Form 7203 Filing Requirements

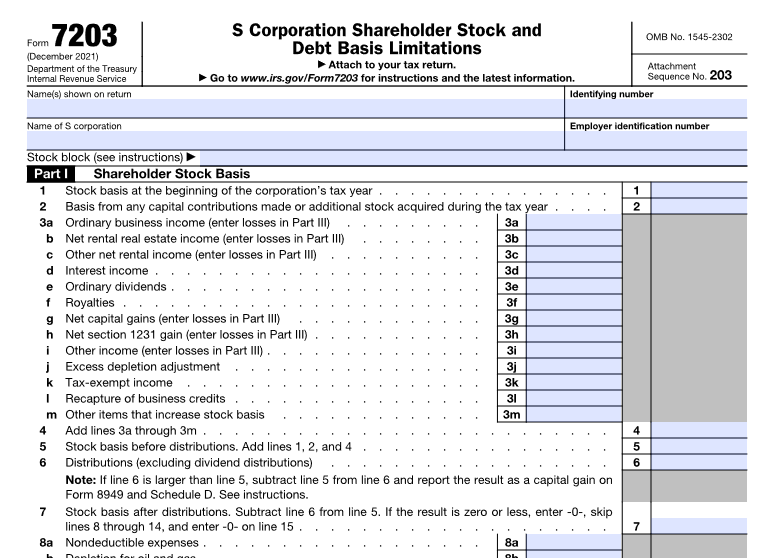

Form 7203 Filing Requirements - Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be. In response to a renewed irs focus on s corporation shareholder basis issues, the irs has developed a new tax form 7203 that certain. Department of treasury on september 7, 2021, the difference. Web form 7203 is required to be attached to the 2021 federal income tax return by s corporation shareholders who meet any one of the following four scenarios: Are claiming a deduction for their share of an aggregate loss from an s corporation (including an. Web who must file form 7203 is filed by s corporation shareholders who: Received a distribution received a loan. As of publication, form 7203 and its instructions. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury. Web you must complete and file form 7203 if you’re an s corporation shareholder and you:

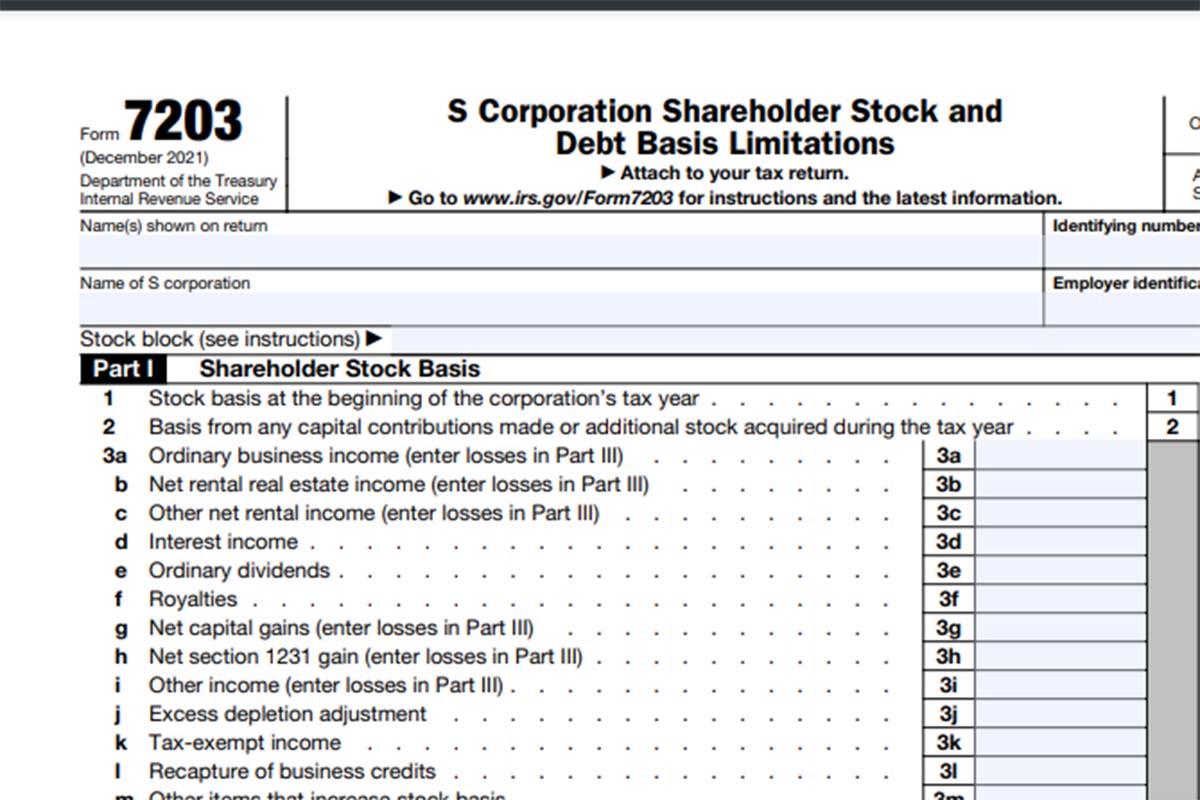

Department of treasury on september 7, 2021, the difference. Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be. The final form is expected to be. Form 7203, s corporation shareholder stock and debt basis limitations, is used by the s corporation shareholder to calculate and report their stock and debt basis. Web january 19, 2021 the irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft. Web the irs recently issued the official draft form 7203, s corporation shareholder stock and debt basis limitations. General instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury. Web you must complete and file form 7203 if you’re an s corporation shareholder and you: Are claiming a deduction for their share of an aggregate loss from an s corporation (including an.

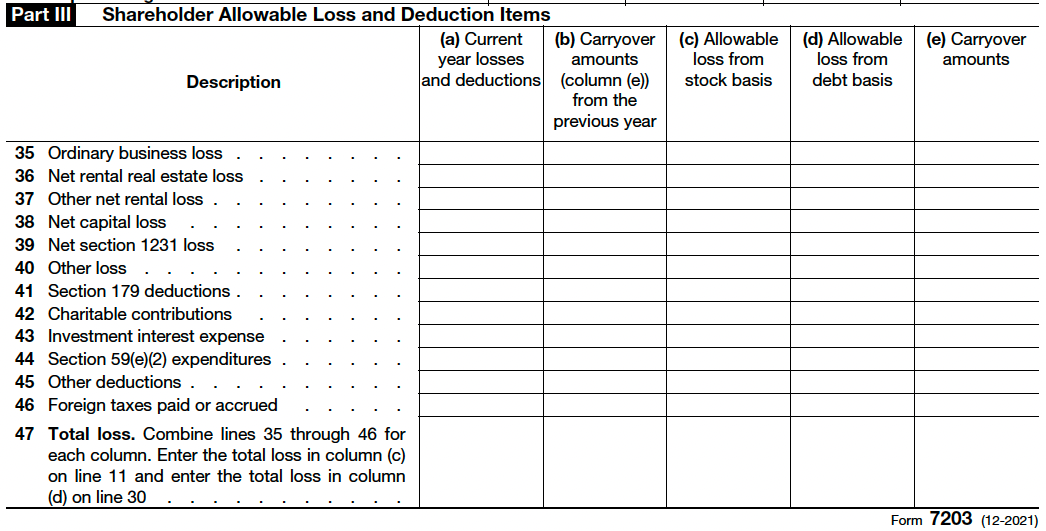

December 2022) s corporation shareholder stock and debt basis limitations department of the treasury. General instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other. Web form 7203 requirements claiming a deduction for their share of an aggregate loss, including one that may have been disallowed last year due to. Are claiming a deduction for their share of an aggregate loss from an s corporation (including an. Web the irs recently issued the official draft form 7203, s corporation shareholder stock and debt basis limitations. Web this form is required to be attached to 2021 federal income tax returns of s corporation shareholders who: The final form is expected to be. Shareholder allowable loss and deduction items. Web you must complete and file form 7203 if you’re an s corporation shareholder and you: Form 7203, s corporation shareholder stock and debt basis limitations, is used by the s corporation shareholder to calculate and report their stock and debt basis.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Form 7203, s corporation shareholder stock and debt basis limitations, is used by the s corporation shareholder to calculate and report their stock and debt basis. As of publication, form 7203 and its instructions. Web you must complete and file form 7203 if you’re an s corporation shareholder and you: Web form 7203 requirements claiming a deduction for their share.

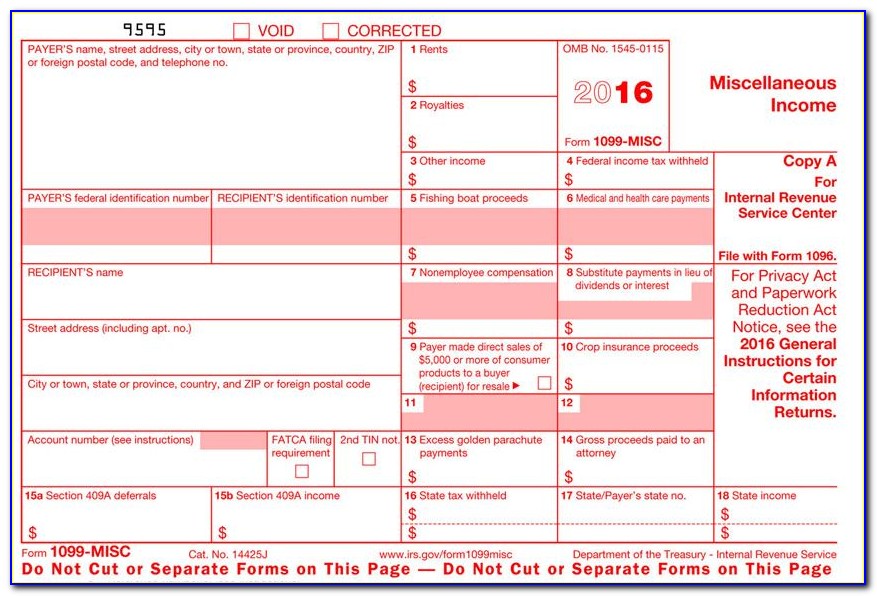

Irs Form 1099 Int Filing Requirements Form Resume Examples o85pxXq5ZJ

The final form is expected to be. Web do not file september 28, 2022 draft as of form 7203 (rev. Web form 7203 is required to be attached to the 2021 federal income tax return by s corporation shareholders who meet any one of the following four scenarios: Web you must complete and file form 7203 if you’re an s.

Irs Form 1099 Int Filing Requirements Form Resume Examples o85pxXq5ZJ

Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be. Web form 7203 is required to be attached to the 2021 federal income tax return by s corporation shareholders who meet any one of the following four scenarios: Web the irs recently issued.

Form7203PartI PBMares

Web form 7203 is required to be attached to the 2021 federal income tax return by s corporation shareholders who meet any one of the following four scenarios: In response to a renewed irs focus on s corporation shareholder basis issues, the irs has developed a new tax form 7203 that certain. Department of treasury on september 7, 2021, the.

Form 7202 Pdf Fill and Sign Printable Template Online US Legal Forms

Web do not file september 28, 2022 draft as of form 7203 (rev. Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be. The final form is expected to be. Web january 19, 2021 the irs recently issued a new draft form 7203,.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Web the irs recently issued the official draft form 7203, s corporation shareholder stock and debt basis limitations. · are claiming a deduction for their share of an aggregate loss from an. Shareholder allowable loss and deduction items. Web you must complete and file form 7203 if you’re an s corporation shareholder and you: Web form 7203 is required to.

More Basis Disclosures This Year for S corporation Shareholders Need

In response to a renewed irs focus on s corporation shareholder basis issues, the irs has developed a new tax form 7203 that certain. As of publication, form 7203 and its instructions. General instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other. Received a distribution received a.

IRS Form 7203 Fileable PDF Version

Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be. The final form is expected to be. Received a distribution received a loan. Form 7203, s corporation shareholder stock and debt basis limitations, is used by the s corporation shareholder to calculate and.

How to complete IRS Form 720 for the PatientCentered Research

· are claiming a deduction for their share of an aggregate loss from an. Are claiming a deduction for their share of an aggregate loss from an s corporation (including an. Web january 19, 2021 the irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft. Web the irs recently.

National Association of Tax Professionals Blog

Are claiming a deduction for their share of an aggregate loss from an s corporation (including an. The final form is expected to be. Received a distribution received a loan. In response to a renewed irs focus on s corporation shareholder basis issues, the irs has developed a new tax form 7203 that certain. Web you must complete and file.

General Instructions Purpose Of Form Use Form 7203 To Figure Potential Limitations Of Your Share Of The S Corporation's Deductions, Credits, And Other.

As of publication, form 7203 and its instructions. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Received a distribution received a loan.

Web S Corporation Shareholders Use Form 7203 To Figure The Potential Limitations Of Their Share Of The S Corporation’s Deductions, Credits, And Other Items That Can Be.

Web who must file form 7203 is filed by s corporation shareholders who: In response to a renewed irs focus on s corporation shareholder basis issues, the irs has developed a new tax form 7203 that certain. Web you must complete and file form 7203 if you’re an s corporation shareholder and you: Web form 7203 is required to be attached to the 2021 federal income tax return by s corporation shareholders who meet any one of the following four scenarios:

Web Do Not File September 28, 2022 Draft As Of Form 7203 (Rev.

Shareholder allowable loss and deduction items. The final form is expected to be. Web this form is required to be attached to 2021 federal income tax returns of s corporation shareholders who: Are claiming a deduction for their share of an aggregate loss from an s corporation (including an.

Form 7203, S Corporation Shareholder Stock And Debt Basis Limitations, Is Used By The S Corporation Shareholder To Calculate And Report Their Stock And Debt Basis.

Web january 19, 2021 the irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft. Web form 7203 requirements claiming a deduction for their share of an aggregate loss, including one that may have been disallowed last year due to. Web the irs recently issued the official draft form 7203, s corporation shareholder stock and debt basis limitations. · are claiming a deduction for their share of an aggregate loss from an.