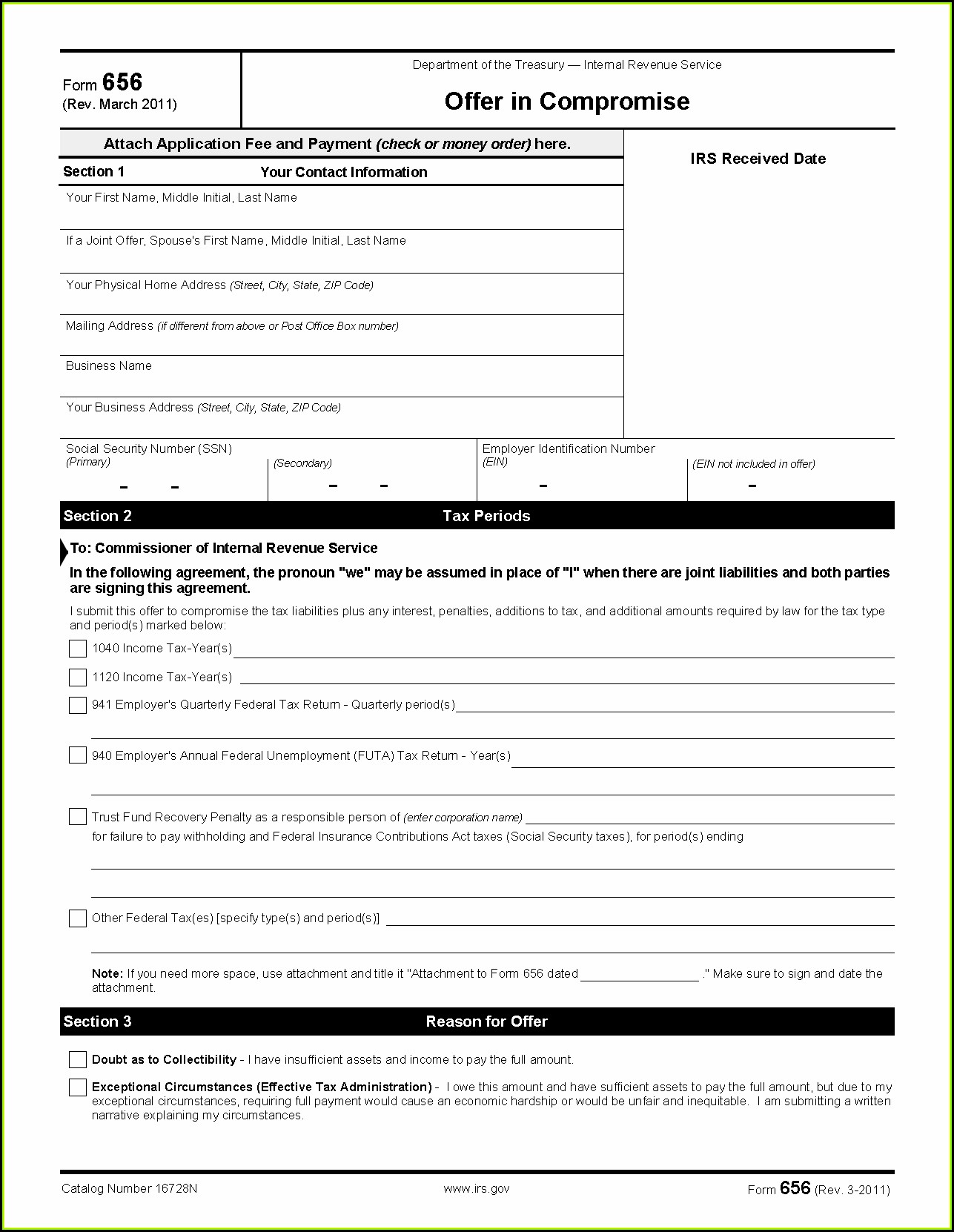

Form 656 L - Web information about form 656, offer in compromise, including recent updates, related forms, and instructions on how to file. It will determine whether the offer suits both parties' best interests, both the agency's and your own. You don’t have enough income or assets to pay your balance due in full. Completed financial statements and required application fee and Web form 656, the offer in compromise (oic), gives the irs an overview of your financial situation so it can review your debt and your ability to pay. Taxpayer resources you may also seek assistance from a professional tax assistant at a low income taxpayer clinic, if you qualify. The offer in compromise (oic) is a tax settlement arrangement rolled out by the irs. You can pay all your balance due, but it would create an economic. Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on www.irs.gov. Do not submit both an offer under doubt as to liability and an offer under doubt as to collectibility or effective tax administration at the same time.

You can pay all your balance due, but it would create an economic. Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on www.irs.gov. You don’t have enough income or assets to pay your balance due in full. Web information about form 656, offer in compromise, including recent updates, related forms, and instructions on how to file. It is an attempt to allow both individual and business taxpayers who owe taxes but are unable to pay to come to an agreement with the irs whereby they are allowed to pay only a part of their tax dues. Do not submit both an offer under doubt as to liability and an offer under doubt as to collectibility or effective tax administration at the same time. Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities for less than the full amount owed. Web form 656, the offer in compromise (oic), gives the irs an overview of your financial situation so it can review your debt and your ability to pay. It will determine whether the offer suits both parties' best interests, both the agency's and your own. Taxpayer resources you may also seek assistance from a professional tax assistant at a low income taxpayer clinic, if you qualify.

You can pay all your balance due, but it would create an economic. You don’t have enough income or assets to pay your balance due in full. Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on www.irs.gov. The offer in compromise (oic) is a tax settlement arrangement rolled out by the irs. Completed financial statements and required application fee and Do not submit both an offer under doubt as to liability and an offer under doubt as to collectibility or effective tax administration at the same time. Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities for less than the full amount owed. Doubt as to collectability (datc): Web form 656, the offer in compromise (oic), gives the irs an overview of your financial situation so it can review your debt and your ability to pay. Web information about form 656, offer in compromise, including recent updates, related forms, and instructions on how to file.

Form 656L Offer in Compromise (Doubt as to Liability) (2012) Free

Completed financial statements and required application fee and Do not submit both an offer under doubt as to liability and an offer under doubt as to collectibility or effective tax administration at the same time. Web form 656, the offer in compromise (oic), gives the irs an overview of your financial situation so it can review your debt and your.

Form 656L Offer in Compromise (Doubt as to Liability) (2012) Free

Doubt as to collectability (datc): The offer in compromise (oic) is a tax settlement arrangement rolled out by the irs. You can pay all your balance due, but it would create an economic. Web information about form 656, offer in compromise, including recent updates, related forms, and instructions on how to file. It is an attempt to allow both individual.

Offer In Compromise Form 656 Ppv Universal Network

Web information about form 656, offer in compromise, including recent updates, related forms, and instructions on how to file. Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities for less than the full amount owed. You can pay all your balance due, but it would create.

Form 656L Offer in Compromise (Doubt as to Liability) (2012) Free

Completed financial statements and required application fee and Web form 656, the offer in compromise (oic), gives the irs an overview of your financial situation so it can review your debt and your ability to pay. You don’t have enough income or assets to pay your balance due in full. Doubt as to collectability (datc): The offer in compromise (oic).

IRS Form 656 Understanding Offer in Compromise YouTube

Do not submit both an offer under doubt as to liability and an offer under doubt as to collectibility or effective tax administration at the same time. Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities for less than the full amount owed. Completed financial statements.

How to Fill Out IRS Form 656 Offer In Compromise

Do not submit both an offer under doubt as to liability and an offer under doubt as to collectibility or effective tax administration at the same time. It is an attempt to allow both individual and business taxpayers who owe taxes but are unable to pay to come to an agreement with the irs whereby they are allowed to pay.

Irs Gov Form 656 Fill out and Edit Online PDF Template

Doubt as to collectability (datc): Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on www.irs.gov. Completed financial statements and required application fee and You don’t have enough income or assets to pay your balance due in full. You can pay all your balance due, but.

IRS Form 656L Download Fillable PDF or Fill Online Offer in Compromise

Do not submit both an offer under doubt as to liability and an offer under doubt as to collectibility or effective tax administration at the same time. You don’t have enough income or assets to pay your balance due in full. Web information about form 656, offer in compromise, including recent updates, related forms, and instructions on how to file..

Irs Offer In Compromise Form 656 L Form Resume Examples goVLD7ZVva

It will determine whether the offer suits both parties' best interests, both the agency's and your own. Web information about form 656, offer in compromise, including recent updates, related forms, and instructions on how to file. Do not submit both an offer under doubt as to liability and an offer under doubt as to collectibility or effective tax administration at.

Irs Offer In Compromise Form 656 Booklet Form Resume Examples

Do not submit both an offer under doubt as to liability and an offer under doubt as to collectibility or effective tax administration at the same time. Doubt as to collectability (datc): You can pay all your balance due, but it would create an economic. It is an attempt to allow both individual and business taxpayers who owe taxes but.

It Will Determine Whether The Offer Suits Both Parties' Best Interests, Both The Agency's And Your Own.

Taxpayer resources you may also seek assistance from a professional tax assistant at a low income taxpayer clinic, if you qualify. Web form 656, the offer in compromise (oic), gives the irs an overview of your financial situation so it can review your debt and your ability to pay. Web information about form 656, offer in compromise, including recent updates, related forms, and instructions on how to file. You don’t have enough income or assets to pay your balance due in full.

You Can Pay All Your Balance Due, But It Would Create An Economic.

Do not submit both an offer under doubt as to liability and an offer under doubt as to collectibility or effective tax administration at the same time. Individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on www.irs.gov. The offer in compromise (oic) is a tax settlement arrangement rolled out by the irs. Doubt as to collectability (datc):

Use Form 656 When Applying For An Offer In Compromise (Oic), An Agreement Between You And The Irs That Settles Your Tax Liabilities For Less Than The Full Amount Owed.

It is an attempt to allow both individual and business taxpayers who owe taxes but are unable to pay to come to an agreement with the irs whereby they are allowed to pay only a part of their tax dues. Completed financial statements and required application fee and