Form 8889-T Line 12

Form 8889-T Line 12 - Web if you have an hsa and hdhp coverage: Web 1 best answer billm223 expert alumni none. Web dec 2, 2022 reminders personal protective equipment. Web form 8889 instructions—part ii. Client has w2 with box 12 containing a code w with and amount of $2,550. Line 12 wks, line b $xxxx. Web line 12 wks, line b should be blank. There are no excess employer contributions. Web if you contributed to your hsa from an ira you would indicate that on line 10, and line 11 is simple addition. You, or someone on your behalf (such as an employer) made contributions to a health.

Amounts paid for personal protective equipment (ppe), such as masks, hand sanitizer, and sanitizing wipes, for use. Line 12 wks, line b $xxxx. I keep getting an error and don't understand why. Web the purpose of the form is to report your deductible contributions, calculate the deduction, report the distributions you take to pay medical expenses and to calculate. The section that line 18 is in is on form 8889 in the section referring to “failure to maintain hdhp coverage”. Line 15 determines how much was spent on. Web if the review asks you to check a box in the line 3 smart worksheet of form 8889, go ahead and check none for a1 through a12 (i.e., each month). Web form 8889t line 12 wks line b: The testing period begins with the last month of your tax year and. Web if you contributed to your hsa from an ira you would indicate that on line 10, and line 11 is simple addition.

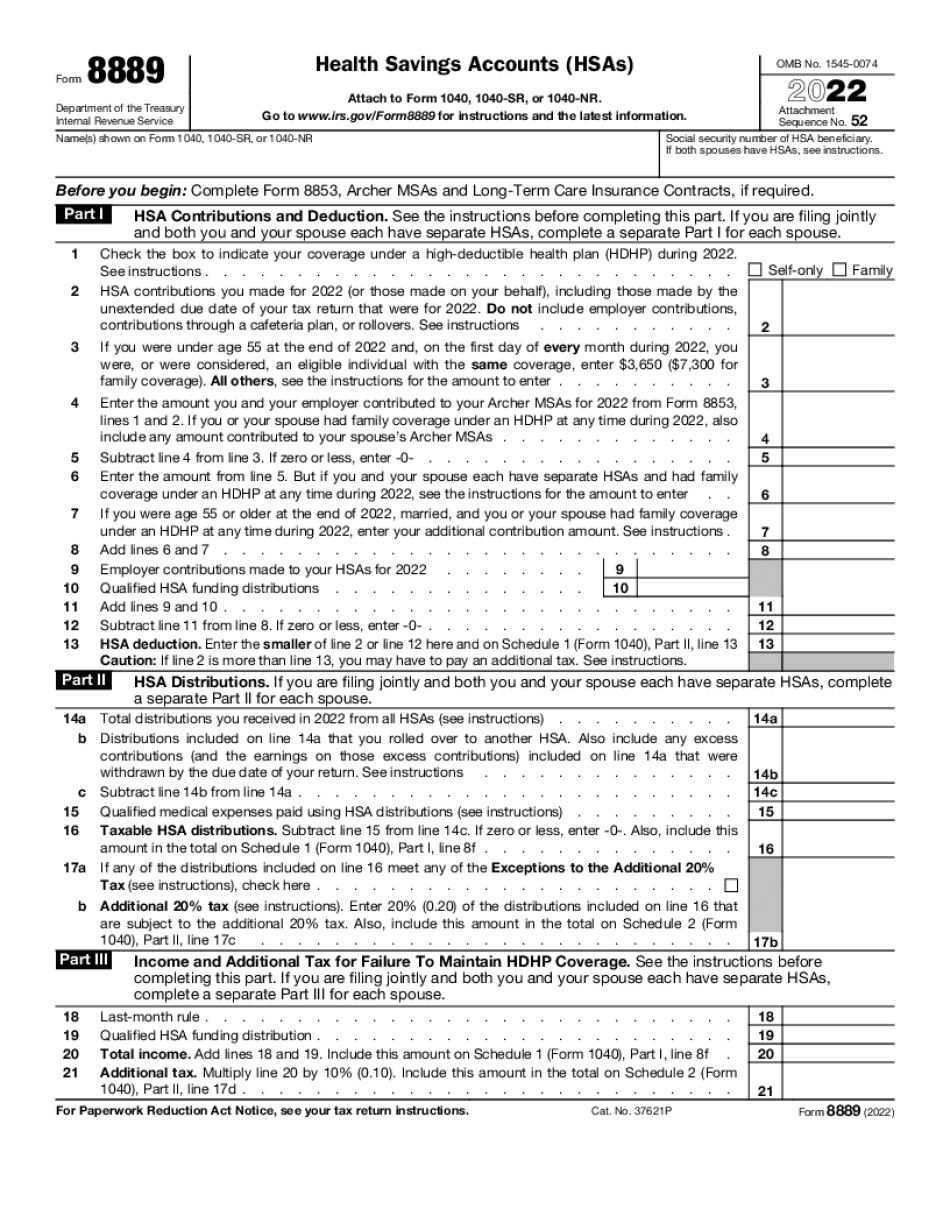

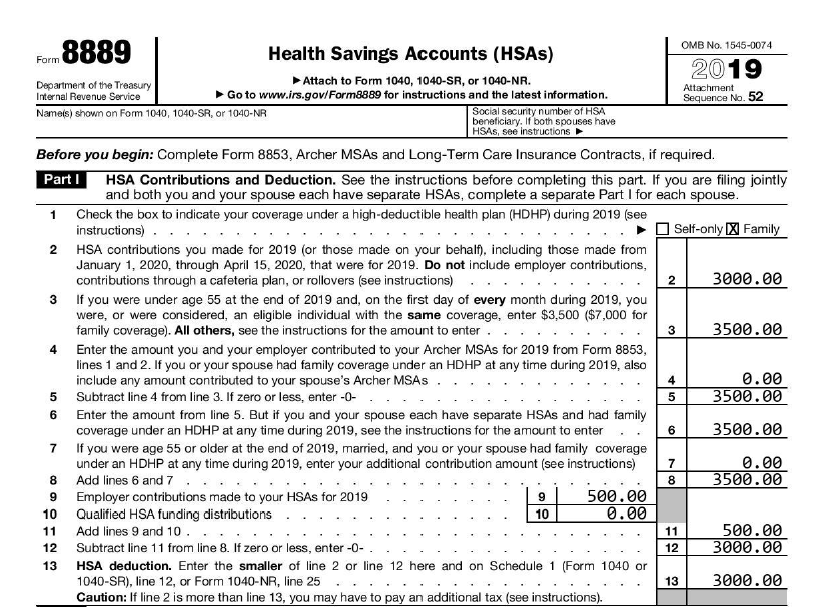

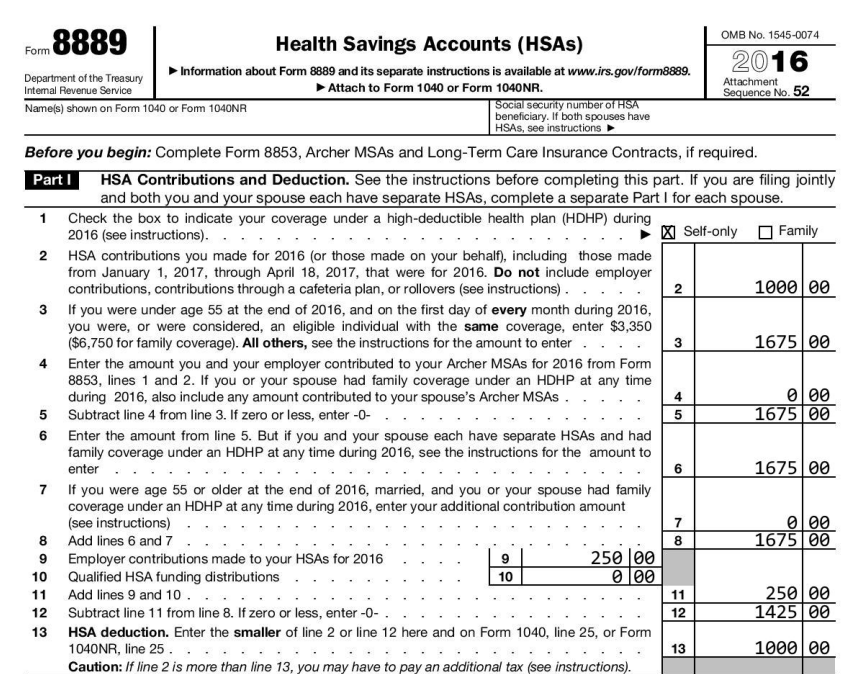

Web hsa contributions you made for 2022 (or those made on your behalf), including those made by the unextended due date of your tax return that were for 2022. The testing period begins with the last month of your tax year and. Web yes, the form does say that line 13 should be the smaller of line 2 or line 12 (and the instructions for the 8889 don’t say anything different), but in this case, you have. Report contributions to a health savings account (hsa). Line6 shows amount equal to line 9 instead of line 5 (7000$ for familly hsa). Web file form 8889 to: What likely happened is that you on a previous pass had an. You, or someone on your behalf (such as an employer) made contributions to a health. Line 12 is subtraction, and line 13 does a comparison. Web 1 best answer billm223 expert alumni none.

Form 8889T for FSA/HSA, I am SO confused. r/TurboTax

Web you would need to file form 8889 if one or more of the following were true: Web line 12 wks, line b should be blank. Web yes, the form does say that line 13 should be the smaller of line 2 or line 12 (and the instructions for the 8889 don’t say anything different), but in this case, you.

8889 Form 2022 2023

Web if you contributed to your hsa from an ira you would indicate that on line 10, and line 11 is simple addition. Web if the review asks you to check a box in the line 3 smart worksheet of form 8889, go ahead and check none for a1 through a12 (i.e., each month). Web dec 2, 2022 reminders personal.

2016 HSA Form 8889 instructions and example YouTube

Report health savings account (hsa) contributions (including those made on your behalf and employer contributions). Web line 12 wks, line b should be blank. Amounts paid for personal protective equipment (ppe), such as masks, hand sanitizer, and sanitizing wipes, for use. Web if you have an hsa and hdhp coverage: You, or someone on your behalf (such as an employer).

Form 8889t line 12 Fill online, Printable, Fillable Blank

Line6 shows amount equal to line 9 instead of line 5 (7000$ for familly hsa). Web if you have an hsa and hdhp coverage: Web form 8889 instructions—part ii. Web file form 8889 to: Web dec 2, 2022 reminders personal protective equipment.

Top 19 919 form australia 2020 en iyi 2022

There are no excess employer contributions. Line 12 is subtraction, and line 13 does a comparison. Web yes, the form does say that line 13 should be the smaller of line 2 or line 12 (and the instructions for the 8889 don’t say anything different), but in this case, you have. Actually, this surprises me, because when you indicated that.

How to file HSA tax Form 8889 Tax forms, Filing taxes, Health savings

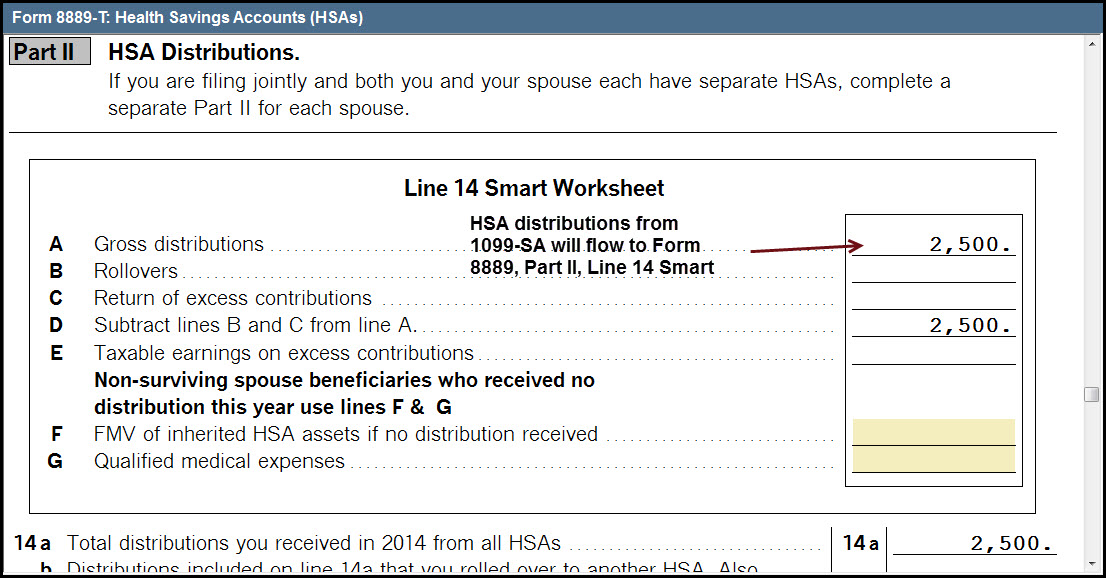

The testing period begins with the last month of your tax year and. I keep getting an error and don't understand why. This section of tax form 8889 assesses your distributions and verifies whether it was spent properly. Web form 8889 is used to report the contributions to and distributions from the hsa for the purpose of determining the hsa.

Form 8889 Instructions & Information on the HSA Tax Form

Web form 8889t line 12 wks line b: Amounts paid for personal protective equipment (ppe), such as masks, hand sanitizer, and sanitizing wipes, for use. Line 12 wks, line b $xxxx. Web if you contributed to your hsa from an ira you would indicate that on line 10, and line 11 is simple addition. Is this turbotax error ?

2018 Instruction 1040 Tax Tables Irs Review Home Decor

Web hsa contributions you made for 2022 (or those made on your behalf), including those made by the unextended due date of your tax return that were for 2022. Web form 8889 is the irs form that helps you to do the following: The section that line 18 is in is on form 8889 in the section referring to “failure.

Entering HSA Health Savings Account Information Accountants Community

There are no excess employer contributions. Web you would need to file form 8889 if one or more of the following were true: Web 1 best answer billm223 expert alumni none. Is this turbotax error ? 1) i do not have an hdhp.

2016 HSA Form 8889 Instructions and Example HSA Edge

I keep getting an error and don't understand why. Is this turbotax error ? Amounts paid for personal protective equipment (ppe), such as masks, hand sanitizer, and sanitizing wipes, for use. This section of tax form 8889 assesses your distributions and verifies whether it was spent properly. Calculate your tax deduction from.

This Section Of Tax Form 8889 Assesses Your Distributions And Verifies Whether It Was Spent Properly.

Line 15 determines how much was spent on. Web hsa contributions you made for 2022 (or those made on your behalf), including those made by the unextended due date of your tax return that were for 2022. There are no excess employer contributions. Web if you have an hsa and hdhp coverage:

The Testing Period Begins With The Last Month Of Your Tax Year And.

Calculate your tax deduction from. Line 12 wks, line b $xxxx. Web form 8889 instructions—part ii. Report contributions to a health savings account (hsa).

Web File Form 8889 To:

Line6 shows amount equal to line 9 instead of line 5 (7000$ for familly hsa). Web form 8889 is used to report the contributions to and distributions from the hsa for the purpose of determining the hsa deduction and if any distributions are taxable. Web if you contributed to your hsa from an ira you would indicate that on line 10, and line 11 is simple addition. Client has w2 with box 12 containing a code w with and amount of $2,550.

I Keep Getting An Error And Don't Understand Why.

You, or someone on your behalf (such as an employer) made contributions to a health. Amounts paid for personal protective equipment (ppe), such as masks, hand sanitizer, and sanitizing wipes, for use. Web form 8889t line 12 wks line b: Web you would need to file form 8889 if one or more of the following were true: