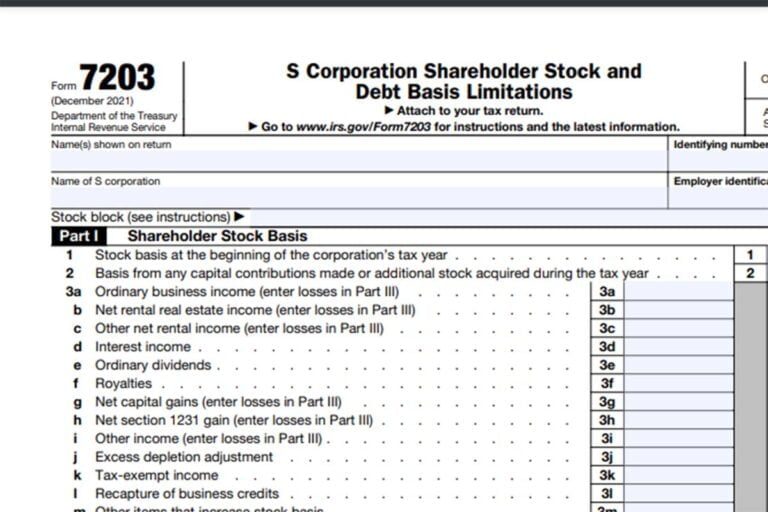

Form 7203 Example

Form 7203 Example - Web the irs estimates that 70,000 respondents will have to complete form 7203 and that it will take each respondent 3 hours and 46 minutes to complete the form, for a. Web tax @ armanino published feb 4, 2022 + follow form 7203: Web march 30, 2022 9:23 pm last updated march 30, 2022 9:23 pm 5 49 9,925 reply bookmark icon aliciap1 expert alumni i'll answer your questions by your numbers:. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Web by turbotax•99•updated january 13, 2023. Web abraham finberg tax tips form 7203 is a new form developed by irs to replace the shareholder’s stock and debt basis worksheet that has previously been. Form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's. Web ef message 5851 generates with the attachment steps. If either of these applies to your father, his. Not an s corp tax form, but filed with form 1040.

Web march 30, 2022 9:23 pm last updated march 30, 2022 9:23 pm 5 49 9,925 reply bookmark icon aliciap1 expert alumni i'll answer your questions by your numbers:. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Form 7203 is used to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your return. Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be. Irs changes to s corporation shareholder stock and debt basis limitations reporting requirements. Web jj the cpa. If form 7203 has no entries other than the header. Form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's. Web form 7203 is a new form requirement for some s corps. I have read all of the instructions for form 7203, but cannot find anything.

If form 7203 has no entries other than the header. Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your return. Not an s corp tax form, but filed with form 1040. Web jj the cpa. Web taxes get your taxes done dkroc level 2 please explain stock block on form 7203. If either of these applies to your father, his. Web by turbotax•99•updated january 13, 2023. Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be. Web tax @ armanino published feb 4, 2022 + follow form 7203: S corp basis form 7203:

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Web ef message 5851 generates with the attachment steps. Web the irs estimates that 70,000 respondents will have to complete form 7203 and that it will take each respondent 3 hours and 46 minutes to complete the form, for a. One or more shareholder basis computations must be attached to the return. Web abraham finberg tax tips form 7203 is.

More Basis Disclosures This Year for S corporation Shareholders Need

Irs changes to s corporation shareholder stock and debt basis limitations reporting requirements. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. One or more shareholder basis computations must be attached to the return. Web abraham finberg tax tips form 7203 is a new form developed by irs.

IRS Form 720 Instructions for the PatientCentered Research

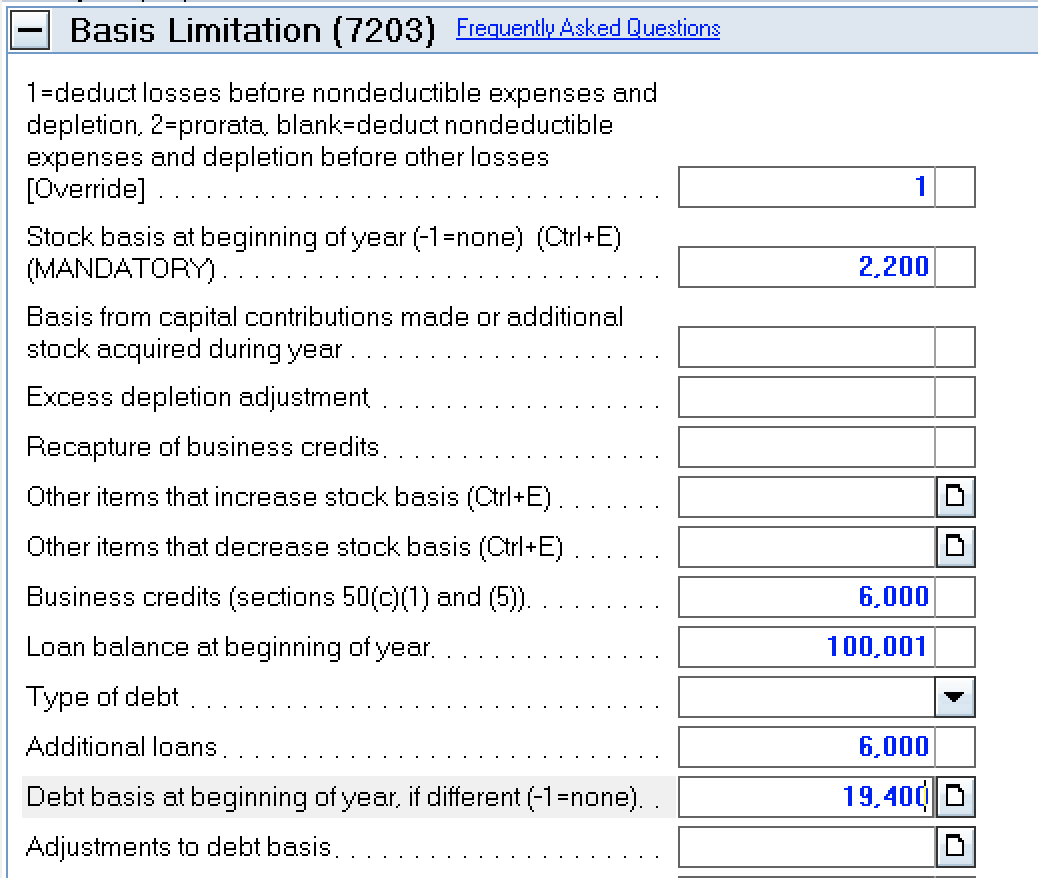

Web taxes get your taxes done dkroc level 2 please explain stock block on form 7203. If form 7203 has no entries other than the header. Web by turbotax•99•updated january 13, 2023. Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on.

How to complete Form 7203 in Lacerte

Irs changes to s corporation shareholder stock and debt basis limitations reporting requirements. If form 7203 has no entries other than the header. Form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's. One or more shareholder basis computations must be attached to the return. S corp basis form.

Form7203PartI PBMares

December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Irs changes to s corporation shareholder stock and debt basis limitations reporting requirements. Not an s corp tax form, but filed with form 1040. Form 7203 is used to calculate any limits on the deductions you can take for.

How to complete IRS Form 720 for the PatientCentered Research

Web the irs estimates that 70,000 respondents will have to complete form 7203 and that it will take each respondent 3 hours and 46 minutes to complete the form, for a. Irs changes to s corporation shareholder stock and debt basis limitations reporting requirements. Web abraham finberg tax tips form 7203 is a new form developed by irs to replace.

Written by Diane Kennedy, CPA on May 20, 2022

One or more shareholder basis computations must be attached to the return. Web march 30, 2022 9:23 pm last updated march 30, 2022 9:23 pm 5 49 9,925 reply bookmark icon aliciap1 expert alumni i'll answer your questions by your numbers:. Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s.

Brandnew IRS form could cause confusion for tax preparers in the midst

Form 7203 is used to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your return. Web tax @ armanino published feb 4, 2022 + follow form 7203: Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits,.

Form

Irs changes to s corporation shareholder stock and debt basis limitations reporting requirements. Form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's. Web march 30, 2022 9:23 pm last updated march 30, 2022 9:23 pm 5 49 9,925 reply bookmark icon aliciap1 expert alumni i'll answer your questions.

Fillable Form 7202 Edit, Sign & Download in PDF PDFRun

Web jj the cpa. Web form 7203 is a new form requirement for some s corps. Web march 30, 2022 9:23 pm last updated march 30, 2022 9:23 pm 5 49 9,925 reply bookmark icon aliciap1 expert alumni i'll answer your questions by your numbers:. Irs changes to s corporation shareholder stock and debt basis limitations reporting requirements. Web the.

Web Ef Message 5851 Generates With The Attachment Steps.

Web form 7203 is a new form requirement for some s corps. Web by turbotax•99•updated january 13, 2023. If either of these applies to your father, his. S corp basis form 7203:

Not An S Corp Tax Form, But Filed With Form 1040.

Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be. Web taxes get your taxes done dkroc level 2 please explain stock block on form 7203. Web tax @ armanino published feb 4, 2022 + follow form 7203: Irs changes to s corporation shareholder stock and debt basis limitations reporting requirements.

If Form 7203 Has No Entries Other Than The Header.

Form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's. Web jj the cpa. I have read all of the instructions for form 7203, but cannot find anything. Web march 30, 2022 9:23 pm last updated march 30, 2022 9:23 pm 5 49 9,925 reply bookmark icon aliciap1 expert alumni i'll answer your questions by your numbers:.

December 2022) S Corporation Shareholder Stock And Debt Basis Limitations Department Of The Treasury Internal Revenue Service Attach To Your Tax.

Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your return. Form 7203 is used to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your return. One or more shareholder basis computations must be attached to the return. Web abraham finberg tax tips form 7203 is a new form developed by irs to replace the shareholder’s stock and debt basis worksheet that has previously been.