Form 8865 Schedule K-2

Form 8865 Schedule K-2 - Part iv information on partners’ section 250 deduction with respect to. With respect to form 1065, the following are the different. (updated january 9, 2023) 2. The irs today released draft versions of schedules k. Persons with respect to certain foreign partnerships. Persons with respect to certain foreign partnerships. Partnership’s operations, such as foreign taxes paid, income from foreign sources, and. Web up to 10% cash back a partnership files the schedules with its form 1065 or form 8865, return of u.s. Persons with respect to certain foreign partnerships (for u.s. Persons filing form 8865, return of u.s.

Partnership’s operations, such as foreign taxes paid, income from foreign sources, and. Web up to 10% cash back a partnership files the schedules with its form 1065 or form 8865, return of u.s. (updated january 9, 2023) 2. The irs today released draft versions of schedules k. Persons filing form 8865, return of u.s. Persons with respect to certain foreign partnerships. With respect to form 1065, the following are the different. Web for the tax year beginning in 2021, the irs has implemented a new reporting requirement for partnerships, s corporations, and filers of form 8865 to include. Persons with respect to certain foreign partnerships (for u.s. Web beginning with tax year 2021, partnerships, s corporations, and filers of form 8865, return of u.s.

Web for the tax year beginning in 2021, the irs has implemented a new reporting requirement for partnerships, s corporations, and filers of form 8865 to include. Partnership’s operations, such as foreign taxes paid, income from foreign sources, and. Persons with respect to certain foreign partnerships (for u.s. Partner’s share of income, deductions, credits, etc. With respect to form 1065, the following are the different. Web up to 10% cash back a partnership files the schedules with its form 1065 or form 8865, return of u.s. Persons filing form 8865, return of u.s. The irs today released draft versions of schedules k. Return of partnership income , form 8865, return of u.s. Persons with respect to certain foreign partnerships.

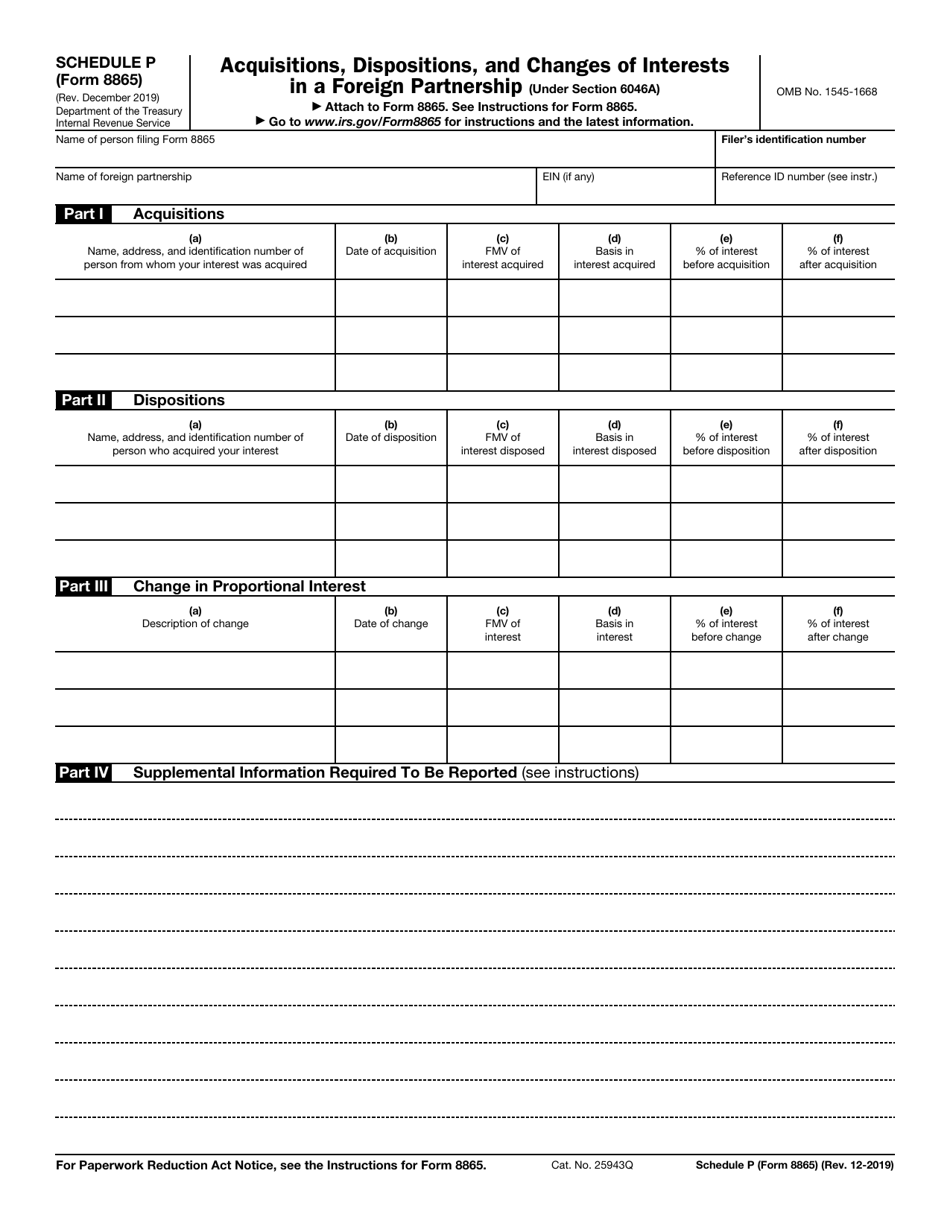

Form 8865 (Schedule P) Acquisitions, Dispositions, and Changes of

Return of partnership income , form 8865, return of u.s. Part iv information on partners’ section 250 deduction with respect to. Partnership’s operations, such as foreign taxes paid, income from foreign sources, and. Web up to 10% cash back a partnership files the schedules with its form 1065 or form 8865, return of u.s. Persons with respect to certain foreign.

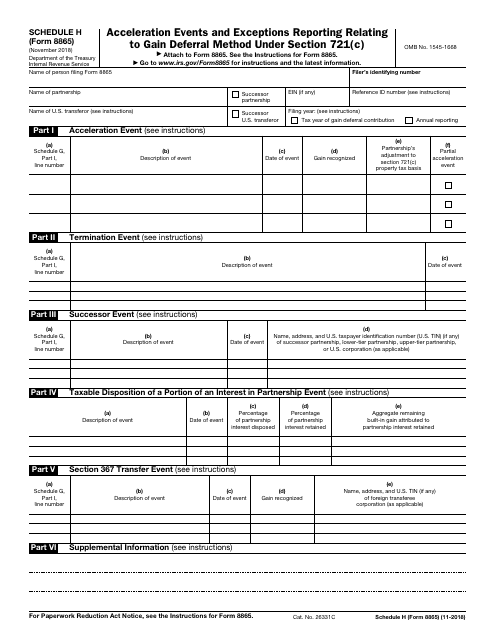

2018 8865 Fillable and Editable PDF Template

Partner’s share of income, deductions, credits, etc. Web for the tax year beginning in 2021, the irs has implemented a new reporting requirement for partnerships, s corporations, and filers of form 8865 to include. Persons with respect to certain foreign partnerships. (updated january 9, 2023) 2. Return of partnership income , form 8865, return of u.s.

Form 8865 Schedule N FORM.UDLVIRTUAL.EDU.PE

With respect to form 1065, the following are the different. Partnership’s operations, such as foreign taxes paid, income from foreign sources, and. Persons with respect to certain foreign partnerships. Part iv information on partners’ section 250 deduction with respect to. Web beginning with tax year 2021, partnerships, s corporations, and filers of form 8865, return of u.s.

Updates to IRS Schedules K2 and K3 International Tax Relevance for

With respect to form 1065, the following are the different. Persons with respect to certain foreign partnerships. Persons filing form 8865, return of u.s. Part iv information on partners’ section 250 deduction with respect to. Persons with respect to certain foreign partnerships (for u.s.

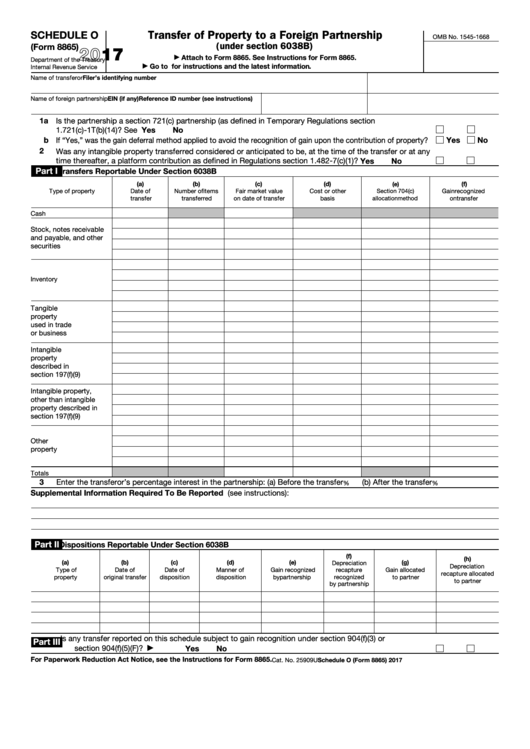

Fillable Schedule O (Form 8865) Transfer Of Property To A Foreign

(updated january 9, 2023) 2. With respect to form 1065, the following are the different. Part iv information on partners’ section 250 deduction with respect to. Web for the tax year beginning in 2021, the irs has implemented a new reporting requirement for partnerships, s corporations, and filers of form 8865 to include. Persons with respect to certain foreign partnerships.

2021 Form IRS 8865 Schedule K1 Fill Online, Printable, Fillable

With respect to form 1065, the following are the different. Persons with respect to certain foreign partnerships. Return of partnership income , form 8865, return of u.s. Partnership’s operations, such as foreign taxes paid, income from foreign sources, and. Web beginning with tax year 2021, partnerships, s corporations, and filers of form 8865, return of u.s.

Form 8865 Return of U.S. Persons With Respect to Certain Foreign

(updated january 9, 2023) 2. The irs today released draft versions of schedules k. Persons with respect to certain foreign partnerships. Persons filing form 8865, return of u.s. Web for the tax year beginning in 2021, the irs has implemented a new reporting requirement for partnerships, s corporations, and filers of form 8865 to include.

IRS Form 8865 Schedule H Download Fillable PDF or Fill Online

Persons with respect to certain foreign partnerships. The irs today released draft versions of schedules k. Partnership’s operations, such as foreign taxes paid, income from foreign sources, and. Persons with respect to certain foreign partnerships. (updated january 9, 2023) 2.

Form 8865 (Schedule O) Transfer of Property to a Foreign Partnership

With respect to form 1065, the following are the different. Persons filing form 8865, return of u.s. (updated january 9, 2023) 2. Part iv information on partners’ section 250 deduction with respect to. Web beginning with tax year 2021, partnerships, s corporations, and filers of form 8865, return of u.s.

Irs Form 8865 Schedule P Download Fillable Pdf Or Fill Online

(updated january 9, 2023) 2. Web for the tax year beginning in 2021, the irs has implemented a new reporting requirement for partnerships, s corporations, and filers of form 8865 to include. Web beginning with tax year 2021, partnerships, s corporations, and filers of form 8865, return of u.s. Return of partnership income , form 8865, return of u.s. Persons.

The Irs Today Released Draft Versions Of Schedules K.

Persons filing form 8865, return of u.s. Persons with respect to certain foreign partnerships. Web for the tax year beginning in 2021, the irs has implemented a new reporting requirement for partnerships, s corporations, and filers of form 8865 to include. Web beginning with tax year 2021, partnerships, s corporations, and filers of form 8865, return of u.s.

Partner’s Share Of Income, Deductions, Credits, Etc.

(updated january 9, 2023) 2. Part iv information on partners’ section 250 deduction with respect to. Persons with respect to certain foreign partnerships (for u.s. Persons with respect to certain foreign partnerships.

Partnership’s Operations, Such As Foreign Taxes Paid, Income From Foreign Sources, And.

With respect to form 1065, the following are the different. Web up to 10% cash back a partnership files the schedules with its form 1065 or form 8865, return of u.s. Return of partnership income , form 8865, return of u.s.