Form 7004 Instructions 2021

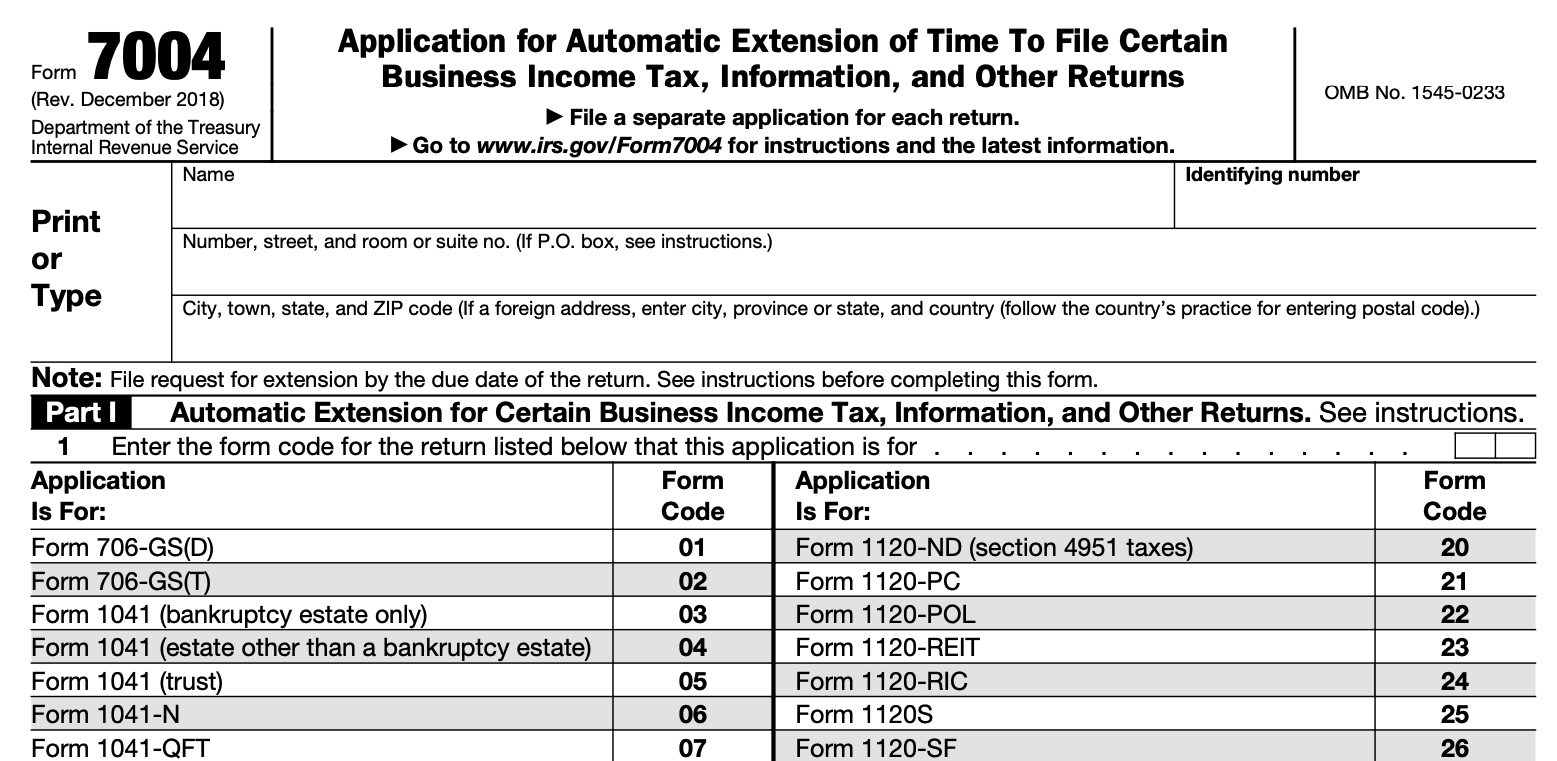

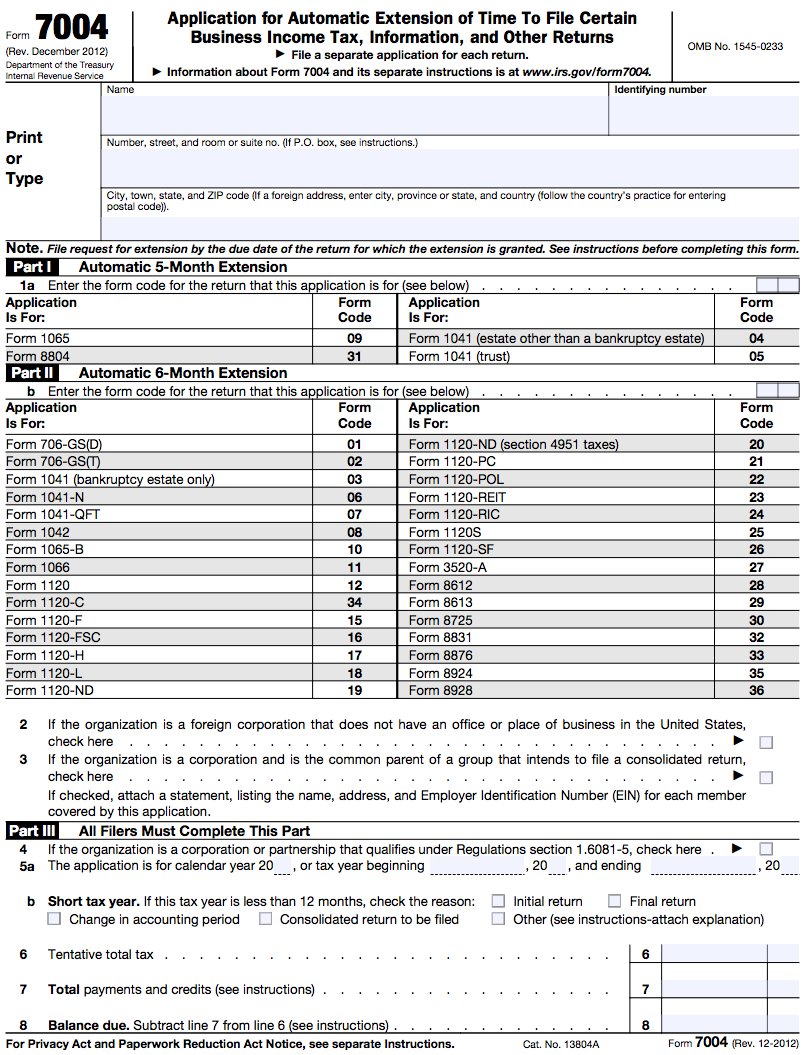

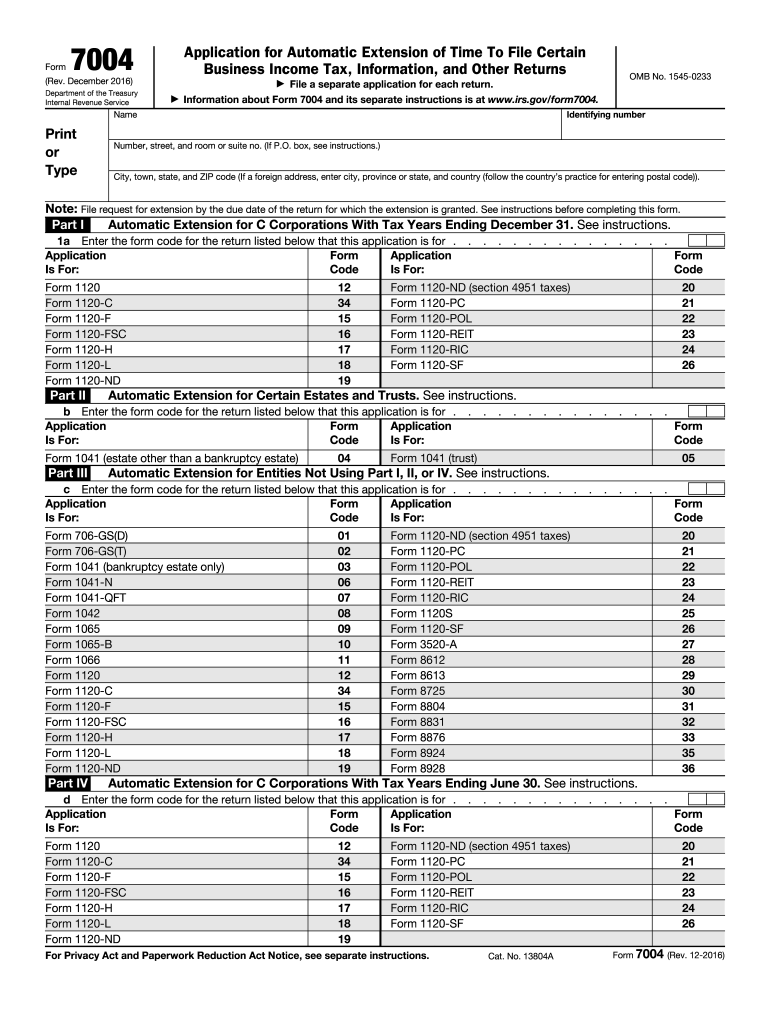

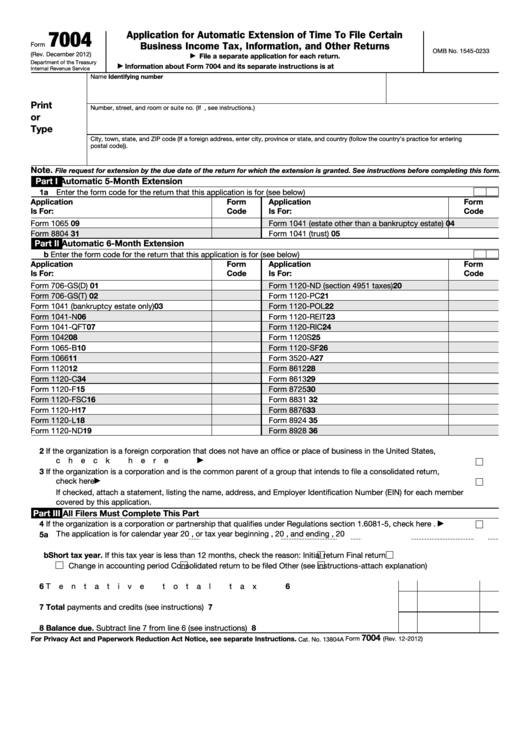

Form 7004 Instructions 2021 - For instructions and the latest information. The first two depend on the kind of tax that needs to have its due date extended, while the third is universal. December 2018) department of the treasury internal revenue service. File a separate application for each return. Before you start filling out the printable or fillable form 7004, reading and understanding the provided instructions is crucial to ensure you complete it accurately. Web purpose of form. December 2018) 2020 form 7004 instructions instructions for form 7004 (rev. The form is used for individuals who elect to file an income tax return but also have a tax liability. Web the form 7004 does not extend the time for payment of tax. Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns

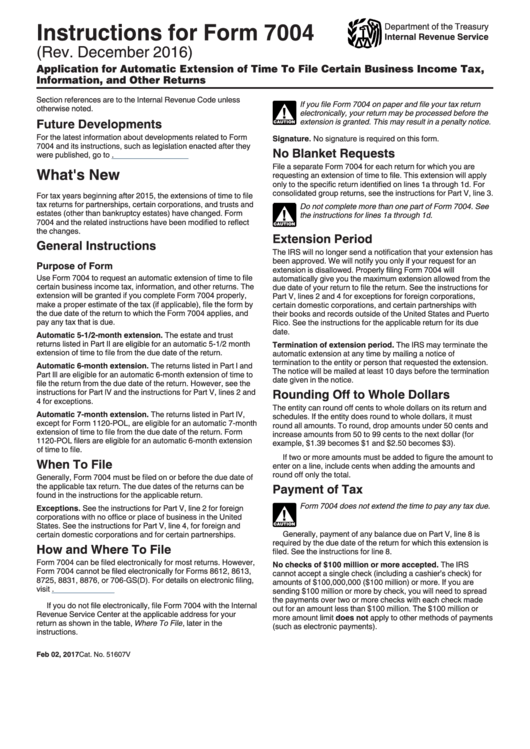

Application for automatic extension of time to file certain business income tax, information, and other returns. Web irs 7004 form for 2021 📝 form 7004 with instructions: Web the form 7004 does not extend the time for payment of tax. Web 2021 form 7004 instructions instructions for form 7004 (rev. Web use the chart to determine where to file form 7004 based on the tax form you complete. Web irs form 7004 instructions are used by various types of businesses to complete the form that extends the filing deadline on their taxes. Form 7004 is used to request an automatic extension to file the certain returns. While we do our best to keep our list of federal income tax forms up to date and complete, we cannot be held liable for errors or omissions. The form is used for individuals who elect to file an income tax return but also have a tax liability. Web all types of businesses are required to file income tax returns with the irs annually to disclose financial information.

The form is used for individuals who elect to file an income tax return but also have a tax liability. Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns Web irs form 7004 instructions are used by various types of businesses to complete the form that extends the filing deadline on their taxes. File a separate application for each return. While we do our best to keep our list of federal income tax forms up to date and complete, we cannot be held liable for errors or omissions. December 2018) department of the treasury internal revenue service. The first two depend on the kind of tax that needs to have its due date extended, while the third is universal. The extension will be granted if you complete form 7004 properly, make a proper estimate of the tax (if applicable), file form 7004 by the due date of the return for which the extension is. There are three different parts to this tax form. December 2018) 2020 form 7004 instructions instructions for form 7004 (rev.

Get an Extension on Your Business Taxes with Form 7004 Excel Capital

Web 2021 form 7004 instructions instructions for form 7004 (rev. The extension will be granted if you complete form 7004 properly, make a proper estimate of the tax (if applicable), file form 7004 by the due date of the return for which the extension is. Web irs 7004 form for 2021 📝 form 7004 with instructions: Web use the chart.

Form 12 Extension Why You Should Not Go To Form 12 Extension AH

Web the form 7004 does not extend the time for payment of tax. Refer to the form 7004 instructions for additional information on payment of tax and balance due. Find the federal tax form either online as a pdf file, or you can request a printable blank template from the irs website. While we do our best to keep our.

Irs Form 7004 amulette

Web all types of businesses are required to file income tax returns with the irs annually to disclose financial information. Web 2021 form 7004 instructions instructions for form 7004 (rev. Find the federal tax form either online as a pdf file, or you can request a printable blank template from the irs website. File a separate application for each return..

What Partnerships Need to Know About Form 7004 for Tax Year 2020 Blog

Web all types of businesses are required to file income tax returns with the irs annually to disclose financial information. File a separate application for each return. Refer to the form 7004 instructions for additional information on payment of tax and balance due. The extension will be granted if you complete form 7004 properly, make a proper estimate of the.

How To Fill Out Property Tax Form Property Walls

Web use the chart to determine where to file form 7004 based on the tax form you complete. Web all types of businesses are required to file income tax returns with the irs annually to disclose financial information. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web purpose.

Form 7004 Fill Out and Sign Printable PDF Template signNow

Web use the chart to determine where to file form 7004 based on the tax form you complete. The form is used for individuals who elect to file an income tax return but also have a tax liability. Web irs form 7004 instructions are used by various types of businesses to complete the form that extends the filing deadline on.

How to file extension for business tax return arlokasin

Refer to the form 7004 instructions for additional information on payment of tax and balance due. Before you start filling out the printable or fillable form 7004, reading and understanding the provided instructions is crucial to ensure you complete it accurately. Select the appropriate form from the table below to determine where to send the form 7004, application for automatic.

Form 7004 Instructions 2021 2022 IRS Forms TaxUni

Application for automatic extension of time to file certain business income tax, information, and other returns. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. For instructions and the latest information. Refer to the form 7004 instructions for additional information on payment of tax and balance due. File a.

Where to file Form 7004 Federal Tax TaxUni

Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. December 2018) 2020 form 7004 instructions instructions for form 7004 (rev. Web irs form 7004 instructions are used by various types of businesses to complete the form that extends the filing deadline on their taxes. Web all types of businesses.

Instructions For Form 7004 Application For Automatic Extension Of

Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file. Web purpose of form. The extension will be granted if you complete form 7004 properly, make a proper estimate of the tax (if applicable), file form 7004 by.

Form 7004 Is Used To Request An Automatic Extension To File The Certain Returns.

Before you start filling out the printable or fillable form 7004, reading and understanding the provided instructions is crucial to ensure you complete it accurately. Refer to the form 7004 instructions for additional information on payment of tax and balance due. For instructions and the latest information. Web irs 7004 form for 2021 📝 form 7004 with instructions:

While We Do Our Best To Keep Our List Of Federal Income Tax Forms Up To Date And Complete, We Cannot Be Held Liable For Errors Or Omissions.

The extension will be granted if you complete form 7004 properly, make a proper estimate of the tax (if applicable), file form 7004 by the due date of the return for which the extension is. December 2018) department of the treasury internal revenue service. Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns Web irs form 7004 instructions are used by various types of businesses to complete the form that extends the filing deadline on their taxes.

Web All Types Of Businesses Are Required To File Income Tax Returns With The Irs Annually To Disclose Financial Information.

Find the federal tax form either online as a pdf file, or you can request a printable blank template from the irs website. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. The form is used for individuals who elect to file an income tax return but also have a tax liability.

File A Separate Application For Each Return.

There are three different parts to this tax form. Web use the chart to determine where to file form 7004 based on the tax form you complete. Web here what you need to start: The first two depend on the kind of tax that needs to have its due date extended, while the third is universal.