Form 8865 Instructions 2021

Form 8865 Instructions 2021 - When a us person has a qualifying interest in a foreign. For calendar year 2022, or tax year beginning / / 2022 , ending / see separate instructions. Persons with respect to certain foreign partnerships, including recent updates, related forms, and instructions on how to file. Information furnished for the foreign partnership’s tax year. Web (form 8865) 2022 partner’s share of income, deductions, credits, etc.— international department of the treasury internal revenue service omb no. International irs tax form 8865 refers to a return of u.s. Persons with respect to certain foreign partnerships. Persons with respect to certain foreign partnerships. October 2021) department of the treasury internal revenue service. Do you have ownership in a foreign partnership?

Attach to your tax return. Do you have ownership in a foreign partnership? Web information about form 8865, return of u.s. Web for specific instructions for form 8865, schedule b, use the instructions for form 1065, lines 1a through 21 (income and deductions). Person filing form 8865 with respect to a foreign partnership that has made an mtm election described in treas. See the instructions for form 8865. Persons with respect to certain foreign partnerships, including recent updates, related forms, and instructions on how to file. Persons with respect to certain foreign partnerships. Web 4 min read october 25, 2022 resource center forms tax form 8865 at a glance if you are involved in a foreign partnership, you may need to file form 8865. International irs tax form 8865 refers to a return of u.s.

Form 8865 is used to report the information required under section 6038 (reporting with respect to controlled foreign partnerships), section 6038b (reporting of transfers to. For instructions and the latest information. Department of the treasury internal revenue service. Web similarly, a u.s. For instructions and the latest information. See the instructions for form 8865. Information furnished for the foreign partnership’s tax year. For calendar year 2022, or tax year beginning / / 2022 , ending / see separate instructions. Persons with respect to certain foreign partnerships, including recent updates, related forms, and instructions on how to file. When a us person has a qualifying interest in a foreign.

2021 Form IRS Instructions 8865 Fill Online, Printable, Fillable, Blank

Persons with respect to certain foreign partnerships, including recent updates, related forms, and instructions on how to file. Web information about form 8865, return of u.s. Learn more about irs form 8865 with the expat tax preparation experts at h&r block. Web form 8865 : Do you have ownership in a foreign partnership?

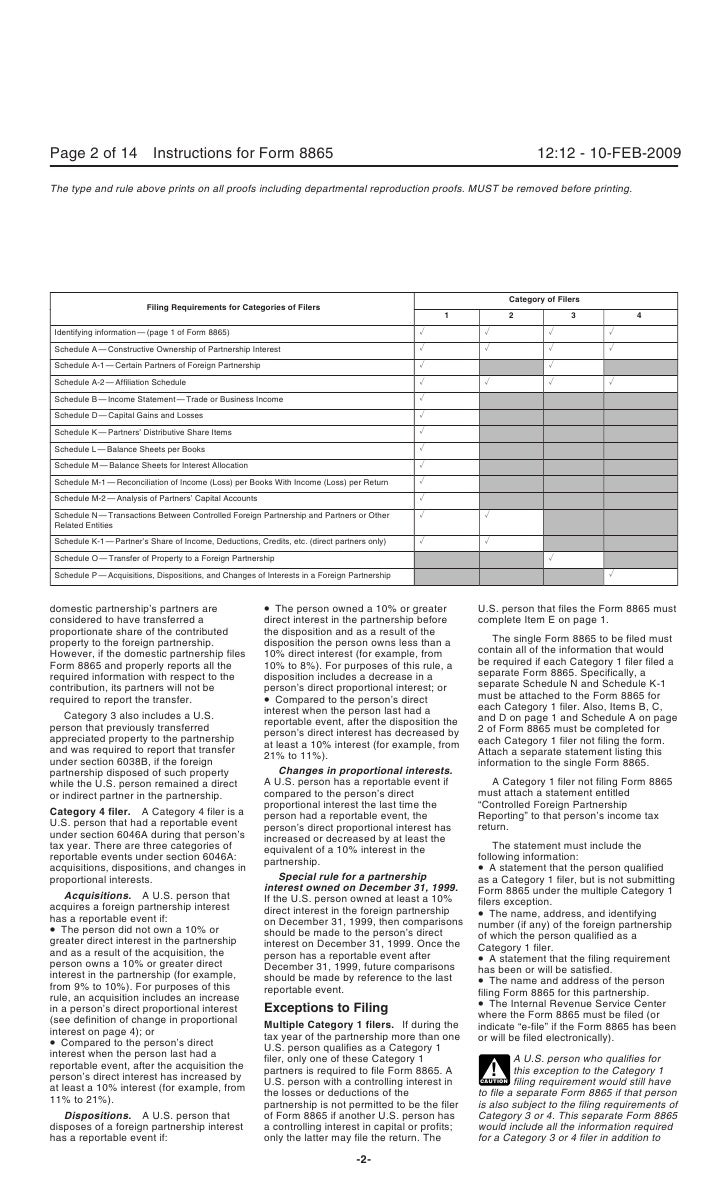

Inst 8865Instructions for Form 8865, Return of U.S. Persons With Res…

Web (form 8865) 2022 partner’s share of income, deductions, credits, etc.— international department of the treasury internal revenue service omb no. Persons with respect to certain foreign partnerships, including recent updates, related forms, and instructions on how to file. See the instructions for form 8865. Persons with respect to certain foreign partnerships. Web for specific instructions for form 8865, schedule.

2021 Form IRS 8865 Schedule K1 Fill Online, Printable, Fillable

You can view or download the instructions for form 1065 at irs.gov/scheduled(form1065). Attach to your tax return. Transfer of property to a foreign partnership (under section 6038b). For instructions and the latest information. Web 4 min read october 25, 2022 resource center forms tax form 8865 at a glance if you are involved in a foreign partnership, you may need.

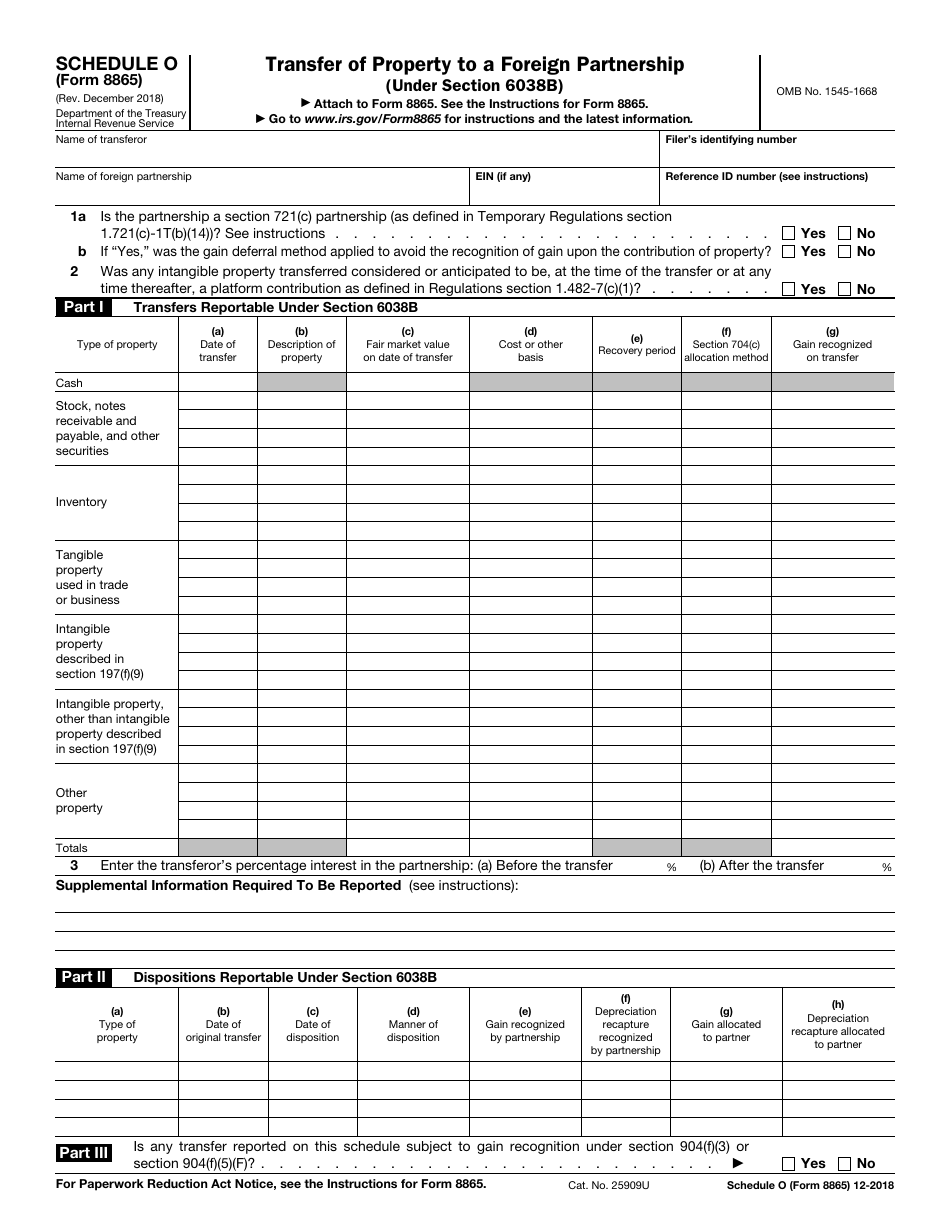

IRS Form 8865 Schedule O Download Fillable PDF or Fill Online Transfer

Web information about form 8865, return of u.s. Form 8865 is used to report the information required under section 6038 (reporting with respect to controlled foreign partnerships), section 6038b (reporting of transfers to. International irs tax form 8865 refers to a return of u.s. Information furnished for the foreign partnership’s tax year. Persons with respect to certain foreign partnerships.

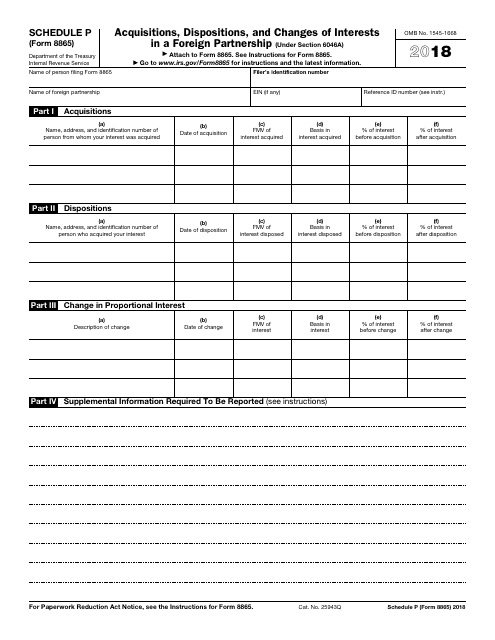

Form 8865 (Schedule P) Acquisitions, Dispositions, and Changes of

Web for specific instructions for form 8865, schedule b, use the instructions for form 1065, lines 1a through 21 (income and deductions). Web information about form 8865, return of u.s. Information furnished for the foreign partnership’s tax year. Transfer of property to a foreign partnership (under section 6038b). For instructions and the latest information.

Form 8865 Tax Returns for Foreign Partnerships

Transfer of property to a foreign partnership (under section 6038b). Form 8865 is used to report the information required under section 6038 (reporting with respect to controlled foreign partnerships), section 6038b (reporting of transfers to. October 2021) department of the treasury internal revenue service. Persons with respect to certain foreign partnerships. Information furnished for the foreign partnership’s tax year.

Form 8865 Return of U.S. Persons With Respect to Certain Foreign

Information furnished for the foreign partnership’s tax year. Persons with respect to certain foreign partnerships, including recent updates, related forms, and instructions on how to file. International irs tax form 8865 refers to a return of u.s. Do you have ownership in a foreign partnership? Department of the treasury internal revenue service.

Inst 8865Instructions for Form 8865, Return of U.S. Persons With Res…

October 2021) department of the treasury internal revenue service. Web for specific instructions for form 8865, schedule b, use the instructions for form 1065, lines 1a through 21 (income and deductions). Web information about form 8865, return of u.s. Web (form 8865) 2022 partner’s share of income, deductions, credits, etc.— international department of the treasury internal revenue service omb no..

IRS Form 8865 Schedule P Download Fillable PDF or Fill Online

Web (form 8865) 2022 partner’s share of income, deductions, credits, etc.— international department of the treasury internal revenue service omb no. International irs tax form 8865 refers to a return of u.s. Learn more about irs form 8865 with the expat tax preparation experts at h&r block. October 2021) department of the treasury internal revenue service. See the instructions for.

Form 8865 Return of U.S. Persons With Respect to Certain Foreign

Department of the treasury internal revenue service. Learn more about irs form 8865 with the expat tax preparation experts at h&r block. For instructions and the latest information. Web information about form 8865, return of u.s. Persons with respect to certain foreign partnerships, including recent updates, related forms, and instructions on how to file.

Web (Form 8865) 2022 Partner’s Share Of Income, Deductions, Credits, Etc.— International Department Of The Treasury Internal Revenue Service Omb No.

Form 8865 is used to report the information required under section 6038 (reporting with respect to controlled foreign partnerships), section 6038b (reporting of transfers to. Department of the treasury internal revenue service. For instructions and the latest information. Web 4 min read october 25, 2022 resource center forms tax form 8865 at a glance if you are involved in a foreign partnership, you may need to file form 8865.

Web Similarly, A U.s.

October 2021) department of the treasury internal revenue service. For calendar year 2022, or tax year beginning / / 2022 , ending / see separate instructions. When a us person has a qualifying interest in a foreign. See the instructions for form 8865.

Persons With Respect To Certain Foreign Partnerships.

Transfer of property to a foreign partnership (under section 6038b). Web form 8865 : Person filing form 8865 with respect to a foreign partnership that has made an mtm election described in treas. Web information about form 8865, return of u.s.

Web For Specific Instructions For Form 8865, Schedule B, Use The Instructions For Form 1065, Lines 1A Through 21 (Income And Deductions).

International irs tax form 8865 refers to a return of u.s. Do you have ownership in a foreign partnership? Learn more about irs form 8865 with the expat tax preparation experts at h&r block. You can view or download the instructions for form 1065 at irs.gov/scheduled(form1065).