Form 8582 Turbotax

Form 8582 Turbotax - Rental real estate activities with. Web form 8582 is used to figure the amount of any passive activity loss. Web form 8582 department of the treasury internal revenue service (99) passive activity loss limitations see separate instructions. Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities. Web every year of my rental property, turbotax generated form 8582. Web the form 8582 is available for turbotax online, however the irs still has it in draft and for turbotax cd/download it was scheduled to be available today. Easily sort by irs forms to find the product that best fits your tax situation. Web 858 name(s) shown on return identifying number part i 2022 passive activity loss caution: Complete parts iv and v before completing part i. Noncorporate taxpayers use form 8582 to:

Web every year of my rental property, turbotax generated form 8582. Web about form 8582, passive activity loss limitations. Figure the amount of any passive activity loss (pal) for the current. Complete parts iv and v before completing part i. This year, i sold the property, but form 8582 was not generated. Noncorporate taxpayers use form 8582 to: A number from form 8582 is. Web 13 best answer eternal3 level 2 i have the turbotax deluxe. Web form 8582 department of the treasury internal revenue service (99) passive activity loss limitations see separate instructions. If this is in your maryland tax return, our team is working to resolve an error message in some.

Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities. If all the credits and benefits are. Web assuming you have no passive activity losses in the current year, and none to carryover from prior years, form 8582 is not necessary and thus, deleting it, assuming you have it. Complete parts iv and v before completing part i. Figure the amount of any passive activity loss (pal) for the current. If this is in your maryland tax return, our team is working to resolve an error message in some. Web 858 name(s) shown on return identifying number part i 2022 passive activity loss caution: Tax tax filing is one job always on the mind of tax filers, whether it’s july, march, or december. Easily sort by irs forms to find the product that best fits your tax situation. Web to make these adjustments on form 8582, from the main menu of the tax return (form 1040) select:

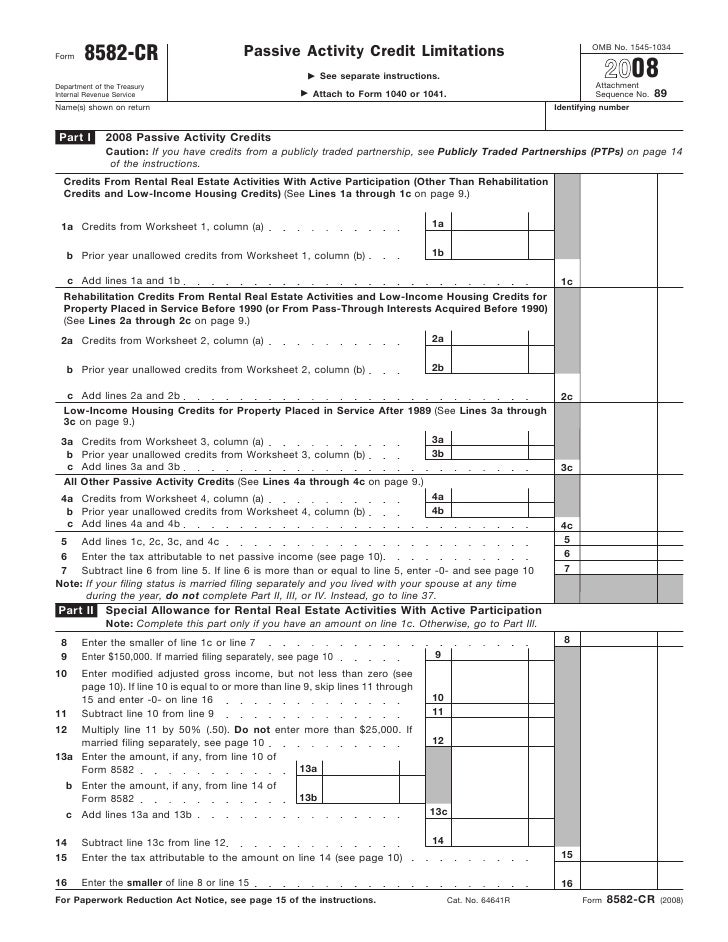

Form 8582 Passive Activity Loss Limitations (2014) Free Download

This year, i sold the property, but form 8582 was not generated. Web about form 8582, passive activity loss limitations. Web 858 name(s) shown on return identifying number part i 2022 passive activity loss caution: Web form 8582 is used to figure the amount of any passive activity loss. Tax tax filing is one job always on the mind of.

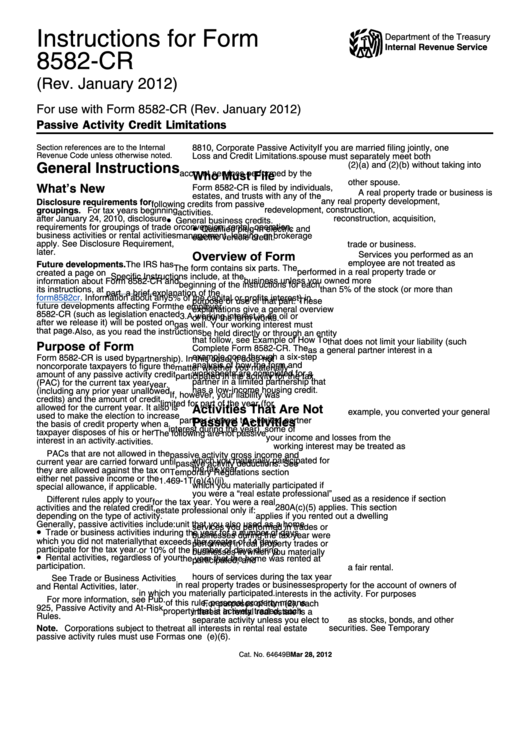

Instructions for Form 8582CR (12/2019) Internal Revenue Service

A number from form 8582 is. If this is in your maryland tax return, our team is working to resolve an error message in some. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Web when will form 8582 be available on turbotax? Figure the amount of.

Fill Free fillable form 8582 passive activity loss limitations pdf

Figure the amount of any passive activity loss (pal) for the current. Rental real estate activities with. Web use form 8582, passive activity loss limitations to summarize income and losses from passive activities and to compute the deductible losses. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Web the form.

form 8582 turbotax Fill Online, Printable, Fillable Blank

Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Web about form 8582, passive activity loss limitations. Web assuming you have no passive activity losses in the current year, and none to carryover from prior years, form 8582 is not necessary and thus, deleting it, assuming you have it. Web to.

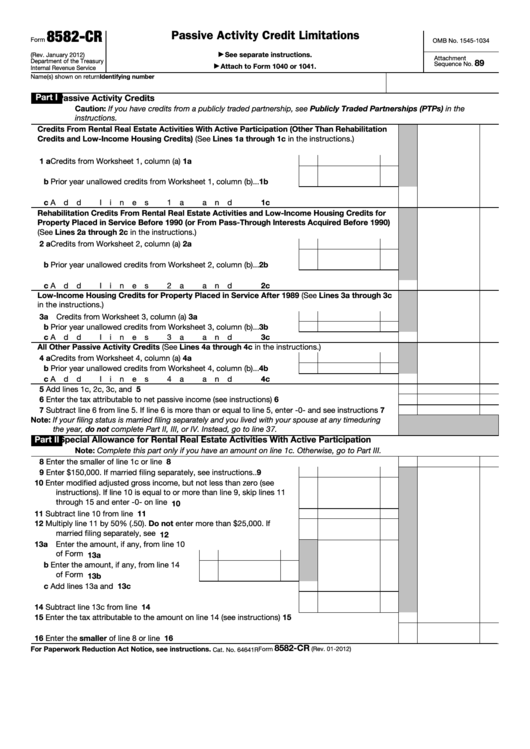

Form 8582CR Passive Activity Credit Limitations (2012) Free Download

Web form 8582 is used to figure the amount of any passive activity loss. Edit, sign and print tax forms on any device with uslegalforms. Web form 8582 department of the treasury internal revenue service (99) passive activity loss limitations see separate instructions. If this is in your maryland tax return, our team is working to resolve an error message.

I have passive activity losses from prior years on...

Web form 8582 is used to figure the amount of any passive activity loss. Tax tax filing is one job always on the mind of tax filers, whether it’s july, march, or december. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. If this is in your maryland tax return, our.

Form 8582CR Passive Activity Credit Limitations

Edit, sign and save irs activity loss limits form. If all the credits and benefits are. Noncorporate taxpayers use form 8582 to: Web 13 best answer eternal3 level 2 i have the turbotax deluxe. Definition of real property trade or business.

Instructions For Form 8582Cr Passive Activity Credit Limitations

A number from form 8582 is. If this is in your maryland tax return, our team is working to resolve an error message in some. If this is in your maryland tax return, our team is working to resolve an error message in some. Web assuming you have no passive activity losses in the current year, and none to carryover.

tax question. complete form 8582 and Schedule E. Rental Property The

Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. A passive activity loss occurs when total losses (including. Web form 8582 department of the treasury.

Fillable Form 8582Cr Passive Activity Credit Limitations printable

Web about form 8582, passive activity loss limitations. Web every year of my rental property, turbotax generated form 8582. If this is in your maryland tax return, our team is working to resolve an error message in some. Rental real estate activities with. Web to make these adjustments on form 8582, from the main menu of the tax return (form.

Easily Sort By Irs Forms To Find The Product That Best Fits Your Tax Situation.

Web 858 name(s) shown on return identifying number part i 2022 passive activity loss caution: Figure the amount of any passive activity loss (pal) for the current. Rental real estate activities with. Definition of real property trade or business.

This Year, I Sold The Property, But Form 8582 Was Not Generated.

Web about form 8582, passive activity loss limitations. Web use form 8582, passive activity loss limitations to summarize income and losses from passive activities and to compute the deductible losses. Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities. Web form 8582 is used to figure the amount of any passive activity loss.

If This Is In Your Maryland Tax Return, Our Team Is Working To Resolve An Error Message In Some.

If all the credits and benefits are. Edit, sign and save irs activity loss limits form. Web 13 best answer eternal3 level 2 i have the turbotax deluxe. A passive activity loss occurs when total losses (including.

Web Assuming You Have No Passive Activity Losses In The Current Year, And None To Carryover From Prior Years, Form 8582 Is Not Necessary And Thus, Deleting It, Assuming You Have It.

If this is in your maryland tax return, our team is working to resolve an error message in some. A number from form 8582 is. Web when will form 8582 be available on turbotax? Web form 8582 is used to figure the amount of any passive activity loss.