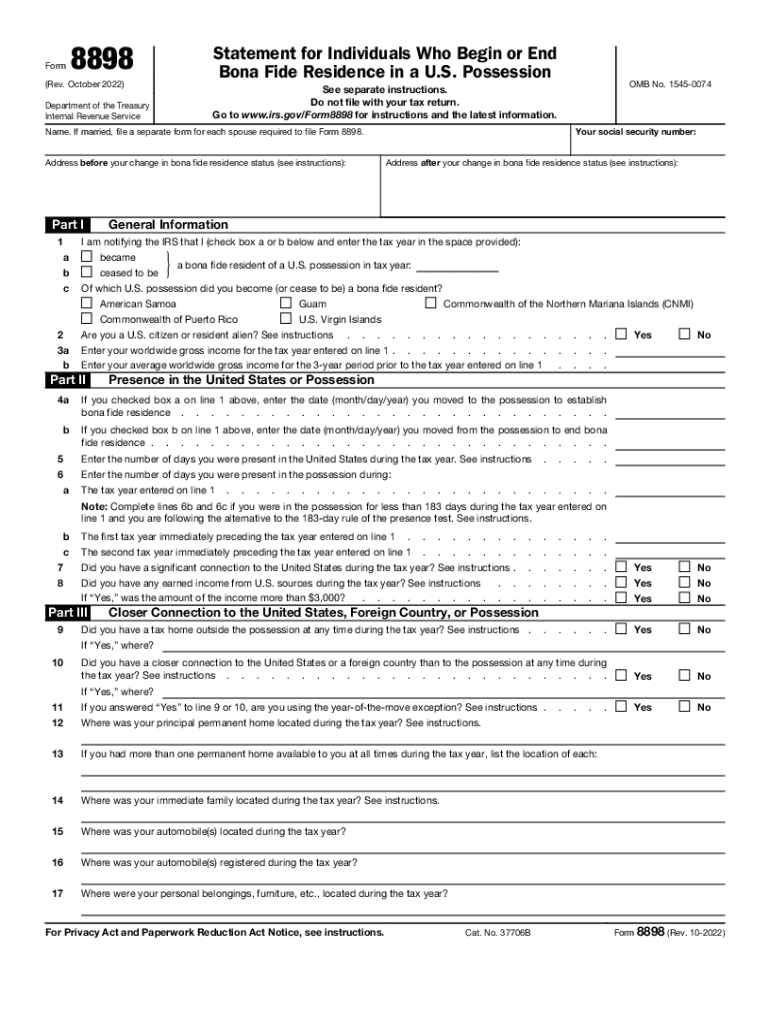

Form 8898 Instructions

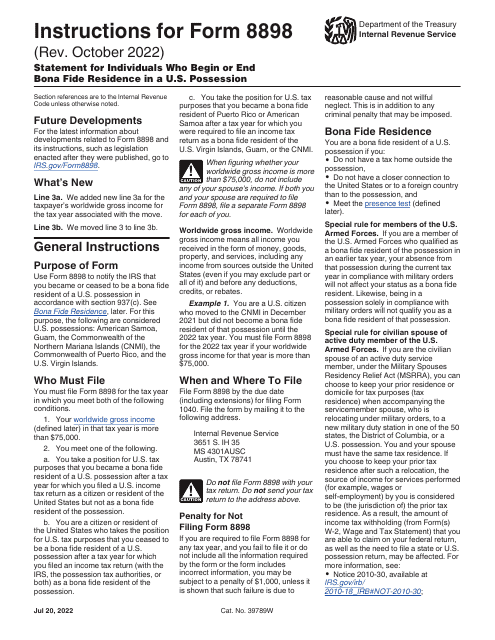

Form 8898 Instructions - Report health savings account (hsa) contributions (including those made on your behalf and employer contributions), figure your hsa deduction, report. When individuals aren?t associated with document administration and law operations, submitting irs docs can be very exhausting. Web instructions for form 8898, statement of individuals who begin or end bona fide residence in a u.s. File form 8898 by the due date (including extensions) for filing form 1040 or form 1040nr. File form 8898 by the due date (including extensions) for filing. Who must file form 8898. Statement for individuals who begin or end bona fide residence in a u.s. See bona fide residence, on this. Top 13 mm (1⁄ 2), center sides. Web in this tax guide article, we’ll cover what you need to know about this tax form, to include:

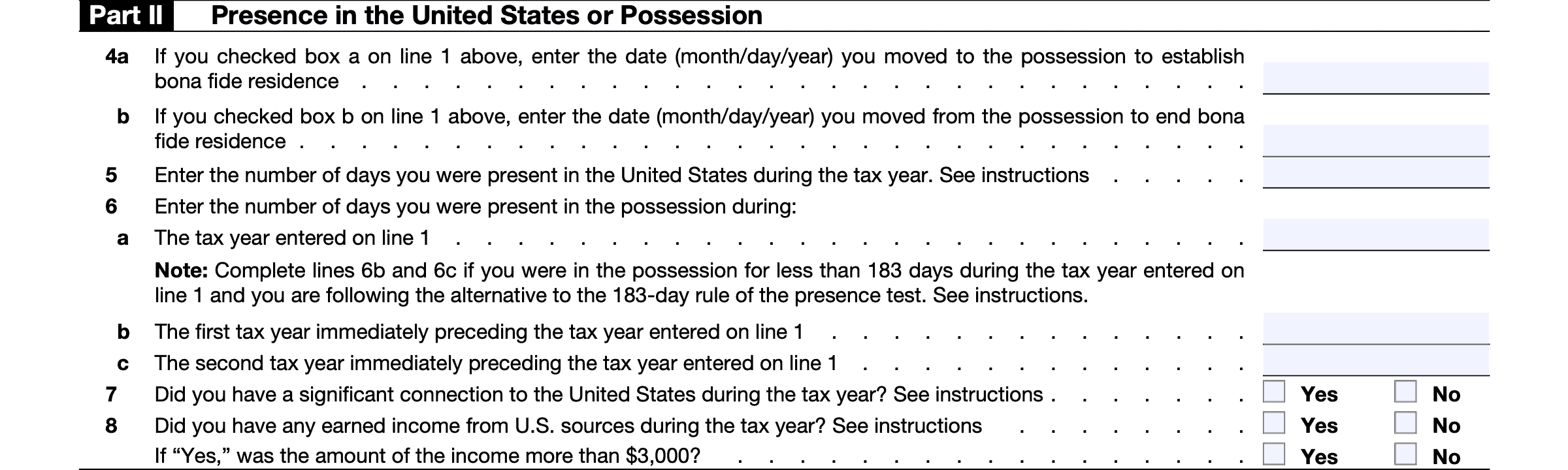

When and where to file file form 8898 by the due. Citizen who moved to the cnmi in december 2021 but did not become a bona fide resident of that possession until the 2022 tax year. Report health savings account (hsa) contributions (including those made on your behalf and employer contributions), figure your hsa deduction, report. Web when and where to file. How to complete and file irs form 8898. 2022), statement for individuals who begin or end bona fide residence in a u.s. Possession in accordance with section 937(c). See bona fide residence, on this. Web use form 8898 to notify the irs that you became or ceased to be a bona fide resident of a u.s. Web up to $3 cash back use form 8898 to notify the irs that states (even if you may exclude part or year in compliance with military orders.

You must file form 8898 for the 2018 tax year if your worldwide gross income for that year is more than $75,000. Web instructions to printers form 8898, page 2 of 2 margins: File form 8898 by the due date (including extensions) for filing. When individuals aren?t associated with document administration and law operations, submitting irs docs can be very exhausting. Web follow the simple instructions below: Possession in accordance with section. Web use form 8889 to: Web instructions for form 8898, statement of individuals who begin or end bona fide residence in a u.s. How to complete and file irs form 8898. Web when and where to file.

Download Instructions for IRS Form 8898 Statement for Individuals Who

File the form by itself at the following address: Web follow the simple instructions below: Web in this tax guide article, we’ll cover what you need to know about this tax form, to include: Web instructions for form 8898, statement of individuals who begin or end bona fide residence in a u.s. Possession, includes a new line for the taxpayer's.

IRS Form 8898 Instructions U.S. Territory Bona Fide Residence

See bona fide residence, on this. Web use form 8898 to notify the irs that you became or ceased to be a bona fide resident of a u.s. Report health savings account (hsa) contributions (including those made on your behalf and employer contributions), figure your hsa deduction, report. Possession in accordance with section 937(c). Web form 8898 (final rev.

Download Instructions for IRS Form 8898 Statement for Individuals Who

Web the irs has released the 2020 version of form 8889 (health savings accounts (hsas)) and its instructions, and has updated publication 969 (health. Web when and where to file. You must file form 8898 for the 2018 tax year if your worldwide gross income for that year is more than $75,000. Type, draw, or upload an image of your.

Download Instructions for IRS Form 8898 Statement for Individuals Who

Who must file form 8898. Top 13 mm (1⁄ 2), center sides. Type, draw, or upload an image of your handwritten signature and place it. Web instructions for form 8883, asset allocation statement under section 338 2002 form 8898: You must file form 8898 for the 2018 tax year if your worldwide gross income for that year is more than.

Form 8898 Fill Out and Sign Printable PDF Template signNow

File the form by itself at the following address: When and where to file file form 8898 by the due. Web instructions to printers form 8898, page 2 of 2 margins: Report health savings account (hsa) contributions (including those made on your behalf and employer contributions), figure your hsa deduction, report. File form 8898 by the due date (including extensions).

Download Instructions for IRS Form 8898 Statement for Individuals Who

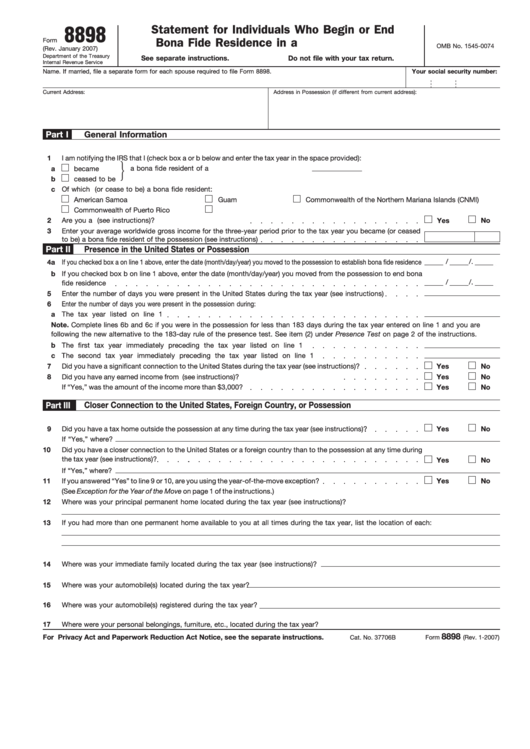

American samoa, guam, the commonwealth of the. You became or ceased to be a bona fide all of. When and where to file file form 8898 by the due. Possession, released july 21 add new line 3a to. Citizen who moved to the cnmi in december 2021 but did not become a bona fide resident of that possession until the.

IRS Form 8898 Instructions U.S. Territory Bona Fide Residence

Report health savings account (hsa) contributions (including those made on your behalf and employer contributions), figure your hsa deduction, report. Web use form 8898 to notify the irs that you became or ceased to be a bona fide resident of a u.s. File form 8898 by the due date (including extensions) for filing. Possession, includes a new line for the.

IRS Form 8898 Instructions U.S. Territory Bona Fide Residence

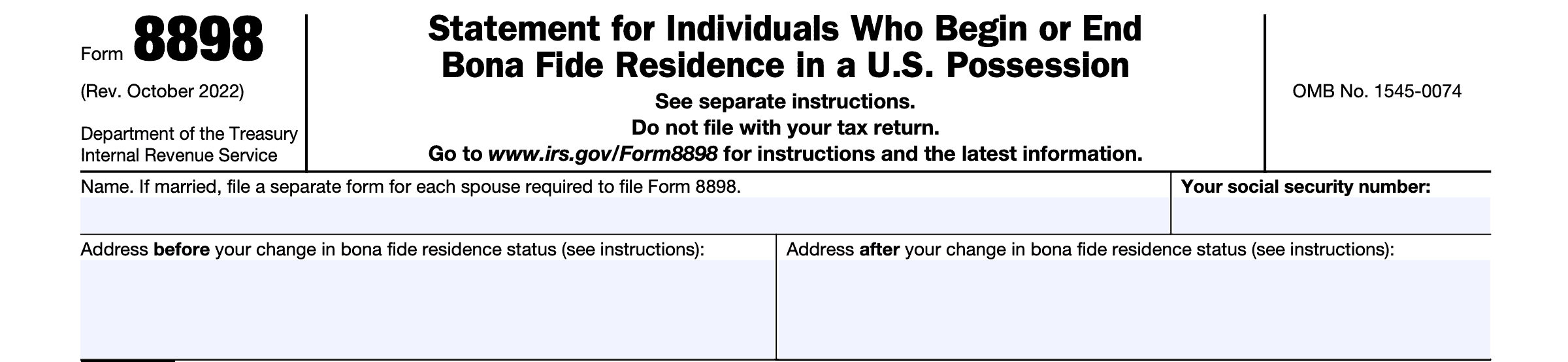

Web draft instructions for form 8898, statement for individuals who begin or end bona fide residence in a u.s. Web the irs has released the 2020 version of form 8889 (health savings accounts (hsas)) and its instructions, and has updated publication 969 (health. October 2020)departmentof the treasury internal revenue service statement for individuals who begin or end bona fide residence.

Form 8898 Statement For Individuals Who Begin Or End Bona Fide

Type, draw, or upload an image of your handwritten signature and place it. Web instructions for form 8883, asset allocation statement under section 338 2002 form 8898: Web general instructions purpose of form use form 8898 to notify the irs that you became or ceased to be a bona fide resident of a u.s. Web draft instructions for form 8898,.

IRS Form 8898 Instructions U.S. Territory Bona Fide Residence

October 2020)departmentof the treasury internal revenue service statement for individuals who begin or end bona fide residence in a u.s. Web you must file form 8898 for the 2022 tax year if your worldwide gross income for that year is more than $75,000. Web form 8898 is used to notify the irs of a change in residency status for a.

Possession, Includes A New Line For The Taxpayer's.

You became or ceased to be a bona fide all of. Report health savings account (hsa) contributions (including those made on your behalf and employer contributions), figure your hsa deduction, report. Top 13 mm (1⁄ 2), center sides. Web follow the simple instructions below:

Web The Irs Has Released The 2020 Version Of Form 8889 (Health Savings Accounts (Hsas)) And Its Instructions, And Has Updated Publication 969 (Health.

Statement for individuals who begin or end bona fide residence in a u.s. Web you must file form 8898 for the 2022 tax year if your worldwide gross income for that year is more than $75,000. Possession in accordance with section. Web instructions for form 8883, asset allocation statement under section 338 2002 form 8898:

Web In This Tax Guide Article, We’ll Cover What You Need To Know About This Tax Form, To Include:

See bona fide residence, on this. File form 8898 by the due date (including extensions) for filing. Web instructions to printers form 8898, page 2 of 2 margins: You must file form 8898 for the 2018 tax year if your worldwide gross income for that year is more than $75,000.

When Individuals Aren?T Associated With Document Administration And Law Operations, Submitting Irs Docs Can Be Very Exhausting.

October 2020)departmentof the treasury internal revenue service statement for individuals who begin or end bona fide residence in a u.s. Possession, released july 21 add new line 3a to. Web up to $3 cash back use form 8898 to notify the irs that states (even if you may exclude part or year in compliance with military orders. Web general instructions purpose of form use form 8898 to notify the irs that you became or ceased to be a bona fide resident of a u.s.