Form 8915-E Instructions 2020

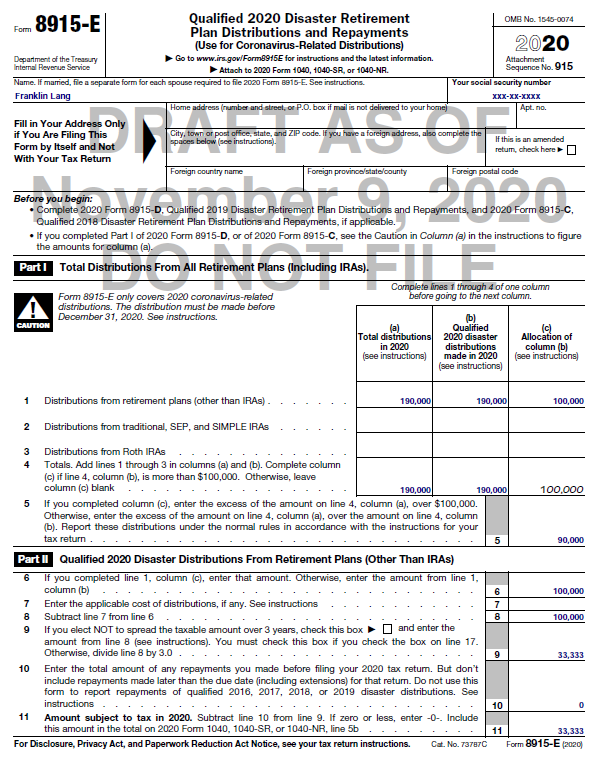

Form 8915-E Instructions 2020 - Use fill to complete blank online irs pdf forms. If you were impacted by the coronavirus and you made. Web in tax year 2020 this form is used to elect to spread the distributions over three years. Plan distributions and repayments qualified 2020 (irs) form. This will also include any. Web go to www.irs.gov/form8915e for instructions and the latest information. Any distributions you took within the 2021 tax year will be taxable on your federal return. If married, file a separate form for each spouse required to. Turbotax deluxe online posted january 18, 2021 2:07 pm last updated january 18, 2021 2:07 pm 4 346.

Web go to www.irs.gov/form8915e for instructions and the latest information. Plan distributions and repayments qualified 2020 (irs) form. If married, file a separate form for each spouse required to. Any distributions you took within the 2021 tax year will be taxable on your federal return. This will also include any. Use fill to complete blank online irs pdf forms. If you were impacted by the coronavirus and you made. Turbotax deluxe online posted january 18, 2021 2:07 pm last updated january 18, 2021 2:07 pm 4 346. Web in tax year 2020 this form is used to elect to spread the distributions over three years.

Web in tax year 2020 this form is used to elect to spread the distributions over three years. Use fill to complete blank online irs pdf forms. Turbotax deluxe online posted january 18, 2021 2:07 pm last updated january 18, 2021 2:07 pm 4 346. If married, file a separate form for each spouse required to. Any distributions you took within the 2021 tax year will be taxable on your federal return. This will also include any. Plan distributions and repayments qualified 2020 (irs) form. If you were impacted by the coronavirus and you made. Web go to www.irs.gov/form8915e for instructions and the latest information.

8915e tax form instructions Somer Langley

If you were impacted by the coronavirus and you made. Use fill to complete blank online irs pdf forms. If married, file a separate form for each spouse required to. Plan distributions and repayments qualified 2020 (irs) form. Web go to www.irs.gov/form8915e for instructions and the latest information.

Wordly Account Gallery Of Photos

Turbotax deluxe online posted january 18, 2021 2:07 pm last updated january 18, 2021 2:07 pm 4 346. Use fill to complete blank online irs pdf forms. Web in tax year 2020 this form is used to elect to spread the distributions over three years. Any distributions you took within the 2021 tax year will be taxable on your federal.

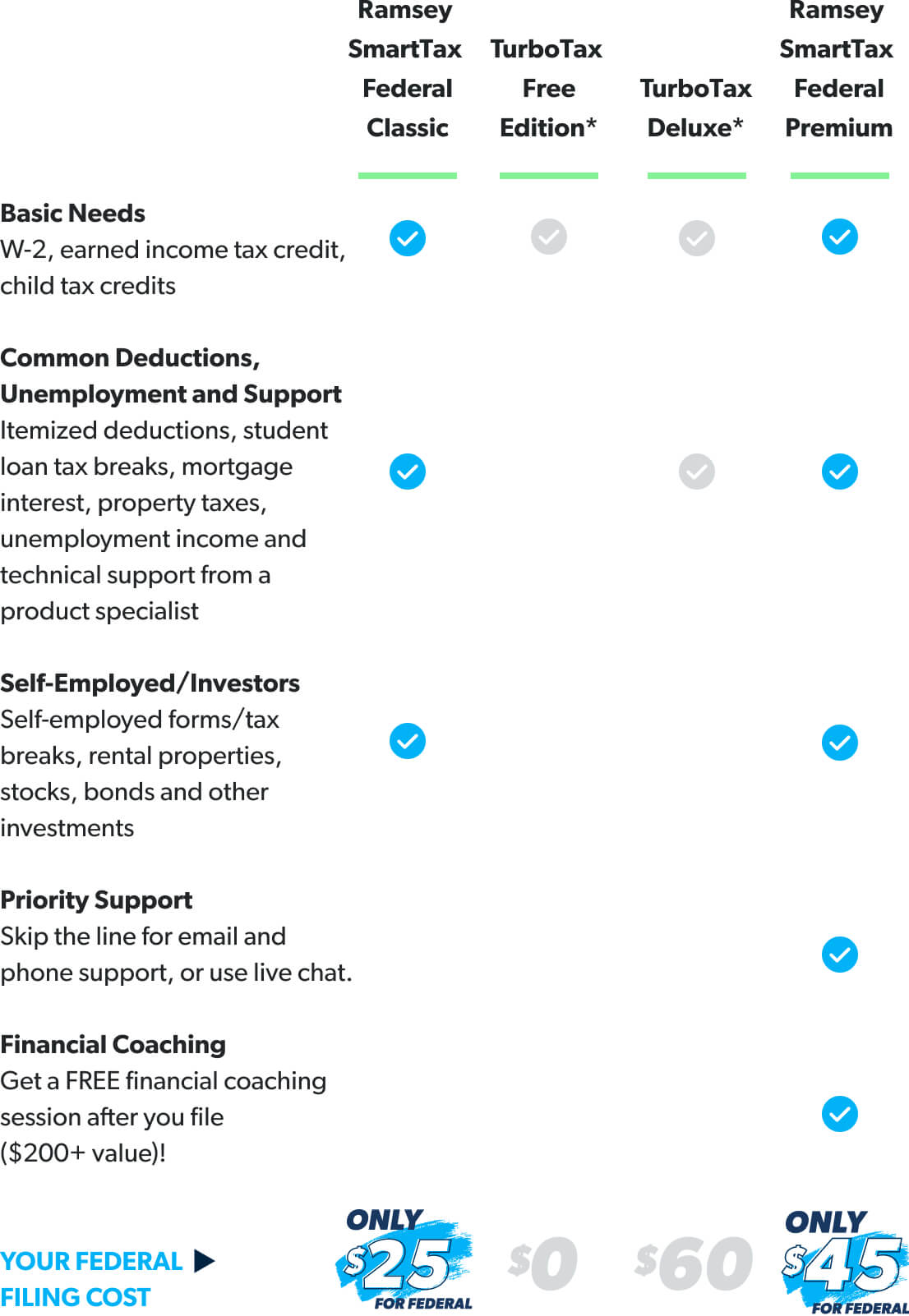

form 8915 e instructions turbotax Renita Wimberly

Any distributions you took within the 2021 tax year will be taxable on your federal return. Web in tax year 2020 this form is used to elect to spread the distributions over three years. If you were impacted by the coronavirus and you made. Web go to www.irs.gov/form8915e for instructions and the latest information. This will also include any.

form 8915 e instructions turbotax Renita Wimberly

This will also include any. If you were impacted by the coronavirus and you made. Turbotax deluxe online posted january 18, 2021 2:07 pm last updated january 18, 2021 2:07 pm 4 346. Use fill to complete blank online irs pdf forms. Web go to www.irs.gov/form8915e for instructions and the latest information.

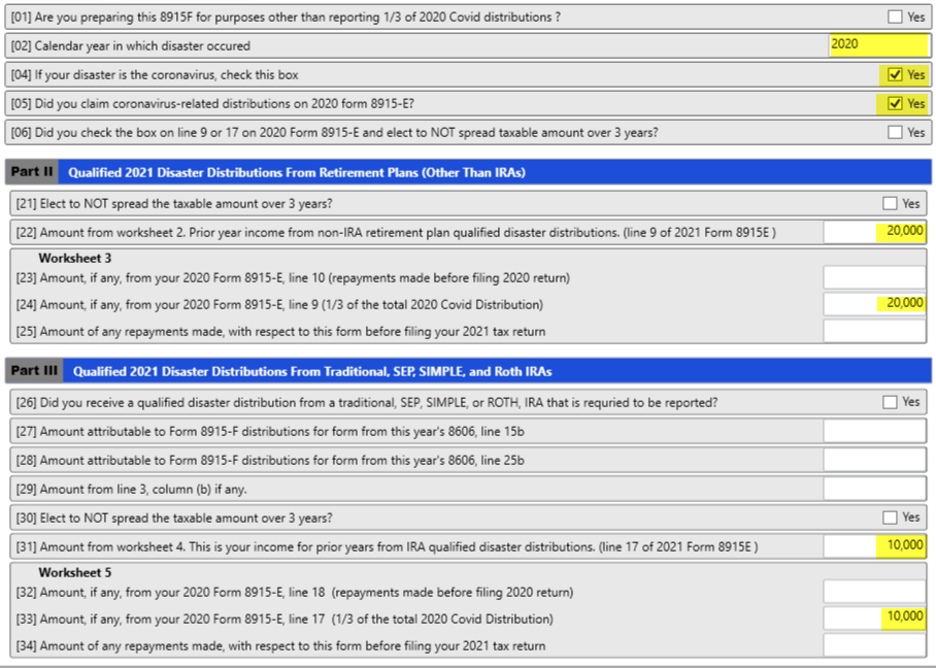

Basic 8915F Instructions for 2021 Taxware Systems

Turbotax deluxe online posted january 18, 2021 2:07 pm last updated january 18, 2021 2:07 pm 4 346. Plan distributions and repayments qualified 2020 (irs) form. Any distributions you took within the 2021 tax year will be taxable on your federal return. If married, file a separate form for each spouse required to. This will also include any.

Form 8915e TurboTax Updates On QDRP Online & Instructions To File It

Plan distributions and repayments qualified 2020 (irs) form. If married, file a separate form for each spouse required to. Web in tax year 2020 this form is used to elect to spread the distributions over three years. Use fill to complete blank online irs pdf forms. Web go to www.irs.gov/form8915e for instructions and the latest information.

Generating Form 8915E in ProSeries Intuit Accountants Community

Turbotax deluxe online posted january 18, 2021 2:07 pm last updated january 18, 2021 2:07 pm 4 346. If married, file a separate form for each spouse required to. This will also include any. Web go to www.irs.gov/form8915e for instructions and the latest information. Web in tax year 2020 this form is used to elect to spread the distributions over.

Kandy Snell

Plan distributions and repayments qualified 2020 (irs) form. Web in tax year 2020 this form is used to elect to spread the distributions over three years. If you were impacted by the coronavirus and you made. Turbotax deluxe online posted january 18, 2021 2:07 pm last updated january 18, 2021 2:07 pm 4 346. Any distributions you took within the.

Fill Free fillable Form 8915E Plan Distributions and Repayments

If married, file a separate form for each spouse required to. This will also include any. If you were impacted by the coronavirus and you made. Any distributions you took within the 2021 tax year will be taxable on your federal return. Use fill to complete blank online irs pdf forms.

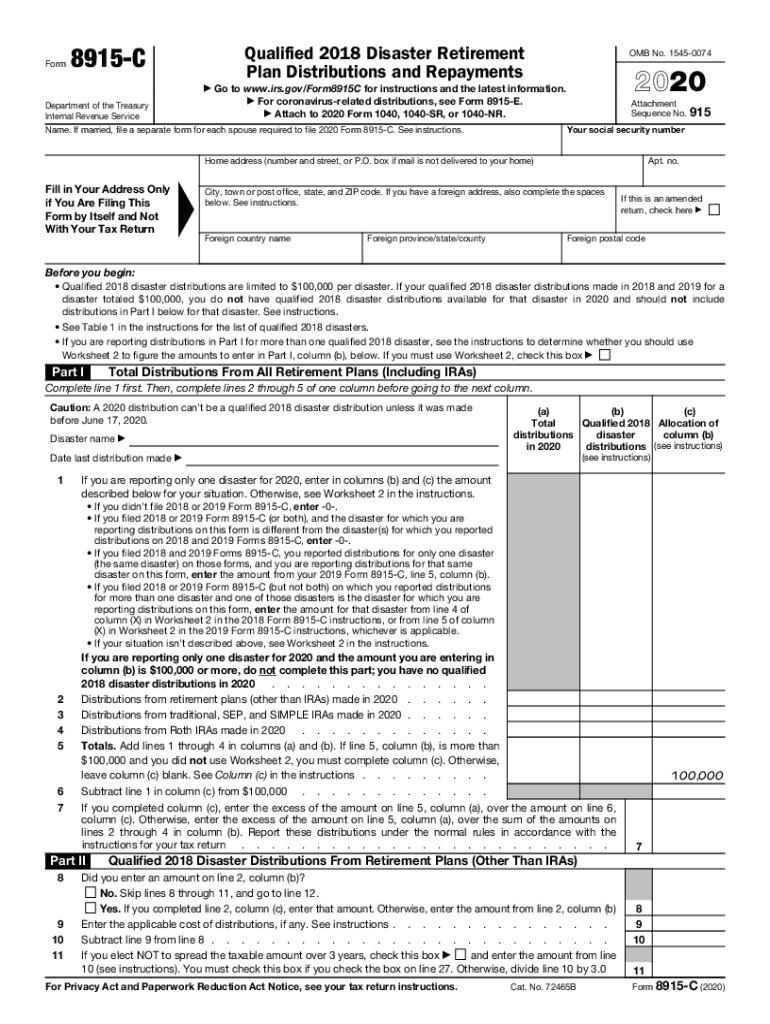

2020 Form IRS 8915C Fill Online, Printable, Fillable, Blank pdfFiller

This will also include any. Any distributions you took within the 2021 tax year will be taxable on your federal return. Turbotax deluxe online posted january 18, 2021 2:07 pm last updated january 18, 2021 2:07 pm 4 346. Use fill to complete blank online irs pdf forms. Web in tax year 2020 this form is used to elect to.

Turbotax Deluxe Online Posted January 18, 2021 2:07 Pm Last Updated January 18, 2021 2:07 Pm 4 346.

Use fill to complete blank online irs pdf forms. Web go to www.irs.gov/form8915e for instructions and the latest information. If married, file a separate form for each spouse required to. Plan distributions and repayments qualified 2020 (irs) form.

If You Were Impacted By The Coronavirus And You Made.

Web in tax year 2020 this form is used to elect to spread the distributions over three years. This will also include any. Any distributions you took within the 2021 tax year will be taxable on your federal return.

.jpeg)