Form 7004 Where To File

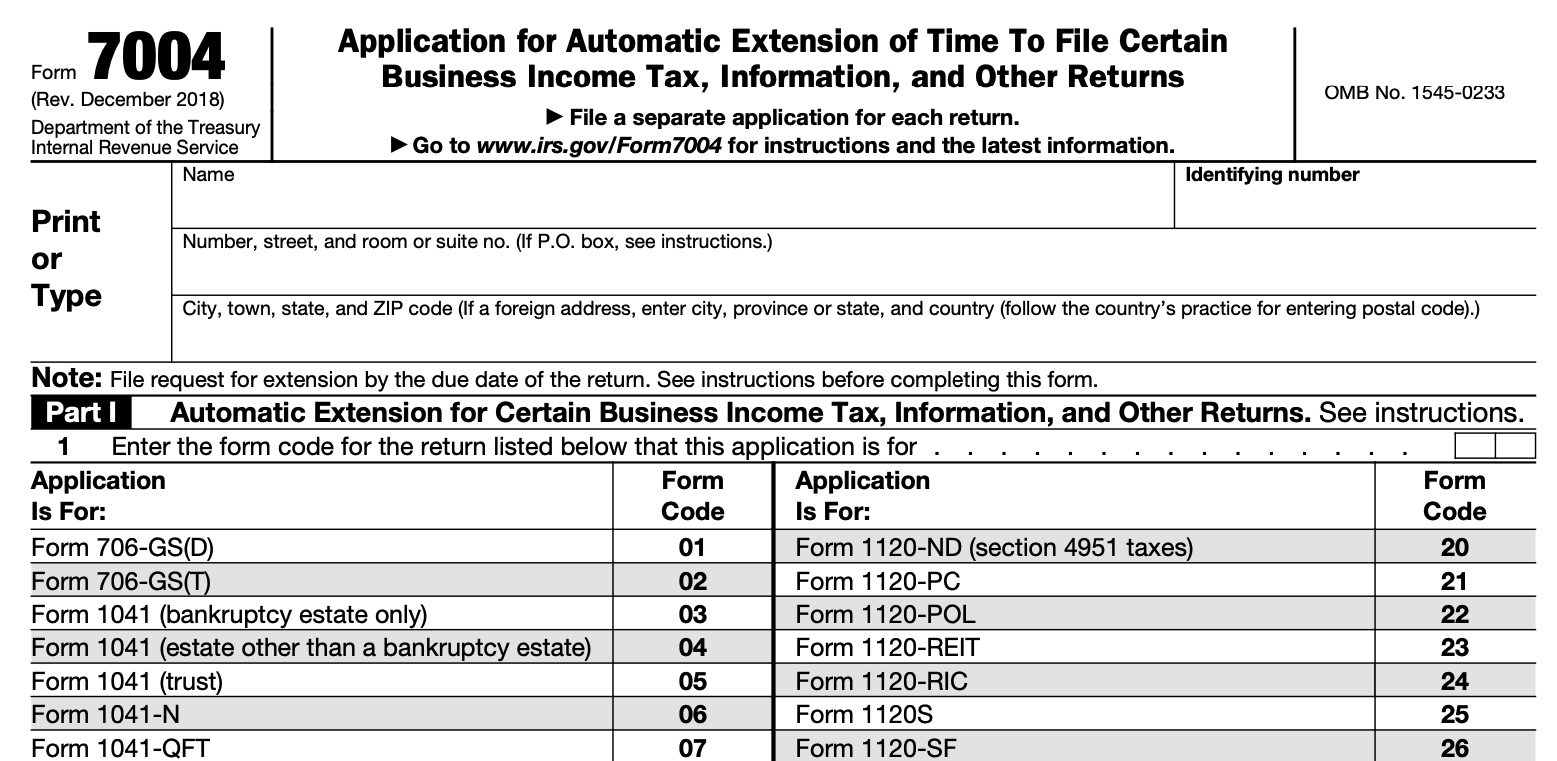

Form 7004 Where To File - With your return open, select search and enter extend; However, form 7004 cannot be filed electronically for forms 8612, 8613, 8725,. 4 or if filing form 1120 and the corporation is claiming the. Web how to file form 7004? Web how and where to file form 7004 can be filed electronically for most returns. Web who’s eligible for a form 7004 extension; Web address changes for filing form 7004. Web how and where to file. Web file form 7004 now for an automatic extension of up to 6 months! However, form 7004 cannot be filed electronically for forms 8612, 8613, 8725, 8831, 8876, or 706.

The irs mailing address will differ. Select extension of time to. However, form 7004 cannot be filed electronically for forms 8612, 8613, 8725, 8831, 8876, or 706. Web where should i mail form 7004? Web follow these steps to print a 7004 in turbotax business: However, form 7004 cannot be filed electronically for forms 8612, 8613, 8725,. With your return open, select search and enter extend; Web download or print the 2022 federal (application for automatic extension of time to file certain business income tax, information, and other returns) (2022) and other income. Similar irs forms there are also other irs forms with a similar purpose that. Web form 7004 is a federal corporate income tax form.

How and when to file form 7004 and make tax payments; Web download or print the 2022 federal (application for automatic extension of time to file certain business income tax, information, and other returns) (2022) and other income. Web follow these steps to print a 7004 in turbotax business: Web how and where to file. Web how to file form 7004? There are three different parts to this tax. Web address changes for filing form 7004. Web file form 7004 now for an automatic extension of up to 6 months! However, form 7004 cannot be filed electronically for forms 8612, 8613, 8725, 8831, 8876, or 706. However, form 7004 cannot be filed electronically for forms 8612, 8613, 8725,.

Less Than 48 Hours Remaining to Efile Extension Form 7004!

Similar irs forms there are also other irs forms with a similar purpose that. With your return open, select search and enter extend; If you just need the basics, here’s the skinny: However, form 7004 cannot be filed electronically for forms 8612, 8613, 8725, 8831, 8876, or 706. Select extension of time to.

Where to file Form 7004 Federal Tax TaxUni

Web how and where to file. Taxpayers will require information such as name, address, contact information of taxpayer, business entity type, total tax amount one. Web where should i mail form 7004? However, form 7004 cannot be filed electronically for forms 8612, 8613, 8725, 8831, 8876, or 706. 4 or if filing form 1120 and the corporation is claiming the.

Form 7004 Where To Sign Fill Out and Sign Printable PDF Template

If you choose to file a paper copy of form 7004, you will need to fill out the form and mail it to the irs. The address for filing form 7004 has changed for some entities located in georgia, illinois, kentucky, michigan, tennessee, and. Web form 7004 is a federal corporate income tax form. There are three different parts to.

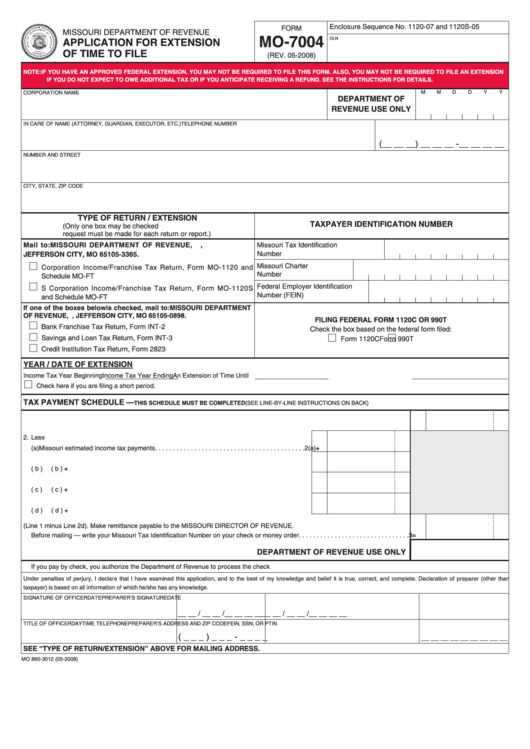

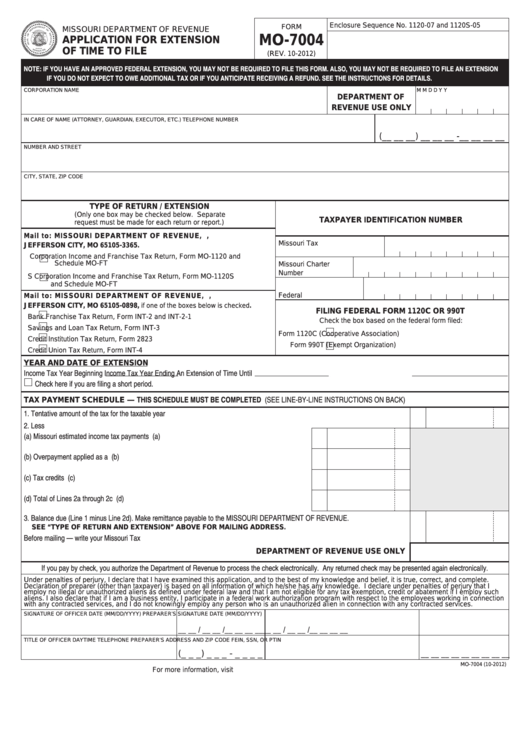

Fillable Form Mo7004 Application For Extension Of Time To File

Form 7004 can be filed electronically for most returns. However, form 7004 cannot be filed electronically for forms 8612, 8613, 8725,. Web file form 7004 now for an automatic extension of up to 6 months! The address for filing form 7004 has changed for some entities located in georgia, illinois, kentucky, michigan, tennessee, and. There are three different parts to.

File IRS Tax Extension Form 7004 Online TaxBandits Fill Online

Web how and where to file. Web who’s eligible for a form 7004 extension; You can also download and print an interactive version of the tax form on the irs website and paper file it. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates,. Similar.

Last Minute Tips To Help You File Your Form 7004 Blog

Web where should i mail form 7004? Web how and where to file. However, form 7004 cannot be filed electronically for forms 8612, 8613, 8725, 8831, 8876, or 706. Similar irs forms there are also other irs forms with a similar purpose that. With your return open, select search and enter extend;

Fillable Form Mo7004 Application For Extension Of Time To File

Similar irs forms there are also other irs forms with a similar purpose that. It'll also assist you with generating the. Web who’s eligible for a form 7004 extension; Web form 7004 is a federal corporate income tax form. Taxpayers will require information such as name, address, contact information of taxpayer, business entity type, total tax amount one.

What Partnerships Need to Know About Form 7004 for Tax Year 2020 Blog

Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates,. It'll also assist you with generating the. However, form 7004 cannot be filed electronically for forms 8612, 8613, 8725, 8831, 8876, or 706. Web where should i mail form 7004? Web how and where to file.

Form 7004 Extension to file Business Tax Returns

However, form 7004 cannot be filed electronically for forms 8612, 8613, 8725,. However, form 7004 cannot be filed electronically for forms 8612, 8613, 8725, 8831, 8876, or 706. There are three different parts to this tax. Taxpayers will require information such as name, address, contact information of taxpayer, business entity type, total tax amount one. If you just need the.

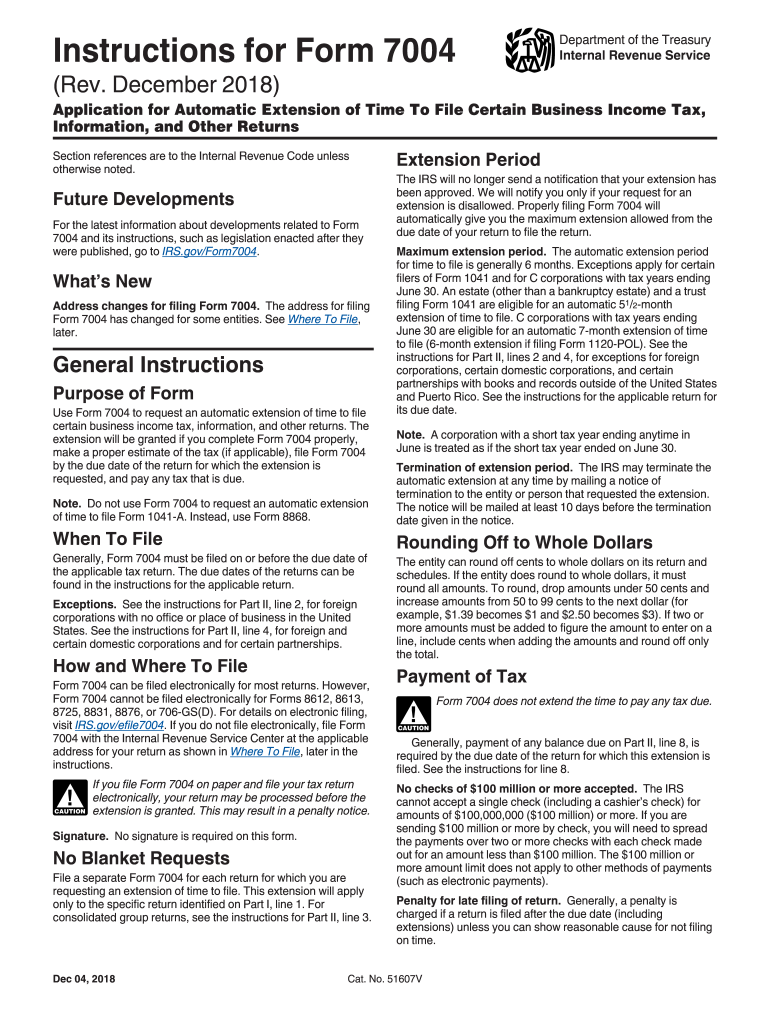

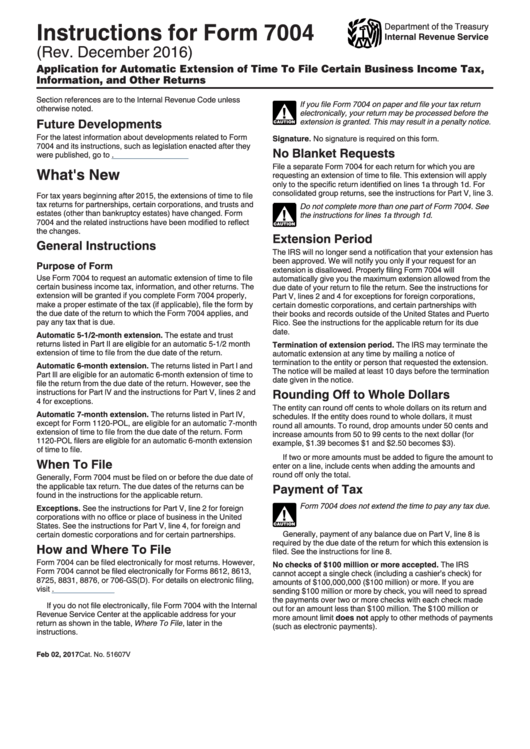

Instructions For Form 7004 Application For Automatic Extension Of

Similar irs forms there are also other irs forms with a similar purpose that. Web how and where to file form 7004 can be filed electronically for most returns. Web where should i mail form 7004? Web follow these steps to print a 7004 in turbotax business: Web who’s eligible for a form 7004 extension;

Web Information About Form 7004, Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns, Including Recent Updates,.

The address for filing form 7004 has changed for some entities located in georgia, illinois, kentucky, michigan, tennessee, and. Web how and where to file. It'll also assist you with generating the. Web where should i mail form 7004?

Similar Irs Forms There Are Also Other Irs Forms With A Similar Purpose That.

Web follow these steps to print a 7004 in turbotax business: Web how to file form 7004? You can also download and print an interactive version of the tax form on the irs website and paper file it. Web file form 7004 now for an automatic extension of up to 6 months!

Form 7004 Can Be Filed Electronically For Most Returns.

How and when to file form 7004 and make tax payments; Web form 7004 is a federal corporate income tax form. Taxpayers will require information such as name, address, contact information of taxpayer, business entity type, total tax amount one. Web irs form 7004 instructions are used by various types of businesses to complete the form that extends the filing deadline on their taxes.

However, Form 7004 Cannot Be Filed Electronically For Forms 8612, 8613, 8725,.

If you just need the basics, here’s the skinny: Web how and where to file form 7004 can be filed electronically for most returns. Select extension of time to. However, form 7004 cannot be filed electronically for forms 8612, 8613, 8725, 8831, 8876, or 706.